See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

When invoice processing runs smoothly, all other accounts payable responsibilities follow. Payments are on time, compliance checks pass easily, and finance teams can finally breathe.

Yet across Europe, many companies are still stuck in manual routines that drain time and create costly errors.

In this guide, we’ll examine the current state of efficient invoice processing and explain how AP automation and artificial intelligence (AI) help teams achieve it more quickly.

Key Takeaways

- Invoice processing is how businesses receive, organise, verify, and pay new invoices from suppliers. It is a critical part of the accounts payable function.

- Manual invoicing workflows slow many European finance teams down while increasing errors and compliance risk.

- Invoice management automation helps companies work faster and smarter, reducing human error, increasing cash flow visibility and cutting operational costs.

- Tipalti’s AI invoicing tools make automation smarter, helping teams process all types of invoices with minimal intervention and freeing time for more profitable work.

What Is Invoice Processing and How Does It Work?

Invoice processing is the journey a business goes through from receiving a new supplier invoice to paying and recording it on its system.

Also called invoice management, the process is a core part of accounts payable (AP), ensuring every supplier invoice gets recorded accurately and paid correctly.

How Invoice Processing Goes for Most Businesses

For most AP management functions, invoice processing is still a mix of digital and manual tasks.

Documents arrive as PDFs, electronically, or on paper.

Each one is verified against a purchase order number, coded to the correct general ledger (GL) account, and approved before being submitted for payment.

Then it’s recorded and archived.

How Invoice Processing Is Changing

To fix these issues, companies across Europe are swapping manual invoice processing for AI and automation software.

These tools extract data automatically, validate amounts in real time, and route invoices to approval with minimal human effort.

The difference helps everyone involved:

- CFOs gain better cash flow visibility.

- AP managers reduce processing time.

- Finance controllers get cleaner audit trails.

- Procurement teams can track spending more accurately.

In other words, it’s a solid investment in productivity, profitability, and peace of mind.

Why Effective Invoice Processing Matters for European Finance Teams

When invoice workflows run smoothly, businesses maintain healthy cash flow, avoid penalties, and build trust with suppliers.

They also free employees’ time for other duties, helping morale and productivity.

When processing breaks down, the opposite happens: costs spiral and compliance risks stack.

So, what does effective processing look like? For most finance teams, it comes down to:

- Visibility. You know what’s received, approved, and paid at any moment.

- Accuracy. Each invoice matches the purchase order, contract, and delivery details.

- Control. There’s an audit trail for every supplier invoice and approval.

These pillars are fundamental in the EU, where financial reporting and e-invoicing rules keep evolving.

EU Compliance Requirements to Consider

Depending on your business type and location, you may need to comply with some or all of these EU regulations:

| Regulation/standard | What it means for finance teams |

|---|---|

| DAC7 | Requires digital platforms to report seller income to tax authorities across EU countries.Note: Denmark recently expanded these rules to include crypto transactions, with more countries expected to follow. |

| Peppol | A standardised network for e-invoicing and procurement used across many EU countries. |

| Late Payment Directive | Sets limits on payment terms (generally 30 or 60 days) and entitles suppliers to interest or compensation for overdue invoices. |

| E-Invoicing Directive (EU 2014/55) | Mandates the use of structured electronic invoices for public sector transactions. |

| VAT in the Digital Age (ViDA) | A proposed EU initiative aimed at modernising VAT reporting and e-invoicing. It’ll require near real-time digital reporting of cross-border transactions. |

| GDPR | Requires careful handling of personal data within financial records (learn more about GDPR). |

Effective invoice processing helps reduce compliance costs by keeping financial data accurate, accessible, and ready for validation when regulators or auditors need it.

This matters because compliance is expensive.

In a recent Sumsub report, almost 45% of European financial services firms reported high operational compliance costs. Over half also said that keeping up with regulations is their main challenge.

Much of this cost comes from the manual effort required to gather, verify, and format invoice data for regulatory reporting.

Ultimately, strong invoice processing provides invaluable peace of mind for everyone involved in a company’s finances.

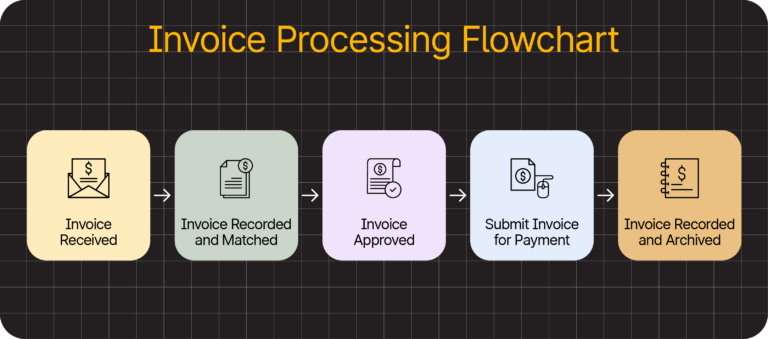

The Invoice Processing Workflow Explained

Exact approaches may vary across companies, but most invoices follow the same basic journey through accounts payable.

It generally goes like this.

Stage 1) Receive the Invoice

The invoicing process starts when the accounts payable department receives an invoice (or, more formally, an “invoice to pay”), which can happen in a few different ways.

Some incoming invoices are paper-based and arrive by post, while others are PDF attachments.

Electronic invoices, meanwhile, flow through networks like Peppol or electronic data interchange (EDI) systems.

However the document arrives, the first step is to collect and organise it so that nothing goes missing.

Stage 2) Capture the Invoice Data

Next, the accounts payable team records key details from the invoice documents.

The most important details are:

- Supplier name

- Invoice number

- PO reference

- Invoice amount

Some teams do this manually. Others use optical character recognition (OCR) or AI invoice capture tools to extract data automatically, freeing up time for other work.

Stage 3) Validate the Details

The team checks that each invoice matches the related PO and goods receipt. Before an invoice is processed, amounts, quantities, and VAT rates must align.

At this stage, every invoice is also checked for fraud. The vendor should be validated and preapproved so the company knows where its money goes.

There should also be only one invoice version, and its line items should be unique (i.e., not duplicated on other invoices).

Validation is a pivotal moment in the process: catching discrepancies early helps stop payment errors and reconciliation issues later.

Stage 4) Approve the Invoice

The appropriate person or people confirm that the goods or services were delivered and that the invoice amount is accurate.

In smaller companies, invoice approval might be the job of a single manager. In larger firms, it could include an AP department head, procurement team lead, or finance controller.

Another option is to have different approval processes depending on the invoice’s size or type.

For example, you might scrutinise a large payment to a new supplier more heavily than a small, repeat payment to a pre-approved vendor.

Stage 5) Pay and Record the Invoice

After approval, it’s time to pay the vendor in line with the agreed payment terms (e.g., by a specific date).

To process the payment, an AP representative needs:

- The total owed

- Vendor information

- Payment identifiers (e.g., an account or invoice number)

- Payment methods accepted

The team then records the completed payment in an enterprise resource planning (ERP) or accounting system to keep a clear audit trail for VAT reporting and compliance checks.

Note: Recording invoice payments enables CFOs and finance teams to track outstanding liabilities and monitor cash flow in real-time. It’s more than just practical in the EU, where e-invoicing rules require issuing, receiving, and storing documents in a digital format.

Without the right systems, invoice processing can hit roadblocks. Being aware of the most common means you can prepare—or choose a more effective approach.

Challenges Faced in Invoice Processing

The invoicing process becomes more complex the more suppliers you have.

Smaller businesses may manage with basic, manual systems, but most notice some or all of the following challenges as they grow.

1) Human Errors Cause Inaccurate Data

Invoice data is sensitive. One small error can have significant knock-on effects, such as over- or underpayment, disagreements with clients, and costly delays.

The most common invoicing errors come from rushed, manual data entry on the vendor’s part. There are issues like:

- Assigning to the wrong client

- Failing to itemise products and services clearly

- Not including a payment deadline

- Applying the wrong currency to the order

- Using bad math or incorrect pricing calculations

Errors like these don’t just look unprofessional; they often mean the process has to start over.

Even with a correct invoice, an AP team with manual processes may misread the data or enter it incorrectly into their own system.

Automated invoice processing tools reduce the chances of this happening as they don’t lose concentration or become tired like humans.

2) Documents Go Missing

Losing invoices is easy when dealing with stacks of physical paperwork or email attachments, especially as the company grows and you pay for many orders in different ways.

When an invoice is lost, the supplier simply can’t pay it on time. The team’s focus switches to finding the document or starting over, and the supplier gets frustrated.

You may even fall foul of the Late Payments Directive, designed to protect EU businesses from slow invoice processing.

Meanwhile, the next AP task is also delayed.

The more it happens, the bigger the backlog becomes. That’s why it’s crucial to consolidate all of the paper copies, PDFs, and Word documents, etc.

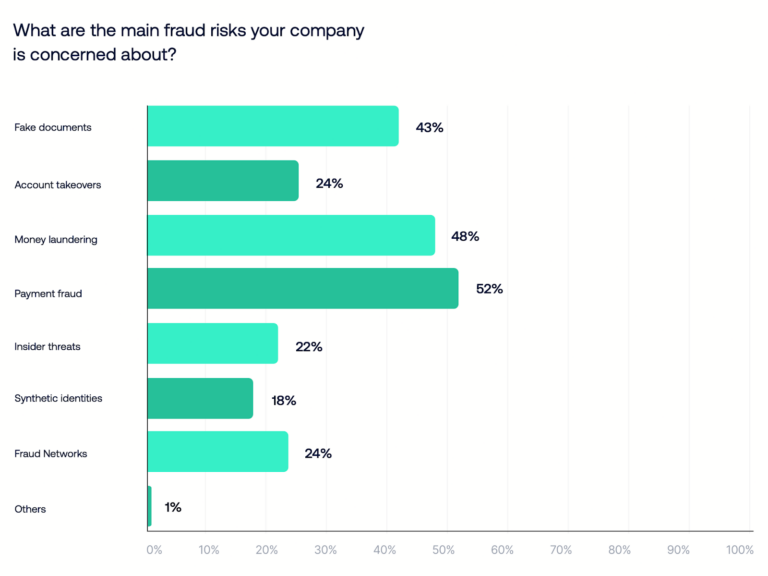

3) Fraud Risks Multiply

Invoice fraud is a growing threat to European businesses. It involves criminals sending fake invoices, altering supplier payment details, or impersonating real vendors to steal funds.

Time-consuming, manual processes make these schemes much harder to detect, as they rely on busy team members scouring every single document for discrepancies.

Company expansion makes checking invoices one by one even more difficult. Eventually, issues are bound to slip through—and that can be costly.

Almost a quarter of EU financial services organisations lose between €500,000 and €1 million to fraud every year, Sumsub reports. Two of the top three risks are payment fraud and fake documents, as shown in this chart:

The risk is both reputational and financial.

Over 80% of respondents to an IAPP buyer survey said they’d likely stop using a business after it falls victim to a cyberattack or data breach.

In other words: if suppliers and customers learn you’re vulnerable to crime—and that their data could be compromised—they’ll take their business elsewhere.

These challenges explain why AI and automation have become central to how leading European businesses now process invoices.

How AI and Automation Transform Invoice Processing and Ensure EU Compliance

Automation reduces friction in accounts payable by handling the repetitive work that slows teams down. AI makes it even smarter and more powerful.

Here’s what it looks like in practice.

Smarter OCR and AI-driven Invoice Capture

OCR has been helping finance teams pull text from invoices for a long time, but it often struggles with different formats and templates.

Note: Learn more about those data extraction limitations in our post on why OCR isn’t enough.

New AI-driven tools add more convenience, teaching systems to recognise invoice formats, extract data intelligently, and adapt over time.

These functions are the foundations of modern AP automation—and Tipalti’s solution builds on them to deliver even greater accuracy and speed.

How Tipalti AI Simplifies Invoice Capture

Tipalti is an AI-powered AP automation solution built to streamline how finance teams capture, validate, and process invoices.

For example, Tipalti’s AI Invoice Capture Agent uses machine learning to read and extract information from invoices at both the header and line-item level—as shown below:

Rather than just scanning words, this accounts payable automation solution understands context—much like a human would, but with far less risk of error.

The software recognises supplier names, amounts, VAT rates, and purchase order references, even when layouts vary.

Tipalti’s auto-coding AI then tags each invoice, assigning the right GL accounts and custom fields based on past activity and supplier data.

Here’s what the two-step matching and coding process looks like in action:

The results are fewer clicks, faster turnaround, and less guesswork.

For finance teams processing hundreds or thousands of invoices monthly, those minutes saved on each one add up fast.

Automate Invoice Processing at Scale––From Capture to Payment

Tipalti’s invoice management solution automates the entire processing workflow—helping EU finance teams reduce manual effort, increase speed, and ensure compliance.

Automated Approval Workflows and Notifications

After data capture, AP automation keeps everything moving, with your rules determining who the invoices go to.

For example, you could send any invoice over a certain amount straight to a finance manager. Or you might send recurring vendor invoices straight to department heads for faster sign-off.

However you route the invoices, approvers get notified instantly. They can review from any device and sign off with a single click, allowing them to continue their work uninterrupted.

If something sits too long, the system will follow up automatically. No more bottlenecks, no more missed payment dates, and no more strained supplier relationships.

You might even set faster reminders to capitalise on early payment discounts.

Accounting and ERP System Integrations

Modern invoice processing platforms like Tipalti integrate directly with ERP and accounting tools, such as SAP, Microsoft Dynamics, and NetSuite.

They can share data in real time for perfect consistency across your tech stack.

The image below shows how Tipalti links up with SAP, one of the most widely used ERP systems:

Approved invoices post automatically, payments sync in the moment, and finance teams finally have one source of truth instead of juggling scattered spreadsheets.

This cohesion matters because finding data is one of the biggest time drains in finance.

A recent survey of knowledge workers (most of whom are in Europe) found that they spend an average of 3.2 hours every week searching for information. Those hours should be spent on more profitable work, like budgeting and negotiations.

Integrations also help scalability. As your business grows and you add more tools, well-connected payment processing tools continue fitting neatly into your setup.

For example, global translation company Dragoman used Tipalti automation to cut payment delays across multiple currencies.

By integrating Tipalti with Xero, the business scaled efficiently, achieving 4x revenue growth and 8x higher net profit.

Visibility and timely payment are crucial for maintaining trust in this industry. Tipalti gave us the tools to address these challenges.

Ümit Özaydın, CEO, Dragoman

Real-time Reporting and Compliance Visibility

Automation gives finance leaders a clear view of every invoice from start to finish—what’s pending, what’s overdue, and what’s been paid.

Dashboards display all information in real time, saving teams from having to search through inboxes or spreadsheets to find answers.

The system automatically logs every step, creating a tamper-proof audit trail that tracks who approved what and when. That kind of traceability is exactly what EU regulations demand.

And, as compliance rules evolve, invoice processing software makes it easy to adapt.

Updates like DAC7—and the upcoming DAC8, which expands to cover crypto-asset reporting and cross-border transactions—are introducing new data requirements across Europe, to take effect as early as 2026.

With automation, structured digital records are already in place. When these rules take effect, teams can adjust workflows quickly, rather than rebuilding them from scratch.

For instance, the European Family Office once struggled to maintain consistent invoice data across entities, which complicated EU reporting and VAT compliance.

With Tipalti, the processes became automated and transparent. The system gives the team full visibility and confidence in their data.

Tipalti has given us all peace of mind. It really doesn’t matter how much we scale and grow; we can easily handle any volume of invoices.

Lisa, Finance Director, European Family Office

AI-Powered Fraud Detection

Invoice processing AI can serve as an early warning system for fraud, identifying issues before they result in costly consequences.

It flags issues like duplicate invoices, suspicious payment amounts, or sudden changes to supplier bank details. These are the subtle red flags that humans often miss under pressure.

Here’s an example of Tipalti Direct’s Integrated Fraud Management system highlighting invoice discrepancies:

These checks run automatically, providing an extra layer of protection against fraud and error.

More than just saving money, this helps preserve trust with suppliers, auditors, and partners—the kind of trust that takes years to build but can be lost in moments.

Build a Smarter AP Future for your EU Business

Invoice processing will never be a “set it and forget it” operation.

Regulations evolve, business volumes grow, and supplier expectations change, so you’ll always need to be adaptable.

Thankfully, invoice process automation makes that continuous adaptation far easier.

But perhaps most importantly, automation frees finance teams to focus on the strategic work they’re paid and trained for, like:

- Analysing spending patterns

- Negotiating better supplier terms

- Optimising cash flow

- Supporting business growth

After all, these activities drive growth far better than repetitive data entry.

Ready to make your AP more efficient? Learn how Tipalti’s invoice management solution helps European finance teams improve accuracy and comply with evolving EU regulations.