The EU’s Digital Services Act (DSA) is reshaping how online platforms, services, and marketplaces operate.

Under the DSA, citizens benefit from safer online experiences, while EU businesses build trust and grow without endless red tape and the associated costs.

In this guide, you’ll learn what DSA compliance means for your business and the obligations you must adhere to. We’ll also share best practices to help you meet compliance while improving user transparency.

Key Takeaways

- The Digital Services Act (DSA) replaces fragmented national laws with a single framework to promote safe online spaces, transparency, and fair competition.

- DSA compliance requires online platforms to verify traders, prevent illegal goods and services, ban illegal content, regulate advertising, and ensure the safety of minors.

- DSA compliance tiers apply proportionate rules based on impact and reach, with more stringent obligations for larger platforms.

- Automation tools like Tipalti simplify DSA compliance tasks, helping platforms meet EU rules while boosting trust and user experience.

What Is the Digital Services Act?

The EU Digital Services Act (DSA) regulates online services, platforms, and marketplaces to create a safe digital space for consumers and a level playing field for businesses.

Developed by the European Commission (and approved by the European Parliament), the legislation became applicable across European Union member states in February 2024. It covers all digital services offered or provided in the EU, regardless of business location.

Before the DSA, EU member states had their own laws regulating online service providers, which may or may not have applied to platforms and marketplaces.

The DSA aims to consolidate separate laws into a single piece of legislation that holds businesses to account. By doing so, the European Commission expects cross-border digital trade to increase by up to 2%.

The main goals of the DSA are:

| Key DSA Aim | Company Obligations |

|---|---|

| Restriction of illegal and harmful content | Digital service providers are responsible for: • Removing hate speech. • Terrorist content. • Child sexual abuse material. • Intellectual property infringement. |

| Operational transparency | Service providers must give users clear and transparent information on: • Policies • Tools • Content moderation practices • Complaint handling Companies must also file transparency reports detailing content moderation activities. |

| Protection of user information | Service providers must not use targeted advertising based on sensitive personal data, such as: •Race • Religion • Political opinions All ads should be clearly labelled. |

| Recommender system transparency | Platforms must be transparent about how recommender systems (e.g., personalised homepages and news feeds) work. Additionally, the DSA prohibits “dark patterns” (e.g., deceptive websites or apps) that prevent users from making informed and free choices. |

| Prevention of illegal goods and services | Online marketplaces must: • Implement trader traceability practices. • Work with “trusted flaggers.” • Have user-friendly reporting systems to flag and remove illegal products or services. |

| Ensuring the safety of minors | Services accessible to minors must use appropriate and proportionate measures to ensure privacy, safety, and security. The DSA also forbids ads targeting children. |

The DSA provides a safe online ecosystem for EU citizens to communicate, shop, and express ideas. Platform owners protect users from illegal activities and dangerous goods, prioritising their fundamental rights.

Businesses get clear and transparent rules applicable across 27 regimes in the single market.

If your company serves users across different European countries, the framework eliminates the extra cost and complication of complying with national-level regulations. This means SMEs have the opportunity to compete with larger players.

As the European Commission notes:

With a single framework for the EU, the DSA makes the single market easier to navigate, lowering compliance costs and establishing a level playing field. Fragmentation of the single market disproportionately disadvantages SMEs and start-ups wishing to grow, due to the absence of a large enough domestic market and to the costs of complying with many different legislations. The costs of fragmentation are much easier to bear for businesses, which are already large.

DSA implementations like transparency reports and trusted flaggers, alongside financial compliance tools to gather user information, also make it easier to spot and remove illegal activities.

This accuracy helps you prevent harmful practices and reduce losses, while growing user trust—and your reputation.

Pro Tip: The DSA aims to complement the General Data Protection Regulation (GDPR) to ensure the highest protection of fundamental rights for EU citizens in online environments. Learn more about GDPR in our compliance guide for finance teams.

Which Organizations Does DSA Compliance Apply To?

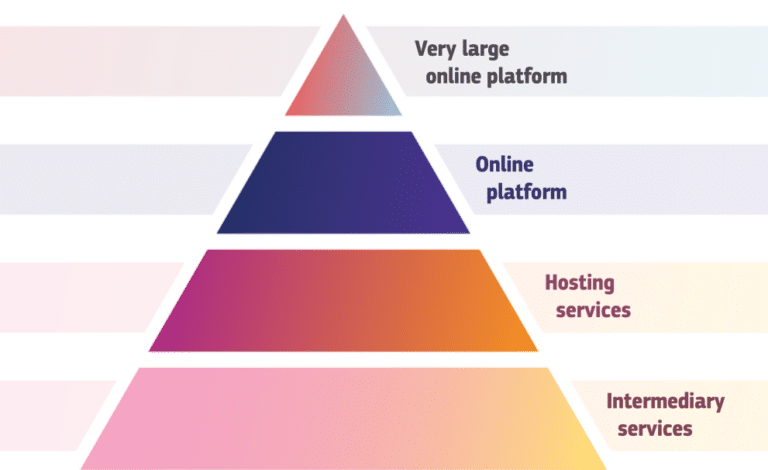

While the DSA covers all digital services and marketplaces, compliance works on a tiered system. Organisations are subject to different obligations depending on the size and nature of the business.

The European Commission takes a risk-based approach based on the level of risk and societal impact. The higher the tier, the stricter the rules.

For example, due to its size and impact on the digital market and society, a large online platform like Facebook must meet more stringent regulations than a toy company that lets third-party traders sell on its platform.

Here are the four DSA tiers and their scope:

| Tier | Examples | DSA Compliance Requirements |

|---|---|---|

| Tier 1: Online intermediary services | • Internet service providers (ISPs) • Virtual private networks (VPNs) • Domain registrars | Basic transparency reporting requirements. Businesses must: • Have a single point of contact for European regulators and users. • Comply with orders to act against illegal information or provide user data (if applicable). |

| Tier 2: Hosting services | • Cloud storage providers • Web hosting services • Content delivery networks (CDN) | All obligations of tier 1, plus: • Setting up notice and action mechanisms for illegal content. • Providing reasons for content moderation. |

| Tier 3: Online platforms | • Marketplaces • Social media platforms • Video-sharing sites • App stores • Community forums | All obligations of tiers 1 and 2, plus enhanced requirements to protect users and against the dissemination of illegal content. Online platforms must: • Increase platform transparency. • Eliminate dark patterns. • Set up internal systems for handling complaints and resolving disputes. |

| Tier 4: Very large online platforms (VLOPs) and very large online search engines (VLOSEs) | • Meta • TikTok • Amazon VLOPs and VLOSEs are platforms that reach 45+ million users, as designated by the European Commission. | All obligations of other tiers, plus requirements for comprehensive: • Content moderation • Systemic risk assessments • Independent audits • Independent compliance functions VLOPs and VLOSEs are under direct European Commission supervision. |

The DSA shares supervision and rule enforcement between:

- The European Commission—primarily responsible for VLOPs and VLOSEs.

- Member states—accountable for other platforms and search engines (depending on where they’re established).

The consequences of non-compliance depend on your tier. VLOPs and VLOSEs that fail to meet their obligations face a fine of up to 6% of global online turnover, plus suspension from the EU.

For intermediary services, hosting services, and online platforms, digital service coordinators (DSCs) in each member state decide the penalty.

Say you violate information or transparency obligations in Germany. You receive an administrative fine of up to €100,000, or up to €300,000 plus 6% of global annual turnover if your turnover exceeds €5,000,000, according to DLA Piper.

Small and micro-enterprises are currently exempt from some of the more burdensome rules of DSA, Article 19 of the DSA explains. You fall into this category if you have fewer than 50 employees and a maximum turnover of $10 million.

The Commission carefully monitors the effect of regulations. So, you must stay updated with the latest version of the DSA to understand your obligations.

How EU Platforms and Marketplaces Can Improve Transparency for DSA Compliance

To comply with the DSA, online platforms and marketplaces need transparent, user-centric systems to verify traders, handle illegal content, and disclose practices.

With rules already in force, accountability and compliance should be immediate priorities—regardless of where your business or customer base is in Europe.

Here’s how to ensure you’re fostering accountability, trust, and safer experiences for users.

Conduct Know Your Customer Due Diligence

If you allow consumers to conclude distance contracts (i.e., purchase goods or services from sellers), you must meet the DSA’s trader traceability requirements.

Trader traceability is more commonly known as Know Your Customer (KYC), or Know Your Business Customer (KYBC).

KYC involves obtaining and verifying key information from third parties selling or offering services on your platform.

It’s a practice that benefits both businesses and users. If you can identify and clarify who’s trading on your platform, you can create a safe, transparent, and trustworthy space for customers while discouraging illicit traders.

Article 30 of the DSA states you should obtain the following trader information where applicable:

• Name, address, telephone number, and email address.

• A copy of their ID or any other electronic identification, per Article 3 of Regulation (EU) No 910/2014 of the European Parliament and the Council (40).

• The payment account details.

• Trade register details and registration number or equivalent identification.

• Self-certification, committing to only offer products or services compliant with applicable Union law rules.

Note: Collecting and verifying trader information is nothing new for online marketplaces. Much of the data required for trader traceability overlaps with the EU’s DAC7 due diligence rules.

Under DAC7, digital platforms must record and annually report seller details for EU tax compliance in member states. This includes the individual or business name, address, tax identification number (TIN), business registration number, and value-added tax (VAT) number.

Therefore, conducting KYC due diligence for each trader on your platform can help you maintain DSA and DCA7 tax compliance simultaneously. The best way to ensure robust KYC is with an automated compliance solution.

Use Automation to Streamline DSA Compliance

Why automate? Manual data entry is labour-intensive and error-prone. As KYC demands grow, traditional methods cause verification delays and prevent smooth transactions.

For example, Tipalti’s automated DSA compliance features include:

- Accurate data collection. Safely guide payees to provide DSA and DAC7 business information during onboarding.

- Validation checks. Automatically compare seller data (e.g., business, tax, and VAT numbers) against EU and international databases and blacklists to flag inconsistencies, reducing manual work and errors.

- Audit trails. Securely store records and internal communications for clear accountability—supporting internal reviews and DSA requirements.

Automating repetitive tasks reduces administrative workload and frees up internal resources—allowing you to scale without extra headcount.

Smooth onboarding and clear communication build trust, making your platform more appealing to sellers and consumers.

Implement Notice and Action Mechanisms

Notice and action mechanisms allow users to report illegal content or products, so you can act on them promptly. Article 16 of the DSA states:

Mechanisms shall be easy to access and user-friendly, and shall allow for the submission of notices exclusively by electronic means.

Here’s how to implement a notice and action mechanism that supports users, while protecting your business against reputational damage:

1. Establish a clear point of contact, such as an online portal, email address, or “flag” button and form for users to submit notices.

2. Send confirmation receipts to inform users you’ve successfully received the notice.

3. Assign a team to assess reports and take down illegal content when justifiable.

4. Provide users with clear and specific reasons for your moderation decision. When taking action and justifying your move, consider users’ fundamental rights and respond in a way that respects their freedom of expression.

5. Record all notices for internal reviews and DSA transparency reports.

A clear, fair notice and action process shows you take accountability seriously—safeguarding users, ensuring compliance, and nurturing trust with each interaction.

Submit Annual Transparency Reports

Transparency reports are one of the main requirements of the DSA, applying to all in-scope digital services.

The DSA requires you to publish a yearly transparency report (twice a year for VLOPs and VLOSEs). The reporting period runs for a full calendar year (i.e., January 1 to December 31), with your report due by February 28 the following year.

Reports should include information on content moderation practices for the year, such as:

- Number of takedown orders received from relevant national judicial or administrative authorities (e.g., trusted flaggers).

- Number of moderation actions and the kinds of actions taken.

- Number of notices received from users and trusted flaggers, and the actions taken.

- Number of moderation action appeals.

- Actions taken in response to appeals.

- Information on out-of-court dispute settlements.

- Number of suspensions imposed on users misusing your services.

- Number of active users on your platform.

- Information on content moderation teams (e.g., number, qualifications, linguistic experience, and tools used).

Reported data goes into the DSA Transparency Database, giving users clarity and allowing oversight of your content management. It also enables EU stakeholders to improve and successfully enforce the DSA.

A proactive approach to accountability is crucial to keep notice numbers low and subsequent actions swift. Achieving this starts with KYC.

Using a tool like Tipalti to onboard sellers via a secure hub helps you validate them before they use your platform. Which prevents bad actors and illegal content from reaching your users.

Make Compliance Your Competitive Edge in the EU

Tipalti simplifies DSA and DAC7 reporting—automating seller data collection and validation for online platforms and marketplaces. Save time, manage risk, and scale without extra headcount.

DSA Compliance Best Practices for EU Online Platforms and Marketplaces

DSA compliance helps deliver transparency and user protection across your company’s processes.

To meet requirements and drive improvement, apply these content moderation best practices that protect sellers, users, and your business.

Conduct Platform Risk Assessments

Under DSA legislation, risk assessments are currently only mandatory for VLOPs and VLOSEs. Still, understanding how your users may be at risk is good practice for any online platform or marketplace.

Risk assessments help identify areas where your platform might enable illegal content or products, consumer harm, or regulatory risk—and spot opportunities to prevent them.

Here’s how you might carry out a risk assessment:

| DSA Risk Assessment Step | Action |

|---|---|

| 1. Identify DSA-related risks | Assess how your platform might unintentionally allow illegal content or products, data misuse, disinformation, or user deception. |

| 2. Look at how risks arise | Assess your business model, platform features, and user behaviour. Do incentives, tools, or activities encourage or promote risky activity? Or are they open to exploitation? |

| 3. Document current safeguards | Map out how you currently reduce risk (e.g., verification processes, platform rules, content and product moderation, or takedown procedures). |

| 4. Develop measures to improve controls | Implement risk mitigations such as automated onboarding, content detection rules and protocols, along with regular audits of Terms of Service documents and data use. |

| 5. Document and review policies and practices | Record risk assessment findings and new measures. Update them periodically or whenever you expand features or markets. Track progress for continual improvement, using insights to support internal training. |

Think of risk assessments as an early warning system. Catching potential risks before they become public issues keeps you accountable and proves you take your DSA responsibilities seriously.

Create a DSA Compliance Plan

A DSA compliance plan acts as a playbook for meeting EU law and keeping your team aligned on best practices.

It should provide all stakeholders with clear instructions on safeguarding sellers and users and on driving trust in your platform.

Here’s what to include in your DSA compliance plan:

| Section | What to Include |

|---|---|

| DSA scope | Information on your platform, user base, risks, and DSA obligations. Include details for the EU DSC in your member state. You may need to liaise with DSCs on complaints and reports. |

| Responsibilities | Internal responsibilities across relevant departments such as finance, customer service, tech, marketing, and legal (e.g., who manages risk, who processes notices, who maintains technical systems, etc.). |

| Policies and procedures | Operational rules and processes for notice and action mechanisms, complaint handling, seller verification, data retention, and advertising transparency. |

| Risk management | Risk assessment processes, review schedule, and mitigation measures. |

| Transparency report requirements | Data required for DSA transparency reports, plus details on deadlines for data collection and publishing reports. |

| DSA resources | Links to resources on DSA rules and EU guidance. Plus links to company handbooks and training materials for consistent compliance practices. |

A DSA compliance plan isn’t set in stone. The DSA is still in its infancy and will be monitored closely by the Commission, European Parliament, and national authorities. Evolve your plan in line with the latest DSA rules and your company’s growth.

Appoint a DSA Compliance Lead

While currently only VLOPs and VLOSEs legally require a DSA compliance officer, appointing a compliance lead is a smart way to boost accountability, trust, and governance.

A DSA compliance lead can sit in your legal, operations, or trust and safety team to:

- Draft and oversee your DSA compliance plan.

- Lead on risk assessments and monitor mitigation measures.

- Coordinate with internal teams on notice handling, content moderation, and appeals.

- Stay up to date on DSA guidance and requirements.

- Be the main point of contact for internal stakeholders, DSCs, and trusted flaggers.

Their presence in the company can ensure DSA consistency across teams, keeping your platform aligned if enforcement expands and your company grows. It also clearly signals to regulators, partners, and users that you value online safety.

Implement Technology to Support Compliance

Utilising technology can help streamline your DSA compliance efforts, allowing you to focus on enhancing user experience while meeting EU requirements.

For efficient content handling, artificial intelligence (AI) moderation tools can automate the detection and removal of illegal or harmful content at scale.

However, human oversight is essential to provide context and ensure fair and accurate decisions. As AI moderation tools must meet DSA and EU AI Act standards for transparency, the onus is on your business to detail their accuracy, error rates, and the role of human reviewers.

For vendor management, a tool like Tipalti helps vet third-party sellers and verify every transaction to ensure secure payments.

The Tipalti Detect feature includes automatic risk checks, detailed audit trails, and payee data tracking—protecting both buyers and sellers.

With information stored in one place and easily accessible for reporting, you save time and effort complying with DSA and DAC7 reporting obligations.

Tipalti also complies with EU GDPR laws—keeping sensitive seller data secure from third-party manipulation.

Whatever technology solution you choose, ensure it has robust data encryption, role-based access, and compliance certifications to safeguard your business and its customers.

Support Your EU Business’s DSA Compliance with Tipalti

While DSA compliance creates extra work for online platforms and marketplaces, the Digital Services Act ultimately makes the EU a safer, more transparent place to operate.

With a single set of rules, meeting your obligations means you can expand into new member states without the cost or burden of adhering to multiple online legislations. You also get to compete on a level playing field, where trust and transparency can be key advantages.

Partnering with a tool like Tipalti will help you fulfil your KYC requirements to protect sellers and users while streamlining DSA compliance. See how our automated tax compliance features support your reporting and drive process efficiency.