Fast, Global Mass Payments for

- Contractors

- Freelancers

- Creators

- Streamers

- Affiliates

- Publishers

From payee onboarding to year-end tax reporting, our global solutions meet the needs of the creator, ad tech, marketplace, sharing, and Internet economies.

Mass Payments Automation Features

End-to-End Payouts Automation

Take the pain out of manual payouts with automated payee onboarding, payments, tax compliance, fraud prevention, and reconciliation—with a best-in-class experience for your valued payee network.

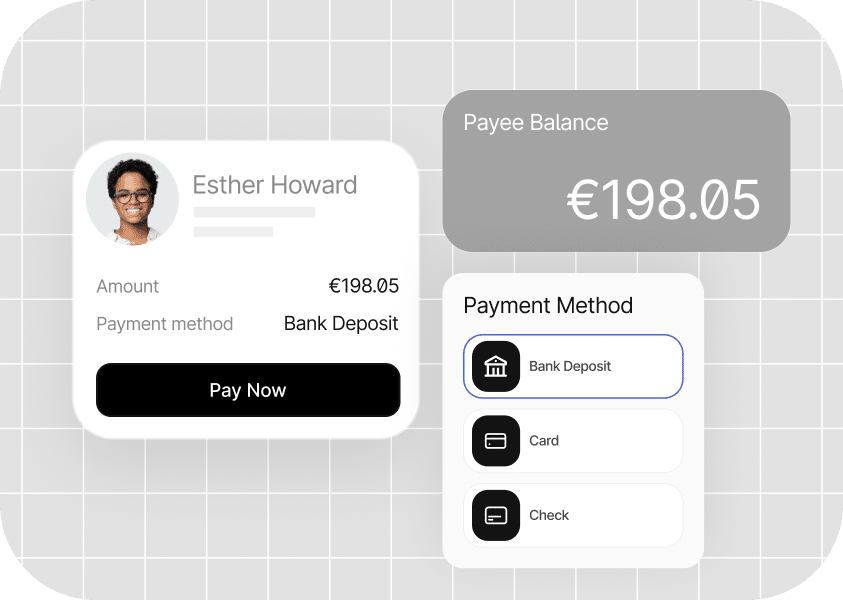

Seamless Payment Experience

Save time and reduce errors with self-service onboarding via a branded payee hub. Offer a wide range of payment methods and currency options, with automated payment status notifications.

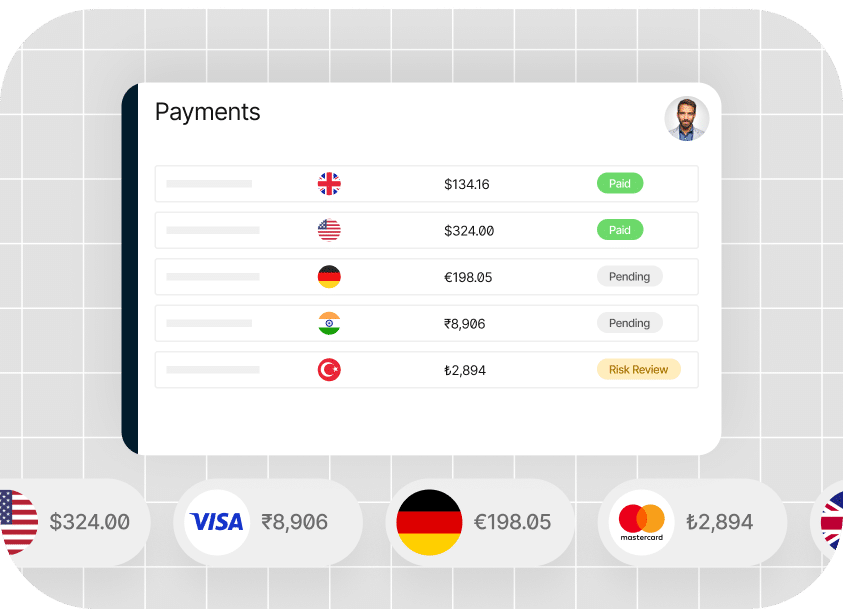

Global Scale, Total Control

Efficiently scale payments around the world from a single platform that helps you to manage multi-currency, multi-entity, and multi-language setups with ease.

Built-In Risk Protection

Built-in OFAC screening validates every payment while enterprise-grade platform security and advanced fraud controls help de-risk your business.

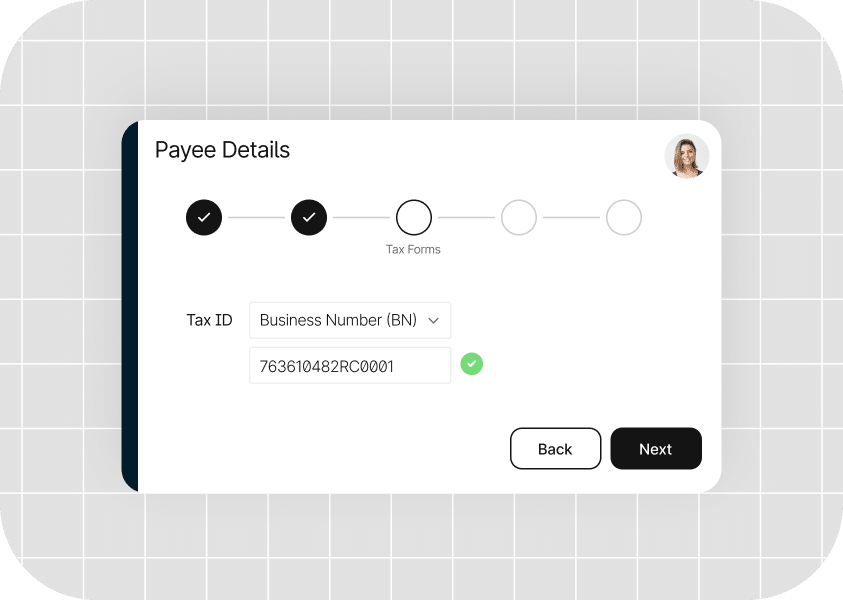

Instant Tax Compliance

Keep your payments tax-compliant with our KPMG-approved digital tax engine. Collect and validate tax details during payee onboarding and generate prep reports that make your year-end filing a breeze.

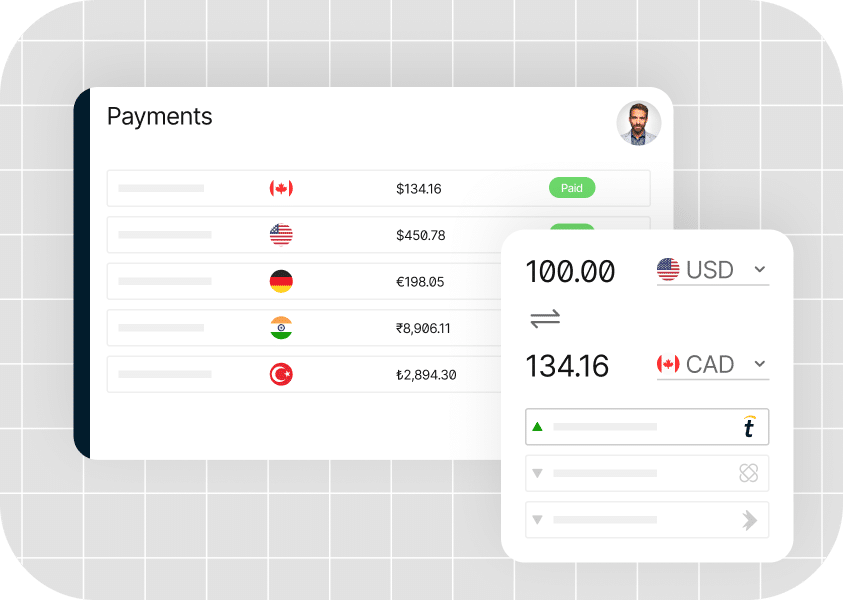

Frictionless Currency Management

Better rates mean you can save on FX fees, while reducing the time and effort required to manage and send payouts in multiple currencies. Plus, payees can get paid in their currency of choice.

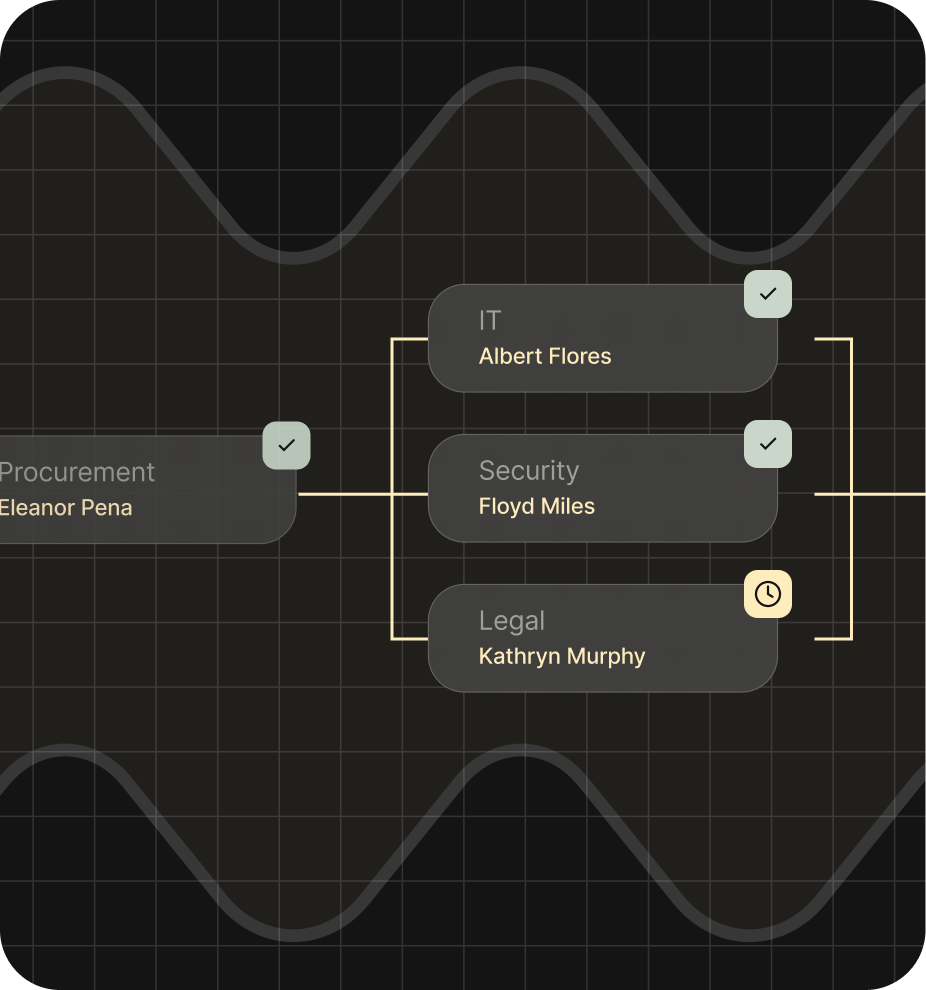

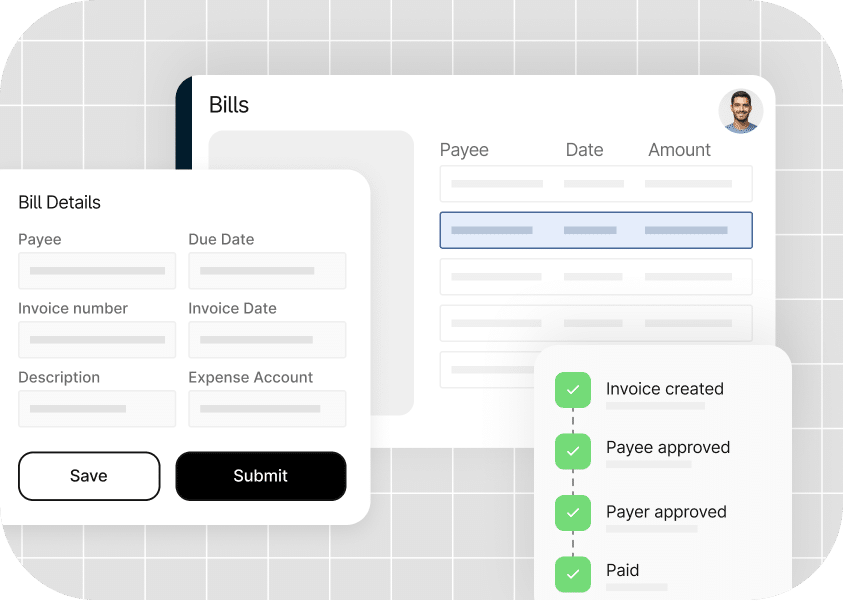

Easy Self-Billing

Automatically generate invoices from your payees, and run them through approval workflows to enhance the payee experience and simplify your payment workload.

Platform Features

Work smarter, not harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with customized onboarding to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive initial call to align on goals, scoping, and technical configurations for your setup and to prepare you for training.

Step 2

Configure

Customer onboarding experts configure Tipalti sandbox and production environments, test the hosted payee portal or embedded iFrame, execute sample payment runs, and establish integrations.

Step 3

Deploy

In-depth training on the Tipalti Hub and end-to-end payment automation functionalities will ensure thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Tipalti supports user adoption and change management during launch with the option to guide payees through onboarding too. Once set, you’ll be ready to fund your Tipalti Account, execute your first batch of payments, and officially launch Tipalti.

Step 5

Optimize

Following your setup, technical support teams are always available by phone and email, and the Tipalti customer success team will continuously advise you on achieving your goals.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

Create Music Group

Learn how this independent music, distribution, and publishing giant saved critical time by eliminating 36 days of payments work annually.

GoDaddy

Discover how this web-hosting powerhouse offloaded onboarding thousands of partners and customers as it scaled.

Sptifire Audio

Read how this UK-based music technology company reduced royalty payment run time from six weeks to only 30 minutes.

Vivino

Find out how the world’s largest online wine retailer reimagined its vendor onboarding and approval process, reducing its multi-country, multi-currency payment process from hours to minutes.

Realwear

Learn how this AI-powered smartglasses pioneer streamlined its payment workload by 20% and cut its financial close cycle in half.

Compare

See how we stack up

| Features | Tipalti | Payoneer | PayPal | Trolley |

|---|---|---|---|---|

|

Payee Management

|

|

Limited functionality | Limited functionality |

|

|

Tax Compliance

|

|

Limited functionality |

|

Limited functionality |

|

Payments Network

|

|

Limited functionality | Limited functionality | Limited functionality |

|

Fraud Prevention

|

|

Limited functionality |

|

|

|

FX Solution

|

|

Limited Functionality | Limited Functionality | Limited Functionality |

|

Prebuilt Integrations

|

|

Limited Functionality | Limited Functionality | Limited functionality |

|

Developer Tools

|

|

|

|

|

|

Self-Billing

|

|

|

|

Limited Functionality |

|

Multi-Entity

|

|

|

|

|

|

Finance Automation

|

|

Limited Functionality |

|

|

Ready to save time and money?

Request a demo today and take control of your finance operations.

Mass Payments FAQs

What are mass payouts?

Mass payments, also known as mass payouts, batch payments, or bulk payments, are used by organizations to pay multiple recipients simultaneously in a single batch, regardless of the payee’s location, currency, or payment method.

Mass payment processing solutions like Tipalti help organizations save time, money, and resources by expediting the payment process. Payment information can be communicated for mass payouts either through a mass payments API or file upload.

Depending on a company’s infrastructure, batch payment processing solutions may need to be integrated with performance marketing systems to tie analytics to mass payments. Integrations with ERPs and accounting systems also facilitate payment reconciliation and reporting.

What global payment methods does Tipalti support?

Tipalti’s global payout platform enhances the effectiveness of cross-border payments to 196 countries in 120+ currencies, using 50+ payment methods. It supports:

- Local bank transfers: SEPA payments (Europe), BACS payments (UK), EFT payments (Canada) and other bank transfers via local networks

- Global ACH, also known as International ACH or IACH

- PayPal: payments to PayPal eWallets

- Wire transfer: SWIFT payments

- Prepaid debit cards: card issuance via Intercash

Domestic payment methods in the US include ACH and paper cheques.

Why is global payment processing important?

When international payees seek a flexible payment experience, a business may need multiple global payment methods. Efficient global payment processing means payees receive their money on time, in their local currency, using a preferred method.

The best international payment methods depend on location and expectations. Each payment type has benefits and drawbacks that impact the satisfaction of payment recipients and the team’s workload.

Offering a wealth of global payment processing methods makes a payee’s comfort and security a priority. Mass payment platforms like Tipalti enable thousands of payments in minutes while the payer complies with tax and regulatory obligations.

What are the benefits of using a mass payment system for businesses?

There are many benefits to using a mass payment system for your business, including:

Cost Efficiency

Mass payment systems automate the entire process, reducing the time and effort needed for manually processing transactions individually.

Scalability

This type of software is designed to grow with your business. It can easily scale, handling increasing volumes of transactions, without added complexity.

Reduced Error

Automation improves accuracy and reduces the likelihood of errors that occur with the manual data entry process.

Enhanced Security

Advanced data encryption methods work to protect sensitive financial information. Many systems also include fraud detection, safeguarding against unauthorized transactions.

Improved Cash Flow

Companies can schedule recurring payments, ensure timely disbursement, and drive better cash flow management. Real-time tracking and reporting also provide valuable insights into payment statuses and financial health.

Additional Benefits

- Mass payment systems facilitate global reach

- Competitive exchange rates and currency conversion

- Clear communication and easy access to mass payment details

- Intuitive dashboards simplify user training

- Efficient and reliable payment practices enhance reputation

How does Tipalti support online marketplaces?

Tipalti supports online marketplaces in a variety of ways, including:

- Payee onboarding: payment method selection, banking and tax information collection and validation, custom branded experience.

- Fraud and risk controls: tax ID validation, OFAC, and sanctions list screening of all payees.

- Vendor payout processing: payment approval workflows, multiple payment methods, currency, and payment thresholds.

- Payment reconciliation: real-time reporting on past and pending transactions and audit trails of all transactions.

- Manageable infrastructure: updates for changing bank dynamics, ongoing diligence on tax and regulatory compliance issues, integration to ERP, accounting, and GL systems.

Automating online marketplace payments requires a comprehensive approach covering the entire payout engagement span.

What are the best ways to pay freelancers and independent contractors?

The more freelancers you hire, the more complexity there is in freelancer payments.

Tools like Tipalti centralize payment methods and terms (with minimum payment thresholds) in a single platform for easy contractor payouts. It also offers fee-splitting capabilities to incentivize contractors to use the most cost-effective payment methods.

Need to pay people abroad? Tipalti offers FX conversion payouts with highly competitive exchange rates.

Tipalti simplifies 1099 payment processing and digitally collects and validates W-9 and W-8 tax forms and TINs. You can generate 1099 and 1042-S preparation reports and simplify annual 1099 filing with Tipalti’s e-filing service or e-filing integrations.

How does Tipalti support affiliate marketing management?

Tipalti helps you provide a best-in-class affiliate payout experience with self-service affiliate payment and tax onboarding, verification of identity and fraud protection, choice of preferred payment methods and currencies, and complete visibility into payment statuses.

The best way to track the performance of your affiliate network is by using a performance marketing platform. These systems have affiliate marketing management capabilities that include partnership management, performance tracking, attribution, and analytics.

Tipalti integrates with performance marketing systems (like Everflow, Cake, and Linktrust) to directly tie analytics and data to affiliate payments and to provide visibility into the performance-to-pay lifecycle.

In addition to affiliate payouts, you can sync onboarding data, such as bank and tax information, from publishers, affiliates, influencers, creators, or other affiliate network partners.

Can you use PayPal for mass payments?

Yes, Tipalti offers PayPal mass payment. With Tipalti, you can schedule bulk payments using 50+ payment methods, including US ACH, global ACH, wire transfer, PayPal, paper cheque, and prepaid debit card, to 196 countries using 120 currencies.

Tipalti has a PayPal “mass transaction” (MT) license for PayPal mass pay or PayPal bulk payments. This removes restrictions around payment and funding limits, provides access to more favourable FX rates and payment speeds, and allows Tipalti customer service and support to troubleshoot any PayPal payment issues.

PayPal’s “account direction” (AD) model uses a payer’s existing PayPal account to facilitate a PayPal mass payment.

How does Tipalti help mitigate foreign exchange risk?

Tipalti offers advanced solutions, like FX hedging, to reduce foreign exchange risk. It gives you access to live foreign exchange rates and full transparency to track currency conversion statuses.

Avoid expensive, complex, and tedious bank conversion and transfer processes across multiple bank accounts by enabling self-service execution of transfers through Tipalti.

Get highly competitive rates for conversions that leverage Tipalti’s $60B+ of throughput on our platform annually and support for over 120 currencies.

Tipalti eliminates the need to maintain regional bank accounts solely for payouts and provides one central virtual account to manage payments across all subsidiaries, currencies, and payment methods.

What is an international wire transfer?

An international wire transfer (cross-border or global payment) is a financial transaction involving multiple parties and is typically made through the SWIFT network.

International wire transfers require information like:

- Recipient’s contact and bank contact data

- Payment amount

- SWIFT or BIC code

- Recipient’s routing number

- Recipient’s account number and type

When banks don’t have an established relationship, intermediary banks play a crucial role. An intermediary bank is required when making global transfers between the originator and beneficiary banks.

What are the real-time costs involved in sending money overseas? Tipalti’s International Wire Transfer Fee Calculator can help you determine more accurate costs.

What is global ACH?

Global ACH is also referred to as an international Automated Clearing House (ACH) transfer. ACH handles transactions in the United States, while a global ACH involves a financial agency outside of America.

The US National Automated Clearing House Network (NACHA) typically manages an international ACH transfer in Europe. It’s the Single Euro Payments Area (SEPA) and consists of 35 participating countries (with specific exclusions).

Each payment rail’s transactions differ based on the payment type, speed, technology, or geographical location.

What are payout APIs?

Payout APIs (payment APIs or accounting APIs) distribute mass payments to recipients such as contractors, freelancers, affiliates, publishers, and suppliers.

The most common functions of payment APIs include:

- Mass payouts: Disburse payments to multiple payees or recipients at once.

- Automatic payouts: Automate the payout process, ensuring that payments are disbursed on a predetermined schedule.

- Payment status: Provide businesses with real-time information on payment status, like the amount paid, date, and payment method.

- Payment reconciliation: Reconcile payments within your accounting system, ensuring accurate financial reporting.

- Compliance: Comply with regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML).

How can I set up mass payments for my business?

Setting up mass payments for your business involves a few steps to ensure accuracy, efficiency, and global security.

Step #1) Determine Payment Needs

Identify the types of payments you need. These could include:

- Payroll

- Supplier payments

- Contractor payments

- Customer refunds

Step #2) Choose a Payment Method

Decide on the method you’ll use for mass payments. Will it be a bank transfer, like a global ACH? Another popular method is a digital payment platform like PayPal.

Step #3) Select a Payment Processor

Numerous platforms and systems are designed to accommodate mass payments. Tipalti is a prime example, offering global payment solutions with built-in compliance and support for 120+ currencies.

Step #4) Automate Mass Payments

To streamline the process and enhance workflows, a business should take full advantage of automation. Look for key features to:

- Upload batch files

- Facilitate API integration

- Schedule payments

Step #5) Ensure Security and Compliance

Security is critical when handling mass payments (especially on a global level). Look for a payment solution with data encryption, two-factor authentication, and global compliance (such as GDPR and PCI-DSS).

Step #6) Monitor and Reconcile Mass Payments

The final step is to ensure each payment is confirmed and completed. Reconcile bank statements with payment records, and use reporting tools to track transactions.

Recommendations