Once a company reaches mid-market scale, paying freelancers across the EU becomes significantly more complex. Finance teams must suddenly track tax details, banking formats, currencies, and reporting rules that vary from one market to the next—and manual methods quickly start to fall apart.

What used to be a manageable workflow quickly turns into a tedious process of chasing missing documents, correcting payment errors, and reworking compliance reports.

To maintain consistent payments at this scale, companies require a predictable system that automates onboarding, validation, and cross-border payouts—which is where mass payment automation becomes essential.

This guide explains why EU freelancer payments become complex at scale, and how mass payment platforms like Tipalti help finance teams stay compliant while delivering fast, consistent payouts.

Key Takeaways

- Differing tax rules, labour classifications, and reporting requirements across the EU create complexity for companies paying freelancers in multiple countries.

- When handled manually, these variations lead to slow approvals, payment failures, and compliance issues, particularly when scaling payments across jurisdictions.

- By simplifying freelancer onboarding, tax form validation, multi-currency payouts, and reconciliation, automation reduces operational bottlenecks and provides consistent, well-documented records.

- Automated mass payment platforms, such as Tipalti, provide finance teams with a central, compliant system for managing growing freelancer networks while enhancing the payee experience.

What Are Freelancer Payments?

Freelancer payments are the transactions made to independent contractors for project-based work.

For EU mid-market companies, paying freelancers isn’t as simple as “sending money”. It involves managing:

- Multiple tax identifiers (e.g., TIN, VAT, and local equivalents)

- Labour classification rules, which vary by country

- GDPR-restricted personal data

- Cross-border payment methods and currency differences

- Reporting obligations (e.g., DAC7 for freelancer platforms)

Once a company’s freelancer network extends across multiple EU countries, these responsibilities quickly become overwhelming. Each jurisdiction has its own tax, banking, and labour regulations.

When a finance team has to handle Taxpayer Identification Numbers (TIN) such as Steuer-ID in Germany, Value Added Tax (VAT) IDs in France, and local bank requirements in Spain simultaneously, the likelihood of reporting errors, missed deadlines, compliance breaches, and frustrated freelancers increases sharply.

To minimize these risks and pay EU freelancers accurately and efficiently, companies need streamlined, compliant workflows that:

- Centralize freelancer onboarding

- Automate tax validation

- Ensure timely, accurate international payments

Without these systems, managing EU freelancer payments at scale becomes a high-risk challenge that drains resources and slows business growth.

Freelancer Payment Obligations Across Jurisdictions

There are three broad sets of obligations that companies paying freelancers in the EU must meet to comply with the required rules and regulations.

1) Freelancer Data and Onboarding Obligations

Before a company can pay a freelancer, it must collect and verify a standardised set of information.

This onboarding data typically includes:

- Proof of identity (passport or national ID)

- Payment details, such as IBAN or SWIFT numbers, or digital wallet details

- TIN and legal address

- VAT registration details, where applicable

- Labour classification documentation that distinguishes a contractor from an employee

- GDPR-compliant consent for handling personal data

For finance teams, this means processing a vast amount of data from different sources. For example, a team onboarding 40 freelancers might receive:

- Bank details via email

- TINs inside PDFs stored in multiple folders

- VAT numbers sent informally over Slack

- ID documents uploaded in different formats

The sheer volume of data makes verifying the information slow and labour-intensive. It also increases the risk of mismatched data and gaps that could later become compliance risks.

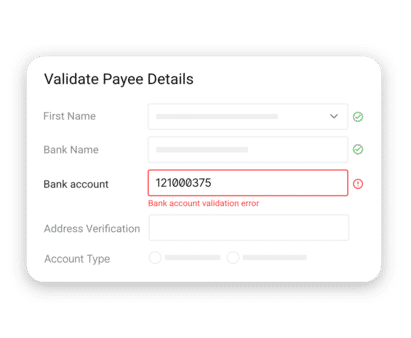

As your freelancer network grows, manual onboarding becomes increasingly difficult to maintain consistency and efficiency. Tipalti’s mass payments solution supports this with fully customisable onboarding flows and automated validation, so teams don’t have to manage every detail themselves.

Freelancers can use self-service onboarding to enter and update their own information, choose payment preferences, and maintain accurate records—reducing back-and-forth and the payment errors that often accompany manual updates.

2) Compliance Requirements for EU Freelancer Payments

Once freelancers are onboarded, companies face a second layer of responsibility: complying with EU tax, labour, and reporting regulations.

At this stage, the priority shifts from collecting information to proving that it’s valid, consistent, and correctly reported across jurisdictions.

DAC7 and Platform Reporting Obligations

Under the EU’s Directive on Administrative Cooperation 7 (DAC7), platforms facilitating freelance services must:

- Verify seller data (name, address, TIN, VAT number, bank details)

- Track payments made throughout the year

- File annual reports to each seller’s local EU tax authority

- Correct and resubmit filings if authorities flag inconsistencies

Where onboarding focuses on gathering data, DAC7 focuses on whether that data withstands regulatory scrutiny.

Even small discrepancies—such as a German VAT ID that doesn’t match the VAT Information Exchange System (VIES) or a French TIN with outdated address details—can trigger follow-up questions or resubmission requests. These delays create extra work for finance teams and slow the reporting cycle.

VAT and Tax Form Collection Requirements

EU VAT compliance goes beyond capturing a freelancer’s ID number. Companies must maintain the supporting documents that prove why VAT was applied (or not applied), and that invoices follow the rules of the country where the service is delivered.

This typically involves keeping:

- VAT registration or exemption certificates

- Tax residency forms

- Locally compliant invoice formats

- Documentation showing when VAT should be recognised (e.g., milestone schedules)

Gaps here often surface weeks or months later, when teams prepare VAT returns and discover missing or inconsistent documents that need to be chased again.

Misclassification and Labour Documentation

EU labour regulators also expect companies to demonstrate that each freelancer is correctly classified as an independent contractor or an employee.

The criteria differ by country:

- Spain considers whether a freelancer is economically dependent on a single client.

- The Netherlands relies on model agreements to prove contractor status.

- France may reclassify freelancers if the hiring entity dictates their working hours or provides them with equipment.

Misclassification creates significant downstream risk—ranging from retroactive employment obligations to backdated labour taxes.

3) Cross-Border Payment Obligations

Cross-border EU payments introduce multiple requirements that teams often struggle to keep up with:

- Currency and Foreign Exchange (FX) payments management involves converting funds at the right point in time to avoid short-payments or reconciliation gaps. Weekly EUR-to-SEK fluctuations, for example, can leave payouts misaligned with the invoice value.

- Jurisdiction-specific banking formats must be followed exactly. SEPA transfers depend on correct IBAN and BIC details, while countries like Poland and Hungary require additional beneficiary checks.

- Regulatory transfer requirements vary by market. Missing or incomplete data can cause payments to be held or rejected without a clear explanation.

- Audit trail expectations demand a clean link from invoice to payment confirmation. Gaps or inconsistent data mapping often lead to extra back-and-forth with banks or auditors.

These obligations create plenty of opportunities for error. A single mistyped IBAN or outdated detail can result in delays, fees, and time-consuming manual follow-up with both banks and freelancers.

Pro Tip: If your freelancer network extends beyond the EU, cross-border obligations become even more complex.

For additional best practices on managing international payouts, see our guide on paying overseas freelancers.

EU Freelancer Payment Methods: Comparing Options

When paying freelancers across the EU, businesses rely on a mix of payment methods, each with its own advantages and limitations.

Bank Transfers

Direct bank transfers—including SEPA for EU payments or SWIFT for international wire transfer payments—are reliable and widely accepted.

By sending payments to a freelancer’s local bank, these transfers are both secure and traceable. However, transaction fees can be high, and transfers can take several business days to process.

Digital Wallets

Digital wallets and payment gateways such as PayPal, Skrill, and Payoneer offer speed and convenience for freelancers who are already using them.

Using a PayPal account or other type of digital wallet streamlines “send money” workflows for freelancers. However, wallet limits, fees, and the need for freelancers to sign up for new systems make them less practical for high-volume payouts.

Card-Based Payments

Card-based solutions allow near-instant transfers with minimal setup. These include:

- Debit cards

- Credit cards like Visa and Mastercard

- Prepaid cards

- Stripe, an online processing platform for card payments

These methods are convenient for smaller payment volumes but tend to come with higher transaction fees and limited currency compatibility.

For multi-country payment runs, they often create more inconsistencies than they solve.

Escrow and Milestone-Based Payments

Freelancer platforms such as Upwork or Fiverr use escrow to release funds once project milestones are completed, protecting both parties in the freelancer arrangement.

These freelance marketplaces can work well for individual contracts, but they rarely integrate smoothly with internal finance workflows and often come with high fees for both parties.

For example, Upwork charges businesses a 3–5% fee per payment, while freelancers may pay up to 15% on earnings.

While these methods can work for paying one or two freelancers, they quickly collapse at scale. At that point, you don’t need another payment method. You need a mass payment system built for automated, compliant global payouts.

Pay Freelancers at Scale and Stay Compliant across the EU

Tipalti gives finance teams one place to run mass payouts across entities, currencies, and payment methods, so monthly payment cycles stay predictable even as your freelancer network grows.

6 Common EU Freelancer Payment Challenges for Mid-Market Companies

Once EU freelancer payments move from setup to execution, practical issues begin to surface. These are the problems finance teams encounter most often in their monthly freelance work payment runs.

1) Cross-Border Payments Breaking Down

Cross-border payments fail when teams rely on scattered tools and manual checks.

A missing BIC code, an outdated IBAN format, or an incorrect currency choice can hold up money transfers for days. Foreign exchange (FX) swings, such as EUR to DKK shifts from week to week, often create reconciliation gaps that aren’t caught until month-end.

These issues multiply as the number of freelancers grows, turning payment runs into cycles of exception handling rather than execution.

2) Compliance Risks Escalating

Financial compliance becomes increasingly challenging to manage manually when payments span multiple EU countries.

Even when onboarding is thorough, details shift: addresses change, VAT numbers expire, and each entity may record information in its own format.

Most of these issues surface only when filings are prepared, and finance teams are forced to reconcile information that was never aligned in the first place.

As payment volumes grow, these breaks compound. A missing classification document, an invoice stored in the wrong folder, or a VAT ID that no longer passes VIES validation might appear minor individually—but at scale, they lead to rejected filings, delays, and additional queries from authorities.

Over time, the administrative load grows faster than finance teams can reasonably keep up with, even when everyone is working at full capacity.

3) Fragmented Payment Methods Failing

When finance teams manage different payout methods across separate systems, errors become hard to spot and even harder to resolve.

Each platform and payment solution comes with its own rules, cut-off times, and error codes, so problems often surface only after the run has closed. For example:

- A PayPal payout might fail because a wallet ID was entered incorrectly

- A SEPA transfer might bounce due to a mistyped IBAN

- An international wire could sit in “review” with no clear reason

Regardless of where the problem starts, it usually ends the same way: with unexpected exceptions that slow down payouts and pull finance into extra rounds of follow-up.

4) Operational Bottlenecks Slowing the Payment Cycle

Disconnected systems make even simple tasks harder:

- Approvals stall when each payment method relies on its own workflow and cut-off times.

- Status updates appear in different tools, making exceptions easy to miss.

- Entities store records differently, so group finance teams must reconcile manually.

These complications ripple through the EU payment process, requiring finance teams to combine data from multiple tools to avoid errors and delays.

5) Recurring Payments Slipping Through the Cracks

Recurring freelancer payments are especially vulnerable to human error—especially when schedules live in calendars, inboxes, or informal notes.

Even small lapses create real consequences. A weekly hours-based contractor might miss a payment because a manager forgot to forward timesheets. A milestone payout may be delayed because it wasn’t added to the payment run that week.

These errors result in a poor experience for freelancers and an increased workload for finance teams as they attempt to resolve the issue.

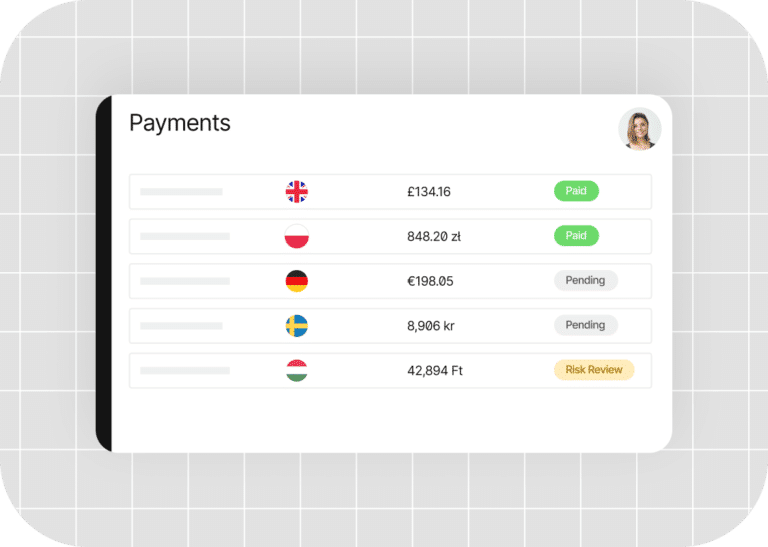

6) Finance Teams Hindered By Limited Visibility

Without a central dashboard, finance teams have to piece together payment status from emails, bank portals, and Slack threads. This makes it nearly impossible to track exceptions, confirm approvals, or verify compliance documents.

Multi-entity companies feel this even more. A French subsidiary, for example, may record international transactions differently from a Dutch one, which leaves group finance to align records that don’t always line up at month-end.

How Tipalti Uses Automation to Improve EU Freelancer Payments

The patterns in the challenges above show that most issues aren’t caused by one major failure, but by many small steps happening in different places. Automation helps steady the process by consolidating those steps into a single system and applying consistent checks along the way.

Tipalti uses mass payments automation in a few specific areas that directly reduce the friction mid-market teams face when paying freelancers across the EU.

Here’s where freelance payment automation has the biggest operational impact:

| Automation Feature | What It Does | What Problem It Solves |

|---|---|---|

| Consolidated payment runs across banks, wallets, and cards | Automates payments across banks, digital wallets, and card-based systems with scheduled, consistent workflows. | Removes hours of repetitive processing, reduces delays caused by switching between systems, and ensures freelancers are paid on time across regions. |

| Integrated FX and multi-currency handling | Supports EUR, GBP, SEK, PLN and other currencies in one payment flow. | Prevents FX misalignment and simplifies reconciliation for cross-border payouts. |

| Built-in validation and compliance checks (powered by Tax Form Scan Agent) | Validates bank details, tax information, and required freelancer documentation before payment. | Surfaces inconsistencies early and reduces failed transfers, DAC7 issues, and VAT mismatches. |

| ERP and accounting system synchronisation | Syncs payment data directly with systems such as NetSuite. | Keeps ledgers accurate and reduces manual reconciliation during month-end. |

| Exception and payment-status visibility (powered by Reporting Agent) | Provides real-time updates on payments, exceptions, and reconciliation items. | Gives teams a clear audit trail and reduces time spent gathering information from different tools. |

| Fraud and sanctions screening | Screens payees and transactions against sanctions lists and risk signals before execution. | Helps prevent risky or non-compliant payouts and protects against accidental violations. |

In practice, each of these improvements translates into a more predictable payment workflow for EU teams. Here’s a closer look at how Tipalti helps make that happen.

Make Onboarding Consistent Across EU Countries

Tipalti streamlines freelancer onboarding by automatically collecting, validating, and standardising bank details, tax forms, and identity documents.

Built-in checks help ensure information is complete and accurate from the start. DAC7 compliance, for example, is embedded into the workflow, ensuring that the records needed for EU reporting remain consistent over time.

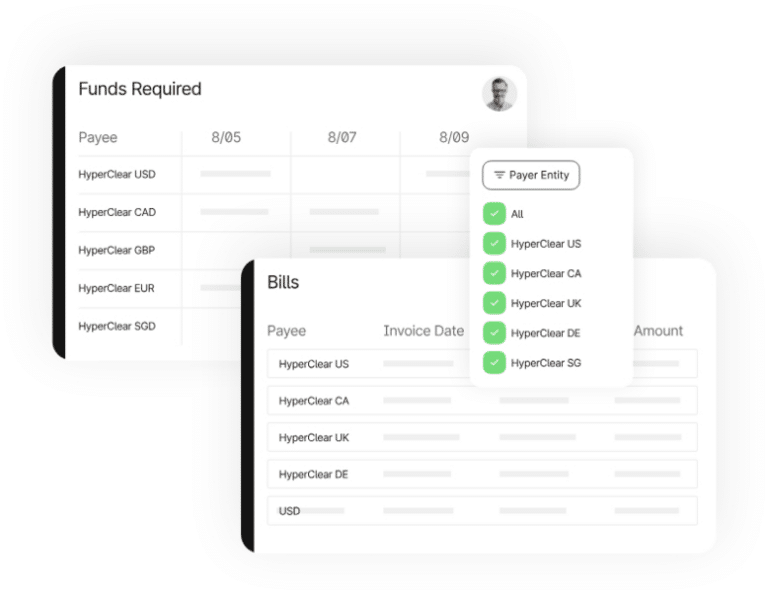

Pay Freelancers Faster With Multi-Currency Support

Tipalti Mass Payments supports payments in over 200 countries and 120 currencies, with more than 50 payout methods, including SEPA, SWIFT, PayPal, and card-based payments.

Tipalti’s multi-currency support helps reduce conversion costs, avoid timing delays, and keep payouts coordinated across countries.

For example, a team paying freelancers in both Germany and Poland can:

- Send SEPA payments in EUR to German freelancers

- Pay Polish freelancers in PLN via SWIFT

Offering freelancers their preferred payout method ensures a smoother, more convenient payment experience.

Prevent Payment Failures With Automated Checks and Fraud Controls

Tipalti’s freelancer payment platform features automated bank detail validation, fraud checks, and error prevention controls, reducing both payment failures and compliance risks.

Tipalti shields finance teams from risk by:

- Validating bank account formats and ownership signals

- Spotting anomalies

- Blocking suspicious payments

These automated safeguards help prevent failed transfers and protect the business from costly errors, fraud, and exposure. Meanwhile, freelancers receive accurate and reliable payments on time.

Eliminate Cross-Country Complexity With Centralised EU Payment Management

For businesses operating across multiple EU entities, Tipalti consolidates payments, approvals, and reporting into a single platform.

This means a finance team running separate operations in Ireland, France, and the Netherlands can manage entity-specific bank accounts, tax treatments, and payment approvals in a single, unified system.

Tipalti’s multi-entity support eliminates common operational headaches like payment reconciliation errors and inconsistent reporting. The functionality also ensures that costs are allocated correctly, ledgers remain aligned, and records stay consistent for review.

Keep Cross-Border Payments Predictable and On Schedule

Tipalti’s mass payment automation allows companies to set up predictable payment schedules and make consistent and timely payouts to freelancers automatically. This helps maintain timelines even when payment cycles vary by country.

Automation also reduces the manual steps that cause delays, helping teams avoid late or missed payments and spend less time on routine follow-up.

Get Real-Time Insight Into Payment Status and Exceptions

Tipalti’s real-time dashboards for finance and operations teams offer up-to-date visibility into pending, approved, and completed payments.

Integrations with invoicing software like QuickBooks and ERPs help keep payment data in sync with financial systems and make month-end reconciliation more straightforward.

Customer Story: How Honeygain Streamlined Onboarding and Payments with Tipalti

Honeygain required a more reliable method for onboarding payees and processing payouts across multiple countries. Manual data collection, inconsistent identity checks, and repeated follow-up slowed payment processing and made it difficult to maintain accurate records.

By embedding Tipalti’s onboarding flow directly into its platform, Honeygain automated tax form collection, ID verification, and bank-detail validation. Payees now complete every required step through a single, structured process, and validated information moves straight into payout runs.

Tipalti’s multi-currency support and coordinated payment workflows also helped Honeygain handle cross-border payouts with fewer exceptions and greater predictability.

Results:

- Faster, more predictable payout cycles

- Automated onboarding with consistent tax and ID validation

- Fewer payment errors and less manual troubleshooting

- Lower operational effort for the finance team

Integrating Tipalti’s technology enhanced data verification and created a seamless workflow that drastically reduced onboarding timelines.

Tipalti’s solution allowed us to shift from a manual, multi-day workflow to a real-time, robust system that delivers on both efficiency and compliance.

Sandra Krikstaponyte, Product Director, Honeygain

How to Build a Scalable Freelancer Payment Operation (Step-by-Step)

Setting up a scalable EU freelancer payment system can seem daunting, but with software like Tipalti, the process becomes more structured from the start.

Once the system is in place, the next step is configuring your workflows so payments remain compliant and efficient—regardless of how many freelancers you work with or which online payment method they prefer.

Here are some simple steps for getting started.

Step-by-step checklist:

- Define contractor payment categories to organise freelancers by type of work, region, or schedule.

- Standardise onboarding and tax collection to gather consistent bank, tax, and identity information.

- Map payment options by region to align with local preferences and regulatory requirements.

- Set approval routes to assign responsibility for payment verification and authorisation.

- Automate recurring and milestone-based payments to reduce manual effort and avoid missed deadlines.

- Set up reconciliation workflows to integrate payments with accounting or ERP systems and maintain accurate records.

- Centralize reporting to consolidate transaction, compliance, and payment data in one dashboard.

- Prepare DAC7 reports using validated information to ensure timely and accurate EU tax and platform reporting.

Following these steps helps ensure that your freelance payment platform does the heavy lifting by reducing manual work and supporting a smooth, reliable payment experience for every freelancer.

Build a Scalable Freelancer Payment Operation with Tipalti

At mid-market scale, EU freelancer payments hit a breaking point.

The payment workflow becomes less about individual transactions and more about coordinating different currencies, payment providers, and expectations from international clients. Mass payment automation is the only model built for this stage.

Tipalti brings those choices into one automated workflow, selecting the best payment method for each region, reducing processing time, and offering predictable online payment options with clear pricing.

Explore Tipalti’s scalable freelancer payment platform and give your growing team a better way to manage payments for international clients and freelancers alike.

FAQs about Freelancer Payments

Which types of companies and departments typically hire freelancers?

Many departments hire freelancers, including teams in graphic design, marketing, and social media management. Small businesses and startups often rely on freelancers while establishing operations. Freelancers can also support core business activities as long as the engagement meets local labour classification criteria for independent contracting.

How often should I pay freelancers working in different EU countries?

It depends on the payment terms you agree with each freelancer. However, most businesses issue payments either monthly or at specified project milestones. It’s good practice to establish clear payment schedules with any freelance business before they begin working for you.

What information do I need from an EU freelancer before making a payment?

Before paying a freelancer, collect their legal name, bank details, and tax identification. For cross-border EU payments, you may need to collect additional documentation to meet financial compliance obligations. These details might include VAT registration, identity verification, and records required for reporting in the freelancer’s jurisdiction.

How do I minimize currency conversion costs when paying international freelancers?

To reduce currency conversion fees, use a freelancer payment platform that supports multi-currency balances or offers competitive exchange rates, like Tipalti’s mass payments solution. It handles conversions efficiently to help control costs, improve predictability, and simplify accounting for international freelance payments.

What is an ACH transfer, and can I use it to pay EU freelancers?

An ACH transfer is a U.S. domestic payment method that moves USD between U.S.-based bank accounts using the Automated Clearing House network. ACH transfers only move USD between U.S.-based bank accounts, so they cannot be used to pay EU freelancers.

EU-based contractors must be paid through SEPA (the EU’s local clearing system for EUR payments), an international wire, or a global payout platform that supports local EU rails.