Nonprofit Finance Automation to Fuel Your Mission

Cut manual tasks, scale global mass payments, and reclaim time with finance automation that lets you focus on impacting your community.

Nonprofit Features

Scale Your Impact

Our connected solutions across accounts payable, mass payments, and procurement help automate and streamline your most critical finance processes, reducing costs, streamlining supplier onboarding, managing headcount, and enforcing compliance.

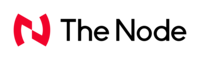

Reduce Costs, Build Trust

Nonprofits need to keep operations lean to maintain donor trust. Our automated AP solutions keep costs low, while also minimizing errors.

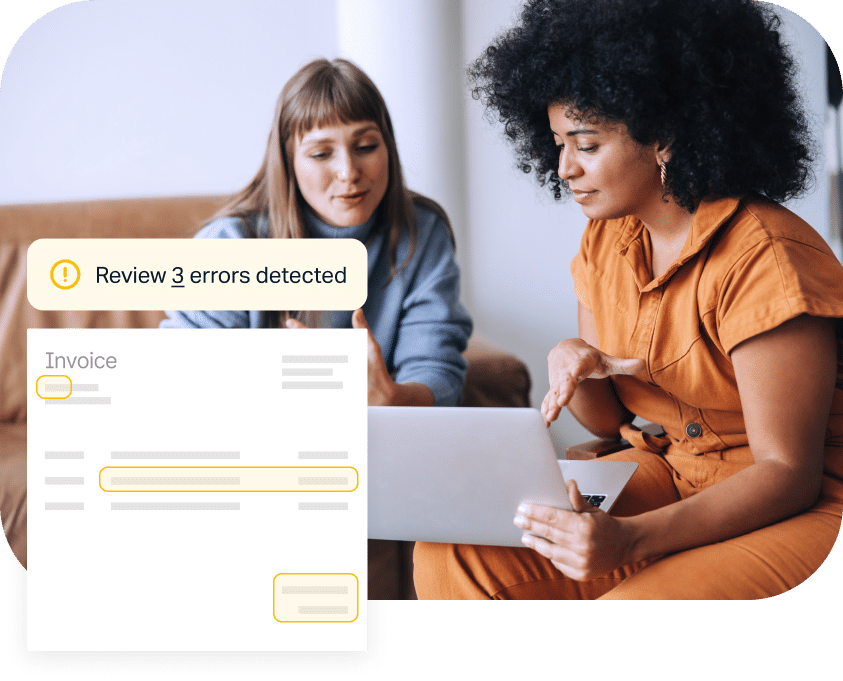

Automated Compliance

Digitally collect and validate local tax IDs to eFile during tax season.

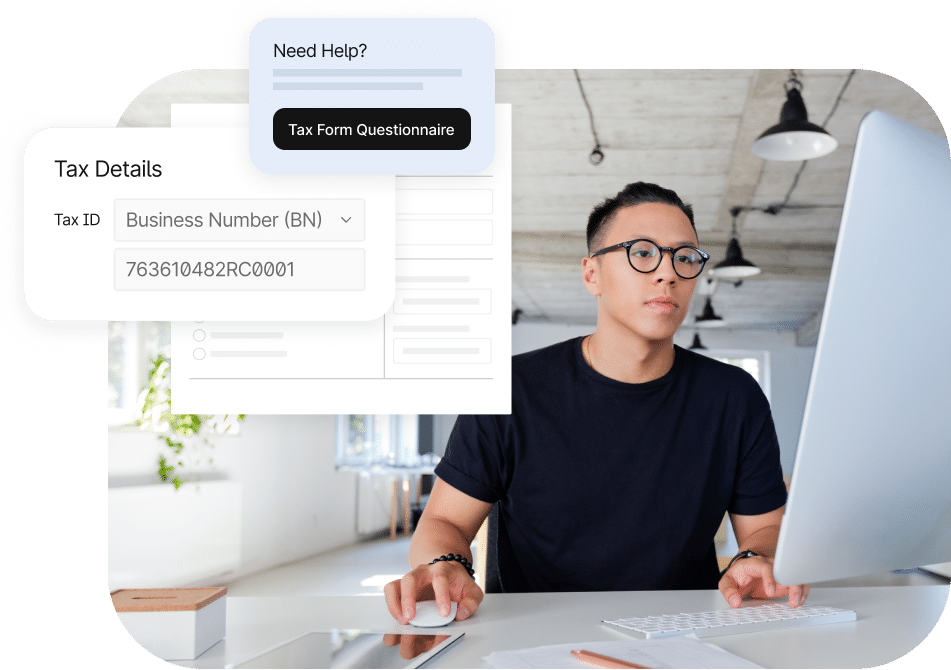

Personalized Onboarding

Our fully customizable, self-service onboarding system is designed to provide a user-friendly experience for suppliers.

Lightning-Fast Payments

Quick and easy payments across 200+ countries in 120 currencies and 50+ different payment methods. Proactively eliminate payment errors with 26,000+ built-in rules.

Integrate With Existing Systems

Connect other systems to your payments engine to increase transparency—including ERPs like NetSuite, Sage Intacct, Microsoft, and Xero.

Customer Stories

Don’t just take our word for it,

see what our nonprofit customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalized assistance to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimize

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your finance operations with Tipalti.

Recommendations

You may also like

Nonprofits Payment Solutions FAQs

What are accounts payable for nonprofit organizations?

Just like for-profit organizations, nonprofits need accounts payable to represent the amounts owed to suppliers, vendors, and other creditors for goods and services received (yet not paid for).

Nonprofit accounting considers expenses like:

- Utilities and rent

- Office supplies

- Equipment

- Professional services (i.e. legal, accounting)

- Maintenance and repairs

Nonprofits may also incur costs for marketing and advertising. All of these expenditures require some form of financial management, regardless of whether the business is fundraising or turning profit.

Subsequently, if a not-for-profit business is using Excel for bookkeeping and accounts payable, it may fall behind or miss important vendor payments.

Effective accounting software helps a nonprofit stay compliant, maintain healthy supplier relationships, and ensure accurate financial reporting.

What are the accounting standards for nonprofits?

In Canada, nonprofit organizations (NPOs) follow specific accounting standards that ensure transparency and accountability in financial reporting. This is similar to the Generally Accepted Accounting Principles (GAAP) in the US.

These standards are set by the Accounting Standards Board (AcSB) and are part of the Canadian Accounting Standards for Not-for-Profit Organizations (ASNPO).

Here’s an overview of the key accounting standards for nonprofits in Canada:

Financial Statements

Canadian NPOs must prepare financial statements to provide a clear and accurate picture of their financial position and performance. Key financial statements include:

- Statement of Financial Position

- Statement of Operations

- Statement of Changes in Net Assets

- Statement of Cash Flows

Fund Accounting

Some Canadian NPOs use fund accounting to segregate resources based on restrictions and purposes. This involves:

- Restricted funds: these are restricted by donors or external parties for specific purposes or projects.

- Unrestricted funds: these are available for general operations and can be used at the organization’s discretion.

Revenue Recognition

Revenue recognition for Canadian NPOs is governed by specific guidelines, primarily outlined in Section 4410 of Accounting Standards for Not-for-Profit Organizations (ASNPO). This includes:

- Contributions and donations

- Grants

- Membership dues and fees

Expense Reporting

Non-profits must allocate and report expenses in a manner that reflects their use of resources. This includes:

- Functional classification

- Disclosure of allocated costs

Additional Considerations

- Capital assets

- Accounting for Endowments

- Related Party transactions

- Financial instruments

What accounting method do most nonprofits use?

The majority of nonprofits use the accrual basis of accounting (as opposed to cash-basis accounting).

Accrual basis is the preferred method because it provides the most accurate view of a company’s financial situation (including real-time cash flow and liabilities). It also ensures transparency for funders, donors, and regulatory bodies.

Revenue

In accrual accounting for nonprofits, revenue is recorded when it is earned, regardless of when cash is received. For example, a grant that is awarded but not yet received, would still be considered revenue.

Expenses

Functional expenses are recorded when they are incurred, not necessarily when they are paid. If a nonprofit receives an invoice for lawn care, the expense is recorded when the services are received (even if the payment is being made later).

Financial Statements

In the accrual basis of accounting practices, nonprofits prepare financial statements such as:

- Balance Sheet (statement of financial position)

- Income Statement (statement of activities)

- Statement of Cash Flows

Internal Control

Accrual accounting helps nonprofits monitor receivables, payables, and other obligations, which is crucial for effective budgeting and financial planning.

This form of accounting also helps nonprofits maintain a clean audit trail, which is critical for the Canada Revenue Agency to continue granting tax-exempt status.

Fund Accounting

Fund accounting is a specialized accounting method also used by nonprofits. This is a specific method used by professional accountants to manage and report funds that have a restriction on their use.

What are some examples of internal controls for nonprofit organizations?

Internal controls are important to ensure the integrity of operational and financial activities, as well as the proper allocation of resources. Some examples of common internal controls for a nonprofit organization include:

- Segregation of Duties: Separate responsibilities for authorizing transactions, recording transactions, and custody of assets.

- Authorization: All financial transactions require authorization from designated personnel.

- Access Controls: Restrict access to certain systems that contain sensitive financial data.

- Reconciliations: Regularly reconcile bank accounts with your general ledger to ensure accuracy and maintain accounting standards.

- Budgeting and Reporting: Develop and adhere to a detailed budget that outlines expected revenue/expenses, then regularly review reports.

It’s also important to establish clear written policies, including procedures for financial management and conflict of interest.

Nonprofits should also periodically conduct independent audits and reviews of everything, from day-to-day journal entries, net assets, and disclosures, to short-term assets (including depreciation), the chart of accounts, and other forms of reporting.

How can accounts payable automation benefit a nonprofit organization?

Accounts payable automation offers significant benefits to a nonprofit organization, enhancing accuracy, efficiency, and eliminating time-consuming manual tasks.

Key advantages of nonprofit accounting software include:

Greater Cost Savings

AP automation reduces administrative and storage costs. It also enables nonprofits to collect on early payment discounts offered by vendors.

Improved Efficiency

Automation streamlines the entire AP process, reducing the time needed to manage invoice data and make manual payments.

Streamlined Compliance

AP software provides a detailed, time-stamped audit trail that enhances transparency for all stakeholders involved. It also ensures adherence to policies.

Enhanced Accuracy

Tools to automate AP reduce human errors in manual data entry. Smart dashboards can also easily detect duplicated invoices and payments.

Better Supplier Relationships

Automation ensure vendors are paid on time, fostering better relationships and potentially improving the terms of service.

Additional Benefits

- Data protection through secure access controls

- Seamless integration with existing ERPs (like QuickBooks)

- Easily scales with higher transaction volumes

- Real-time visibility into AP status and initiatives

- Improves cash flow forecasting

How do I manage grant payments on behalf of donors?

To maintain financial health, transparency, and trust, a nonprofit must manage grant payments effectively.

Here are some critical steps to managing grant payments for donors:

- Implement a Donor Management System (DMS). This helps to track donor data.

- Provide Multiple Payment Options. This can include anything from credit/debit card to ACH and online payment platforms.

- Ensure Secure Payment Processing. Use secure payment gateways to protect donor information.

- Automate Accounts Payable. Automate the processing of recurring grant payments to reduce administrative burden and ensure cash flow.

- Communicate Regularly. Send receipts to donors for tax purposes and to say thank you.

- Segment Donor Base. Use criteria like donor frequency, amount, and preferred comms.

- Reporting and Analytics. Use the DMS and AP software to analyze trends and identify areas for improvement.

- Ensure Compliance. Issue receipts and maintain proper audit trails.

- Offer Donor Support. Provide a dedicated point of contact to address any payment issues promptly or answer questions.

A nonprofit should also be open to productive feedback about the payment experience to refine the process and enhance donor satisfaction.

Can I manage grant payments for donors and business payments in one solution?

Yes, you can manage both grant payments on behalf of donors and business payments in one integrated solution.

Software geared towards nonprofit accounting will be the most successful strategy and can consistently segregate your payments based on custom rules and regulations.

Solutions like Tipalti will ensure all global compliance and security standards are met, offering an unparalleled level of flexibility when it comes to nonprofit vendor payments.

Using Tipalti, a nonprofit has the ability to make quick grant payments to 200+ countries in 120 currencies using 50+ different payment methods.

Additionally, Tipalti offers a self-service vendor portal. This gives nonprofits the time to focus on fundraising, strengthening donor relationships, and accomplishing more strategic tasks.