Platform-based businesses thrive on strong partners—see how mass payments tech streamlines operations, reduces risk, and boosts partner retention.

Fill out the form to get your free eBook.

Digital companies that rely on platform-based models know how important their partners are. See how mass payments technology can improve operations and cut down on risks, all while helping you attract and keep those key partners.

In business relationships where the customer is aware of the value of the supply, a self-billing arrangement can save time, reduce administrative costs, and facilitate faster payouts.

However, switching to a new supplier invoice system introduces new obligations that must be adhered to for self-billing to work.

In this guide, you’ll learn how self-billing works and the pros and cons to consider. We’ll also guide you through the process of staying compliant with EU VAT rules and share best practices for managing self-billing relationships.

Key Takeaways

- Self-billing enables customers to issue invoices on behalf of suppliers, simplifying administration and improving cash flow predictability.

- For a self-billing arrangement to be valid, businesses and their payees must have a written agreement in place and up-to-date tax details.

- Invoices must include all required VAT details to comply with EU self-billing regulations. If VAT numbers change, a new agreement is needed.

- Mass payments automation solutions like Tipalti reduce errors and maintain compliance beyond self-billing practices, saving time and improving control for payment operations teams.

What Is Self-Billing?

Self-billing—also known as reverse billing—is a financial arrangement in which the customer prepares and issues an invoice on behalf of the supplier, then forwards it with payment.

Rather than the typical method of a supplier (or vendor) sending a tax invoice for goods or services provided, a self-billing arrangement puts responsibility on the buyer.

Self-billing is recognised under the EU Value Added Tax (VAT) Directive, provided there is a formal agreement between two VAT-registered companies.

Self-Billing Benefits and Example

A self-billing arrangement can be beneficial when regular, repetitive transactions occur between businesses or businesses and service providers (e.g., freelancers or contractors).

If the buyer has more reliable transaction data (e.g., timesheets, delivery records, and price visibility), they are often better positioned to create an invoice.

For example, an online content platform might pay creators royalties based on the number of times their users read or view their content. In this case, the amount payable is known by the platform, not the creator.

Since the online platform has performance data, it calculates what each creator earned and issues self-billing invoices and payments on their behalf, eliminating the need for suppliers to ask the customer, “How much should we invoice you for?”

A self-billing arrangement creates a standardised workflow that saves time and money for both parties. Since neither has to deal with the other’s invoice systems, they can focus on strategic business activities.

Self-billers benefit from consistent purchase documentation, making processing and spend management simpler.

Meanwhile, with VAT handled by the customer, suppliers lessen the burden of compliance and managing invoicing across EU member states.

How a Self-Billing Process Works

The primary difference between self-billing and traditional invoicing lies in the method of invoice exchange.

The self-billing process works the opposite way of a traditional arrangement, with the customer issuing the invoices and the supplier reviewing them.

Modern self-billing systems support end-to-end approval workflows, ensuring that every automatically generated invoice follows your internal controls before payment is issued. Finance teams can route invoices for managerial approval, flag discrepancies, and enforce multi-level sign-offs without slowing down payment cycles.

Here’s a basic self-billing invoice workflow:

| Self-Billing Invoice Step | Self-Billing Invoice Task |

|---|---|

| Customer creates the supplier’s invoice | The customer generates their own VAT invoice in the supplier’s name and processes it as a purchase invoice. The invoice includes: Supplier’s business and VAT details. Supplier’s goods or services. Totals. |

| Customer sends a self-billed invoice and payment to the supplier (unless specific payment terms are agreed) | Customers can send invoices electronically or via paper, and payments via a payment portal, bank transfer, or cheque. For record-keeping and EU electronic invoicing (e-invoicing) compliance, it’s best to manage this process digitally (we’ll explain why later). |

| Supplier receives self-billed invoice | Upon receipt, the supplier reviews the invoice and does one of the following: Fully approves the invoice. Rejects the invoice and requests a credit note and/or an adjusted self-billed invoice. |

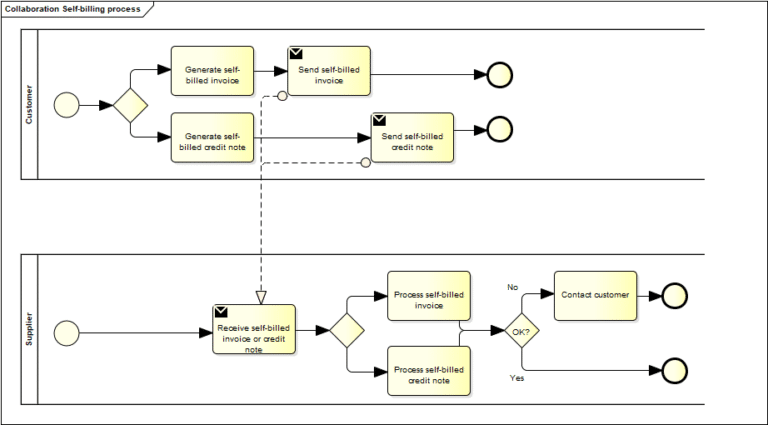

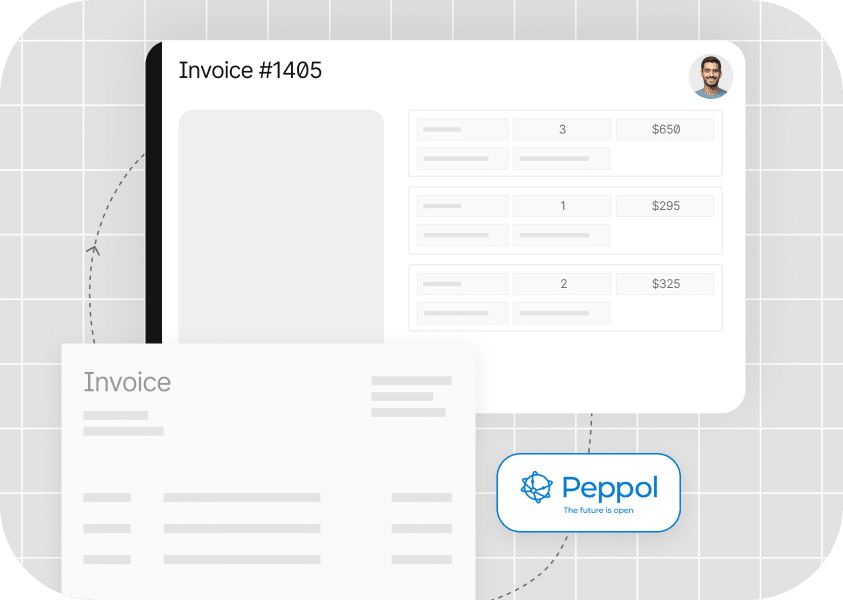

The workflow diagram below shows how the self-billing process works in the Pan-European Public Procurement Online (Peppol) e-invoicing system:

Customers initiate the process by managing their self-billing invoices. In scenarios where supplier invoices are sporadic, customers maintain consistency by alerting suppliers to invoices, thereby speeding up transactions.

The self-billing arrangement eases stress on supplier finance teams, who no longer have to raise multiple invoices for a growing customer base.

The Pros and Cons of Self-Billing for EU Businesses

Self-billing can simplify invoicing and tax compliance for buyers and suppliers. For business-to-business (B2B) transactions with high volume or recurring supply needs, self-billing streamlines processes, boosts financial closing, and improves accountability.

However, it’s not a one-size-fits-all solution. Businesses must consider the practical and compliance challenges before entering into a self-billing arrangement.

Here are some of the common pros and cons of self-billing, starting with the benefits:

| Advantages of Self-Billing | What It Leads To |

|---|---|

| Reduces administrative workload | Customer and supplier accounting staff work with uniform purchase information, making processing easier and reducing admin overhead costs. |

| Improves accuracy | Invoices generated from customer purchase data reduce human error, combat disputes, and prevent fraud. |

| Increases efficiency | Suppliers no longer need to create invoices, eliminating potential duplication of efforts. Customers can standardise processing to promote effective workflow. |

| Speeds up payment cycles | Customers can issue invoices on delivery and specify when they receive payment, improving cash flow management. |

| Simplifies VAT compliance | Customers are responsible for ensuring invoice details are correct, making it easier for supplier finance teams to manage tax compliance across EU member states. |

| Enhances cross-border business | Suppliers don’t need to be in the same country. Self-billers can invoice suppliers in EU member states and globally. Customers ensure invoices comply with national VAT regulations. |

| Supports automation and scaling | Self-billing integrates with Enterprise Resource Planning (ERP) and accounting systems, allowing businesses to manage large invoice volumes. |

For all the positives, there are potential drawbacks to be aware of. Here are some cons to weigh up when deciding whether self-billing is right for your business:

| Disadvantages of Self-Billing | What It Means |

|---|---|

| Not suitable for all businesses | One-off, irregular, or high-value bespoke supplies benefit more from traditional invoice management. |

| Initial setup effort | Self-billing requires a written agreement, system configuration, and VAT validation to run smoothly. |

| The supplier is liable for output tax | While invoices and payments are generated by the self-biller, suppliers must account for output tax. It’s down to the supplier to correct undeclared VAT, potentially at their own expense. This may deter suppliers from entering into agreements. |

| Ongoing compliance monitoring | VAT status and supplier details require regular monitoring to ensure agreements are valid, creating additional compliance measures for finance teams. |

| Robust system requirements | Managing self-billing for multiple suppliers requires a robust, accurate accounting solution. Customers need this in place before setup. |

Self-billing is most effective for supply chains, online platforms, or service networks that require frequent payments based on measurable output.

Traditional invoicing may be simpler for one-off projects or relationships where suppliers are uncomfortable with self-billing arrangements.

Assess whether the administrative savings and VAT control benefits of self-billing outweigh the setup and compliance efforts for your specific business relationship.

Streamline Mass Payments With Self-Billing Automation

True efficiency comes from optimising your entire process for global payouts. Learn how Tipalti centralises your traditional accounts payable invoice processes and self-billing workflows for mass payments in a single platform—eliminating silos and giving finance teams full visibility and control.

The Legal Requirements for Self-Billing for EU Businesses

For a self-billing arrangement to be valid under EU regulations, both the supplier and the customer must be VAT-registered, have a prior agreement, and meet the invoice arrangements.

As stated in Article 224 of EU Council Directive 2006/112/EC:

Invoices may be drawn up by the customer in respect of the supply to him, by a taxable person, of goods or services, where there is a prior agreement between the two parties, and provided that a procedure exists for the acceptance of each invoice by the taxable person supplying the goods or services. Member State may require that such invoices be issued in the name and on behalf of the taxable person.

A supplier must accept invoices on behalf of the customer, and those invoices must be clearly labeled as self-billed. They are only deemed to have issued an invoice under these arrangements when they accept it.

As part of the self-billing arrangement, the supplier must also:

- Not create sales invoices for the same supply during the period of the self-billing agreement.

- Notify customers if tax registration details change (e.g., a new VAT number). Any changes will require you to draw up a new self-billing agreement.

Meanwhile, a customer must adhere to contract dates, provide complete invoices, and initiate a new agreement if a supplier’s VAT status changes.

If you don’t follow self-billing rules, your invoices won’t count for VAT purposes. This means you’ll lose the right to reclaim input tax, and your suppliers will have to issue their own invoices—thus invalidating your self-billing arrangement.

Some member states also have rules governing the sending and receiving of self-billing invoices that both parties must follow.

For example, following a staged rollout, e-invoicing will be mandatory for all businesses in Germany starting in 2028.

From 2025, self-billed e-invoices in Spain must comply with the Veri*factu Regulation to meet strict integrity and traceability standards.

Italy already operates a similar system, in which all businesses issue and send invoices through the national Sistema di Interscambio (SDI) platform.

Check your member state’s self-billing and e-invoicing regulations before implementing a self-billing agreement. Staying up to date with national rules is crucial to meet your obligations and ensure invoices are compliant across borders.

How to Stay Compliant with EU Self-Billing Rules

Self-billing can make invoicing faster and more accurate, but it puts more regulatory responsibility on the business generating invoices.

By following the rules for agreeing, issuing, and recording invoices, you collect the right amount of VAT and avoid interest or penalties for over-claims.

Here’s how to keep your self-billing process compliant, accurate, and transparent.

1) Create a Self-billing Agreement

A formal self-billing agreement is a legally binding document outlining your self-billing arrangement and obligations.

If your business and supplier are VAT-registered, both must sign a contract to validate your self-billing agreement. Without it, the self-billing invoices you issue won’t be evidence for claiming input VAT.

Your self-billing agreement should include:

- Customer and supplier names.

- Customer and supplier VAT registration numbers.

- Confirmation that you can issue invoices on the supplier’s behalf.

- Details on what each invoice will include (e.g., name, address, and VAT number).

- Confirmation that you will set up a new supplier’s agreement in the event of a VAT number or registration change, or business sale.

- Confirmation that the supplier will not issue VAT invoices for transactions covered by the agreement.

- A pledge to inform suppliers if you outsource self-billed invoicing to a third-party.

The agreement should be signed by an authorised representative of each company. Typically, this is a:

- Business owner

- Managing director

- Finance director

- Procurement manager

- Legal representative

If VAT self-billing suits your accounting process, you may set up similar arrangements with non-VAT-registered suppliers. In these relationships, a formal agreement isn’t required.

However, it can be a good practice to prepare one so that both parties understand their obligations.

Remember: if a supplier becomes VAT-registered during your relationship, you’ll need a written agreement to issue self-billed invoices.

2) Include Compulsory Details on Every Self-Billed Invoice

To get paid quickly and accurately, every invoice must meet the required conditions. Any mistake can result in the issuance of a self-billed credit note or a corrected invoice, which can prolong payment and create cash flow issues.

Businesses in the EU are subject to a single set of basic EU-wide VAT invoicing rules. While some member states have specific rules and exemptions, VAT invoices tend to require the same information.

These details simplify the invoicing processes, allowing you to use the same format for suppliers across the EU.

Here’s a checklist of what your self-billing invoices should include:

□ The words “SELF-BILLING”.

□ Invoice date of issue.

□ Unique sequential number identifying the invoice.

□ Supplier’s full name and business address.

□ Customer’s full name and business address.

□ Customer’s VAT identification number.

□ Type of goods or services supplied.

□ Unit price of goods or services (exclusive of tax, discounts or rebates, unless included in the unit price).

□ Date of transaction or payment (if different from invoice date).

□ Correct VAT rate applied and amount payable.

□ Breakdown of VAT amount payable by rate of VAT (or exemption).

□ Reference to exemptions or reverse charge (if applicable).

With the right details, a full VAT invoice acts as proof that you can recover input tax.

If you create a high volume of invoices for multiple suppliers as part of your mass payments operations, consider using automation software to streamline the process and ease the pressure on your finance team.

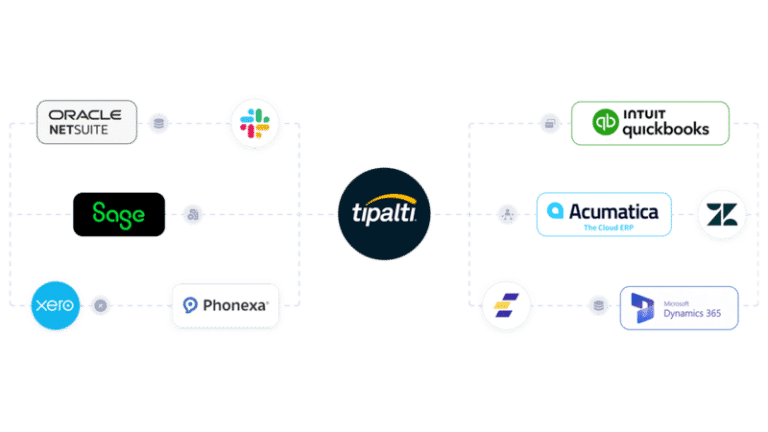

For example, a self-billing invoice solution like Tipalti integrates with your current finance and marketing systems. It automatically creates digital invoices on behalf of your payees using data from your spreadsheets or performance marketing systems.

Self-billing solutions like Tipalti also support custom fields, enabling you to include such as campaign IDs, royalty categories, SKU data, cost centers, metadata from your ERP or performance systems, and more. This flexibility ensures every self-billed invoice contains all relevant business information, not just VAT requirements.

Tipalti’s automation eliminates time spent verifying and formatting invoices, improving accuracy and helping teams meet submission deadlines.

By automating invoice creation for mass payments, finance teams work more efficiently and with fewer errors—reducing disputes and fostering trust across your payee network.

3) Review Supplier Tax and Agreement Status

You can only use self-billing if the terms of your agreement are valid and in effect. While it’s up to suppliers to notify you of any changes to their business or tax status, regular reviews are a good safeguard. They allow you to confirm details and ensure ongoing compliance.

Self-billing agreements typically last 12 months. Check in with your suppliers on the expiry date to make sure they are:

- Still VAT registered.

- Happy to renew a self-billing agreement.

If you have multiple self-billing agreements expiring simultaneously, any EU operation may look to the UK’s HM Revenue & Customs (HMRC), which recommends staggering reviews to avoid expiry overlap:

If you do make individual agreements with your suppliers on the same date, and the agreements all expire on the same date (for example, you have agreed with all of your suppliers to operate VAT self-billing for a period of 12 months from today’s date), you may find it difficult to review all of the agreements on the same date. In such a situation, you may review them on a rolling basis spread over 6 to 12 months. If you do this, you should set the appropriate time limits on your original agreements when they’re made.

This is good practice for any EU business, as it prevents you from billing without a supplier agreement, thereby invalidating your invoices.

Automated verification makes the process even smoother. It validates—and continuously monitors—supplier tax IDs, banking details, and VAT numbers upfront.

A solution like Tipalti flags mismatches, expired VAT registrations, and risky payment details in real time, reducing manual checks and preventing invalid self-billed invoices.

4) Store Self-Billing Records for Tax Compliance

As a self-biller, you are required to maintain records for VAT purposes, even if you outsource your self-billing to a third party. These include:

- Copies of all self-billing agreements.

- Copies of self-billed invoices.

- Business details and VAT numbers of suppliers you self-bill.

You need to maintain these records alongside documentation you save for EU VAT rules, including:

- Invoice support documents, such as purchase orders, delivery notes, or goods receipts.

- Credit notes for any corrected or cancelled self-billed invoices linked to the original invoice numbers.

- Accounting entries for each self-billed invoice.

- VAT returns detailing when tax became chargeable and deductible.

EU One-Stop-Shop rules require you to keep certain records for up to 10 years from the end of the year a transaction takes place. National VAT retention periods range from 5 to 10 years. You must also ensure they are secure and easily accessible.

With complete and accurate records, you’ll avoid EU VAT penalties and prevent disallowed input tax claims. You’ll also give yourself an audit trail that stands up to scrutiny from national authorities.

To ensure reliable transaction data, consider connecting mass payments automation software with your ERP system.

Tipalti, for example, automatically syncs invoice payment data and reconciliation reports in your ERP, ensuring your records are updated in real-time. Take the NetSuite integration below:

Not only does this strengthen your audit trail for EU compliance, but it also enhances cash flow accuracy, providing better financial insights and informed decision-making.

Note: If you run an online platform, the information you collect and store for self-billing will overlap with the EU’s Directive on Administrative Cooperation 7 (DAC7) reporting requirements. Learn more about your obligations in our comprehensive DAC7 compliance guide.

4 Self-Billing Best Practices for EU Businesses

While meeting legal requirements is crucial, successful self-billing arrangements are built on clear, consistent practices.

When both parties align on processes and obligations, you build trust, accuracy, and efficiency that contribute to compliance.

The following best practices will help keep your self-billing process running smoothly, allowing finance teams to stay organized and avoid administrative headaches.

1) Create a Strong Onboarding Process

A successful self-billing arrangement requires full buy-in from the supplier. A strong onboarding process sets expectations early, explaining how self-billing works and what information you require.

It also ensures you have the correct contact data, VAT details, and payment information from day one, reducing the risk of supplier disputes or compliance issues later on.

Develop a self-billing document for new suppliers that details:

- What self-billing is and means under VAT rules.

- How suppliers will receive invoice copies and payment.

- What to do if invoice or payment details are incorrect (e.g., how and when to notify your finance team).

To streamline communication and ensure accurate payments, consider using a supplier portal where both parties can share information.

For example, Tipalti’s self-service supplier management functionality lets payees choose payment preferences and upload VAT information, so your finance team doesn’t have to chase documentation.

A proprietary rules engine automatically vets and validates banking details and tax/VAT ID, identifying issues before they happen.

This safeguarding step reduces payment errors by up to 66%, speeding up the invoice process and ensuring accurate record-keeping.

Additionally, suppliers get complete visibility with real-time payment updates and statuses. This transparency helps them manage cash flow and cuts down on payment questions, freeing payment teams to focus on more strategic tasks.

A positive onboarding experience that involves suppliers from the outset prevents confusion and fosters trust, laying the groundwork for a successful arrangement.

2) Automate Your Self-Billing Workflow

Manual self-billing can quickly become unmanageable, especially when dealing with mass payments with multiple suppliers or high transaction volume. Automating your workflow ensures that you generate and validate invoices, as well as make payments, without the risk of human error.

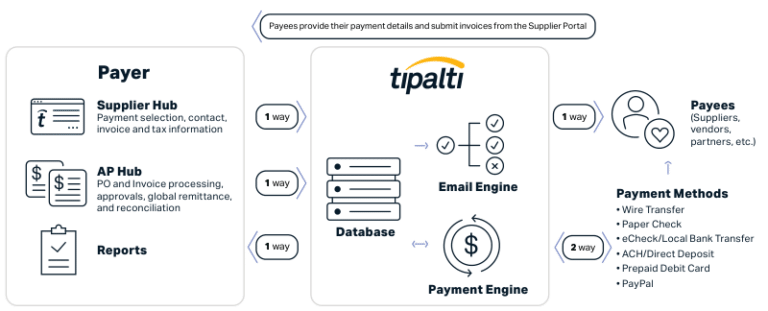

A mass payments automation solution like Tipalti pulls data directly from your purchase orders, ERP, and supplier hub to help you itemize invoices and apply the correct VAT.

It also integrates seamlessly with global payment portals, so you can instantly and securely pay suppliers across the EU (or internationally) via wire transfer, ACH (local bank transfer), PayPal, and more.

With less need for human intervention, automation reduces workload and speeds up financial close—helping finance teams work smarter and better manage cash flow.

3) Choose a Solution That Supports E-invoicing Mandates

Automated invoice processing isn’t just good for productivity and scalability. It’s essential for compliance.

To boost efficiency and close the VAT gap, the EU is making e-invoicing a standard. It’s already mandatory for public bodies and B2B transactions in some member states. In line with VAT in the Digital Age (ViDA), e-invoicing will be rolled out for all cross-border transactions—including self-billing—by 2035.

To meet EU e-invoicing rules and ensure valid VAT invoices, your invoice software should:

- Create invoices in standard data formats, such as XML.

- Include all required data fields for self-billing.

- Share invoices electronically in a secure environment without human intervention.

- Comply with General Data Protection Regulations (GDPR).

- Maintain an audit trail between the e-invoicing system and other processing applications (e.g., communication platforms and ERP).

Mass payments software that supports Peppol provides a ready-made automation solution for e-invoicing.

The Peppol framework simplifies interoperability for e-invoicing and sharing other procurement documents across the EU.

A solution built for e-invoicing automates the processing of invoices to ensure they are correctly formatted, reducing manual entry and improving compliance with national mandates in the EU and globally.

Here’s Tipalti in action:

Automation systems also record all invoice actions (e.g., creation, approval, and adjustments), giving you strong transparency and a visible audit trail for EU VAT compliance.

4) Document Your Self-Billing Controls

A clear record of your self-billing process shows auditors you have an organised, compliant process. It can also save hours of stress during a VAT compliance check.

Alongside your self-billing records, keep a short control summary in your compliance file, detailing:

- How you manage self-billing agreements.

- How you check supplier VAT numbers.

- How you number, store, and reconcile invoices.

Documenting your process shows that your self-billing arrangement is legally valid, VAT is correctly applied, and invoices are traceable. With this information, you’ll reduce errors, support accurate reporting, and make audits quicker.

Review and update your controls at regular intervals to ensure your self-billing process remains accurate, transparent, and aligned with EU VAT rules.

Streamline Your Self-Billing Process With Tipalti

Self-billing can improve efficiency and support strong business relationships in repetitive, high-volume transactions. To ensure it works for both parties, ensure you have a clear legal agreement and robust measures in place for monitoring VAT obligations and meeting compliance requirements.

Tipalti’s Mass Payments solution streamlines supplier onboarding, automates invoice creation, and syncs data for EU regulatory compliance. You can easily scale self-billing arrangements and create a better supplier experience without adding work for your finance team.

See how Tipalti’s self-billing capabilities can improve your mass payments workflow, reducing risks and freeing up your payment operations team to focus on higher-value activities.