Finance trends shift fast—explore 5 key processes & tips to stay ahead.

Fill out the form to get your free eBook.

Trends in finance processes change as often as CFOs check their dashboards. This guide takes a look at five key finance processes, offering a step-by-step breakdown of the latest trends and best practices to stay ahead of the curve.

Global expansion, economic volatility, and rapid technological advancement are redefining the role of the modern finance team. A recent Tipalti survey of over 2,300 finance professionals across North America and Europe, titled The Global Finance Outlook: Are Finance Teams Equipped for Today’s Economy?, reveals that the pace and complexity of global business are accelerating faster than most finance teams can manage. 83% of finance teams report that their workload is increasing, as global expansion, tariffs, and evolving regulations outpace outdated systems and limited automation.

While 74% of teams are being pulled into more strategic roles, they are simultaneously losing a massive 11 hours per week—equating to nearly 72 workdays per year—to manual accounts payable (AP) tasks that stifle both productivity and growth.

Finance teams lose an average of 11 hours every week to manual AP tasks — that’s nearly 72 workdays a year.

Global Ambition is Outpacing Readiness

The core challenge lies in a fundamental capacity gap. More than one-third (35%) of businesses plan to expand globally within the next 12–24 months, with 55% already spending more time on international business. Yet, the underlying operational readiness is dangerously behind. 56% of respondents state that their current AP systems cannot support long-term growth without major overhauls, and a resounding 80% admit they need to scale their AP processes just to handle growing invoice volumes. This infrastructure debt is forcing finance teams to fight global battles with outdated domestic tools.

Compliance, Tariffs, and Fraud Are Adding More Complexity

Compounding internal inefficiencies are external headwinds, such as tariffs and economic volatility. Nearly 6 in 10 (59%) finance leaders report that U.S.-related tariffs are directly impacting their expansion plans, and 61% have already slowed or halted investment or growth due to this uncertainty. Furthermore, the pursuit of global expansion is escalating compliance and fraud risks. Half (50%) of finance professionals lack a clear roadmap for managing global compliance, and 60% report that fraud has become a greater concern across the AP process. While many teams are layering in short-term fixes, such as adding staff or new internal protocols, these actions risk being short-term patches instead of scalable, long-term solutions.

Automation and AI are the Future of Finance

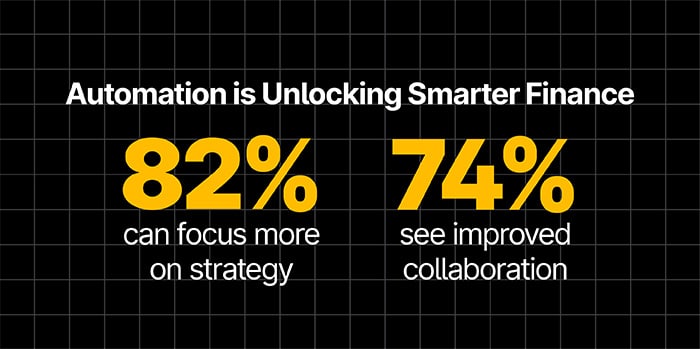

The findings highlight a near-universal consensus on the solution: automation and AI are key to the future of finance. Despite 80% of finance leaders agreeing that automation drives long-term business goals that go far beyond mere efficiency, only 7% of organizations have fully automated their AP operations today. However, momentum is building: 68% of teams are actively re-evaluating how they manage AP, and nearly half (46%) are actively implementing or piloting AI tools. For those moving forward, the payoff is clear, enabling them to realize measurable benefits, such as fewer errors, faster approvals, and stronger financial control.

This realization is driving clear investment priorities going forward. When asked to rank their top strategic priorities for AP, finance leaders cited AI as the #1 most critical investment (50%), followed closely by fraud detection and risk monitoring (44%), data security and privacy (44%), and financial compliance and audit (41%). These trends reflect a strategic pivot toward using AI as a core driver of business readiness, a shift reinforced by the fact that 73% of leaders who have piloted AI are seeing improved retention of skilled employees.

The Path Forward: Building a Future-Ready Finance Function

With 64% of professionals stating they have an AP modernization plan in place for the next 12 months, the time for decision-makers to take action is now. Whether expanding internationally or simply trying to improve operations at home, finance teams need access to tools that help them take AP from manual to meaningful. By eliminating workflow inefficiencies, reducing compliance risks, and empowering teams to focus on strategic initiatives, finance can become a true driver of business growth.

As your organization navigates the rapidly evolving financial landscape and seeks to transform complexity into competitive advantage, here are a few actionable takeaways to consider:

- Assess Automation Readiness and Its Impact on Risk: Start with a detailed evaluation of current finance operations. Where are the most significant manual bottlenecks consuming those “lost 11 hours per week,” and, critically, where do these manual processes introduce the greatest risks for compliance breaches or fraud attempts? Understanding specific pain points—from invoice processing and global supplier onboarding to tax reporting and payment validation—is the first step toward identifying where integrated automation and AI can deliver the most immediate and impactful relief, bolstering both efficiency and security.

- Prioritize Strategic Long-term Solutions Over Tactical Patches: While short-term fixes, such as new manual processes or protocols, may offer temporary relief, these often become unsustainable patches. Consider whether your current investments are truly building scalable, long-term solutions that can proactively address evolving regulatory landscapes and sophisticated fraud tactics, or merely delaying the inevitable overhaul. Prioritizing intelligent, AI-powered systems can help you move from reactive firefighting to proactive, strategic financial control.

- Empower Your Team: Connect Automation to Talent and Compliance: There is a clear link between automation, AI, and improved employee retention. Think about how liberating finance teams from repetitive tasks not only boosts morale but also frees them to become experts in areas like global compliance monitoring and advanced business reporting. This transforms your finance team into a more attractive environment for skilled talent and equips them to better safeguard against financial and regulatory risks, directly contributing to long-term business goals.

- Seek Comprehensive Solutions for Global Visibility and Control: With tariffs, escalating compliance requirements, and sophisticated fraud concerns multiplying in a global economy, fragmented systems are a significant liability. Look for solutions that offer a unified approach to managing payments, supplier onboarding, and financial operations across multiple entities and currencies. A single, intelligent source of truth provides real-time visibility and comprehensive control, enabling navigation of international complexities, ensuring adherence to regulations, and proactively managing overall finance operations.

By integrating intelligent automation across AP and payment workflows, finance leaders can regain control, strengthen compliance, and free teams to focus on strategic growth. At Tipalti, we empower organizations to transform complexity into opportunity through our purpose-built global finance automation solutions.

Ready to see how your finance team stacks up against global peers?

Explore the latest insights from over 2,300 finance professionals worldwide.