What does it take to get your business IPO-ready? Deep-dive into our comprehensive guide.

Fill out the form to get your free eBook.

The market for IPOs is very dynamic, and the window of opportunity may open only for a short period of time. A successful IPO requires organizational alignment to standards, strong controls, and increased agility enabled by technology. If you’re on the path to go public or think you might want to go public in the future, ensure that your company is set up for success. Download the eBook to learn how to: 1. Find your window of opportunity 2. Lay the necessary groundwork 3. Lead the way with technology 4. Build a strong accounts payable infrastructure 5. Boost your financial operations

Going public is an exit strategy available to corporations when growth expectations are high, minimum financial levels for an initial listing or SEC requirements are reached, and timing is right.

What is Going Public?

Going public is the process of listing and selling shares through a public stock exchange or over-the-counter (OTC) market like NYSE or Nasdaq for subsequent investing and trading or quotation on the OTC bulletin board (OTCBB). In the IPO process, a private company makes the transition to becoming a publicly held corporation.

In the U.S., a public company is subject to Securities and Exchange Commission (SEC) regulations, registration of securities, and reporting.

What are Different Methods for Going Public?

Methods of going public are an initial public offering (IPO) of newly issued shares using an underwriter syndicate, including a lead investment banking firm, direct listing of shares as a secondary offering of previously held investor shares without underwriters, or going public through a merger with an already-public shell company, including a SPAC.

Going public through an IPO may include the spin-off or carve-out of the subsidiary of a parent company that seeks its own listing on a stock exchange.

A SPAC (special purpose acquisition company) is a publicly held shell investment company (blank check company) with discretion in acquiring companies to add to its investment portfolio. A SPAC portfolio company can be acquired and go public on Nasdaq without an IPO.

As a SPAC going-public example, online sports betting company DraftKings was acquired by the blank check company, Diamond Eagle Acquisition, to go public on Nasdaq without an IPO in April 2020.

Does a Company have to Go Public?

Sometimes a company has to go public when SEC regulations like Section 12(g) apply.

When Should a Company Go Public?

A company should go public when it qualifies under one of the listing standards and meets other qualifications for initial listing of operating company shares on a stock exchange, and its SEC registration statement is effective. A company should have significant growth potential to achieve an acceptable valuation for IPO pricing and make the investment attractive to future investors.

The company should be prepared to go public, with an impressive management team and Board of Directors, good internal controls and financial reporting, and training in public company requirements.

The benefits of listing a company on the stock exchange include increased liquidity for equity trading.

Before going public, a company should weigh advantages and disadvantages of going public if it has the choice of going public or remaining private. Selling the company through an M&A transaction is an alternative exit strategy.

How Big Should a Company Be to Go Public?

The decision of how big a company should be to go public includes:

• What are SEC requirements for going public?

• What are stock exchange listing requirements1 for the minimum size to IPO?

• How big does an emerging growth company need to be to go public?

• What is the optimal company revenue level for an IPO?

• Will the expected revenue growth rate be high enough to attract IPO investors and investment banking underwriters?

Securities and Exchange Act of 1934, Section 12(g) Requirements

As part of the IPO process for going public, a company files a registration statement with the SEC that declares it “effective” before the company prices and lists its shares, allocates IPO shares to the initial investors, and trades its shares on a stock exchange.

SEC 12(g) regulations changed in May 2016 to implement the JOBS Act for emerging growth companies (ESGs) and the FAST Act.

The SEC applies Section 12(g) rules of the Securities and Exchange Act of 1934 regarding maximum amount of assets and number of existing shareholders define when a company must become a “reporting company” that files a registration statement like SEC Form S-1. In 2018, the SEC amended the reduced prospectus disclosure requirements for “smaller reporting companies” under Regulation S-K.

Requirements for registering a class of equity securities under Section 12(g) of The Securities and Exchange Act of 1934 are defined separately for a bank, bank holding company, or savings and loan holding company vs other company types.

According to the 12(g) SEC law,

“An issuer that is not a bank, bank holding company or savings and loan holding company is required to register a class of equity securities under the Exchange Act if:

- it has more than $10 million of total assets; and

- the securities are “held of record” by either 2,000 persons, or 500 persons who are not accredited investors.

An issuer that is a bank, bank holding company or savings and loan holding company is required to register a class of equity securities if:

- it has more than $10 million of total assets; and

- the securities are “held of record” by 2,000 or more persons.

In addition, a bank, bank holding company or savings and loan holding company may terminate or suspend the registration of a class of equity securities under the Exchange Act if the securities are held of record by fewer than 1,200 persons.”

The SEC further describes a May 2016 change from the JOBS Act about shares “held of record” that applies to the number of shares included in the application of the registration requirement:

“Amending the definition of “held of record” to exclude certain employee compensation plan securities from the determination of whether an issuer is required to register a class of equity securities with the Commission under Exchange Act Section 12(g)(1).”

The change in number of shareholders of record has increased significantly from the prior 500 stockholder requirement that didn’t have exceptions for employee compensation plan securities. As a result, the number of shareholders will not trigger the requirement for a company to register equity shares with the SEC and begin public reporting as quickly if a specified shareholder level is reached.

Stock Exchange Listing Requirements

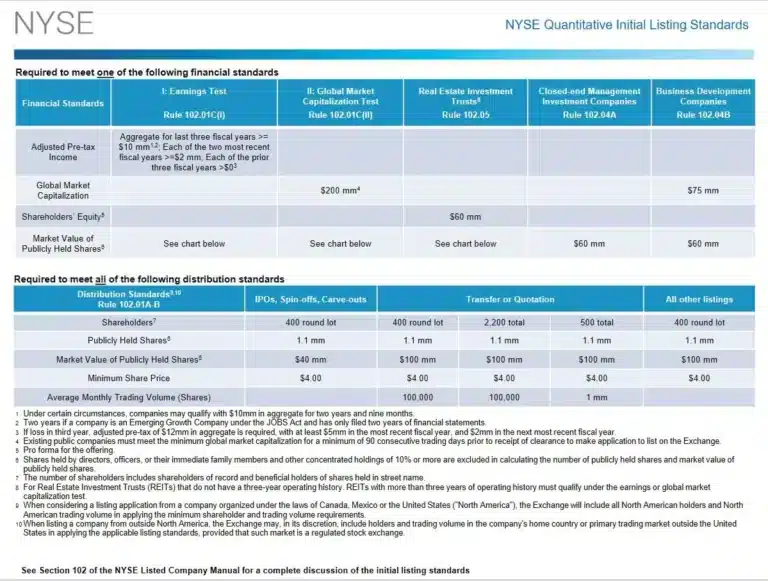

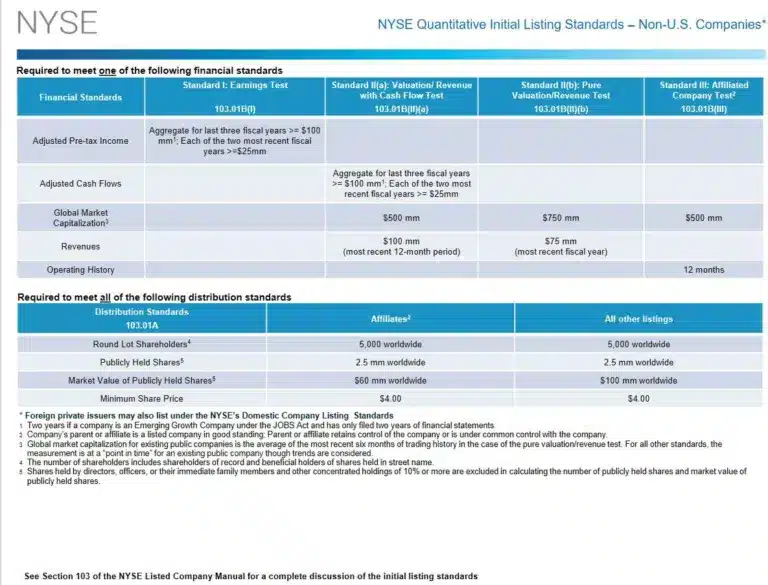

Smaller and younger companies typically go public through Nasdaq. The New York Stock Exchange has higher minimum quantitative and qualitative requirements than Nasdaq for an initial listing (IPO) of company shares. Besides applying these minimum standards, NYSE evaluates the corporate governance requirements under Section 303A and uses its discretion for listing approval.

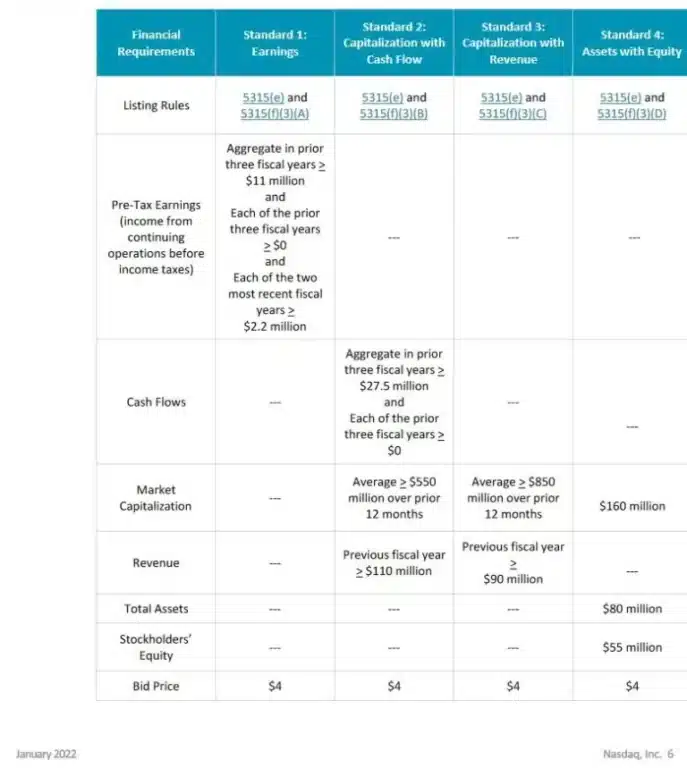

Nasdaq

For a Nasdaq initial listing of the primary class of securities, an operating company must meet all of the financial requirements under at least one standard and meet liquidity requirements. The following tables are from the linked Nasdaq Initial Listing Guide dated January 2022:

New York Stock Exchange (NYSE)

New York Stock Exchange listing requirements are included in the linked presentation. The following tables from this NYSE presentation show (financial and distribution) quantitative initial listing standards for U.S. and non-U.S. companies. For more information on current listing standards, read Section 102 of the NYSE Listed Company Manual.

As stated by the New York Stock Exchange (NYSE) in an article:

“6 signs you’re probably ready to go public are:

- You can accurately forecast financial performance.

- You have the right executive team in place.

- The company regularly closes its books on time and is audit-ready.

- You have realistic valuation expectations.

- There’s a compelling business case for going public.

- You have a clear strategic roadmap.”

An impressive, expected growth rate and industry market share make companies very attractive to potential investors.

As part of the IPO process, companies file a prospectus with the SEC that includes audited financials and required disclosures. The SEC must review the prospectus and give its final approval for issuing shares.

JOBS Act Encouraging Emerging Growth Companies to Go Public

In 2012, the U.S. government passed the JOBS Act to simplify emerging growth companies (EGCs) going public. The JOBS Act is Jumpstart Our Business Startups Act. The SEC’s revised definitions in Section 12(g) of the Securities and Exchange Act of 1934 apply to EGCs and other companies subject to SEC regulation.

Optimal Company Revenue and Financial Levels for an IPO

The optimal revenue level for a private company to become a public company through an IPO is a situational, judgmental decision. Financial levels reached are only one factor in the determination of when a company should go public.

By year, Renaissance Capital IPO stats track the number of U.S. IPOs for companies with at least $50 million in revenues and the overall amount of IPO proceeds raised in billions of dollars.

Larger companies may wait until they generate $100 million to $250 million or even $500 million in revenue before going public. With the JOBS Act, an IPO revenue level can be lower than $50 million, as can a company’s total assets.

VC firms are institutional investors that understand post-IPO institutional investors, including mutual funds, pension plans, and insurance companies with huge investment portfolios. They have extensive IPO experience.

Venture capital firms recommend that it’s time for a portfolio company to go public through an IPO as an exit vehicle to let them reinvest capital in new venture opportunities after the lock-up period. If your company is venture-backed, you’ll receive guidance from your VC firm.

Company profitability isn’t required for an IPO as long as the expected revenue growth rate is attractive. Several unprofitable unicorn companies with valuations exceeding $1 billion have gone public successfully. According to a Crunchbase article, Palantir uses “a metric called ‘adjusted operating income” for financial reporting.

Expected Revenue Growth Rate for an IPO

According to a 2013 TechCrunch article, IVP analyzed growth rates for 70 Internet and software IPOs by company size for the four years before going public and their IPO year. During this time, companies ranged from startups with no revenue or small businesses to huge companies with revenue of $500 million.

This TechCrunch article summarizes the study results:

If you’re hoping to be a public company, you should be growing significantly faster (by percentage) the smaller you are. The median company with revenues between $0 and $25 million grew at a whopping 133 percent. As these companies scaled to the $150 million to $500 million revenue range, they grew at a more modest rate of 38 percent per year.

M&A Strategy Using Public Company Shares

If companies meet the other requirements for going public on Wall Street, they may decide that using publicly traded shares in future M&A deals to purchase other businesses would be a good corporate strategy. Share price valuation in the public market is generally higher for publicly traded companies than for private company shares.

IPOs are an excellent method to raise capital for M&A and other corporate purposes.

Stock Market Conditions for Going Public

IPO market conditions and market value multiples determine the timing of when a company should go public. The market capitalization of a company is the number of shares times price per share. Price per share can be analyzed in terms of a price-earnings ratio or P/E ratio.

When the IPO market is hot in a bull market, P/E ratios and valuations through stock prices are high, enticing companies to go public. During bear markets, the door may be closed to issuing IPOs and going public. Other methods like reverse mergers with shell companies may still work to enable going public at these bear market times.

High-potential companies can ask potential investment bank underwriters like Goldman Sachs to give them insight into when market conditions favor going public.

Going Public Takeaway – When and Company Size

Before going public, the credentials of the Board of Directors must be impeccable. Adding or replacing Board of Directors members before an IPO may be required. A company’s Board of Directors will advise the company and vote to approve when it’s time to go public. Adequate corporate governance measures must be in place.

Being prepared to going public includes having the right management team in place and good financial statements and systems.

Considerations for when and how big a company should be to go public depends on:

- When they meet SEC regulatory and stock market listing requirements

- When revenue and growth potential are sufficient to reward existing shareholders and attract potential investors through an IPO

- When their venture capital firm, CPA and legal firms, or potential investment bankers (underwriting firms) advise going public

- When issuing public shares would be a good strategy for raising M&A capital

- When they are prepared to go public.