Finance trends shift fast—explore 5 key processes & tips to stay ahead.

Fill out the form to get your free eBook.

Trends in finance processes change as often as CFOs check their dashboards. This guide takes a look at five key finance processes, offering a step-by-step breakdown of the latest trends and best practices to stay ahead of the curve.

The AI revolution is often told through the lens of technology, but that’s only half the story. Tipalti analyzed OECD (Organisation for Economic Co-operation and Development) venture investment data to identify which industries, such as food and defense, outside the pure technology sector have made the largest investments in AI since 2012.

These investments are supporting operational improvements, including supply chain optimization (for example, PepsiCo using AI for warehouse operations¹), as well as enhancements in financial workflows such as scaling mass payments and global payouts to support operations like paying affiliates, freelancers, and international vendors. They are also improving core processes such as payment reconciliation, as seen at companies like Unilever². Other industries are applying AI in areas such as logistics, forecasting, and inventory management, reflecting a broader shift toward using AI to streamline both operational and financial processes.

This report highlights the sectors quietly investing in AI to enhance efficiency, resilience, and their ability to manage growing complexity across a wide range of activities. Specific AI uses vary by sector, ranging from operational to customer-facing, analytical, and strategic applications.

Explore the full data approach and calculation process in our methodology.

Achieving efficiency at scale often depends on having the right foundations in place.

Learn how automation in global mass payments and AI in finance can increase efficiency, reduce risk, and give teams the time to focus on strategic priorities rather than manual processing.

Key Findings

- The food and beverage industry now leads the way in AI investment growth outside of tech.

- Median deal sizes for AI-related funding rounds have skyrocketed—up more than 6,000% year over year.

- Government, defense, and robotics sectors are consistently making substantial AI investments, with funding extending well beyond the headline firms typically associated with the field.

- Finance teams are adopting AI in accounts payable (AP) and reporting, with 46% piloting tools and 80% viewing automation as a means to support their long-term goals, according to a Tipalti survey.

- Across finance functions in particular, survey respondents reported measurable efficiency gains, including time (44%) and cost (34%) savings.

- Survey data shows mid-market companies’ (typically those larger than SMEs but smaller than global enterprises) AI adoption is 32% higher than SMBs.

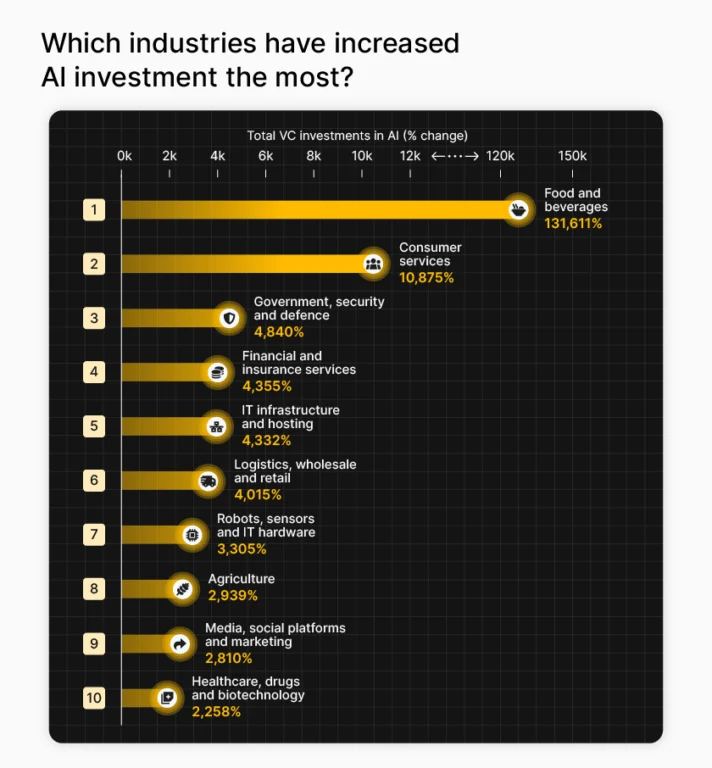

Which Industries Have Increased AI Investment the Most?

AI investment patterns have shifted dramatically over the past decade, with new sectors emerging as surprising leaders. Below is a look at how those changes have taken shape.

The total venture capital investment numbers reveal some unexpected leaders in artificial intelligence investment, beyond the obvious tech sectors, with food and beverages, consumer services, and government, security, and defense experiencing the most significant percentage growth.

While AI was far from being a mainstream priority in 2012, several industries were already investing meaningfully in it. Sectors such as government and defense, financial services, and IT infrastructure each recorded tens or even hundreds of millions in early AI-related venture funding. These early adopters laid the groundwork for the broader operational transformation seen across industries over the following decade.

Total VC investments in AI

| Rank | Industry | 2012 | 2025 | % change |

|---|---|---|---|---|

| 1 | Food and beverages | $0.06m | $76.2m | 131,611% |

| 2 | Consumer services | $2.02m | $221.5m | 10,875% |

| 3 | Government, security and defense | $32.1m | $1.6bn | 4,840% |

| 4 | Financial and insurance services | $266.3m | $11.9bn | 4,355% |

| 5 | IT infrastructure and hosting | $1.3bn | $56.1bn | 4,332% |

| 6 | Logistics, wholesale and retail | $38.5m | $1.6bn | 4,015% |

| 7 | Robots, sensors and IT hardware | $275.5m | $9.4bn | 3,305% |

| 8 | Agriculture | $8.61m | $261.7m | 2,939% |

| 9 | Media, social platforms and marketing | $967.2m | $28.1bn | 2,810% |

| 10 | Healthcare, drugs and biotechnology | $491.8m | $11.6bn | 2,258% |

1. Food and Beverages: 131,511% Increase in Total AI Investment

The food and beverages industry grew its VC investment from $0.06 million in 2012 to $76.2 million in 2025, representing an immense increase of over 131,600%.

The rise has seen companies like PepsiCo using AI in factory and warehouse operations for maintenance and quality control.¹

This growth may indicate greater investor interest in AI within traditionally physical, labor-intensive sectors.

2. Consumer Services: 10,875% Increase in Total AI Investment

Consumer-facing industries—hospitality, entertainment, and personal services—saw venture funding skyrocket from $2.02M to $221.5M, a nearly 11,000% surge. This growth reflects accelerating global expansion and an intensified focus on automation. AI is optimizing everything from bookings and logistics to personalization and service delivery, making these sectors increasingly scalable.³

For finance teams, this scale comes with new operational pressures, including higher-volume payouts, royalty distributions for entertainment companies, and rising payment needs for contractors and the gig economy across global markets. Managing these flows requires fast, compliant, and automated mass payment infrastructure—systems built to streamline onboarding, handle multi-currency transactions, and support recurring or high-frequency payouts at scale.

3. Government, Security, and Defense: 4,840% Increase in Total AI Investment

Government, security, and defense sectors saw AI investment climb from $32.1M to $1.6B—an almost 5,000% increase. Much of this momentum reflects growing interest in AI for procurement automation, supply-chain intelligence, and operational analytics within highly regulated environments.⁴

For finance teams supporting these industries, the ripple effects are substantial: managing regulated payments, navigating strict audit trails, coordinating multi-entity reporting, and ensuring compliance across numerous jurisdictions. As these organizations scale AI initiatives, they increasingly rely on tools such as accounts payable software and other automation platforms to manage the volume and complexity of financial operations—enabling secure onboarding, controlled workflows, and global payouts with transparency and accuracy.

Which Industries are Seeing the Largest Increase in Median AI Investment?

The median deal size helps balance out the effect of a few very large investments that can skew the totals. Rising median values can suggest that AI adoption is expanding across a broader range of companies within the sector, not just among the top-funded firms.

Median VC investment in AI

| Rank | Industry | 2012 | 2025 | % change |

|---|---|---|---|---|

| 1 | Food and beverages | $0.06m | $3.58m | 6,098% |

| 2 | Government, security, and defense | $0.65m | $10.0m | 1,438% |

| 3 | Robots, sensors, and IT hardware | $3.00m | $13.9m | 362% |

| 4 | Consumer services | $0.75m | $3.30m | 340% |

| 5 | Business processes and support services | $1.28m | $4.45m | 246% |

| 6 | Agriculture | $1.10m | $3.72m | 238% |

| 7 | Healthcare, drugs and biotechnology | $1.40m | $4.50m | 221% |

| 8 | Media, social platforms and marketing | $1.40m | $3.92m | 180% |

| 9 | Financial and insurance services | $2.00m | $5.45m | 173% |

| 10 | IT infrastructure and hosting | $1.90m | $5.00m | 163% |

1. Food and Beverages: 6,098% Increase in Median AI Deals

The food and beverage industry now leads all non-tech sectors in AI investment. Median deal sizes for AI-related funding rounds have skyrocketed—up more than 6,000% since 2012.

This indicates that AI adoption is no longer limited to a few large companies but rather is spreading across a broader range of firms in the sector.

For example, companies such as Yum! Brands (owner of Taco Bell, Pizza Hut, and KFC), in partnership with NVIDIA, are deploying voice ordering and computer-vision systems in restaurants, reflecting operational AI investment.⁵

For finance teams, this expansion creates a need for scalable mass payments and accounts payable software to manage a growing base of AI-driven suppliers, vendors, and operational partners.

2. Government, Security, and Defense: 1,438% Increase in Median AI Deals

Median VC deals in this sector increased from $0.65 million to $10.0 million between 2012 and 2025, suggesting broader participation across manufacturers, startups, and component suppliers.

Defense technology firms, such as ARX Robotics, a German defense-tech startup, have announced multi-million-pound investments in autonomous unmanned systems, illustrating operational AI adoption.⁶

For finance teams supporting these organizations, the implications are significant: managing regulated payments, multi-entity reporting, and compliance across jurisdictions, often using accounts payable software and automation tools to ensure secure, transparent workflows and global payouts.

3. Robots, Sensors, and IT Hardware: 362% Increase in Median AI Deals

The robotics and hardware sector ranks third in median AI investment growth, with typical deals rising from $3.0 million in 2012 to $13.9 million in 2025.

This shows how physical technologies are being developed and deployed. AI is increasingly applied to industrial automation, autonomous systems, and smart sensors integrated into everyday products.

Start-ups like Asteria Aerospace, an Indian robotics and AI company, illustrate that these investments are widespread, extending beyond major robotics firms to a larger ecosystem of manufacturers, startups, and component suppliers.⁷

For finance teams, these developments may require automated accounts payable workflows and scalable payment infrastructure to support complex supplier networks and high-frequency transactions.

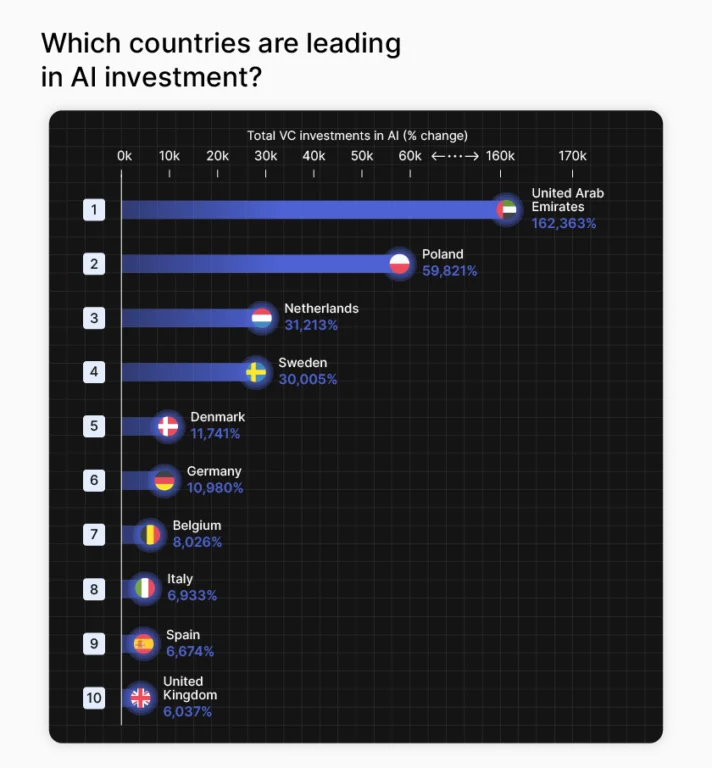

Which Countries are Leading in AI Investment?

AI funding momentum is no longer concentrated in a handful of well-known tech hubs. The visual below highlights how investment leadership is expanding worldwide.

AI investment is expanding beyond traditional technology hubs such as Silicon Valley and Shenzhen. Over the past decade, venture-funding patterns have shifted dramatically, with new regional leaders emerging across Europe and the Middle East.

It’s essential to recognize that venture capital investment is just one indicator of AI activity, and may not accurately reflect AI adoption outside the US, where government-led programs, corporate R&D, and other funding sources play a more significant role.

The data shows that smaller economies are scaling investment, building AI ecosystems that often grow faster and more strategically than those in traditional tech markets.

Total VC Investments in AI

| Rank | Country | 2012 | 2025 | % Change |

|---|---|---|---|---|

| 1 | United Arab Emirates | $0.30m | $487.4m | 162,363% |

| 2 | Poland | $0.43m | $257.7m | 59,821% |

| 3 | Netherlands | $2.65m | $831.3m | 31,213% |

| 4 | Sweden | $2.55m | $768.9m | 30,005% |

| 5 | Denmark | $2.38m | $281.8m | 11,741% |

| 6 | Germany | $24.6m | $2.7bn | 10,980% |

| 7 | Belgium | $1.64m | $133.3m | 8,026% |

| 8 | Italy | $3.79m | $266.8m | 6,933% |

| 9 | Spain | $15.0m | $1.0bn | 6,674% |

| 10 | United Kingdom | $187.5m | $11.5bn | 6,037% |

1. United Arab Emirates: 162,363% Increase in AI Investment

The UAE’s AI investment growth, which has increased by more than 162,000% since 2012, reflects a deliberate, government-led push to embed AI across various sectors, from energy to finance.

National initiatives such as the UAE Strategy for Artificial Intelligence 2031 have prioritized AI as a pillar of economic diversification.⁸

This rapid expansion coincides with significant initiatives by both the state and private sectors to promote AI adoption.

2. Poland: 59,821% Increase in AI Investment

Poland’s AI investment has surged nearly 60,000% since 2012, characterized by a thriving startup scene and strong engineering talent base.

The country’s digital infrastructure investments and EU-backed innovation programs have helped transform it from a small player in 2012 into one of Europe’s fastest-growing AI markets.

This trajectory positions Poland as an emerging player in Central and Eastern Europe’s digital transformation.

3. Netherlands: 31,213% Increase in AI Investment

The Netherlands has built on its established tech and research base to achieve over 31,000% growth in AI investment since 2012.

Unlike some emerging markets, the Netherlands’ growth is accompanied by a steady increase in both public and private funding, particularly in areas such as logistics, healthcare, and transportation hubs.⁹

This balanced approach indicates a mature ecosystem where AI adoption is not just accelerating but also broadening across industries.

The Biggest AI Spenders in 2025

While growth rates highlight how quickly emerging industries are adopting AI, examining absolute 2025 investments reveals a different set of leaders.

Excluding core technology categories, several operationally intensive sectors are now making some of the largest AI commitments.

| Rank | Industry | 2025 |

|---|---|---|

| 1 | IT infrastructure and hosting | $56.1bn |

| 2 | Media, social platforms and marketing | $28.1bn |

| 3 | Financial and insurance services | $11.9bn |

| 4 | Healthcare, drugs and biotechnology | $11.6bn |

| 5 | Business processes and support services | $11.3bn |

| 6 | Robots, sensors and IT hardware | $9.4bn |

| 7 | Digital security | $5.0bn |

| 8 | Mobility and autonomous vehicles | $4.5bn |

| 9 | Government, security and defense | $1.6bn |

| 10 | Logistics, wholesale and retail | $1.6bn |

1. IT Infrastructure and Hosting: $56.1bn in 2025 AI Investment

IT infrastructure and hosting is the largest AI investor in 2025, with $56.1 billion in total funding. This demonstrates the essential role of cloud platforms, data centres, and compute providers in enabling AI development and deployment. In particular, Amazon Web Services (AWS) is set to invest approximately $100 billion in capital expenditures (CapEx) in 2025, up from $83 billion in 2024, to scale its AI infrastructure and maintain its position as a key leader in cloud computing.¹⁰

Investment is focused on expanding capacity, improving performance, and supporting the increasing demand for AI-driven services.

2. Media, Social Platforms, and Marketing: $28.1bn in 2025 AI Investment

Media, social platforms, and marketing represent one of the largest non-tech AI investors in 2025, with total venture funding reaching $28.1 billion.

This level of investment indicates that AI has become a significant presence in the industry, often used for personalized content delivery, advertising optimization, and real-time audience analytics. Platforms are deploying AI to improve recommendation engines, automate moderation, and manage quickly expanding volumes of user-generated content.¹¹

The growth in this sector highlights how AI is integrated into customer-facing experiences and operational workflows.

3. Financial and Insurance Services: $11.9bn in 2025 AI Investment

Financial and insurance services rank among the largest AI investors outside pure technology, with $11.9 billion in 2025 venture funding. Much of this investment appears to be linked to ongoing efforts to strengthen areas such as fraud detection, risk modelling, reporting, and decision-support processes. Across the sector, AI is being increasingly explored for applications such as underwriting, credit analysis, and supporting high-volume payment operations.¹²

As financial services continue to digitize, these developments suggest that AI-enabled automation is steadily shaping how finance teams operate, from accounts payable to payment execution, compliance, and reconciliation, helping organizations manage scale and complexity more efficiently.

Tipalti Surveyed Finance Teams to Reveal AP and AI Insights

A recent Tipalti survey of finance teams highlights how AI and automation are transforming finance operations across sectors.

While tech companies often dominate headlines, the data also highlights growing AI adoption across other sectors.

AI Adoption Across Finance Teams

- Almost half (46%) of finance teams are already piloting or implementing AI tools.

- Mid-market companies are using AI almost a third more (32%) than SMBs, showing adoption is scaling beyond small, nimble teams.

- Almost four in five respondents (77%) view AI and automation as essential for strategic work, while just under three-quarters (73%) believe AI helps retain skilled employees.

| Insight | % of Respondents |

|---|---|

| Finance teams piloting or implementing AI tools | 46% |

| Mid-market companies’ AI use | 32% higher than SMBs |

| View AI and automation as essential for strategic work | 77% |

| Believe AI improves retention of skilled employees | 73% |

The Top Investment Priorities of Finance Teams

- Half of finance teams prioritize AI, followed by over two-fifths focusing on fraud detection and risk monitoring.

- Over two-fifths of finance teams say data security and privacy are a top priority, while a similar proportion highlight financial compliance and audit.

Top Investment Priorities

| Priority | % of Respondents |

|---|---|

| Artificial intelligence | 50% |

| Fraud detection and risk monitoring capabilities | 44% |

| Data security and privacy capabilities | 44% |

| Financial compliance and audit capabilities | 41% |

The Best Value Applications of AI

- Financial reporting leads at 40%, followed by invoice processing (37%), fraud detection and risk monitoring (31%), budgeting and planning (31%), and payment reconciliation (30%).

- Finance teams report seeing returns on AI adoption. Quiet leaders focus on high-impact operational areas, such as automated reporting or invoice processing, rather than high-profile AI experimentation and testing.

Best Value Finance Applications of AI

| Area of Application | % of Respondents |

|---|---|

| Improved financial reporting | 40% |

| Invoice processing | 37% |

| Fraud detection/risk monitoring | 31% |

| Budgeting and planning | 31% |

| Payment reconciliation | 30% |

The Benefits of AI-Enabled Teams

- Time savings (44%) and cost reductions (34%) top the list, with just under a third reporting faster finance and accounts payable (AP) operations overall.

- The benefits signal that AI adoption appears to be driving efficiency across finance teams. Survey respondents reported that AI helps teams work more efficiently, allowing them to focus more on higher-value tasks and manage their workloads more effectively.

Benefits of AI-Enabled Teams

| Benefit | % of Respondents |

|---|---|

| Time savings | 44% |

| Cost savings | 34% |

| Faster finance/AP operations overall | 32% |

AI and Automation in Accounts Payable (AP)

- Eight in ten finance team respondents view automation as a means of supporting long-term business goals.

- Almost two-thirds (64%) are concerned that the lack of automation will limit scaling, while over a third use AI-powered automation in AP.

- The survey shows that while full automation is still rare, most finance teams see AI as an important enabler of growth.

AI and Automation in Accounts Payable (AP)

| Insight | % of Respondents |

|---|---|

| Fully automated AP operations | 7% |

| Use AI-powered automation broadly across AP | 36% |

| See automation as supporting long-term business goals | 80% |

| Concerned that lack of automation will limit scaling | 64% |

The Benefits of Full Automation in AP

The focus is on operational impact, including enhanced payment accuracy, improved compliance, and increased cross-border efficiency.

Survey data suggests finance teams are using automation to manage growing transaction volumes more efficiently.

Two-fifths of respondents cite payment execution and approval routing as benefits of automation of AP, showing how it is transforming the backbone of finance operations.

Benefits of Automation in Accounts Payable (AP)

| Benefit | % of Respondents |

|---|---|

| Payment execution | 40% |

| Approval routing | 40% |

| Regulatory/tax compliance | 32% |

| Cross-border payments | 31% |

Key Considerations in Adopting AI and Automation: How Businesses are Overcoming Challenges

Survey respondents (2,326 finance professionals) reported data security (33%), integration (30%), and accuracy (29%) as top barriers to full automation.

Some businesses are addressing these challenges by starting with contained use cases (such as invoice matching or fraud detection), partnering with trusted vendors that can integrate securely, and focusing on data quality and governance before scaling.

This approach suggests that steady, deliberate progress can be more effective than high-risk initiatives.

Barriers to AI and Automation Adoption

| Barrier | % of Respondents |

|---|---|

| Data security concerns | 33% |

| Difficulty integrating with existing systems | 30% |

| Accuracy concerns of automated tools | 29% |

Methodology

The analysis is for informational purposes only and does not constitute investment advice, recommendations, or solicitation to buy or sell securities. Past performance does not predict future results.

As efficiency becomes the defining measure of business success, we wanted to investigate which industries and companies are leading AI investment, looking beyond the typical technology sector.

Using OECD: Worldwide VC investment in AI, we calculated the difference between 2012 (the first year with available data) and 2025 for the following:

- Sum of VC investments in AI by industry

- Median size of a VC investment in AI by industry

- Sum of VC investments in AI by country

- Median size of a VC investment in AI by country

We only looked at industries and nations for which data was available for both 2012 and 2025.

Further insights into the use of AI by finance teams were sourced from Tipalti: The Global Finance Outlook: Are Finance Teams Equipped for Today’s Economy, a survey of 2,326 respondents.

Sources

- AI Magazine

- Unilever

- Science Direct

- Defence Logistics Agency

- Yum

- ARX Robotics

- Asteria

- UAE National Strategy for Artificial Intelligence 2031

- OECD

- Infotechlead

- Digital Playmakers

- McKinsey & Company

Tipalti is the AI-powered platform for finance automation, elevating how finance teams operate in the global economy. We empower our customers to scale faster and smarter by removing the complexities of doing global business and accelerating their finance operations efficiency. Our platform provides a comprehensive suite of finance automation solutions designed for mid-market businesses, across accounts payable, global payouts, procurement, employee expenses, corporate cards, supplier management, tax compliance, and treasury. Tipalti partners with leading financial institutions such as Citi, Wells Fargo, J.P. Morgan and Visa, enabling over 5,000 global companies to efficiently and securely pay millions of suppliers and payees across 200+ countries and territories, in 120 currencies. For more information, visit tipalti.com.