Digital Media Network Publisher Study Reveals the Need for Significantly Improved Payment and Communications Accuracy

New Research Uncovers Key Payment Issues Publishers Encounter with Their Ad Networks

Palo Alto, Calif. – May 2, 2016 – Tipalti, provider of the leading global payments automation platform, has released findings from a study titled, “Ad Networks Publisher Payment Satisfaction Survey.” Tipalti polled over 250 publishers and site owners worldwide on the state of their ad network payments. The study concluded that publishers’ loyalty to ad networks is heavily influenced by their satisfaction with the payment experience. The study also exposes several key insights, specifically the need for ad networks to improve payment status communications and to provide better access to self-service tools.

According to the findings, nearly all publishers agree that:

- Payment issues drive attrition: 48 percent of publishers have dropped an ad network because of a payment issue. Another 46 percent of those that haven’t yet dropped their networks say they would end the relationship if payment problems were to arise.

- Being paid on time and accurately is the top payment issue experienced by publishers.

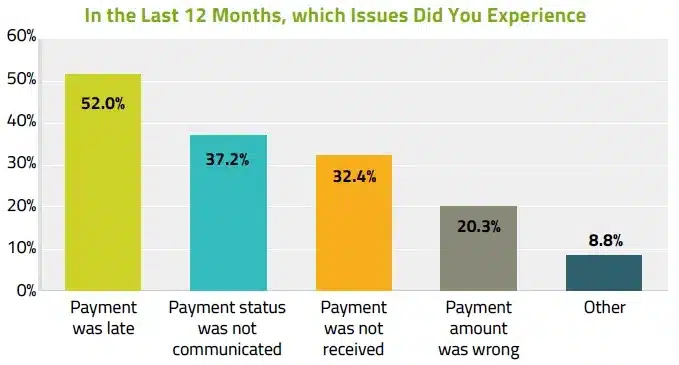

- Over the last 12 months, the top related issue publishers experienced was payments being late (52 percent).

The research also found other issues that were also important to the publisher’s relationship with their ad networks, including:

- Proactive communications such as email notifications on payment status updates and issue resolution are very important.

- 75.7% of publishers stated that when a payment status is changed, it was “very important” that they get a notification email and an additional 20.1% of publishers said it was “important” to get a notification email.

- Proactive communications were even more critical to publishers when payment issues occur. 82.3% of publishers stated that it was very important to receive notifications to help them resolve the payment issue and an additional 15.4% said it was important.

Finally, the survey exposed unique differences between U.S.-based publishers and those in other countries. For example:

- While U.S.-based affiliates prefer to be paid with PayPal and ACH, global publishers prefer local bank transfers (aka. Echeck, International ACH), wire transfers, PayPal, and prepaid debit payments.

- 93.5% of global publishers want to be paid in local currency.

- While tax ID information is generally collected by networks for U.S. publishers, the answer is not as clear for non-U.S. publishers. This is concerning given the new IRS FATCA tax compliance laws require companies to collect W-8 Series tax forms when making payments to global entities.

- 68% of publisher tax information is collected manually and in an insecure way or not at all.

“Ad networks need to consider the importance of their payment experience, ensuring that timely, accurate payments are made and that payment status is clearly communicated. In the highly competitive digital media landscape, the research highlights that their payment experience can make the difference in attracting and retaining the best publishers,” said Chen Amit, CEO and co-founder of Tipalti. “Employing operational best-payment practices, such as improving publisher on-boarding, offering publishers a secure portal to check their payment status 24/7, immediately notifying publishers about payment progress or issues, and providing a range of payment methods and currency choices, will ultimately lead to better publisher quality and, as a result, a better ad network.”

The “Ad Networks Publisher Payment Satisfaction Survey” was conducted by Tipalti in February and March 2016. Tipalti polled participants across social media. More than 250 people responded and the global mix of respondents included 62% non-U.S.-based and 38% U.S-based publishers. Publishers varied in size, ranging from smaller (those generating compensation under $10,000 a year) to larger publishers (those that had ad network compensation of over $200,000). 50% of participants said they were part of five or more ad networks.

The detailed report can be accessed here.