Trading across EU borders looks simple on paper. Goods move freely, there are no customs duties, and member states share a single market.

However, AP processes get more complex when value-added tax (VAT) is involved.

For finance teams handling hundreds of cross-border transactions, differences in rules across countries can quickly lead to compliance risks, increasing the likelihood of penalties and double taxation.

This guide explains intra-community VAT in simple terms and goes further. We’ll explore how to operationalize compliance within AP workflows—with the help of AI and automation—so your team can act quickly and stay audit-ready.

Key Takeaways

- Intra-community VAT allows zero-rated B2B sales between EU member states when both parties hold valid VAT numbers.

- EC Sales Lists, VAT returns, and Intrastat reports must align to avoid costly audits and double taxation.

- The VAT in the Digital Age (ViDA) package will make e-invoicing mandatory for all intra-EU B2B transactions by 2030, but will affect some states sooner.

- AI and automation enable finance teams to maintain accuracy, reduce manual work, and stay compliant as regional regulations evolve.

What Is Intra-Community VAT? A Simple Definition

Intra-community VAT is the value-added tax system governing the sale of goods between businesses in different EU member states (i.e., intra-community transactions).

Unlike domestic deals, cross-border sales in the EU need specific rules to prevent double taxation. These ensure each country’s tax authority collects its fair share.

The intra-community VAT framework is based on two core ideas:

- Intra-community supply of goods—selling goods to a VAT-registered company in another EU country.

- Intra-community acquisition of goods—buying those goods from a supplier based in another member state.

Together, these concepts determine buyers’ and sellers’ VAT obligations: in other words, who collects, reports, and pays value-added tax on B2B deals.

For example, if a supplier in France sells machinery to a VAT-registered business in the Netherlands, it won’t charge VAT on the invoice. It’s an intra-community supply.

Instead, the buyer accounts for VAT in the Netherlands (i.e., it pays Dutch VAT). It’s an intra-community acquisition.

Known as the reverse charge mechanism, this way of handling tax means that VAT is only accounted for once in the buyer’s country. However, the transaction is reported to both the buyer’s and the seller’s national authorities.

To manage tax this way:

- The goods must physically move between member states (i.e., they aren’t digital or service-based).

- Both parties must hold valid VAT numbers, proving VAT registration.

- Documentation must clearly prove that these conditions are met.

Note: The reverse charge mechanism applies only to business-to-business (B2B) transactions. Sales to private individuals—i.e., consumers—have different VAT rules.

B2B Supplies vs. Distance Sales: What’s the Difference?

The reverse charge mechanism doesn’t apply to all sales between European Union countries. Business-to-consumer (B2C) goods transactions are subject to the distance sales of goods rules instead.

For example, a furniture company in Belgium may have B2B and B2C e-commerce stores.

- Cross-border B2B transactions count as intra-community supplies. Under the reverse charge mechanism, the buyer is responsible for accounting for VAT in their own country.

- If it ships the same goods to consumers in another EU country, those are B2C cross-border sales. The seller is responsible for charging and paying VAT in the customer’s country, as the customer isn’t VAT-registered.

For B2C transactions where the seller must pay VAT in the customer’s country, the seller can use the One-Stop Shop (OSS) scheme to simplify declaring and paying. This saves them from having to register individually in each state where they sell.

The OSS scheme applies only if cross-border sales exceed €10,000 annually. Otherwise, the seller can continue using domestic VAT rates and rules.

VAT rules differ again for digital sellers. As of 2015, software, streaming, and other electronic supplies of service are taxed in the customer’s location.

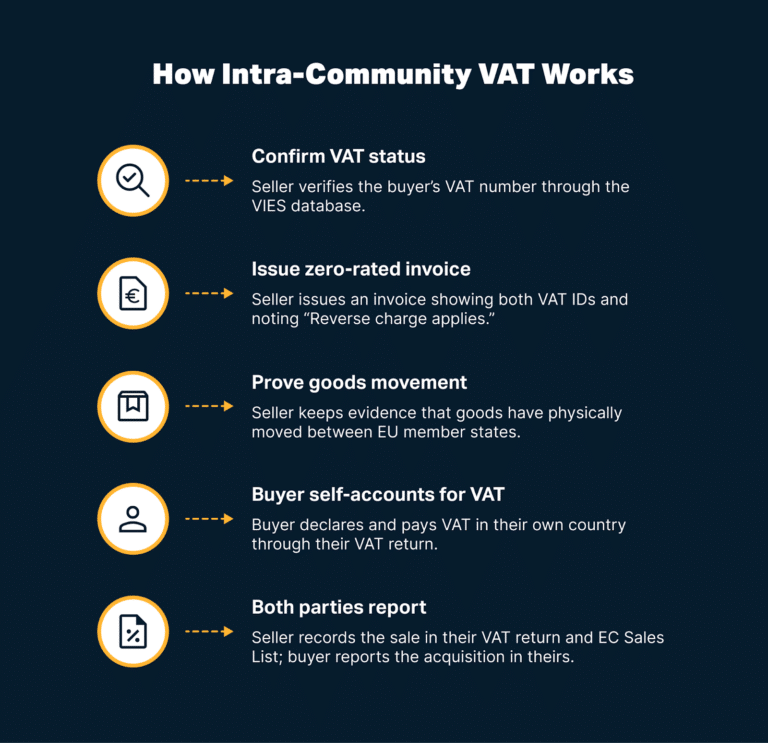

How Intra-Community VAT Works: Step-by-Step

As a general rule, all B2B transactions subject to intra-community VAT follow the same sequence of checks, documentation, and reporting.

Here’s how the process goes from VAT status confirmation to accurate reporting, step by step.

1) The Seller Confirms the Buyer’s VAT Status

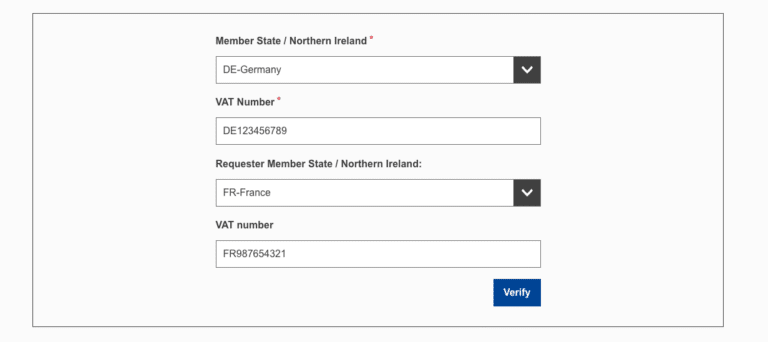

Before sending an invoice, the seller verifies the buyer’s VAT identification number through the VAT Information Exchange System (VIES).

This check—completed using the simple form below—ensures the buyer is recognised as a taxable person for VAT purposes.

VIES supports real-time validation across all EU member states, making verification fast and easy. Also, keeping records of these checks provides evidence of compliance during audits.

2) The Seller Issues a Zero-Rated Invoice

After validation, the seller issues an invoice with zero VAT. This invoice must show:

- Both parties’ VAT IDs.

- A clear statement that the reverse charge mechanism applies.

- The date and place of supply.

Note: Some tax administrations accept simple wording, like “reverse charge.” Others require more specific statements. Many EU businesses use full legal references to Article 138, 194, or 196 of Council Directive 2006/112/EC to ensure compliance and avoid invoice rejection.

3) The Seller Documents Movement of Goods

The seller keeps evidence of the goods physically leaving their country and arriving in another EU member state (i.e., crossing borders by any means of transport).

Acceptable proof includes:

- Signed delivery confirmations

- Shipping documents

- Carrier tracking records

- CMR documentation

The seller doesn’t submit this evidence, but must have it ready for audits. Without it, tax authorities can treat the sale as domestic and demand payment of VAT plus penalties.

4) The Buyer Self-Accounts for VAT

The buyer reports the intra-community acquisition on its VAT return, in its own EU country. Most will do this through their accounting system—and the process may even be automated.

The company purchasing goods calculates VAT based on its domestic rate and, if fully taxable, can usually reclaim the amount on the same return.

5) Both Parties Report the Transaction

When each side has accounted for its part of the transaction, both report separately to their respective tax authorities.

- The seller declares the zero-rated supply in their VAT return and lists it on the EC Sales List (ESL)—a cross-continent record of transactions.

- The buyer reports the acquisition in their VAT return as a reverse-charge transaction.

EU tax administrations automatically cross-check these submissions using shared databases and follow up on discrepancies.

Maintaining consistent and accurate data on both sides is crucial to prevent compliance queries or audits.

Tax Obligations Example: Moving Goods From Poland to Italy

Understanding how intra-community VAT works is even easier when you envisage two companies from different EU countries going through the process.

Here’s what would happen if a Polish IT company sold €10,000 of computers to a business in Italy:

| 1) The seller confirms the buyer’s VAT status. | The Polish company verifies its Italian customer’s VAT number using the VIES system. |

| 2) The seller issues a zero-rated invoice. | It issues an invoice for €10,000 with no VAT added, noting “Reverse charge applies.” |

| 3) The seller proves the movement of goods. | It obtains shipping documentation proving computers crossed borders from Poland to Italy. |

| 4) The buyer self-accounts for VAT. | The Italian business records a €10,000 acquisition in its accounting system, ready to declare on its VAT return. |

| 5) Both parties report the transaction. | The Polish company records the €10,000 supply of goods in its Polish VAT return and reports the sale in its EC Sales List.The Italian also reports the intra-community acquisition in its periodic tax return. |

Thanks to this well-established process, the goods move freely between member states without the Polish company needing to register for VAT in Italy.

Simplify Cross-Border VAT with Tipalti

With Tipalti, finance teams can automate VAT validation, reporting, and compliance across every EU entity—all from one tool.

EU VAT Compliance Requirements: What You Need to Know

One way in which all European tax authorities are aligned is that they expect businesses to maintain detailed records and file regular reports.

Failure to meet those expectations can lead to penalties, operational bottlenecks, and even reputational damage for your business.

Here are the primary compliance considerations related to intra-Community VAT in the EU.

VAT Registration and Identification Numbers

Before operating in multiple EU countries, you need a valid VAT registration in your home country.

Your VAT ID number proves you’re a taxable person eligible to make intra-community supplies and acquisitions. It’s what other parties will check in VIES before doing business with you.

Exact processes vary across countries, but generally, you’ll need to contact your domestic tax authority with the following information:

- Business registration documents (e.g., Certificate of Incorporation)

- Bank account details

- Details of company directors

- Proof of planned commercial activity

Depending on the jurisdiction, you may be able to submit an online application. However you obtain it, your VAT ID must appear on all invoices, returns, and ESLs.

Returns, Sales Lists, and Intrastat Reports

Registered businesses must document their intracommunity transactions in regular filings, which gives tax administrations visibility into trade flows and helps prevent double taxation.

The main filings are as follows:

| VAT Return | Summarises all supplies, acquisitions, and domestic sales within a reporting period. Sellers declare zero-rated intra-community suppliers here. Buyers record their acquisitions. |

| EC Sales List (ESL) | Lists all zero-rated B2B sales to other VAT-registered entities in the EU. Tax authorities use this to match sellers’ and buyers’ data across borders and investigate discrepancies. |

| Intrastat Report | Records statistical data on goods movements between member states once annual thresholds are exceeded. Intrastat reporting is separate from VAT accounting but uses the same underlying information. |

The company’s member state and size determine reporting frequency. For example, the Netherlands requires monthly ESLs, while Ireland allows quarterly ESLs for lower volumes.

Either way, inconsistent or late filings can trigger follow-up audits or penalties.

Record-Keeping and Audit Trails

Buyers and sellers must keep evidence that their intra-community transactions are valid.

Tax authorities may reclassify transactions without sufficient documentation as domestic and re-charge VAT with added penalties.

Records to keep as evidence include:

- Invoices and credit notes

- Proof of transport or delivery

- VIES verification logs

- Contracts, purchase orders, and correspondence

Documents must be kept for 5 to 10 years, depending on national requirements, and stored in an accessible digital format.

That storage need is one of many great reasons for implementing invoice processing software.

Key Regulations and Frameworks Affecting Intra-Community VAT

Several EU regulations and frameworks shape how B2B companies manage intra-community VAT.

Here are the key rules to know and how each one affects your VAT and reporting responsibilities:

| Regulation/Standard | How It Affects Intra-Community VAT |

|---|---|

| The VAT Directive (2006/112/EC) | Creates a legal foundation for intra-community VAT across all EU member states.Defines when the reverse charge mechanism is applicable and sets standards for invoicing and reporting. |

| VAT in the Digital Age (ViDA) | Modernises VAT reporting with mandatory e-invoicing for all cross-border B2B transactions by 2030. Member states can adopt domestic rules earlier, but can’t opt out.Also carries real-time digital reporting requirements to replace quarterly submissions. |

| Peppol | Provides the secure digital infrastructure for cross-border invoice exchange, ensuring invoices meet the technical standards of Directive 2014/55/EU.Not all member states have made Peppol mandatory yet, but many plan to align under ViDA. |

| DAC7 | Strengthens tax transparency and increases scrutiny on intra-community deals by requiring digital platforms (e.g., apps and marketplaces) to report seller information and transaction data to tax authorities. |

Like most laws, these standards will continue to evolve in response to new technologies, geopolitical developments, and changing business models.

For example, DAC7 currently requires reporting of income related to these types of transactions via digital platforms:

- The sale of goods

- The rental of immovable property

- The rental of any mode of transport

- The provision of personal services

Building on this, DAC8 extends reporting obligations to include crypto-assets from 1 January 2026. This reflects the EU’s push to improve tax transparency in the digital finance space.

Changes like these are why it’s essential to remain adaptable and prepared to adjust AP processes as new requirements emerge. One area where Tipalti’s fully compliant AI and automation tools can be particularly helpful.

How Tipalti’s AI and Automation Simplify EU VAT Compliance

Tipalti is a clear example of how AI and automation simplify intra-community VAT compliance for European finance teams.

According to a SteelEye survey, 96% of firms that implemented AI reported improvements in their compliance processes.

Rather than processing each cross-border invoice manually, Tipalti’s automated system enforces VAT rules consistently across applicable transactions.

Here’s an example of the software performing compliance checks on a supplier ahead of payment:

In particular, the following four Tipalti functions help to keep AP affairs in line and on track:

- AI Smart Scan blends OCR and machine learning to extract invoice data in any format or language, and turn it into structured data your ERP can process.

- Tax Form Scan Agent ensures supplier tax compliance with automation that extracts W-9 data and accelerates onboarding.

- VIES integration automatically checks VAT numbers in real time, flagging issues before processing transactions.

- Tipalti Detect automatically screens supplier and transaction data for compliance risks, helping prevent fraud and ensuring invoices meet VAT and regulatory standards.

All the while, integrated reporting syncs invoice and tax data across ERP and accounting systems to keep VAT returns and EC Sales Lists accurate with minimal human intervention.

For example, Tipalti and Acumatica work together to make invoice and payment processing smoother, alongside several other functions.

Those integrated workflows look like this:

In addition to other ERPs (such as SAP, Microsoft Dynamics 365, and Oracle NetSuite), Tipalti can integrate with performance marketing tools, communication apps, and specialized tax filing tools.

These automations and integrations eliminate many roadblocks that slow down finance teams.

3 Common VAT Challenges for EU Finance Teams

As businesses expand across European borders, finance teams face increasing pressure to remain compliant while managing higher invoice volumes and complex reporting requirements.

Here are three of the biggest obstacles that slow EU companies’ VAT operations.

1) Manual Data Entry Creates Costly Errors

Every manual touchpoint in your AP workflow presents another opportunity for human errors to enter your records and compromise data quality.

Almost two-thirds (65%) of the companies SteelEye surveyed (most of which are based in Europe) stated that over 20% of their compliance staff were still performing manual or repetitive tasks.

However, relying on staff alone makes the following mistakes far more likely:

- Transposing VAT numbers incorrectly

- Miscalculating currency conversions

- Failing to apply the right VAT rate for acquisitions

- Missing ESL deadlines

- Submitting Intrastat data with product code errors

These errors don’t always show immediately. Without robust checks, tax authorities may unearth them during audits months or years later, and impose penalties accordingly.

Errors aside, manual data entry also drains teams’ time and morale, reducing productivity.

A Lund University study found that repetitive invoice-processing work in European finance shared service centres reduced motivation and retention. Automation improved both.

How Tipalti helps: AI Smart Scan blends OCR and ML to extract header and line-item data (in any format or language), auto-code GL, and flag anomalies.

2) Disconnected Systems Block Visibility

When your AP workflows run on multiple platforms that don’t communicate, it’s hard to see your true VAT position across member states.

Unfortunately, disjointed tech stacks are common in the finance industry. Lots of European businesses juggle several disconnected systems, including:

- Enterprise resource planning (ERP) software for financial records

- Separate accounting tools for VAT calculations

- Spreadsheets for ESL preparation

- National tax portals in each trading country

Add to that the mix of invoice formats—e-invoices, PDFs, Word files, and even printed documents—and visibility drops further.

With data moving slowly through the business via manual imports and exports, finance teams struggle to get timely insight into outstanding VAT obligations and potential audit risks.

How Tipalti helps: Native ERP integrations (e.g., NetSuite, Dynamics, SAP) sync invoice and tax data, ensuring VAT returns and EC Sales Lists remain aligned across entities.

3) Manual Processes Can’t Keep Up With Growth

Cross-border trade doesn’t scale well when you manage VAT manually.

What starts as a simple domestic process becomes complex as each new member state adds its own rules and reporting steps.

Compliance work grows proportionally with every transaction. Processing 100 cross-border invoices monthly takes 10 times the effort of processing 10, making sales growth bittersweet.

The transactions themselves aren’t more complex—the manual workflows just can’t keep up while maintaining accuracy.

Over time, manual VAT management turns international growth from an exciting opportunity into a costly headache.

This is one of the reasons so many successful finance teams rely on AI and automation to stay compliant and productive.

How Tipalti helps: Built-in VIES validation, reverse-charge handling, and Tipalti Detect screening scale compliance checks, which scale with invoice volume, catch issues before payments are released.

When errors drop and processes run consistently across borders, businesses can scale without increasing headcount. Here’s what that looks like at scale for a fast-growing EU business.

Case Study: How Kittl Cut Errors Across Tax Jurisdictions

Berlin-based design platform Kittl manages payments to over 300 designers and partners worldwide, each bringing their own tax jurisdictions and compliance requirements.

Kittl used to manage invoices and issue payments manually, but the process caused errors and consumed an entire day each week for its lean finance team.

Implementing Tipalti’s automation helped it minimise errors and improve accuracy across all jurisdictions (including in non-EU countries).

The company:

- Standardised incoming invoices, improving financial data accuracy.

- Automated over 300 monthly payouts.

- Reduced payment processing time from one full day per week to just two hours.

And most importantly, it freed Kittl to enjoy growth without worrying about audits or invoice volumes:

It’s like having one extra person to handle the workload. At our scale, where we can grow tenfold, it would otherwise mean needing five more people. Tipalti saves us that requirement.

Christoph Drayss, Finance Manager, Kittl

Take Control of EU VAT Compliance

Cross-border trade should fuel growth, not hinder it. Yet for many finance teams, managing intra-community VAT still means endless checks, corrections, and late-night reconciliations.

Automation changes that, especially once paired with AI.

When your system intelligently validates VAT IDs, applies the right tax rules, and keeps reports aligned, compliance becomes something you can trust without constantly having to check.

With ViDA set to make e-invoicing the standard across Europe, now’s the moment to future-proof your processes—and Tipalti makes that step incredibly easy.

See how Tipalti’s AI Agents work together to keep finance teams productive, on track, and compliant with cross-border tax rules.