See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

Efficient invoice management promotes strong vendor relationships, smoother cash flow, and stress-free EU compliance.

However, for many growing EU businesses, manual data entry and increasing invoice volume quickly lead to mistakes, delays, and rising pressure on AP teams.

In this guide, you’ll learn what invoice management is and how automation can cut errors, speed up approvals, and reduce AP workload. Plus, we’ll share what to look for in an invoice automation solution that helps you tackle manual processes.

Key Takeaways

- Invoice management involves receiving, approving, paying, and reconciling invoices efficiently for prompt payments and reliable records.

- Manual invoice processing causes delays, errors, and poor visibility, which can harm supplier relationships and compromise EU compliance.

- Accounts payable automation reduces manual workload by up to 80% and cuts errors, speeding up approvals and improving cash flow visibility.

- AP automation software like Tipalti captures data accurately, automates payments, and delivers real-time insights while supporting EU compliance, Peppol e-invoicing, and GDPR.

What Is Invoice Management?

Invoice management is the process of receiving, verifying, approving, and paying vendor or supplier invoices.

Also called invoice processing, invoice management is a core operation within accounts payable (AP).

An efficient workflow is crucial to ensure timely, accurate payments and strong vendor relationships.

A well-managed invoicing process also promotes auditability across your AP management cycle, helping you comply with European Union (EU) directives and access clear cash flow data to manage financial obligations.

What Does the Invoice Management Process Look Like?

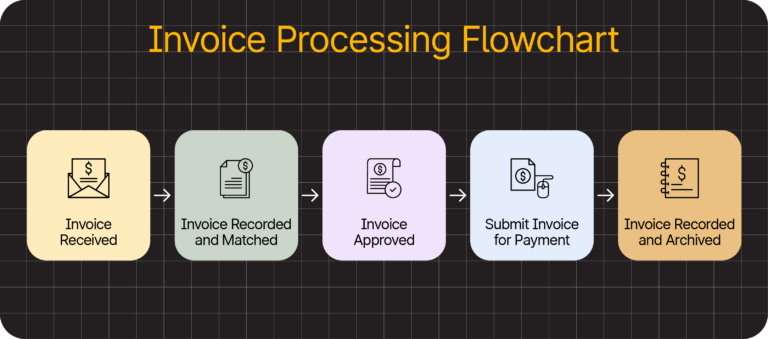

The invoice management process is the steps you take from receiving to paying and recording invoices.

The invoice management process is the steps you take from receiving to paying and recording invoices.

By effectively executing each step, clients get paid faster, and your records stay up to date for EU regulatory and tax compliance.

Here’s how a typical invoice workflow looks:

Here’s how a typical invoice process works:

| Invoice Processing Stage | AP Task |

|---|---|

| 1. Receive invoice | Extract key details: vendor name, purchase order (PO) reference, VAT number, line items, and totals. |

| 2. Validate invoice | Check the invoice to ensure orders and totals are correct, the vendor is legitimate, and the invoice isn’t a duplicate. This step is crucial to prevent invoice fraud and mispayments. |

| 3. Match invoice | Ensure the invoice, PO, and goods receipt match. This step stops billing mistakes (e.g., duplicate payments). |

| 4. Route invoice for approval | Send the invoice to the appropriate person or department for approval. Depending on your invoice workflow, this might be a single-level or multi-level process. |

| 5. Process invoice payment | Schedule the invoice payment according to your cash flow strategy and the vendor’s preferred payment method (e.g., SEPA, Bankgiro, Global ACH, or PayPal). |

| 6. Record invoice | Store invoice records in your enterprise resource planning (ERP) system for tax and auditing purposes. Accurate archiving is vital to comply with EU regulations. |

There are two main ways of managing your invoicing process: manually or with AP invoice automation.

Manual processing involves one or more of your AP team members entering data, reviewing, and paying each invoice individually.

Automation software performs these tasks automatically, with less need for human intervention.

According to research by the Institute of Financial Operations & Leadership (IFOL):

- Almost 23% of businesses rely on manual AP processes.

- 41.4% plan to automate within the next 12 months.

- 40% of businesses that have already implemented automation prioritise invoice management.

Soon, we’ll look at the challenges of manual processes and how automation software solves them. First, let’s discuss why effective invoice management is crucial for EU businesses.

The Importance of Effective Invoice Management for EU Businesses

Getting invoice management right keeps money flowing smoothly, reduces risk, and promotes strong supplier management.

If any part of your payable process is inefficient, it can lead to late payments, data errors, and strained relationships—all roadblocks to a healthy business.

Here’s why effective invoice management matters to EU businesses—legally and operationally.

Adhering to EU E-Invoicing Legal Frameworks

The EU has introduced different legal frameworks to foster widespread electronic invoice adoption (and move away from paper-based invoices).

Adhering to these regulations is critical when sending, receiving, and managing invoices. Failure to do so can result in a penalty fine.

Here are the frameworks that apply to invoice management:

| EU Regulation | What It Means |

|---|---|

| Directive 2014/55/EU | Public authorities and entities in the EU must receive and process e-invoices that are compliant with the European Norm. Some EU member states also mandate e-invoicing for business-to-business (B2B) and business-to-consumer (B2C) transactions. |

| Electronic Identification, Authentication and Trust Services (eIDAS) Regulation | eIDAS ensures the legal validity and cross-border recognition of electronic signatures, seals, timestamps, delivery services, and authentication certificates. It gives digital documents the same legal status as paper documents. |

| Peppol | Peppol facilitates the cross-border exchange of invoices and other digital procurement documents in 32 European countries. Adopting it ensures you receive invoices securely and efficiently. |

| Value Added Tax (VAT) Directive (2006/112/EC) | The VAT Directive sets a minimum VAT rate of 15% within the EU and allows for reduced rates on certain goods and services. Accurate record keeping is crucial for VAT returns and Intrastat reporting. |

To ensure compliance with these legal frameworks, you must:

- Give consent to vendors to supply invoices.

- Check the legibility and authenticity of invoices.

- Securely store invoices and make records available for tax authorities (and relevant parties) for auditing.

- Comply with the General Data Protection Regulation (GDPR) to protect and lawfully process invoice data.

Note: While these rules apply across the EU, some regulations may differ depending on your member state. Consult national legislation to familiarise yourself with specific requirements.

Meeting EU Late Payment Directive Requirements

The Late Payment Directive (2011/7/EU) protects European businesses—particularly small-to-medium enterprises (SMEs)—against cash flow disruption caused by late payments.

The European Commission states the main provisions are:

- Public authorities must pay for the goods and services they procure within 30 days or, in exceptional circumstances, within 60 days.

- Enterprises must pay their invoices within 60 days unless expressly agreed otherwise, and provided it’s not grossly unfair.

- Automatic entitlement to interest for late payment and €40 minimum as compensation for recovery costs.

- Statutory interest of at least 8% above the European Central Bank’s reference rate.

The Commission also notes that:

“EU countries may continue maintaining or bringing into force laws and regulations which are more favourable to the creditor than the provisions of the directive.”

For smaller businesses, prompt payments can be the difference between solvency and insolvency.

Effective invoice management gives vendors and suppliers the cash flow they need to manage obligations, while protecting you against the consequences of missed deadlines.

Complying with DAC7 EU Tax Transparency Rules

If you run an online platform, DAC7 rules require you to collect and report seller and transaction data to EU tax authorities.

This process includes storing information such as:

- Names and addresses

- Tax Identification Numbers (TINs)

- VAT numbers

- Bank details

Depending on national legislation, you’ll need to retain records for 5–10 years. Your invoice processing practices also need to comply with GDPR.

Accurate invoice management is essential to ensure you collect the right details. Failure to do so can land you with a non-compliance penalty.

Pro Tip: Learn about your reporting obligations and how to improve compliance in our DAC7 EU compliance guide.

Supporting AP Productivity and Decision Making

Effective invoice management frees AP teams from the burden of time-consuming, manual processes.

Eliminating repetitive data entry tasks reduces days and keeps processes running smoothly.

The result? More time for AP to focus on productive tasks, such as:

- Nurturing strategic partnerships to strengthen your supply chain.

- Identifying and capitalising on early payment discounts to boost cash flow.

- Managing vendor communication to sustain strong relationships. Monitoring and reporting expenses to support stakeholder decision-making.

Simply put, if you want to grow your business, address the challenges in your invoicing workflow.

4 Common Manual Invoice Management Challenges for EU Businesses

Cracks in invoice management typically appear when your business grows. In most cases, the root cause is the same: outdated processes.

Here are four common issues of an invoicing workflow reliant on spreadsheets, email inboxes, and disconnected tools.

1. Manual Data Entry Leads to Mistakes and Mismatched Records

Manual invoice processes are prone to typos, incorrect totals, VAT miscalculations, and duplicate entries that can impact your records.

When your team manages a small number of invoices, the average human error rate of 1% to 5% is unlikely to cause much disruption.

However, as your business grows, the compounding effect of errors over hundreds of invoices can lead to incorrect vendor details and mispayments that take significant time to fix.

With manual invoice processing costing as much as €20 per invoice, the financial implications caused by a lack of accuracy add up fast.

2. Delayed Approvals and Payments Strain Vendor Relationships

Human error isn’t the only cause of processing delays. Routing invoices to the wrong approver or losing them in shared inboxes are common issues resulting in late or missed payments.

Poor invoice processing costs European companies €10.5 trillion in delayed payments, Intrum research suggests.

Late payments in the EU can result in a fine and compensation costs. But that’s not the only financial hit you face—falling short of vendor expectations damages trust and long-term relationships.

Interestingly, 80% of executives say they’ve lost business because of a payment process miscommunication, according to a B2B and Digital Payments Tracker Series Report by PYMNTS.

3. Slow Processing Means Missing Out on Discounts

Many vendors offer payment discounts for early payment, such as a 2% reduction if you pay within 10 days (known as 2/10 net 30).

Incentives help reduce the likelihood of missed payments and improve a vendor’s day-to-day liquidity.

Inefficient processes mean missing out on these savings and spending more than you need to every month.

4. Poor Record-Keeping Limits Visibility and Disrupts Cash Flow

The longer you spend managing invoices, the harder it is to project cash flow, update records, and make informed decisions.

Every invoice buried in an inbox or scattered across different systems is information not in your system.

This lack of integration:

- Creates a lack of transparency around invoice approvals, which impacts audit trails and puts EU tax and regulatory compliance at risk.

- Prevents a clear view of outstanding invoices, payment status, and overall liquidity—making it impossible to accurately identify trends and inefficiencies in your processes.

In simple terms, poor invoice management costs you money.

How AP Automation Streamlines Invoice Management for EU Businesses

Modern accounts payable automation software cuts up to 80% of AP workload, freeing teams from the manual processes holding your business back.

By automating each step of your invoice process, you can scale operations efficiently without extra headcount or resources.

Implementing software has a positive impact on employee performance and overall experience, too.

According to Salesforce research:

- 92% of workers say automation solutions increase their productivity.

- 85% say software boosts collaboration.

- 88% trust automation tools to complete tasks faster without errors.

By giving employees the tools to work smarter, you also increase retention. In the same survey, 89% say they feel more satisfied with their jobs since they started using automation technology, with 84% feeling happier with their company.

Here’s how AP automation software solves the invoice management problems that outdated processes create.

Smarter Data Capture with AI-Driven OCR

AI-powered optical character recognition (OCR) data capture automates data extraction with high accuracy—streamlining your AP workflow from the moment you receive an invoice.

Unlike traditional OCR that relies on fixed templates, AI-driven automation combines AI and machine learning (ML) to understand any invoice format (e-invoice, PDF, or paper) and improve over time.

AI also automates the next steps to ready invoices for approval, reducing the need for manual checks.

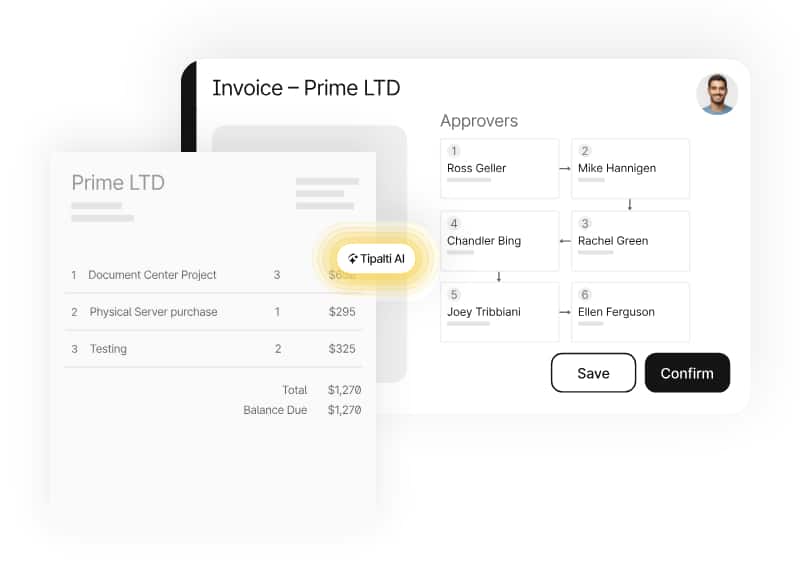

For example, Tipalti’s AI Smart Scan feature speeds up invoice matching, coding, and validation by:

- Using two-way and three-way matching to auto-match headers and line levels, align currencies, units, costs, POs, and goods receipts.

- Automatically spotting specific patterns and anomalies that indicate suspicious or unusual behaviour, as well as potential duplicate invoices.

- Suggesting general ledger (GL) codes based on history, vendor info, and invoice details, and flagging unusual terms.

By eliminating errors from the start, accurate data flows across accounts payable, improving close time, reporting, and cash flow analysis.

Approvals that Route Themselves

An invoice management system uses smart routing to find the right approver—avoiding delays and lost invoices.

AI natural language processing (NLP) and machine learning analyse the context of invoices, recognising keywords or patterns that indicate the type of expense.

For instance, Tipalti’s AI Smart Scan might identify a term like “server purchase.” It then uses past data or company rules to categorise the invoice and send it to the right approver automatically.

What happens if an approver doesn’t see the invoice?

Tipalti lets you tag colleagues and send real-time notifications or reminders to approvers within the platform, keeping your approval process running smoothly.

You can also set up deadlines to approve invoices within a specific timeframe to tighten controls without constant chasing.

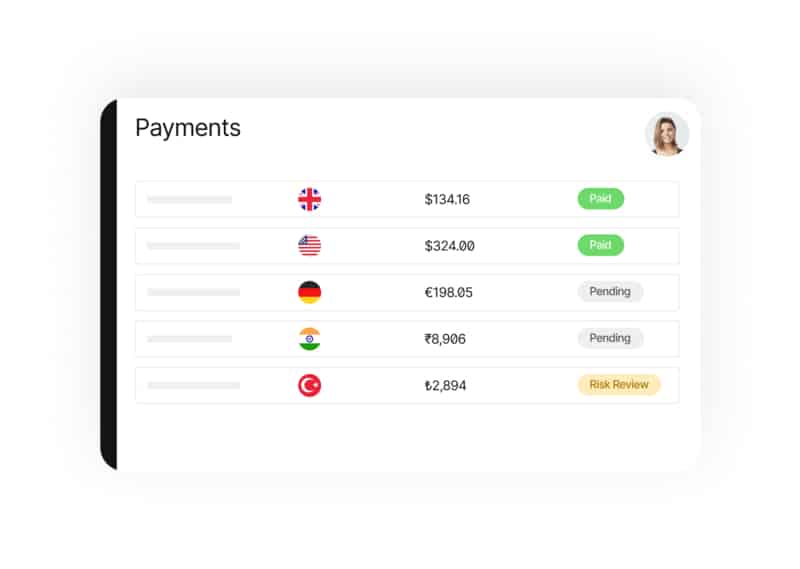

Faster, On-Time Payments

Once an invoice is approved, AP automation software schedules payment.

With Tipalti, for instance, you can set rules to pay invoices in real time, on the due date, or on a specific date that aligns with cash flow or vendor payment terms.

With a tool like Tipalti, you can pay invoices individually or in batches. The latter is helpful if you receive multiple invoices from the same vendor.

You can also put specific invoices on hold within batches for future payments to better manage cash flow.

As mentioned earlier, efficiency pays in accounts payable. Paying invoices faster helps you grab early discounts and avoid EU late fees.

By streamlining the invoice-to-pay lifecycle, Tipalti reduces payment errors by up to 66% and speeds up financial close by up to 25%.

For example, by automating 180+ invoices a month, European Family Office saved around 50% of one employee’s time, freeing the AP team to focus on strategic work.

“Tipalti has given us all peace of mind. It really doesn’t matter how much we scale and grow; we can easily handle any volume of invoices. I just check Tipalti to make sure our payments are moving forward according to plan, and they always are.” —Lisa, Finance Director, European Family Office

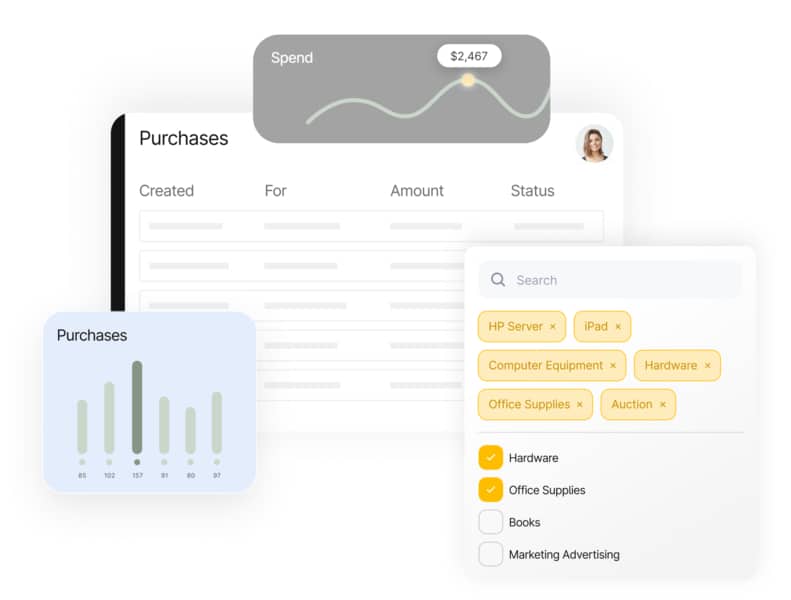

Data That’s Always in Sync

After payment, invoicing software sends real-time reconciliation to your ERP system or accounting software—no more pulling data from scattered spreadsheets or systems.

Bringing multiple invoice data together gives you real-time cash flow visibility. Tipalti AI can analyse historical data and predict future spending patterns, helping you make informed spending decisions.

For example, if you can track how often vendors are paid early, you can make spending decisions on payment cycles, not due dates.

Accurate data flowing into your ERP also improves record-keeping. An automated reconciliation process creates a robust audit trail for transparency and compliance with EU VAT, tax, and DAC7 regulations.

On-Demand Personal Assistance

Automated invoice management software works in the background, streamlining your workflow with little need for human intervention. But AI assistants are always on, answering questions and performing tasks on demand.

Think of them as 24/7 chatbots, with specialist knowledge about your business.

Tipalti AI Assistant, for example, is a personal AI chatbot that knows your financial workflows as well as you do.

You can ask Tipalti AI Assistant to trigger specific AI Agents to perform actions like:

- Creating reports

- Running matches

- Recommending approvers

- Auto-generating purchase requests

- Resolving ERP sync issues

The AI Assistant acts as your conversational interface, combining knowledge of your invoices, requests, and purchase order numbers with advanced reasoning to execute tasks and surface insights and opportunities.

Automating these routine jobs eliminates back-and-forth email or chat conversations, freeing human AP teams to focus on vendor management.

Take Control of Your Invoice Invoice Management

See how Tipalti streamlines AP—reducing manual work by up to 80% while improving speed, accuracy, and compliance.

Customer Story: AP Automation Empowers Growth for Dragoman

Manual processes are hard to scale. For global translation and interpretation leader Dragoman, manually managing payments in multiple currencies was causing payment delays and straining relationships.

The company needed to solve its problem to scale without the burden or expense of hiring. By implementing Tipalti and integrating it with Xero, Dragoman was able to automate its accounts payable.

The results: 4x revenue growth and 8x net profit—all while increasing trust and building an efficient process that future-proofs their operations.

Visibility and timely payment are crucial for maintaining trust in this industry. Tipalti gave us the tools to address these challenges. Tipalti integrates seamlessly with our systems, giving us the efficiency we needed to grow without increasing headcount.

Umit Ozaydin, CEO, Dragoman

What to Look For in AP Automation Software

The right AP automation software can be the difference between accounts payable running smoothly and causing more headaches.

Here are a few non-negotiable features to look for when evaluating solutions:

| AP Automation Software Feature | Invoice Management Benefit |

|---|---|

| AI-driven OCR invoice capture | AI-powered OCR ensures accurate data capture that improves over time. AI also uses historical data to code invoices, detect anomalies, and spot duplications, reducing fraud risk. |

| Customisable approval workflows | Features for creating routing rules by vendor, service, department, and invoice value mean fewer invoice delays and faster processing. |

| Two-way and three-way matching | Automated matching ensures invoice purchase orders and goods receipts correspond, reducing errors, disputes, and mispayments. |

| Peppol and e-invoicing support | Support for Peppol networks and e-invoicing ensures compliance and future-proof data capture as e-invoicing becomes mandatory across EU member states. |

| ERP integration | Seamless integration with ERPs (e.g., Oracle NetSuite, SAP, Microsoft Dynamics, Xero, or Sage) keeps crucial invoice data in sync, eliminating time-consuming manual reconciliation. |

| Multi-entity and global capabilities | Multi-entity and global capabilities allow you to handle multiple currencies, tax codes, and documents from vendors within and outside the EU. |

| Audit-ready transparency | Communication capture, timestamps, and identity logs create a self-generating audit trail. Cloud-based reporting and document storage features make it easier to meet regulatory requirements at EU and national levels. |

| Data security (GDPR) | Safeguards such as GDPR, KPMG-approved validation, electronic payment methods, and verification screening protect vendors and you. |

| Built-in collaboration | In-platform messaging and notifications, alongside chat tool integration (e.g., Slack or email), keep key stakeholders in the loop, reducing bottlenecks from end to end. |

| Real-time monitoring and reporting | Customisable spend analysis dashboards help finance teams spot blockers, uncover saving opportunities, and track KPIs to boost spend management efficiency. |

Use reviews, case studies, and product demos to get a feel for products. Check that software:

- Can scale as your invoice volume increases.

- Addresses EU e-invoicing standards and GDPR.

- Supports international suppliers/vendors (if applicable).

- Is user-friendly for non-finance staff (e.g., managers approving invoices).

- Has mobile functionality for managing approvals on the go.

- Can easily onboard suppliers for faster invoice processing and payments.

- Has tiered pricing to support your needs and budget.

- Offers responsive support across different channels (e.g., phone, email, and live chat).

The right invoice management software will save you time, reduce errors, and increase visibility—turning accounts payable from a bottleneck into a growth engine.

Here’s what Tipalti’s Chief Accounting Officer, Paul Henderson, advises on choosing a solution that grows with your needs:

As Paul explains:

With rapid advancement of technology and AI in accounting, it’s not about whether or not you’re going to adopt new solutions, but what are you going to adopt?

Save Time and Money on EU Invoice Management with Tipalti

Manual invoice management works when your invoice volume is low. But as your business grows, it can hinder scalability.

When data entry piles up, approvals stall, and payments fall behind—putting vendor relationships and EU compliance at risk.

Invoice management automation helps you fix this. It takes repetitive tasks off your team’s plate, automatically managing the invoice process, from receipt to reconciliation.

The result: fewer errors, faster payments, clear audit trails, and the ability to scale without recruiting and training extra AP staff.

Ready to replace your outdated processes? Explore how Tipalti’s Invoice Management streamlines your AP workflow.