In corporate finance, you can add immense value by monitoring and analyzing the accounts payable turnover ratio. The AP turnover ratio is a short-term liquidity ratio. Transform the payables ratio into days payable outstanding (DPO) to see the results from a different viewpoint.

Table of Contents

- What is the Accounts Payable Turnover Ratio, or AP Turnover Ratio?

- How Do you Calculate AP Turnover?

- How Do you Convert the AP Turnover Ratio to the Number of Days Outstanding in Accounts Payable?

- How Can You Analyze Your Accounts Payable Turnover Ratio?

- What is a Good Accounts Payable Turnover Ratio in Days (DPO)?

- Example of How to Secure Good AP Turnover Ratio

- Is a Higher or Lower AP Turnover Ratio Better?

- How Can You Improve Your Accounts Payable Turnover Ratio in Days?

- AR vs AP Turnover Ratios

- How to Track Your AP Turnover Ratio

- Are There Drawbacks to the AP Turnover Ratio?

- Importance of Your Accounts Payable Turnover Ratio

What is the Accounts Payable Turnover Ratio, or AP Turnover Ratio?

The accounts payable turnover ratio measures the rate at which a company pays back its suppliers or creditors who have extended a trade line of credit, giving them invoice payment terms. To calculate the AP turnover ratio, accountants look at the number of times a company pays its AP balances over the measured period.

The AP turnover ratio is one of the best financial ratios for assessing a company’s ability to pay its trade credit accounts at the optimal point in time and manage cash flow.

How do you calculate AP turnover?

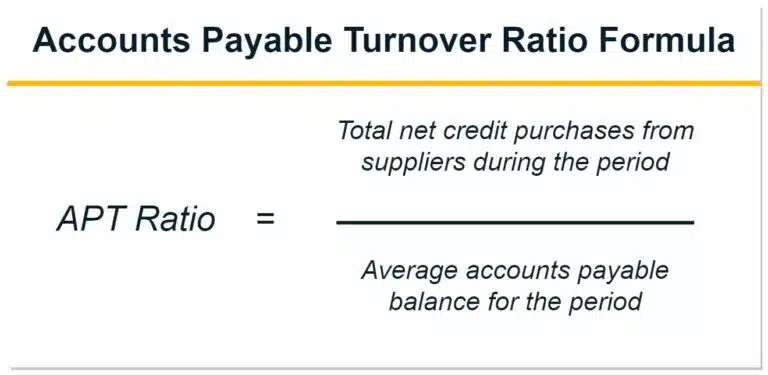

To calculate AP turnover, you need to know the AP turnover formula and how to calculate items in the accounts payable turnover formula, including total net credit purchases and the average accounts payable balance for the time period. You can automatically or manually compute the AP turnover ratio for the time period being measured and compare historical trends.

Instead of using net credit purchases, the accounts payable turnover ratio is sometimes computed using the total cost of goods sold (COGS) from the income statement divided by the average accounts payable balance for the accounting period. We don’t think that this approach is comprehensive enough to get a handle on cash flow. Therefore, we suggest using all credit purchases in the formula, not just inventory and cost of sales that focus on inventory turnover.

AP Turnover Formula

Our suggested accounts payable turnover ratio formula is:

Total net credit purchases from all suppliers during the period

Divided by:

Average accounts payable balance for the period

Choose one or more periods of time. To keep on top of AP turnover often, select each month. Or choose each quarter and fiscal year.

Automatically or Manually Calculate AP Turnover Ratio

Your company’s accounts payable software can automatically generate reports with total credit purchases for all suppliers during your selected period of time. If it’s not automated, you can create either standard or custom reports on demand.

Net credit purchases are total credit purchases reduced by the amount of returned items initially purchased on credit. Remember to use credit purchases, not total supplier purchases, which would include items not purchased on credit.

Calculate the Average Accounts Payable Balance

To calculate the average accounts payable balance:

- Look at the balance sheet in your set of financial statements.

- Find the accounts payable balance in the current liabilities section.

- Add the beginning and ending accounts payable balances for the period.

- Divide them by two.

(Beginning accounts payable balance + Ending accounts payable balance) / 2

AP Turnover Ratio Calculation Example

Total net credit purchases for year 2021: $1,250,000

Accounts payable balance January 1, 2021: $208,000

Accounts payable balance December 31, 2021: $224,000

Average accounts payable = ($208,000 + $224,000) / 2 = $216,000

AP turnover ratio = $1,250,000 / $216,000 = 5.8 times per year

How do you convert the AP turnover ratio to number of days outstanding in accounts payable?

After you’ve computed the payables turnover ratio, you can easily transform the results into days payable outstanding (DPO). The average number of days payable outstanding is calculated as:

Period of time:

One-year formula: 365 days / AP turnover ratio = Days payable outstanding

One-quarter formula: 90 days / AP turnover ratio = Days payable outstanding

One-month formula: 30 days / AP turnover ratio = Days payable outstanding

Converting the AP turnover ratio from the one-year example used above:

365 / 5.8 = 63 Days payable outstanding

Companies may use 360 days instead of 365 days. It’s your choice. Compute AP turnover days often as an accounts payable management tool. Always compute it at year-end for an end-of-the-period stat.

How Can You Analyze Your Accounts Payable Turnover Ratio?

After calculating the accounts payable turnover ratio and DPO, how can you perform a financial analysis of the results to gain insights and take action?

Compare the accounts payable turnover ratio to:

• Invoice payment terms

• Accounts receivable turnover ratio

• Inventory turnover ratio

• Industry benchmarks

• Trends over time

Compare AP Turnover Ratio to Invoice Payment Terms

First, look at the AP turnover ratio compared to invoice payment terms from your creditors. Are you taking early payment discounts when it makes financial sense? Are you paying invoices too fast when payment terms are net 30, net 45, net 60 or net 90 days, and no early payment discounts are offered?

If you pay invoices quicker than necessary, you’re either paying short-term loan interest or not earning interest income as long as you can on your cash balances. Have you thought about stretching accounts payable and condensing the time it takes to collect accounts receivable? You can try this approach. If you do, you want to be sure that your business treats vendors reasonably well. Vendors will cut off your product shipments when your company takes too long to pay monthly statements or invoices.

The 63 Days payables turnover calculation in this article is reasonable considering general creditor terms. It would be best if you made more comparisons to be sure it’s the right number for your company.

Compare Turnover Ratios for Accounts Payable and Accounts Receivable

Compare the AP creditor’s turnover ratio to the accounts receivable turnover ratio. You can compute an accounts receivable turnover to accounts payable turnover ratio if you want to. Are you paying your bills faster than collecting invoices from customer sales? If so, your banker benefits from earning interest on bigger lines of credit to your company.

Compare AP Turnover Ratio to Inventory Turnover Ratio

To generate and then collect accounts receivable, your company must sell purchased inventory to customers. Often a business pays for inventory purchases before making sales. But set a goal of increasing sales and inventory turnover to improve cash flow to the extent possible.

Industry Benchmarking for AP Turnover Ratio

Benchmark your AP turnover ratio with industry average stats. What is the average payable turnover or Days payable outstanding? Are your numbers in line?

Track AP Turnover Ratio Trends

Compute the accounts payable turnover ratio over time. Use graphs to view the changes in trends as the economy and your business change.

What is a Good Accounts Payable Turnover Ratio in Days (DPO)?

A good accounts payable turnover ratio in days (DPO) depends on your business and benchmarking with your industry. AP turnover depends on the average credit term days received from your vendors and your company’s payment timing policies. Policies must support vendor relationships, good credit history, and continuing inventory shipments from suppliers.

How to Look at DPO

The accounts payable turnover in days is also known as days payable outstanding (DPO). It’s a different view of the accounts payable turnover ratio formula, based on the average number of days in the turnover period. The DPO formula is calculated as the number of days in the measured period divided by the AP turnover ratio.

The DPO should reasonably relate to average credit payment terms stated in the number of days until the payment is due and any discount rate offered for early payment.

Example of How to Secure Good AP Turnover Ratio

When you receive and use early payment discounts, you increase the AP turnover ratio and lower the average payables turnover in days.

For example, one of the credit payment terms offered by suppliers is 2/10 net 30, which means that the supplier will offer a 2% early payment discount if you pay the invoice in 10 days instead of 30 days when the full amount of the invoice is due.

If your business has cash availability or can make a draw on its line of credit financing at a reasonable interest rate, then taking advantage of early payment discounts makes a lot of sense.

Is a Higher or Lower AP Turnover Ratio Better?

Some people think that, generally, a high turnover ratio is better. A high ratio for AP turnover means that your company has adequate cash and financing to pay its bills. It’s in good financial condition.

Businesses with a higher ratio for AP turnover have sufficient cash flow and working capital liquidity to pay their suppliers reasonably on time. They can take advantage of early payment discounts offered by their vendors when there’s a cost-benefit. Possibly they can negotiate even more types of discounts from happy suppliers.

But your goal isn’t to earn the highest ratio score among your competitors. Some better questions for you to think about are:

- How do you improve accounts payable turnover?

- Are accounts receivable turnover and accounts payable turnover balanced?

- Does accounts payable turnover consider inventory turnover?

- Is the company’s cash flow timing optimal?

- Is the company able to pursue new business opportunities with its cash flow?

- When is the best time to pay your vendors?

Inverse Relationship Between AP Turnover Ratio and DPO

Note that higher and lower is the opposite for AP turnover ratio and days payable outstanding. For example, if the accounts payable turnover ratio increases, the number of days payable outstanding decreases.

If the AP turnover ratio is 7 instead of 5.8 from our example, then DPO drops from 63 to 52 days. A high turnover ratio implies lower accounts payable turnover in days is better.

The following two sections refer to increasing or lowering the AP turnover ratio, not DPO (which is the opposite).

Ways to Increase AP Turnover Ratio

Ways to increase the AP turnover ratio include:

- Pay vendor invoices by the due date

- Take early payment discounts by paying invoices much sooner

- Increase sales revenue and the sales turnover rate

- Collect accounts receivable faster to generate cash flow for paying bills sooner

- Tap your business line of credit when needed to cover financing gaps

- Consider customer invoice factoring for earlier collection to improve cash flow

Ways to Lower AP Turnover Ratio

Ways to lower the AP turnover ratio include:

- Set and approve a company policy with longer accounts payable turnover days

- Stretch out the payment of accounts payable (without harming vendor relationships)

- Don’t take early payment discounts on invoices as often

The cash conversion cycle spans the time in days from purchasing goods to selling them and then collecting the accounts receivable from customers.

The longer it takes to sell inventory and collect accounts receivable, the more cash tied up for that length of time. It’s harder to pay accounts payable because cash flow is slowing down.

If the cash conversion cycle lengthens, then stretch payables to the extent possible by delaying payment to vendors. But be reasonable in any delays. Vendors must be reasonably happy, so they don’t cut off your shipments.

How Can You Improve Your Accounts Payable Turnover Ratio in Days?

Improve your accounts payable turnover ratio in days (DPO) by lowering the days payable outstanding to the optimal number that meets your business goals. Take early payment discounts. Optimize cash flow by matching DPO with DRO (days receivable outstanding), quickening accounts receivable collection, speeding inventory turnover through faster sales, and getting financing when needed.

AR vs AP Turnover Ratios

The AR turnover ratio formula is Net Credit Sales divided by the Average Accounts Receivable balance for the period measured. Similarly calculated, the AP turnover ratio formula is net credit purchases divided by Average Accounts Payable balance for that time period.

To balance cash inflows and outflows, compare your accounts payable turnover ratio with your accounts receivable turnover ratio. Or apply the calculation comparing the payables turnover in days to the receivables turnover in days if that’s easier for you to understand.

How to Track Your AP Turnover Ratio

Some ERP systems and specialized AP automation software can help you track trends in AP turnover ratio with a dashboard report. Graphing the AP turnover ratio trend line over time will alert you to a break from your typical business pattern. Corporate finance should perform a broader financial analysis than an accounts payable analysis to investigate outliers from the trend.

Track benchmark AP turnover ratio in your industry for periodic comparisons.

Are There Drawbacks to the AP Turnover Ratio?

Drawbacks to the AP turnover ratio relate to the interpretation of its meaning. When is having high accounts payable turnover best? How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash? Industry benchmarks may not reflect your company’s circumstances.

Importance of Your Accounts Payable Turnover Ratio

By benchmarking with industry statistics and doing some internal analysis, you can decide when it’s the best time to pay your vendors. Your company’s accounts payable turnover ratio (and days payable outstanding) may be considered a higher ratio or lower ratio in relation to other companies.

A company with a low ratio for AP turnover may be in financial distress, having trouble paying bills and other short-term debts on time. Or it may be intentionally delaying payments to improve cash flow.

After performing accounts payable turnover ratio analysis and viewing historical trend metrics, you’ll gain insights and optimize financial flexibility. Plan to pay your suppliers offering credit terms with lucrative early payment discounts first.

Look for opportunities to negotiate with vendors for better payment terms and discounts. When you take early payment discounts, your inventory costs less, and your cost of goods sold decreases, improving profitability. Your cash flow improves because less cash is required to pay the vendor invoices.

Are good accounts payable turnover and business credit payment history letting your company get the best interest rates offered by lenders?

Determine whether your cash flow management policies and financing allow your company to pursue growth opportunities when justified. Over time, your business can respond to new business opportunities and changing economic conditions. Improve cash flow management and forecast your business financing needs to achieve the optimal accounts payable turnover ratio.