The First-Class Travel Payment Solution

Our payment solutions will help you attract and retain top agents, simplify operations, and build a stellar industry reputation.

Travel Features

Travel Payment Solutions for Hyper-Scale

Automate your entire global payments process and process thousands of transactions, while minimizing errors and removing the complexities of managing global payments.

Pay Anyone, Anywhere

Send cross-border payments to your global agents, experience providers, and affiliates to 200+ countries and territories in 120 currencies via 50+ payment methods, including PayPal and global ACH.

Personalized Onboarding

A fully customizable, self-service onboarding system designed to provide a user-friendly experience.

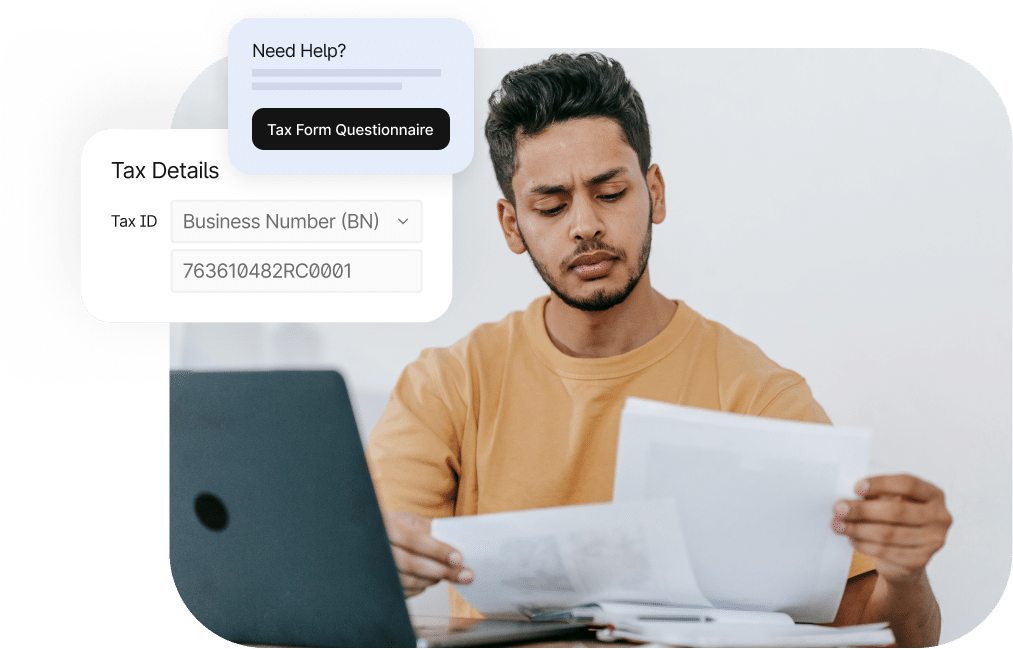

Automated Tax Compliance

Digitally collect and validate local tax IDs like social insurance numbers (SINs) and business numbers (BNs) to eFile during tax season. Gather IRS forms and VAT documentation for international entities.

Integrate with Critical Systems

Connect your workflows to boost visibility into your payment process. Synchronize detailed transaction reports with your ERP system to increase visibility.

Protect Against Fraud

Built-in OFAC screening, enterprise-grade platform security, and advanced fraud controls ensure every payment is checked for legitimacy and legality.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalized assistance to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive initial call to align on goals, scoping, and technical configurations for your setup and to prepare you for training.

Step 2

Configure

Customer onboarding experts configure Tipalti sandbox and production environments, test the hosted payee portal or embedded iFrame, execute sample payment runs, and establish integrations.

Step 3

Deploy

In-depth training on the Tipalti Hub and end-to-end payment automation functionalities will ensure thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Tipalti supports user adoption and change management during launch with the option to guide payees through onboarding too. Once set, you’ll be ready to fund your Tipalti Virtual Account, execute your first batch of payments, and officially launch Tipalti.

Step 5

Optimize

Following your setup, technical support teams are always available by phone and email, and the Tipalti customer success team will continuously advise you on achieving your goals.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Ready to save time and money?

Request a demo today and take control of your finance operations.

Travel Payment Solutions FAQs

What are travel payments?

Travel agency payments typically refer to the transactions between travel agencies and various entities involved in the travel industry. These can include:

- Commissions: travel agencies earn commissions from airlines, hotels, cruise lines, and other service providers for booking travel arrangements on behalf of their clients. Commissions represent a percentage of the total booking cost and serve as a primary source of revenue for many travel agencies.

- Service fees: travel agencies charge service fees for arranging travel during the booking process. These fees can vary depending on the complexity of the booking and services provided.

- Supplier payments: travel agencies need to pay suppliers (such as airlines, hotels, car rental companies, and tour operators) for travel bookings on behalf of the client. This ensures services are reserved.

- Travel insurance premiums: if travel insurance is purchased through the travel agency, the agency collects premiums from clients and remits payments to insurance providers.

- Refunds and adjustments: agencies handle refunds and adjustments when plans change or are canceled. They may process supplier refunds and chargebacks and then adjust payments accordingly with clients.

- Operational expenses: travel agencies also need to manage their operational expenses, including salaries, marketing costs, office rent, and technology expenses, using the payments received from clients and suppliers.

Travel payments encompass a range of financial transactions that facilitate booking travel arrangements for clients. These payments are crucial for maintaining positive relationships with travel suppliers and ensuring smooth customer experiences.

How do travel businesses pay their agents?

Travel businesses use a variety of compensation methods to pay agents. These vary depending on factors like the nature of the business, the agent’s role, and the specific arrangements made between the agent and the company.

Common methods travel companies use to pay agents include:

Commissions

The most traditional and widely used method, agents earn a percentage of the sale from each booking. The commission rate varies depending on the type of travel service (like hotel, flights, cruises, etc.) and the supplier agreement.

Salary + Commission

In this pricing model, travel agents receive a base salary and commission on sales. The base salary provides agents with financial stability, while commissions incentivize them to increase sales.

Salary Only

Some travel agencies, particularly larger ones, offer agents a fixed salary. This strategy provides consistent income regardless of sales performance and is much more common in corporate travel agencies, where agents represent corporations.

Incentives and Bonuses

In addition to base pay, some agents might receive a bonus for meeting specific targets or achieving high performance. This can be in the form of cash bonuses, trips, gift cards, etc.

Hourly Wages

Agents that are part-time or working in customer service roles, might be paid an hourly wage. This is less common for traditional travel agents, but can be found in larger travel service or call centers.

Additional Payments Types

- Referral fees for directing clients to specific services

- Independent contractors that earn commissions from sales

- Override commissions from suppliers based on volume of business

How do travel payment solutions work?

Travel payment solutions are critical for effectively processing transactions in the travel industry. They provide seamless and secure methods for customers to pay for travel services and for businesses to manage and reconcile these payments.

Here’s a detailed look at how it works:

Payment Gateway

A payment gateway captures and transfers payment data. It enables the acceptance of credit card payments for booking flights, car rentals, hotels, and other travel expenses.

Merchant Accounts

A merchant account is a type of bank account that allows a business to accept payments in multiple ways (usually credit, debit, and virtual cards).

Payment Processing

Security is paramount in handling travel transactions. Solutions should incorporate automated payment processing with multiple layers of security to protect sensitive customer data. This includes optical character recognition (OCR) technology for scanning invoice data and automated approval workflows.

Multi-Currency Tools

Travel businesses often deal with international customers, requiring payments in multiple currencies. Tools for currency conversion enable travel companies to pay suppliers in their home currency, while the agency receives payments in their preferred currency.

Fraud Prevention

Travel payment solutions often include fraud prevention features, which are essential for preventing unauthorized access to data. Tools for real-time monitoring detect and flag suspicious behavior, and tokenization replaces sensitive details with a unique identifier (token).

Mobile Solutions

As mobile usage increases, travel payment solutions are supporting mobile payments and digital wallets to provide greater convenience to customers. These systems integrate with mobile apps to facilitate in-app purchases and seamless payment experiences.

Reporting and Analytics

Comprehensive reporting and analytics features will help businesses manage their finances, track performance, and make more informed decisions.

Critical Integrations

The right travel payment platform will integrate with various programs, including a travel management system (TMS), customer relationship management (CRM) tools, booking engines, and other accounting software, to streamline payments and optimize operations.

Do travel companies pay their agents in local currency?

Yes, travel companies will typically pay their agents in local currency. However, the specifics for how this happens will vary based on factors like location, the nature of the employment, and the company’s payment policies.

Here are some key considerations:

Local Employees

For agents who work for a travel company and reside in the same country, payments are usually made in the local currency. This is because local tax regulations and labor laws will require it.

International Agents

For employees based in another country, the currency can vary:

- Local currency payments: some businesses pay agents in their local currency to simplify payment and avoid exchange rate issues.

- Home currency payments: a business may pay agents in their home currency, particularly if the agent’s country has unstable currency or it needs to for accounting purposes.

Independent Contractors

Independent travel agents will often have more flexibility in how they receive payments. Transactions can be made in a contractor’s local currency, or they may prefer a more widely used currency (USD).

Can travel companies automate commission payments?

Travel companies will automate commission payments to streamline operations, ensure more timely transactions, improve cash flow, and increase overall accuracy. This offers a multitude of benefits, from reducing administrative burden to improving efficiency, minimizing errors, and streamlining operations.

Here are a few ways in which travel companies automate commission payments:

Commission Tracking Software

Specialized software can be used to track and calculate commissions, as well as monitor bookings made by each agent. Tracking systems can apply predefined commission rates to sales to calculate the amount owed to each agent.

These tools can also provide detailed reports on commissions earned by each agent, adding an additional layer of transparency and accountability.

Payment Processing Tools

To automate the payment of commissions, travel companies can use payment processing platforms to handle disbursements effectively. These systems enable a business to perform tasks like:

- Scheduling payments: recurring payments can be automatically set up to pay agents weekly or bi-weekly.

- Multiple currencies: manage payments in multiple currencies, converting amounts as necessary.

- Direct deposits: facilitate direct deposits to an agent’s bank account, ensuring timely payments.

Automated Invoicing

Automated invoicing systems can be used to create and send invoices to agents for their commissions. Features of an automated invoicing platform typically include:

- Invoice creation: automatically generates invoices based on sales and commission calculations.

- Payment notifications: set payment reminders to ensure agents receive payments on time.

- Reconciliation: match payments to invoices to ensure more accurate reporting.

Custom Integrations

An application programming interface (API) can automate the commission payment process for businesses with specific needs and custom integrations. An API enables different software systems to communicate and seamlessly share data.

Common APIs include:

- Booking API: capture real-time booking details

- Payment API: automatically initiates payments based on commission rates

- Accounting API: sync commission payments with accounting software

How do travel companies calculate commissions for agents?

Travel companies calculate commissions for agents based on several factors. These can include:

- Agreement with suppliers

- Type of travel service sold

- Specific commission structure

Commission Rates

Different services offer varying commission rates. Common categories include:

- Airfare: typically lower rates between 1-5%

- Hotels: higher commission rates, between 10-20%

- Cruises: 10-20% with potential for bonuses

- Tours and activities: generally 10-20%

Supplier Agreements

Commission rates can also vary depending on supplier agreements. For example:

- Preferred supplier agreements: may offer higher commissions due to a special partnership.

- Volume-based contracts: higher commissions when certain sales targets are met.

- Agent performance: agents with higher sales volumes may receive bonuses

Calculating Commissions

Once the commission rate is determined, the commission amount is calculated based on the total sale value of the service. The calculation looks like this:

Commission Amount = Base Sale Value × Commission Rate

For example, if an agent sells a hotel booking for $1,000 with a commission rate of 10%:

Commission Amount = $1,000 x 0.10 = $100

Bonuses and Incentives

In addition to standard commissions, agents may also receive bonuses or incentives for achieving specific targets. These can include:

- Sales volume bonuses

- Product-specific rewards

- Seasonal promotions

Refunds and Clawbacks

Commission calculations also account for refunds and cancellations. The corresponding commission may be clawed back or adjusted accordingly if a booking is canceled. A “clawback: is when an agent needs to return a commission, which must also be calculated into monies owed.

Recommendations