Financial Services Firms: Meet Finance Automation Magic

We make finance operations infinitely easier by helping you cut out mistakes, speed up global payments, build real-time insights, and stay compliant—without adding extra staff.

Financial Services Features

Total Control of Your Finance Workflows

Our scalable, automated tools for accounts payable, mass payments, expenses, and procurement help you manage everything from invoicing and payments to self-service onboarding and multi-entity operations. Here’s how.

Pay Anyone, Anywhere

Scale anywhere with cross-border payments to 200+ countries and territories in 120 currencies via 50+ payment methods and built-in multi-entity and multi-language capabilities.

Protect Against Fraud

Protect your assets and reputation with built-in OFAC screening, enterprise-grade platform security, and advanced fraud controls.

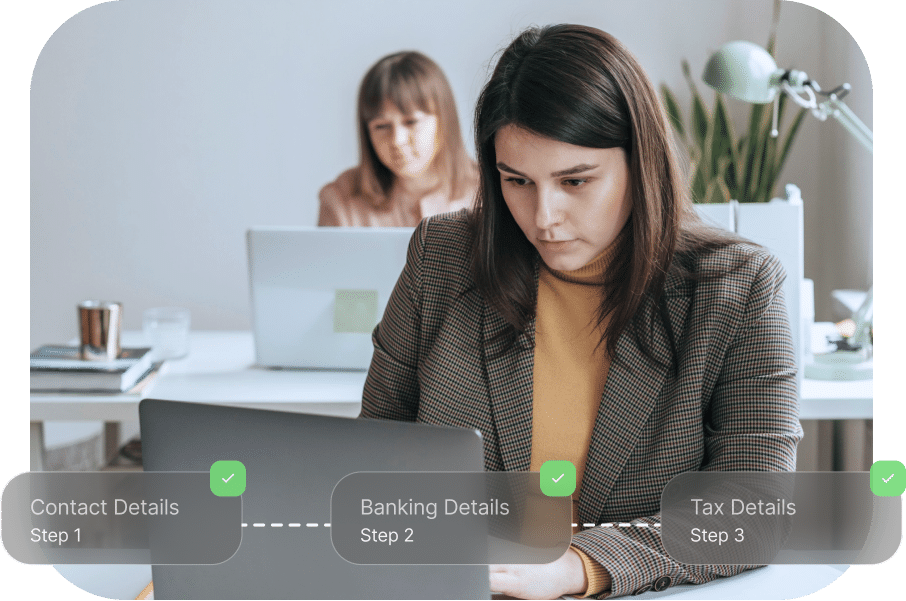

Personalised Onboarding

Our fully customisable, self-service onboarding system is designed to provide a user-friendly experience for suppliers.

Simplified Multi-Entity Payments

Manage all your payables operations from a single system while providing each entity its own workflows and branding.

Never Miss an Invoice

Process more invoices in less time using AI smart OCR. Our automated alerts and notifications inform stakeholders about pending approvals and due dates.

Customer Stories

Don’t just take our word for it, see what our financial services customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with customised onboarding to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimise

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Financial Services Payment Solutions FAQs

What is AP automation software for financial services?

AP automation software for financial services optimizes invoice management and payment processing, leading to enhanced efficiency, accuracy, and compliance. These solutions offer features for OCR technology, automated approval workflows, scheduled supplier payments, streamlined financial operations, and in-depth reporting.

Accounts payable automation software integrates smart ERP systems and banking dashboards to ensure real-time data synchronization. Security and compliance features maintain detailed audit trails and help the AP department detect fraud more effectively.

The automation process also includes detailed reporting and analytics. The right tools provide instant visibility into AP processes and spend analysis. Eliminating manual processes leads to fewer human errors, enabling better decision-making and greater cost-saving opportunities.

Benefits of AP automation include the ability to speed up processing times and reduce late payments. This process enhances supplier relationships with better terms and early payment discounts. Optimized compliance also ensures more secure data handling and adherence to regulations and policies. Promoting a paperless process reduces bottlenecks and time-consuming tasks for finance teams.

Key considerations for purchasing software to automate accounts payable include:

- Scalability (especially for small businesses)

- System compatibility

- Self-service capabilities

- User training

- Customization options

Consider vendor reputation. Considering all of this will help an organization make the most informed decision about which software best complements its business goals and needs.

How does automation improve the efficiency of financial services accounts payable processes?

Automation and accounting software significantly enhances the efficiency of accounts payable (AP) processes in financial services by reducing errors, streamlining tasks, and improving workflow management. Here’s how payable automation solutions contribute to these improvements:

Streamlining Data Entry and Invoice Processing

Automation tools capture invoice data using OCR (Optical Character Recognition) technology, reducing the need for manual data entry. This minimises inefficiencies and speeds up the process.

Automation software will alsouse robotic process automation (RPA) to match invoices to purchase orders and receiving reports. This reduces the time spent on manual verification and helps in quickly identifying discrepancies.

Improving Compliance and Auditability

Automated systems maintain detailed records of every transaction, making it easier to track and audit financial activities.

Automation can ensure that all payments adhere to regulatory requirements and internal policies, reducing the risk of non-compliance.

Enhancing Accuracy and Reducing Errors

Manual data entry is prone to human errors, which can lead to costly mistakes. Automation reduces these errors by ensuring data consistency and accuracy.

Automation tools can use artificial intelligence to detect and prevent duplicate payments by cross-referencing invoices against existing records in real-time.

Accelerating Payment Cycles

Automated workflows route invoices to the appropriate personnel for approval, significantly reducing the time spent on these financial processes.

Automation technology also ensures payments are made on time by scheduling payments based on due dates, thus avoiding late payment fees and improving supplier relationships.

Additional Benefits

- Lower operational and processing costs from paperless invoices, reduced pricing, faster supply chain, and e-invoicing

- Improved supplier relationships with real-time updates on invoice status

- Handle large volume increases and global payments

What are the key features to look for in an AP automation solution for financial services?

When choosing an AP auto automation solution for financial services, consider features that align with business goals and initiatives. Many solutions are on the market, so refining your needs is important.

To get started, here are the top features to consider when looking for an AP automation solution for financial services:

Invoice Processing and Data Capture

- Electronic invoicing: The ability to receive and process supplier invoices in various digital formats (like PDF and EDI).

- Optical character recognition: OCR for invoice capture. OCR digitizes and extracts data from paper invoices.

- Automated data entry: Automatically capture and input invoice data to minimize manual data entry and errors.

Approval Workflow Automation

- Custom controls: Easily configurable approval workflows with routing based on predefined roles, rules, and hierarchies.

- Mobile access: Invoice approval via mobile devices for greater access and flexibility.

- Alerts and notifications: Automated notifications and reminders are sent to approvers to avoid delays in the approval process.

Global Payment Processing

- Automated scheduling: The AP team can schedule payments to optimize cash flow and make timely payments to strengthen vendor relationships.

- Multiple payment methods: Support various global payment options, including ACH, virtual cards, and wire transfers.

- Payment reconciliation: Automatically reconciles payments with invoices and financial records, eliminating the need for manual tasks.

Integration Capabilities

- Bank integration: Direct integration with banking systems for more secure payment processing.

- ERP integration: Seamless integration with existing ERP systems for real-time data syncs.

- API access: APIs for custom integrations with other financial management systems.

Reporting and Analytics

- Custom reports: Tools to generate custom reports that meet specific business needs.

- Real-time reporting: Access to real-time data on AP metrics, cash flow, and outstanding liabilities.

- Spend analysis: Analytical tools to analyze spend patterns, optimize procurement, and identify cost-saving opportunities.

Security and Compliance

- Fraud detection: Features to detect and prevent fraudulent activities.

- Audit trails: Detailed logging of all transactions for compliance and creating an audit trail.

- Data security: Security measures to protect sensitive financial processes, including data encryption and access controls.

Compliance and Security

- Audit trails: Detailed logging of all transactions for audit and compliance purposes.

- Regulatory Compliance: Features to ensure adherence to financial regulations and internal policies.

- Data security: Robust security measures to protect sensitive financial data, including encryption and access controls.

- Fraud detection: Tools and features to detect and prevent fraudulent activities.

User Experience and Support

- User-friendly interface: Intuitive and easy-to-use interface to ensure high adoption rates.

- Vendor support: Reliable customer support and training resources for implementation and ongoing use.

- Scalability: Capability to scale with the organization’s growth and handle increasing volumes of invoices and payments.

Does AP Automation software deter invoice fraud?

Yes, AP automation software can significantly deter invoice fraud with features designed to enhance accuracy, security, and transparency. A few ways in which AP automation software helps prevent fraud include:

- Data validation: Automated systems can perform multiple verification checks on invoices, like purchase order matching.

- Duplicate detection: Software can automatically detect and flag duplicate invoices, preventing double billing.

- Role-based access: Only authorized personnel can approve invoices.

- Data encryption: Protects sensitive data, preventing tampering and unauthorized access.

- Regulatory compliance: Ensures all invoice processing adheres to relevant financial regulations and internal policies.

- Continuous monitoring: Monitors transactions continuously to detect and respond to fraudulent activities promptly.

AP systems can also run fraud detection algorithms. Pattern recognition tools utilize machine learning to determine unusual patterns that may indicate fraud, such as invoices from new vendors with high amounts or inconsistent billing cycles.

Supplier verification features will also ensure that all vendors are verified and approved before submitting invoices. Bank account verification tools confirm that payments are made only to verified bank accounts associated with registered vendors.

Recommendations