The Total Guide to QuickBooks Online

In this guide, we cover everything you need to know about QuickBooks Online integration including market-fit, pricing, features, and comparisons.

Are you maximizing the potential of your QuickBooks Online software? Learn how top-performing businesses are tackling payables challenges with automation.

What is QuickBooks Online?

QuickBooks Online cloud accounting software (QuickBooks Online) offers many types of third-party add-on apps that extend its standard features and business processes. QuickBooks Online with integrated add-on software gives the user a simple, low-cost experience similar to an ERP system.

Besides its small business accounting system, QuickBooks Online offers Self-Employed for independent contractors and freelancers providing professional services. QuickBooks Online works on notebooks and mobile devices with mobile apps using Google Android and Apple iOS for the iPhone and iPad.

Intuit Inc. (Intuit.com) owns both QuickBooks Online as cloud accounting software with a user-friendly user interface and QuickBooks Desktop (including QuickBooks Enterprise for mid-sized businesses with up to 30 users) as a desktop version for Windows or Mac, deployed on-premises, and optionally as a hosted solution. Intuit also owns TurboTax for filing corporate, trust, and personal income taxes at tax time, Mailchimp, and Credit Karma.

Intuit QuickBooks Online competes with Xero and other small business accounting solutions. QBO is used by startups, small business owners, and small businesses or mid-sized companies with up to 25 users (for the Advanced SaaS plan).

Features

Key Features and Benefits of QuickBooks Online

QuickBooks Online has the following key features and benefits.

Low-cost

Low-cost QuickBooks Online isn’t priced on a per-user basis. Instead, a maximum number of users is included in the QuickBooks product software for each plan.

QuickBooks Payments online payment processing and acceptance

QuickBooks Online offers optional QuickBooks Payments to approved users who apply to Intuit Merchant Services through QuickBooks Online. With QuickBooks Payments, IMS processes debit card and credit card payments, electronic United States ACH bank transfers, and Apple Pay. It also allows QuickBooks Online users to provide a Pay Now button when invoicing and accept customer payments for online invoices (including PayPal).

Time tracking for projects with QuickBooks Time add-on

QuickBooks Time (fka TSheets) is an optional product add-on for time-tracking on projects that can be combined with a QuickBooks Payroll Saas subscription in a bundled plan.

Inventory tracking with the Plus and Advanced plans

With QuickBooks Online Plus and Advanced plans, you can track inventory for items in stock and those products you sell, determine what’s on hand and on-order and set reorder points.

Generate single or multiple sales receipts in QBO Advanced

When your customer pays for products or services, create a single sales receipt or import multiple sales receipts in batches via CSV with QuickBooks Online Advanced.

Works with third-party software add-ons and apps

The QuickBooks Online App Store includes over 750 add-on software app options, including CRM software from Salesforce, Tipalti automation software, Excel spreadsheets, and Power BI visualizations.

Recurring transactions templates

Recurring transactions using templates are easy to set up in QuickBooks Online and save time. They work for recurring transactions like paying rent and loans. Recurring transactions don’t work for bill payments, customer payments, and time activities.

Set up sales tax rates for customer invoices

With QuickBooks Online, you can set up, edit, and deactivate tax agencies and sales tax rates for customer invoices in the Sales Tax Center.

Manual employee expense claims processing

After your company manually adds the names of employees allowed to submit expense claims for reimbursement, your employees can prepare and submit expense claims through QuickBooks Online on a mobile device or computer, using photos or manually entering expenses.

Limited purchase order functionality for procurement

Purchasing features in QuickBooks Online include creating purchase orders with custom fields, automatically converting purchase orders related to customers into their bills when the purchase order is billable, and scheduling POs for recurring purchases.

No standard process, automation, or reports for mass global payouts

QuickBooks Online includes basic accounts payable features and lets you make batch payments for payouts. However, QuickBooks Online has no standard feature for automatically making royalty payments or other mass payouts to numerous countries. With QBO, your accounting team can manually set up Class tracking through the Lists setting. It can create a custom report based on a few Classes like royalties, authors, partners, etc. You can use the limited international payment methods that QuickBooks Online provides.

Corporate debit card issuance only for approved QuickBooks Checking account holders

If your company has a QuickBooks Checking account, it can apply to QuickBooks for a physical (and until the card is received, a temporary virtual) debit card for spending on purchases and withdrawing cash from ATMs or your company’s QuickBooks Checking account.

Reconciles bank statements with the general ledger balance

Bank reconciliation for each bank account is automated and efficient with QuickBooks Online.

Import actual QuickBooks Online data when using LivePlan software

QuickBooks Online is integrated into LivePlan for business plan creation and plan vs. actual variance analysis.

Modules

QuickBooks Online Modules and Third-Party Integrations

QuickBooks Online accounting software functionality varies by pricing plan level but only includes optional modules for QuickBooks Payroll and QuickBooks Time. Instead of using modules, users generally add third-party apps to QuickBooks Online to increase its functionality and gain some ERP-like features.

Salesforce CRM

Salesforce CRM (customer relationship management) software is a third-party integration for QuickBooks Online that can be integrated with the Salesforce-owned MuleSoft connector. The Salesforce integration shares customer data, sales orders, expenses, and invoicing with QuickBooks Online for sales and accounting.

Microsoft Excel and Power BI apps

QuickBooks Online integrates with Microsoft software, including Excel spreadsheets and Power BI visualizations for business intelligence.

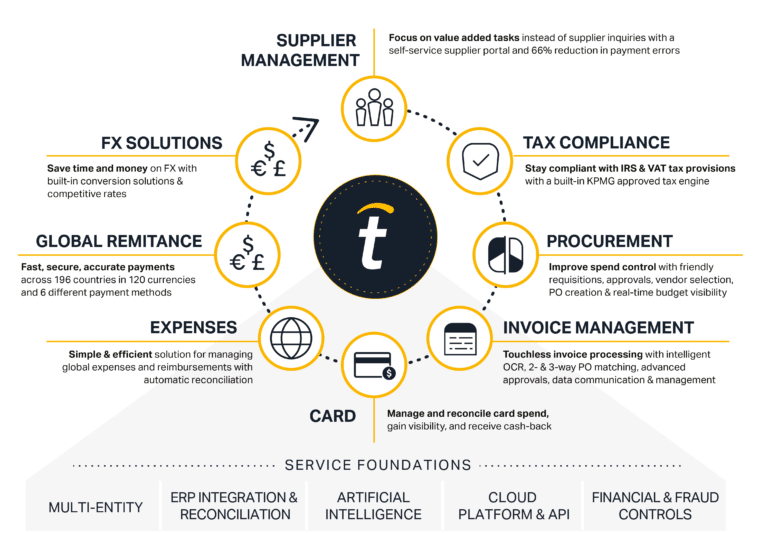

Tipalti AP Automation and Mass Payments

Tipalti’s unified platform of finance automation products integrate with QuickBooks Online. This includes AP automation for global supplier payments and mass payments software for payouts.

Industries

Industries Using QuickBooks Online

QuickBooks Online is usually the first accounting system for small business startups in a wide range of industries and freelancers. Small or medium-sized businesses may continue to use QuickBooks Online until they reach their 25-user limit. CPAs and bookkeepers use QuickBooks Online Accountant (QBOA) to access and review their clients’ QuickBooks Online accounts and manage their accounting practice. QuickBooks has a ProAdvisor program for accountants that offers discounted software for their firms and clients, training on existing and new features, marketing tools, and support.

Service providers, software companies, retailers and eCommerce, healthcare, smaller contractors, education companies, and non-profits are some of the industries that use QuickBooks Online. The full drop-down industry list is more extensive. Almost any company can start its accounting with QuickBooks Online to meet its business needs.

Fast-growing SMB businesses upgrade from QuickBooks business accounting software to a much more expensive cloud ERP system like NetSuite. They may later upgrade to SAP or Oracle ERP when they become a very large enterprise company. However, NetSuite does serve Fortune 500 companies and companies completing IPOs to become publicly held.

Advertising & Digital Marketing Agencies

Apparel, Footwear & Accessories

Campus Stores

Consulting

Energy

Education

Financial

Food & Beverage

Government

Health & Beauty

Healthcare & Lifestyle

IT Services

Manufacturing

Media & Publishing

Non-profit

Professional Services

Restaurant & Hospitality

Retail

Sciences

Tech

Transportation & Logistics

Wholesale Distribution

Implementation

How to Implement and Use QuickBooks Online

Get Bookkeeping Setup (including the chart of accounts) as an upgrade. Or find links to QuickBooks Online tutorials by using Getting Started with QuickBooks Online. This QuickBooks Community page includes links to online training from QuickBooks customer support, including Your First Time with QuickBooks Online, Setting up for Success with QuickBooks Online, and other resources.

Step 1

Appoint an Administrator

Determine the lead person to administer the QuickBooks Online implementation and any needed employee help if a team is required.

Step 2

Consider Using a Consultant or Bookkeeper

Depending on the company’s skills, you may decide to use an experienced QuickBooks partner in the ProAdvisor program, such as an accountant or bookkeeper with implementation experience. As their client, you may receive a discount on QuickBooks Online software.

Step 3

Get QBO Bookeeping Setup

Use Bookkeeping Setup to establish the chart of accounts and implement QuickBooks Online.

Step 4

Select a QBO Plan and Third-Party Integrations

Decide which third-party integrations should be added to QuickBooks Online to increase its functionality.

Step 5

Training

Learn how to implement and use QuickBooks Online.

Step 6

Implement QuickBooks Online

Implement QuickBooks Online according to your plan. Because QuickBooks Is generally entry-level software, it may not require data migration from another accounting software system.

How Does AP Automation Software Integration Work With QuickBooks Online?

AP automation software is seamlessly integrated with QuickBooks Online, providing the same QuickBooks Online login and QuickBooks Online user interface. Teams use the API-connected Tipalti app to streamline and reduce the accounts payable workload by up to 80%. Tipalti cloud software adds self-service supplier onboarding, fraud reduction, cross-border multi-currency global mass payments, and real-time payments reconciliation.

Tipalti AP automation features for end-to-end payables include:

- Self-service onboarding to collect W-9 or W-8 forms data, supplier contact and payment information

- Supplier validation with TIN (taxpayer ID) verification

- Global regulatory compliance with screening against OFAC sanctions lists and other blacklists

- Automated invoice processing

- Digital invoice capture with OCR and AI

- Verification with 26,000+ payment rules

- 3-way matching

- Automated coding using generative AI

- Approvals routing and communications

- Cash requirements for scheduled batch payments to assist in cash flow planning

- Global payments with a choice of electronic payment method to 200+ countries in 120 currencies

- Supplier payment tracking with simple 1099 and 1042-S preparation reports

- Multi-entity, with visibility for accounts payable spending by entity and combined views

- Ask Tipalti AI℠ digital assistant for answering your business spend queries

- Metrics trends and analytics

- Accounting data syncing with QuickBooks Online

Other Tipalti financial automation software products work as a unified platform. These Tipalti software solutions are Mass Payments, Expenses, Multi-FX, FX Hedging, and Procurement.

Multi-FX and FX Hedging are advanced foreign exchange products that combine with Tipalti automation software for payables and payouts. Multi-FX supports 30 currencies and uses a centralized virtual account to make payments for all its subsidiaries or other entities. Tipalti Multi-FX handles complex currency conversions at a reasonable exchange rate and makes payments in various currencies. FX Hedging allows companies using Tipalti to lock in foreign exchange rates on invoices before the payment due date.

Tipalti Expenses works with Tipalti AP automation software by providing a mobile app for employees to submit expense claims through automated photo extraction for receipts and easy approval or rejection of expenses by their designated supervisor. The Expenses software automatically checks submitted these automatically-prepared employee expense claims for compliance with company expense policy and flags exceptions. Employees are reimbursed for approved expenses in the integrated AP automation software.

Companies sometimes use corporate spending cards for non-PO employee purchases for routine, lower-cost items like office supplies. Tipalti issues the Tipalti Card, a spending card for approved users to assign some of their employees.

Although QuickBooks Online has basic procurement features for manually creating POs by entering data or automating recurring purchase orders, Tipalti Procurement handles purchase requisition intake from employees, automated routing for PR approvals, and automatic creation of purchase orders from approved purchase requisitions. Tipalti Procurement makes digitized supplier management easy and includes electronic contract and document management. All role-approved stakeholders can view the status of PRs as they are in process.

How Much Does QuickBooks Online Cost?

QuickBooks Online cost ranges from $35 per month for Simple Start to $235 per month for QuickBooks Online Advanced. QuickBooks offers a 90-day discount or free 30-day trial. QuickBooks Online pricing model matches version features with SaaS pricing plans. QuickBooks Online offers a QuickBooks Payroll upgrade that costs $50 to $130 monthly plus a per-employee cost. Intuit Payments standard pricing includes transaction fees and either a $0 or $20 monthly fee plan for optional QuickBooks Payments.

QuickBooks Time pricing for time tracking ranges from $20 to $40 just to track time for projects or $80 to $135 when combined with QuickBooks Payroll.

Recommendations