Your Go-To Freelancer Payment Platform

Simplify payments with automated solutions that reduce errors, handle international transactions seamlessly, and keep you tax-compliant.

Gig Economy Features

Build a Foundation for Hypergrowth

With our easy-to-use solutions for mass payments, accounts payable, and procurement, you’ll deliver fast, accurate payments that help you build and maintain a strong freelance network.

Self-Service Onboarding

Our fully customisable onboarding system is designed to take the work out of your hands and provide a user-friendly experience for your freelancers.

Pay Anyone, Anywhere

Scale anywhere with cross-border payments to 200+ countries and territories in 120 currencies via 50+ payment methods and built-in multi-entity and multi-language capabilities.

Reduce Payment Risks

Built-in OFAC screening, enterprise-grade security, and advanced fraud controls ensure every payment is checked for legitimacy and legality.

Automated Tax Compliance

Digitally collect and verify vendor VAT IDs across 49 countries, streamlining tax ID collection and DAC7 reporting for seamless eFiling during tax season.

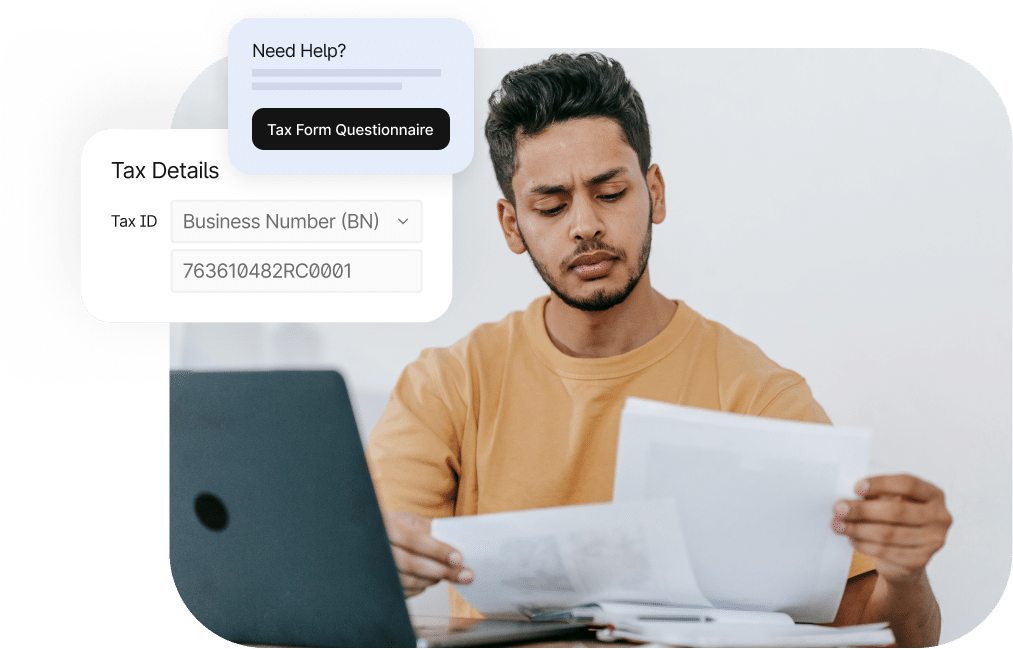

Integrate With Critical Systems

Connect your workflows and tracking platforms to boost visibility into your payment process. Synchronise detailed transaction reports with your ERP system to increase visibility.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalised assistance to get you operational quickly.

Step 1

Plan

Kickstart your success with a comprehensive initial call to align on goals, scoping, and technical configurations for your setup and to prepare you for training.

Step 2

Configure

Customer onboarding experts configure Tipalti sandbox and production environments, test the hosted payee portal or embedded iFrame, execute sample payment runs, and establish integrations.

Step 3

Deploy

In-depth training on the Tipalti Hub and end-to-end payment automation functionalities will ensure thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Tipalti supports user adoption and change management during launch with the option to guide payees through onboarding too. Once set, you’ll be ready to fund your Tipalti Account, execute your first batch of payments, and officially launch Tipalti.

Step 5

Optimise

Following your setup, technical support teams are always available by phone and email, and the Tipalti customer success team will continuously advise you on achieving your goals.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your finance operations with Tipalti.

Gig Economy Solutions FAQs

What is a freelancer payment platform?

A freelancer payment platform is a digital service that facilitates international payments between clients and freelancers. These solutions streamline the process of sending, receiving, and managing payments for freelance work, offering additional functions like invoicing, tax reporting, and currency conversion.

An AP automation system is particularly useful for freelancers who work with clients from different countries, as they handle the complexities of cross-border payments, including currency exchange rates and global transaction fees.

Key features of a successful freelancer payment platform include:

- Multi-currency support: Many platforms support the best payment methods, in multiple currencies, making it ideal software for freelancers.

- Secure transactions: Online payment providers offer more secure payment channels, protecting all parties involved.

- Invoice processing: Freelancers can create and send invoices directly through the platform, simplifying the entire billing process.

- Automate payments: Some systems offer recurring payment options and freelancer payment methods for ongoing projects or retainer work.

- Tax compliance: Systems often generate reports and offer tools to help freelancers manage taxes, particularly for income earned from global clients in local currencies.

Additional Features

- Smart reporting and analytics to help freelancers manage their income and taxes

- Key integrations with accounting software, finance tools, and other services to streamline processes.

- Payment platforms charge a few, either as a flat rate, or a percentage of the transaction, which may vary depending on the payment method and currency exchange.

How do I pay multiple freelancers at once?

To pay multiple freelancers at once, you can use a variety of systems and tools designed to process bulk payments in just a few business days.

Here’s a step-by-step guide:

Step 1. The Right Payment Method

There are several different payment systems you can explore before settling on a final solution. Some key options include:

- Freelancer payment platforms: PayPal, Wise, and Payoneer are all prime examples of freelancer platforms that offer bulk payment options, including cross-global transactions with multiple countries and currencies.

- Freelancer marketplaces: Freelancers using platforms like Upwork or Fiverr have built-in payment systems that allow you to pay multiple freelancers automatically, depending on the contract terms.

- Accounting software: QuickBooks, Stripe, and Xero are all integrations that offer batch payment features where a business can pay multiple contractors or freelancers at once from a direct bank account.

- Automated payment solutions: Tipalti and Bill.com are both designed for managing large-scale, recurring payments and are built to automatically pay multiple independent contractors.

Step 2. Collect Payment Data

Ensure you have the correct payment details for each freelancer, including:

- What is their preferred payment method (i.e PayPal, money transfers, cheques)?

- What is the preferred currency (USD, GBP, EUR, etc.)?

- Collect account details like email for Transferwise or PayPal accounts

Step 3. Prepare a Payment File

Some systems and payment processors require you to upload CSV files containing payment details like the freelancer’s name, payment amount, currency, and account data. Then you must ensure the file is formatted correctly according to the system requirements.

Step 4. Payment Processing

Upload the payment file to your chosen platform or payment gateway. The tough part is ensuring the file is correctly formatted according to the system’s requirements. This is called mapping and when the process is manual, it can become quite challenging. Finally, review the payments for accuracy before submitting them to avoid errors.

Step 5. Track Payments

After mass payment processing with different currencies, for international clients, it’s important to confirm that payments have been successfully sent. Most multi-payment processing platforms provide tracking or status updates for each transaction and will keep subsequent records for auditing purposes.

Step 6. Monitor Payment Status

Use the platform’s tools to monitor the status of each payment. Some platforms notify you when freelancers receive their payments.

What are the benefits of using a freelancer payment platform like Tipalti for your business?

Using a freelancer payment platform like Tipalti offers several benefits for businesses, especially those that work with a high volume of freelancers or operate on a global scale.

Some key advantages:

Efficiency and Automation

Tipalti automates the entire payment workflow, from onboarding freelancers to processing payments and total tax compliance. The invoicing software reduces manual work and minimises errors, saving time and effort compared to handling individual transactions.

The Tipalti solution will also enable a business to pay multiple freelancers simultaneously. You can schedule payments in advance, ensuring all parties are paid on time. Even with a high volume of transactions, there is a certain ease of use.

Continuous Cost Savings

By consolidating payments and automating processes, Tipalti can reduce the transaction fees associated with managing multiple payment methods and international transfers between various bank accounts.

Automating payment processing will eliminate the need for extensive finance teams, leading to low fees in payroll, conversion fees, and administrative expenses.

International Bulk Payments

Tipalti supports payments in 120+ currencies and to more than 200+ countries and territories, making it easy to pay freelancers regardless of where the freelance business is located. Additionally, freelancers can choose from various payment methods, including ACH, wire transfers, PayPal, and more, which enhances their payment experience.

Compliance and Risk Management

Tipalti automates all tax form collection (such as DAC7), ensuring your company remains compliant with all local bank laws and regulations.

The Tipalti suite of solutions also includes built-in security features that include anti-money laundering (AML) checks, sanctions screening, and fraud detection. These tools help to protect your business from financial risks. Tipalti ensures compliance with global financial regulations, reducing the risk of fines and penalties.

Additional Benefits

- Self-service freelancer onboarding with payment method choice (credit card, debit card, bank transfer, digital wallet, etc.)

- Real-time reporting and analytics with full visibility into operations, pay status, cash flow, and more.

- Customisable workflows to tailor the payment approval process and maintain control

- Tipalti can scale and handle increasing volumes of payments without compromising efficiency or accuracy.

- The system integrates with popular accounting software like QuickBooks, NetSuite, and Xero, as well as ERP systems.

What is tax form collection and automation?

Tax form collection and automation simply refers to the process of gathering, validating, and managing tax-related documents from freelancers, contractors, vendors, and more. The automation part comes in with the right software tools which mechanise these tasks to ensure compliance with tax regulations.

Here are the key components you can expect from this financial model:

Step 1. Collecting Global Tax Forms

The types of documents collected will depend on a multitude of factors like region, freelancer location, etc.

Step 2. Validation and Compliance

Tipalti is designed to automatically validate the information provided on tax forms like tax IDs, against federal databases to ensure accuracy.

The system will check for compliance with local tax regulations and international tax laws, ensuring that all required tax forms are collected and accurate.

Step 3. Automate Compliance Reporting

At the end of the tax year, platforms like Tipalti automatically generate and distribute tax forms to freelancers, simplifying year-end reporting. All tax-related data is stored securely and can be easily accessed for audits or reporting purposes.

Automation eliminates the need for manual tracking and data entry, significantly reducing processing times, leading to better cash flow, fewer mistakes, and lower fees.

Can the right software system help us more seamlessly onboard our freelancers or contractors?

Yes, the right software system will efficiently streamline and improve the freelancer and contractor onboarding process in a few ways.

Here’s how:

Centralised and Transparent Platform

The payment software system you choose should offer a centralised onboarding portal that enables freelancers and contractors to complete all necessary onboarding tasks in one spot. This also means your business has all the data in one place.

Self-service onboarding includes tasks like:

- Submitting personal information

- Signing contracts

- Providing tax documents

- Selecting payment methods

Freelancers always manage their own onboarding process, reducing the need for back-and-forth communication and excessive manual data entry.

Automated Document Management

Systems like Tipalti can facilitate electronic signatures for contracts and agreements, speeding up legal formalities, ensuring all documents are securely stored and everything is easily accessible.

The automated collection of tax forms (like DAC7) ensures continuous compliance and significantly reduces errors. The system can prompt freelancers to upload the correct forms and automatically validate the information as it comes in.

Integrated Payment Setup

The system allows freelancers to set up preferred payment methods during onboarding. The platform will then directly link to your payment processing platform, ensuring that once they start working, payments can be made quickly and accurately.

Solutions like Tipalti can also handle multiple currencies, automatically calculating and withholding the correct taxes based on location and tax status.

Additional Benefits

- Compliance and verification with Know Your Customer (KYC) and Anti-Money Laundering (AML) checks

- Customisable onboarding workflows that depend on the location, role, or specific needs of the freelancer

- Built-in support features like chatbots, FAQs, and a helpdesk

- Secure data handling with encryption and compliance with the General Data Protection Regulation (GDPR)

- Tipalti is built to scale as you grow and onboard more freelancers and contractors

Are there any freelancer-specific payment platforms that handle international transactions and can support multiple currencies?

Tipalti is a comprehensive global payables automation platform designed to streamline the entire accounts payable process, from onboarding suppliers to processing digital payments, managing tax compliance, and reconciling transactions.

It is particularly well-suited for companies that work with a large number of suppliers, freelancers, contractors, or international payees and need a solution to automate complex payment workflows.

Recommendations