Mastering independent contractor and freelancer payments can be tricky. Is your business equipped to handle it?

Fill out the form to get your free eBook.

More than 50% of US workers are engaged in the gig economy, which is growing rapidly. These contractors are increasingly crucial to your business success in today’s dynamic digital environment.

To compete effectively, brands like yours need to scale contractor payments faster and more efficiently while keeping your contractors happy. A modern, reliable payment process will give your company a competitive advantage in an unpredictable market.

We invite you to read our new eBook, Are You Struggling With Paying Contractors? which reveals why automation is the solution. You’ll learn:

– Four pain points of manual contractor payments

– Five key ways automation improves payment inefficiencies

– How to build a more robust contractor network

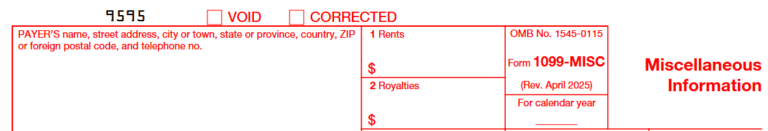

Payers report royalty payments of $10 or more per payee to the IRS and applicable states on Form 1099-MISC, Box 2. Royalties generally cover intellectual property (IP), such as copyrights, patents, books, and music, as well as certain natural resources.

This payer-side guide shows finance teams how to classify royalty payments correctly and operationalize 1099 compliance at scale. It also provides best-practice guidance on how to report 1099-MISC royalties and optimize your royalty reporting and payouts system.

Quick Answer: 1099 Reporting for Royalties

- Use Form 1099-MISC (Box 2) to report royalty payments

- Report royalties starting at $10 per payee (this threshold does not change in 2026)

- Send the 1099-MISC to the IRS, applicable state tax authorities, and each royalty recipient

- Common mistake: Reporting royalties on Form 1099-NEC instead of 1099-MISC

What Counts as a Royalty Payment (Common Examples)

Business IP licensing (for intellectual property) that generates royalty payments typically include:

- Software and technology licenses

- Copyrighted content and media

- Publishing and literary rights

- Music and performance rights

- Trademarks and brand assets

Certain industries also pay natural resource royalties, such as oil, gas, timber, and minerals.

Reporting Threshold: When Is a 1099-MISC Required for Royalties?

The IRS Form 1099-MISC reporting requirements threshold for royalties is $10+ (per payee). As indicated in the IRS Instructions for Form 1099-MISC for Box 2, the threshold applies to gross royalty payments (or similar amounts).

Continuing $10+ Royalty Threshold

The 1099-MISC reporting threshold of at least $10 in royalty payments is much lower than the traditional $600 threshold for reporting many other types of payments for 1099-MISC income. Under the One Big Beautiful Bill Act (OBBA), the higher threshold for some types of non-royalty Miscellaneous Income (1099-MISC) and Nonemployee Compensation income (Form 1099-NEC) increases from $600 to $2,000 in 2026.

But the $10 minimum reporting threshold for royalties 1099 reporting will not change in 2026 or subsequent years under the One Big Beautiful Bill Act. This low threshold proves that small-dollar payments still matter at scale.

1099-MISC Specialized Royalties Reporting Instructions for Box 2

The Box 2 Instructions specify how to report 1099 royalties from:

- Intellectual property (IP)

- Gross royalties paid by a publisher directly to an author or literary agent

- Literary agents who pay author royalties

- Natural resource royalties

- Oil

- Gas

- Timber properties

- Other mineral properties

Royalty income paid is generally determined by applying a royalty rate and, if applicable, a volume factor, which may require complex calculations.

Manage High-Volume Music Royalties Without the Compliance Overhead

Automate royalty payouts, tax form collection, and reporting so your team can handle $10-threshold compliance at scale—and keep the focus on artists, releases, and growth.

Royalties vs Services: When Itʼs 1099-MISC vs 1099-NEC

When comparing royalties vs services, consider these definitions:

- Royalties are the payment for the right to use intellectual property.

- Services are the payment for work performed.

Use Form 1099-MISC for reporting royalties; report services as nonemployee compensation on Form 1099-NEC.

For a payment to be properly classified as IP royalties, there must be an ownership interest in the intellectual property. Royalties are often classified as passive income and reported on Form 1099-MISC.

For example, contracts covering music royalties, service advances, and other potential elements are complex in relation to your 1099 royalty reporting process.

An advance paid to a musician, artist, or author without an ownership interest in the intellectual property is likely a payment for services, rather than part of their royalty income. This advance is for active trade or business, or self-employment income for independent contractors. It’s reportable on Form 1099-NEC at the time the income is recognized for tax purposes.

Consult your CPA or other tax professional to understand the intricacies of royalties vs. services, the appropriate form, and advance vs. income timing for 1099 form reporting in your unique business.

Why Reporting Teams Mix Up 1099-NEC and 1099-MISC

Businesses reporting royalties may use the wrong 1099 form by mistake.

Common reasons for wrong 1099 reporting for royalties include:

- Contracts leading to improper reporting

- Multi-purpose payees

- Unclear coding

Contracts may not be drafted clearly to distinguish between royalties and services, leading the finance team to believe that certain services, such as advances, are also royalties. Some payees may receive both royalties and other income for services covered by the same contract.

To properly report all applicable royalties paid by your company on Form 1099-MISC, your payout system must support consistent, accurate royalty coding.

Consider using the following brief decision checklist for 1099 royalties. Or create a custom checklist that includes all considerations for your unique business circumstances.

Decision Checklist: How to Classify and Report 1099 Royalties

Use this checklist to confirm whether payments qualify as royalties and are reported on the correct 1099 form.

| Do contracts contain royalty and non-royalty elements? | ☑ Yes ▢ No |

| Tracking royalty and other elements separately? | ☑ Yes ▢ No |

| Identifying royalty payees separately in vendor records? | ☑ Yes ▢ No |

| Coding correctly for royalties? | ☑ Yes ▢ No |

| Using 1099-MISC for royalty payments? | ☑ Yes ▢ No |

Who Should Receive a 1099 for Royalties? (Payer-Side Checklist)

The IRS, states, and royalty recipients should receive a 1099 for royalties (and other Miscellaneous Income). Payers prepare 1099 forms using the information submitted by their payees on Form W-9 or an applicable Form W-8.

Collecting W-9 forms from U.S. persons (including U.S.-based companies, U.S. citizens, and resident aliens) is key for U.S. payers. If your business also makes international payouts for royalties to foreign persons, collect Form W-8 from those payees.

Non-Employees Receiving 1099s for Royalty Payments Received

Your payees will use their 1099-MISC tax information form to report royalties on either Schedule E for passive income or Schedule C in certain cases for active income. 1099-MISC recipients who also receive a Form 1099-K for payments made through third-party networks like PayPal must ensure they don’t double-count the royalties received when preparing their income tax returns.

Employees Receiving W-2 vs 1099

Note that employees complete Form W-4 (Employee’s Withholding Certificate) instead of a Form W-9 or W-8. To complete their federal tax return, employees receive Form W-2 (Wage and Tax Statement), which reports their wages, other compensation, and taxes withheld. If your employees receive IP royalties outside the scope of their employment, they will also receive a 1099-MISC with Box 2 completed for royalty income of $10 or more in a calendar year.

If your employees develop intellectual property in the course of working for your business, it’s often owned by the company, but contractual exceptions may grant the employee an ownership interest in the IP as an incentive. In these cases, differentiate royalties vs. services to properly adhere to each IRS form’s filing requirements.

Submit Correct 1099s by the IRS Deadline

Shortly after calendar year-end (see IRS Instructions for the 1099-MISC form), your business must meet the IRS deadline to file Form 1099-MISC for each applicable payee paid in the prior year, which is always a calendar year.

The royalties payer e-Files 1099-MISC with the IRS, distributing copies to the IRS, applicable state tax authorities assessing income taxes, and recipient payees.

The correct payee/entity classification matters. Your company needs to:

- Prevent IRS penalties for submitting incorrect or late-filed 1099s, or missing 1099s

- Not be liable to the IRS for paying any tax withholding on income that should have been deducted from a payee’s royalty payments.

If payee data for Form W-9 or W-8 forms isn’t captured upfront (before the first payment), year-end gets messy. It’s a challenge for your staff to later collect all required W-9 or W-8 forms from a high volume of royalty payees to meet your 1099-MISC deadline. If hourly employees collect the forms, the process results in an additional business expense.

Common Royalty 1099 Reporting Mistakes Finance Teams Can Prevent

ERP systems and accounting software working alone often can’t handle the complexities of royalty compliance at scale. QuickBooks, designed for smaller companies, is an example of accounting software that lacks efficient royalty-tracking capabilities.

Companies may have ERP or accounting systems without adequate royalty-tracking and siloed systems that:

- Require duplicate data entry

- Use error-prone spreadsheets

- Rely on after-the-fact W-9/W-8 form collection

Operational Failure Points

Improve your company’s 1099 royalties process by focusing on preventing these operational failure points:

- Using 1099-NEC when it should be 1099-MISC: $10+ in royalties belongs on Form 1099-MISC.

- Mixing royalties and services in the same vendor record: Separate royalties when establishing vendor records and coding accounts.

- Missing W-9 data until year-end: Collect W-9 forms for “U.S. person” payees (or W-8 for ‘foreign person” payees) during payee onboarding. This onboarding process involves collecting form data before making their first payment, using payout automation software.

- Inconsistent payment categorization across systems: Use unified, integrated systems and be consistent with royalty categorization.

- Manual reconciliation and cleanup after year-end in January: Select a Mass Payments automation system for royalties (and other payouts) that automates instant payment reconciliation when batches are paid in the calendar year.

Avoiding IRS 1099 Penalties and Other Costs

Your business may unnecessarily incur substantial IRS information return penalties for incorrect, late, or missing 1099 forms. Depending on your 1099 volume, these penalties may become very substantial. Royalties can be high-volume payments, particularly with their low 1099 reporting threshold of $10+.

The maximum IRS penalties described in Section O are assessed per information return and per payee statement. These maximum penalties are set differently for larger vs. IRS-defined small businesses with $5 million or less in annual average gross receipts for their most recent 3 tax years ending before the year the information return is due. Larger businesses are subject to higher maximum penalties. The IRS has no maximum penalty for 1099 returns when there is intentional disregard.

Delaying the collection of W-9 or W-8 forms:

- Takes extra staff time, costing money

- May result in uncollectible forms

- Leads to missing 1099s, with IRS penalties

Your company may not be conducting TIN-matching validation with the IRS database to:

- Ensure TIN (taxpayer identification number) accuracy

- Avoid incurring IRS penalties for incorrect 1099 TINs

- Help prevent fraudulent payments

How to Operationalize 1099 Royalty Compliance at Scale

Payers and their finance teams always want to know: How do we issue royalty 1099s correctly and consistently at scale? What do finance teams need in place before year-end?

To operationalize 1099 royalty compliance at scale, businesses can add integrated advanced mass-payout automation systems with automated tax-compliance capabilities to avoid common 1099-MISC royalty reporting and processing errors.

Tipalti Mass Payments provides the operational controls, audit readiness, and scalable compliance workflows needed to support high-volume global payouts across multinational, multi-entity businesses.

Pro Tip: As royalty volumes grow and compliance risk increases, finance teams often need executive buy-in to modernize their processes. The video below explores how accounting teams make that case internally.

Finance Leader Playbook: A Practical Checklist for 1099 Royalties

To improve 1099-MISC royalties compliance:

- Standardize payee onboarding and tax form capture

- Validate payee data early

- Centralize reporting logic and establish an audit trail

- Streamline year-end readiness

Payee Onboarding, Tax Form Selection and Capture, and Validation

Tipalti Mass Payments is software that automates payouts and integrates with your ERP or accounting software. It provides guided contractor/payee onboarding (in 27+ languages) through a self-service, white-branded payee hub portal.

During the onboarding process, payees receiving royalties or other payouts:

- Enter data to complete their W-9 or W-8 form

- Select their preferred payment method (from 50+ choices)

- Provide payment method details

Tipalti’s guided tax form wizard automatically selects the correct IRS tax form for payees to complete, based on their country and business structure, including entity type. Tipalti supports W-9, W-8BEN, W-8BEN-E, W-8EXP, W-8IMY, W-8ECI, or Form 8233. Tipalti automation software incorporates AI agents, including AI Smart Scan (Invoice Capture Agent/Tax Form Scan Agent) and AI assistants.

These Tipalti AI agents for automated tax compliance:

- Digitize documents

- Capture data

- Automate validation upon payee onboarding

- Apply 1,000+ rules

- Perform TIN-matching

Tipalti’s extensive automated validation process helps your business prevent IRS penalties for missing or incorrect TINs, other incorrect 1099 form information, and fraudulent payouts. Tipalti also applies sanctions screening (OFAC/EU) for global regulatory-compliant payments.

Centralize Reporting Logic and Establish an Audit Trail

Tipalti Mass Payments uses AI and other tools to automatically determine which 1099 or similar forms are required for your royalty and other payouts (when you’ve coded correctly). Tipalti also provides an audit trail to enhance financial controls and your company’s audit readiness.

Streamline Year-End Readiness

Because tax data is collected, validated, and categorized during onboarding and payment execution, year-end 1099 filing becomes a reporting exercise—not a cleanup project.

Tipalti Mass Payments moves tax compliance work out of the year-end scramble and into the normal flow of operations. By capturing and validating tax data as payments are executed, finance teams eliminate last-minute form collection, manual data entry, and downstream corrections—resulting in less rework, fewer exceptions, and a smoother close.

Payer Tax Preparation Reports and Optional e-Filing

At year-end, Tipalti generates 1099 and 1042-S tax preparation reports. The Tipalti system calculates any required income tax withholdings.

Your business may increase its tax compliance efficiency by optionally subscribing to partnered Zenwork Tax1099 SaaS e-Filing software (and paying Zenwork’s per-1099 fees for filed information returns). Tax1099 has native Tipalti integration for importing 12 calendar months of tracked payments.

Zenwork supports e-filing for 1099-MISC, 1099-NEC, and 1042-S information returns and distributes copies electronically (or by mail) to your payout recipients.

A unified approach supports accurate reporting while reducing manual effort as payee volume grows. It also improves tax compliance. Learn more about Tipalti Mass Payments.

1099 for Royalties FAQs

Do royalties go on 1099-MISC Box 2?

Yes, royalties are generally reported on IRS Form 1099-Misc, Box 2. Report services for Nonemployee Compensation separately on Form 1099-NEC.

What is the threshold for royalty reporting?

The threshold for reporting royalty payments is $ 10+ (per payee).

Can royalties ever be reported on 1099-NEC?

Most royalties are passive and reported on 1099-MISC. However, a “working interest” (paying all costs of oil & gas development and operations) receives income from a trade or business, and that income is reported on 1099-NEC.

Contractual services, rather than royalties, are reported on Form 1099-NEC. If included in a royalties contract, these services should be separately tracked. Most royalties are passive and reported on 1099-MISC. However, a “working interest” (paying all costs of oil & gas development and operations) receives income from a trade or business, and that income is reported on 1099-NEC.

Contractual services, rather than royalties, are reported on Form 1099-NEC. If included in a royalties contract, these services should be separately tracked.

Do I send a 1099 for royalties under $600?

The 1099 royalties threshold of $10+ is much lower than the $600 threshold (being increased to $2,000 under One Big Beautiful Bill starting with calendar 2026) for certain 1099-MISC income categories.

Electronically send 1099-MISC forms to the IRS, applicable states, and your royalty payees as recipients by the IRS deadline shortly after calendar year-end. Recipients will use the 1099 forms to prepare their income tax returns, with the IRS and states verifying amounts through their 1099 information returns.

What if we issued the wrong 1099 form?

The payer should issue a new 1099 of the correct type, with the Corrected box checked, so the IRS system recognizes this form change.