What’s the real cost of one bad wire transfer? It isn’t just the bank fee that shows up on your statement. It’s the hours your team spends hunting down the problem, the damage to a crucial supplier or freelancer relationship, and the pressure of a deadline you may now miss.

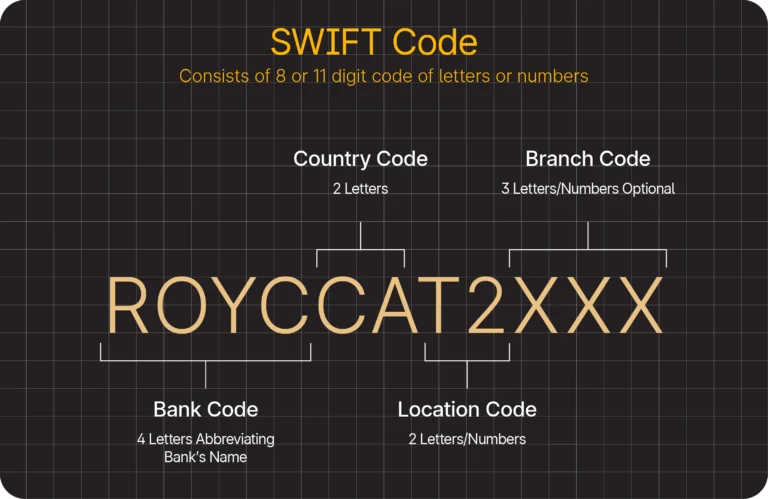

Precision in your international payments is your best defense, and it often comes down to a single string of characters: the SWIFT/BIC code. Also known as a Bank Identifier Code (BIC), a SWIFT code is simply the standardized way banks are identified globally.

A single typo in this BIC number can derail a critical cross-border transaction, trigger unique Canadian FINTRAC compliance rules, and land you in the ever-present US-ACH trap.

This article is a playbook designed to provide you with the Canada-specific knowledge needed to send international SWIFT payments accurately and efficiently.

Key Takeaways

- You’re working with a BIC (Bank Identifier Code), the official term for a SWIFT code, which acts as a global postal code for a bank, not an individual’s account.

- In Canada, using the specific 11-digit BIC is crucial for bypassing any payment delays caused by centralized bank processing hubs in major cities.

- A simple typo in a BIC can raise a serious compliance flag with FINTRAC, Canada’s financial intelligence unit.

- Understanding the difference between the SWIFT network for wires and the ACH network for US payments is the key to preventing your most common cross-border payment failures.

What is a BIC Number?

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) code, also known as a BIC code, is a standard way to identify a bank.

Founded in Belgium in 1973, it was designed to create a universal language for finance, and the reality of how this language works within Canada’s infrastructure is far more nuanced than you might think.

Understanding the ‘Toronto Hub Effect’

Let’s start by breaking down the 8-to-11-character code itself. This Business Identifier Code (BIC) is structured to include a four-letter code representing the bank name, a two-letter country code, and a two-character location code. However, the length creates a critical and often invisible delay due to the “Toronto Hub Effect.”

Whether your company banks with a branch in Burnaby, BC, or Bedford, NS, the central wire processing department for your bank is almost certainly located in Toronto. When you use a generic 8-digit BIC that only identifies the bank’s head office, your payment instruction is routed to that central hub.

From there, it often requires manual intervention to be directed to the correct destination branch, adding another full day to your transfer timeline.

For companies managing hundreds or thousands of supplier and/or contractor payouts, even a one-day delay per transfer scales into significant risk. Mass payment automation eliminates these delays by validating 11-digit BICs in bulk.

How to Ensure a Direct Payment Route

Using a specific, 11-digit BIC number that includes the unique code for a specific branch enables a direct, automated route, a process the industry calls Straight-Through Processing. It’s the difference between a direct flight and one with a mandatory layover.

When a Typo Becomes a Compliance Problem

This precision is important for another, more serious reason. An incorrect BIC code isn’t just an error that gets bounced back—in Canada, it can become a compliance issue. Every international wire transfer you send is reported to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), our nation’s financial intelligence unit.

A payment instruction with an incorrect or invalid BIC can be flagged by a bank’s compliance software as a potential risk. Not only does this just reject the payment, but it can freeze it entirely, triggering a manual review.

When processing hundreds of international transfers at once, even one mistyped BIC can freeze an entire batch. Finance teams processing hundreds of global transactions at scale can’t afford these manual compliance setbacks. Automation ensures every recipient’s bank details are validated before funds are sent.

Suddenly, your team is on the phone with your bank’s compliance department, proving the legitimacy of a routine transaction and explaining the delay to a valuable vendor or contractor.

Not only does a typo potentially create a massive compliance headache, but Mid-market Canadian companies face the highest penalty risks when SWIFT transfers are misrouted.

SWIFT vs. IBAN vs. Canadian Transit Numbers

As someone managing global mass payments, one invoice might be from a supplier in Montreal, another from Munich, and a third from Miami.

Each requires a different set of bank details to get paid correctly, and knowing which to use is fundamental to avoiding payment rejections for your international money transfers.

Choosing the Right Code for the Right Payment

Think of these codes as different addresses for different delivery services. For your supplier in Montreal, you’re making a domestic payment, so you’ll use their 5-digit transit number and 3-digit institution number to send a Canadian electronic funds transfer (EFT). This service is similar to a local courier service, as it’s fast and efficient, but it only works within Canada.

Handling European Payments with IBAN

For your supplier in Munich, you need to go international. European banks use the International Bank Account Number, or IBAN, to identify individual accounts.

You’ll need their IBAN and their SWIFT/BIC code to ensure the payment is successful, especially for transactions within the EU known as Single Euro Payments Area (SEPA) payments.

How to Find Your Company’s SWIFT Code

Before you can pay others, you need to know your own details for receiving funds. Your company’s SWIFT code is readily available. You can typically locate your bank’s SWIFT code on your monthly bank statement or within your online banking portal’s detailed account statements.

Understanding the US ACH Trap

Now for the supplier in Miami. They’ve sent you an invoice with a 9-digit American Bankers Association (ABA) routing number. This is often the single biggest point of failure for Canadian companies paying American suppliers.

That ABA number is for the US domestic ACH network, which is completely separate from global financial hubs like New York or Hong Kong.

Your team needs to understand that the technical trap is that your Canadian bank’s standard EFT system cannot process a US ABA routing number. This applies whether you’re trying to pay a specific bank or a small credit union.

So, what do you do when you need to send money? You have two correct paths. The first is to send a SWIFT wire transfer, but be mindful of the costs, which include not just fees, but also the exchange rate applied to the foreign exchange. The second, more strategic option, is to use a specialized cross-border provider or a USD account designed to operate on the US ACH network.

Canadian businesses paying multiple US suppliers or contractors often encounter the ACH trap—manual handling doesn’t scale. A global mass payments platform can route USD payouts through the optimal rail automatically.

Choose the best payment method for every global payout

See how different payment methods compare for speed, cost, and reach. Learn how to optimize your mass payments strategy and select the right rail for each supplier or partner.

The Hidden Journey of a Canadian SWIFT Payment

When you authorize swift transfers, 90% of which reach the destination bank within one hour, the money doesn’t just vanish from your account and reappear in your supplier’s. Instead, you initiate a conversation on a vast global network that connects over 11,000 institutions. This conversation takes place using a highly secure messaging system with its own unique rules and potential detours.

Sending Instructions, Not Cash

The first thing to understand about the Swift system is that it doesn’t actually move funds. It moves information. When you send a wire, your bank creates a standardized message, a payment order, that tells the recipient’s bank all the details of the transaction.

The most common message type is the MT103, which acts as the official instruction: who is paying, who is being paid, the amount, the currency, and the date.

How the Actual Money Moves

So if the MT103 is just the instruction, how does the money get there? This happens through a separate, parallel process. The banks involved use a different message, often an MT202 or “cover payment,” to settle the funds between themselves. This settlement happens through accounts that the banks hold with each other.

This two-message system is a frequent source of confusion. It’s why your supplier might email you to say their bank has received “notice of payment” (the MT103 has arrived) but that the funds are not yet in their account (the MT202 settlement is still in transit).

Using USD Accounts for a Strategic Shortcut

For a Canadian business, one of the most effective ways to make this journey shorter and cheaper, especially when paying US suppliers, is by using a USD-denominated account at your Canadian bank.

When you send US dollars from this type of account, your bank can often leverage its own US entity or a direct relationship with a major American bank.

This route bypasses many of the smaller, intermediary “hops” a payment might otherwise have to make, resulting in faster settlement and fewer opportunities for other banks to deduct “lifting fees” along the way.

Why Time Zones Matter

Finally, a simple, practical reality that usually gets overlooked is the impact that Canada’s vast geography and different time zones have on payment timing. Your bank’s central wire room, the one that actually sends the SWIFT code message, almost certainly operates on Eastern Standard Time.

If your payments team is in Vancouver and you finalize a payment run at 3:00 PM Pacific Time, it’s already 6:00 PM in Toronto. You’ve missed the daily cut-off. Your payment won’t be processed until the next morning, which will add a day to the payment cycle and potentially cause you to miss a supplier’s deadline.

Common BIC Codes for Major Canadian Financial Institutions

Having a reliable reference for Canada’s major banks is an invaluable tool for your finance team. While you should always confirm details with the recipient, this list covers the BIC numbers for Canada’s major banks.

- Royal Bank of Canada (RBC): ROYCCAT2

- The Toronto-Dominion Bank (TD): TDOMCATTTOR

- Scotiabank (The Bank of Nova Scotia): NOSCCATT

- Bank of Montreal (BMO): BOFMCAM2

- Canadian Imperial Bank of Commerce (CIBC): CIBCCATT

- Desjardins Group (Quebec): CCDQCAMM

Payments Modernization, Lynx, and ISO 20022

The way money moves in Canada recently underwent its biggest transformation in decades, a national project called the Payments Modernization Initiative. The old system for settling high-value payments was replaced by a new engine named Lynx in March 2023, which is built on a new global messaging standard called ISO 20022.

This new standard is a game-changer for your department. Unlike old formats, ISO 20022 allows vast amounts of common language remittance data that is readily exchanged between corporate and banking systems, to travel with the payment itself.

FX Cost Trends for 2025

Competition between foreign exchange (FX) providers and new entrants into the market is seeing declining currency conversion markups. Popular online currency conversion services typically charge between 0.5% to 1%. This is materially lower than traditional Canadian banks, which charge anywhere between 2% to 5%.

Tipalti’s Multi-Currency and Multi-Entity FX Routing

With Tipalti, you get the tools to manage CAD to USD currency fluctuations, protect profits, and gain greater control over your cash flow. Our multi-currency and multi-entity FX routing allows you to fund virtual accounts in your preferred currency, manage currency exposure with Tipalti Hedging, and execute intercompany transfers for different entities without maintaining multiple regional bank accounts.

How Automation Eliminates BIC Headaches for Canadian Businesses

Understanding these international payment challenges is the first step; the next is recognizing that manually managing them is no longer a scalable or secure strategy. A modern mass payments automation platform validates every BIC against a global database before funds are released, virtually eliminating errors at scale and reducing the risk of FINTRAC reviews.

Instead of your finance team remembering whether to send a wire or use an ACH-enabled account, a smart platform can automatically route the payment through the most efficient rail. This elevates the role of your finance team. Every minute saved from troubleshooting a failed payment is a minute they can spend on what truly matters, driving the financial health of your business.

Future-Proofing Your Canadian Payables

For Canadian businesses operating on the world stage, mastering global payments requires a deep understanding of the unique nuances of our national and cross-border financial systems.

Relying on manual data entry and verification is no longer a sustainable strategy; it exposes your business not only to global payout risks but also to specific Canadian compliance and operational challenges.

The path to secure and scalable growth lies in automating mass payments and enabling your finance team to manage cross-border transactions with confidence. Get a deeper look into optimizing your global payout strategy by exploring Tipalti’s mass payments automation solution.

Frequently Asked Questions (FAQs)

1. Do Canadian banks use IBAN numbers?

No, Canadian banks do not use IBANs. To receive international funds, you must provide your bank’s SWIFT/BIC code and full account details. This is especially important when managing multiple global payouts, as an IBAN will not work for a Canadian account.

2. Why did my payment to a US supplier fail when I used their ABA routing number?

That ABA routing number is exclusively for the US ACH payment system. A standard Canadian bank account cannot send an ACH payment, so you must use a SWIFT wire or a mass payments platform that can automatically route USD transfers through the correct rail.

3. Is the BIC code the same for all bank branches, like RBC or Scotiabank?

Often, a major bank uses a primary BIC code that routes to a central hub (usually in Toronto). While this works, using the specific 11-digit BIC for the recipient’s branch ensures faster processing—especially important when sending payments at scale.

4. Is it safe to provide our company’s SWIFT/BIC code to clients?

Yes, it is completely safe. A SWIFT/BIC code only identifies your bank and is public information required for someone to send you money. It does not provide any access to withdraw funds from your account, making it secure for recurring supplier or partner payouts.