Finance trends shift fast—explore 5 key processes & tips to stay ahead.

Fill out the form to get your free eBook.

Trends in finance processes change as often as CFOs check their dashboards. This guide takes a look at five key finance processes, offering a step-by-step breakdown of the latest trends and best practices to stay ahead of the curve.

Effective financial management depends on more than accurate bookkeeping. Following proven accounting best practices helps businesses improve visibility, reduce risk, and support better decision-making as they grow.

For most organizations, accounting is handled in-house using software to streamline processes, control costs, and maintain compliance. As operations expand, many finance teams also rely on external accounting services to support specialized needs such as audits, tax preparation, and global reporting.

As accounting technology continues to evolve, many teams are also applying AI-driven capabilities to improve accuracy, manage exceptions, and support better financial decision-making.

This guide outlines seven accounting best practices to help finance teams strengthen their accounting processes, improve efficiency, and build a more scalable foundation for financial management.

1. Outsource Payroll

Outsourcing payroll is a common accounting best practice for small and growing businesses. According to The Business Research Company, the global accounting services market grew from $652.3 billion in 2023 to $676.7 billion in 2024 and is expected to reach $804.3 billion by 2028, reflecting the widespread reliance of businesses on external accounting expertise.

Payroll is highly regulated and requires consistent accuracy to avoid errors, penalties, and employee dissatisfaction. Many smaller finance teams lack the in-house resources to manage these requirements at scale, making payroll outsourcing a practical way to reduce risk and administrative burden.

Established providers such as ADP and Paychex offer payroll and benefits services at predictable costs, along with features like direct deposit and automated tax filings that help ensure employees are paid accurately and on time.

2. Use Accounting Software

Your company can start with accounting software for small businesses, such as QuickBooks Online or QuickBooks Desktop, which is suitable for a limited number of users. Alternatively, you can consider starting with Sage Intacct, which offers scalability for small businesses, midsize companies, and some larger enterprises. Sage Intacct targets companies with 2 to 2000 employees.

Sage Intacct software has received approval from the AICPA because it helps your company implement and comply with Generally Accepted Accounting Principles (GAAP). As your budget, requirements, and company size expand, you can either keep using Sage Intacct, with its multi-dimensional reporting views and simplified chart of accounts, or migrate to other midsize business accounting software like NetSuite or Microsoft Dynamics.

Reconcile bank statements to general ledger cash accounts each month using your accounting software’s reconciliation tools.

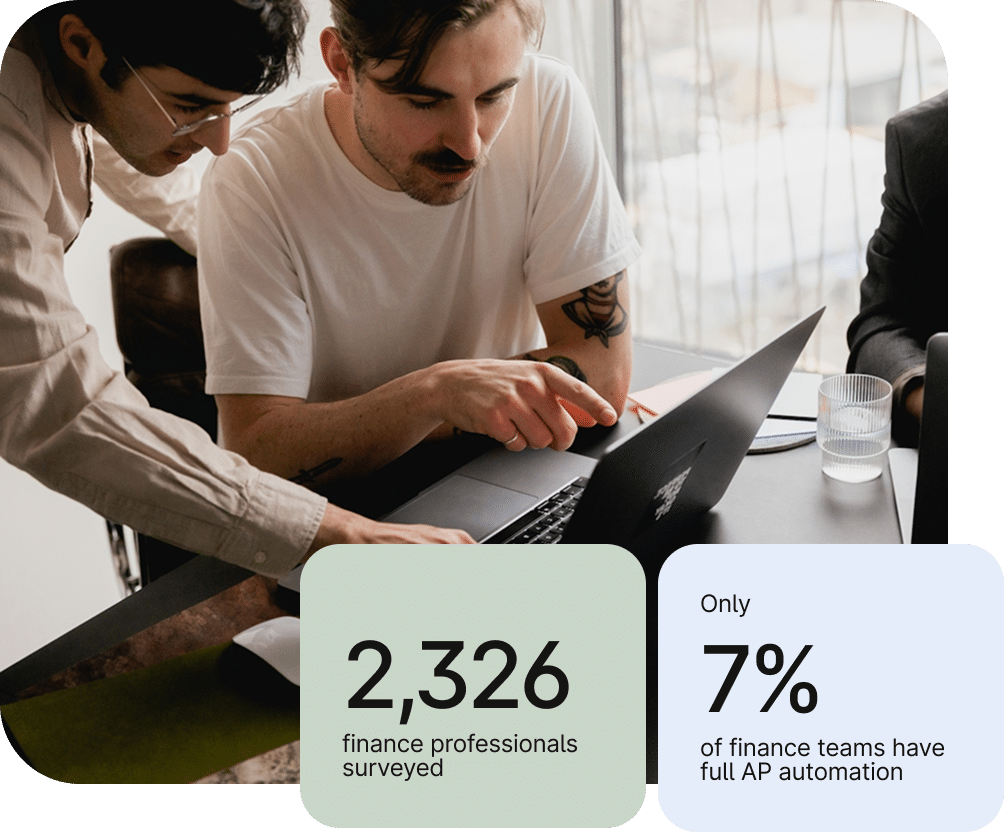

3. Add AP Automation Software

Once you’ve implemented an ERP or accounting system, integrating it with AP automation and mass payments software can help further streamline accounts payable and reduce manual effort.

Tipalti’s AP automation software centralizes invoice processing, approvals, and payments in a single platform, helping finance teams improve accuracy, maintain control, and support global payables operations. Trusted by more than 5,000 businesses worldwide, Tipalti supports organizations as they scale and manage increasing payment complexity.

Tipalti simplifies supplier onboarding and tax compliance by collecting W-9 and W-8 forms through a white-labeled, self-service Supplier Portal. Supplier payment data is automatically tracked and organized to support year-end reporting and preparation of 1099 and 1042-S forms, with optional integration for electronic tax filing.

Invoice workflows are automated to reduce errors and mitigate fraud risk, with built-in controls for approvals and exception handling. Designated approvers can review and approve invoices online, via mobile device, or directly from email, keeping processes moving without delays.

For payments, Tipalti enables scheduled batch processing across multiple payment methods and currencies, improving efficiency and consistency. As a regulated money services business in the U.S. and UK, Tipalti works with established banking partners to support secure, compliant payment execution.

Finally, real-time payment reconciliation helps finance teams maintain accurate records and close books faster, while configurable fee handling provides flexibility based on contractual requirements.

Modern Accounting Best Practices Start with AP

Explore how accounts payable automation plays a foundational role in modern accounting—helping finance teams improve efficiency, maintain control, and support compliant growth.

4. Focus on Cash Flow

Effective cash flow management is a core accounting best practice for businesses of any size. Finance teams forecast cash flow across short- and long-term plans, maintain clear visibility into incoming and outgoing cash, and monitor key drivers such as aged accounts receivable, accounts payable balances, and vendor due dates.

With accurate, up-to-date cash insights, businesses can accelerate collections, make timely payments, and take advantage of early payment discounts when appropriate. Strong cash flow management also helps teams anticipate financing needs, maintain flexibility, and evaluate potential investments using discounted cash flow analysis and project prioritization.

Pro Tip: For growing businesses that need strategic cash flow planning and financial guidance but aren’t ready for a full-time CFO, working with a fractional CFO can provide experienced support on forecasting, financing, and long-term planning.

5. Have Strong Internal Control

Strong internal controls are essential for reducing risk and maintaining accurate financial records. A key best practice is segregation of duties, ensuring that responsibility for handling cash is separated from recording transactions in the accounting system.

In smaller organizations where full segregation isn’t always possible, owners or senior leaders should retain approval authority over invoices and payments. As the business grows and adds staff, internal control procedures can be expanded and formalized to further strengthen oversight and fraud prevention.

COSO, the Committee of Sponsoring Organizations of the Treadway Commission, updated its “Internal Control — Integrated Framework” in May 2013.

In the COSO Framework, a system of internal control includes five integrated components:

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring activities

Internal control best practices are commonly guided by COSO, which was developed through an independent, private-sector initiative focused on understanding and preventing fraudulent financial reporting. COSO brings together leading U.S. accounting and finance organizations and incorporates input from industry, public accounting, and financial markets to establish widely accepted control standards.

Implementing internal controls is part of Enterprise Risk Management (ERM), which is also addressed by COSO in its updated 2017 version of “Enterprise Risk Management — Integrating with Strategy and Performance.”

In public companies, the CEO and CFO must include quarterly certifications regarding internal controls and financial statements fairness of presentation and disclosures per section 302 of the Sarbanes-Oxley Act. These corporate officers are also responsible for Section 404 implementation of SOX annually through internal control assessment and testing. Note the differences between Sarbanes Oxley Section 302 vs. Section 404.

Accounting policies and procedures best practices incorporate good internal controls. This includes establishing company policies to enforce business travel, automobile allowances, and company vehicle usage, as well as employee expense reimbursement. Company policies also establish internal control procedures for designated approval levels and invoice approvers, and other essential business topics.

6. Hire a CPA Firm

Your startup company can choose between the cash basis and the accrual accounting method. It may be wise to start with accrual accounting, which complies with GAAP accounting standards, but cash basis accounting may be more suitable for taxes. Consult your CPA firm.

At some point, you’ll want a public accounting firm that can prepare business tax returns and review (for a lesser scope and fee) or audit financial statements for the business.

CPA firms not only help businesses (and individuals or trusts) with income tax preparation, but they also advise on tax strategies.

In an external audit, the CPA firm tests a sample of underlying accounting records, makes inquiries, sends balance confirmation requests, performs recalculations, tracing, and analytic reviews for reasonableness, and analyzes GAAP compliance.

7. Apply AI to Improve Accuracy and Decision-Making

As accounting operations grow in volume and complexity, finance teams are increasingly applying AI to improve accuracy, efficiency, and oversight across core processes. When used responsibly, AI complements existing accounting systems by helping teams manage exceptions, identify risk, and focus attention where it matters most.

In accounting and accounts payable, AI can support tasks such as invoice classification, anomaly detection, payment validation, and reconciliation. Rather than replacing established controls or human review, these capabilities help reduce manual effort and surface potential issues earlier in the process.

Within accounts payable, platforms like Tipalti apply AI through capabilities such as the Tipalti AI Assistant and AI agents to help automate invoice processing, surface exceptions, and support more accurate, controlled payment workflows as transaction volumes scale.

AI-driven insights can also support cash flow forecasting, audit readiness, and compliance monitoring by continuously analyzing transaction data and highlighting patterns that may require follow-up. This allows finance teams to scale operations while maintaining strong governance and control.

As part of a broader accounting technology stack, AI should be applied selectively and transparently, reinforcing sound accounting practices rather than introducing unnecessary complexity.

Applying Accounting Best Practices in Practice

Establishing best accounting practices to properly structure accounting and finance within your company is essential for resolving potential accounting issues.

To prepare for current bank lending, a future M&A buyout, or IPO (given good market conditions, valuation, and qualifications), establish good internal controls and efficient accounting practices in accordance with GAAP.

Delays often occur when financial statements must be corrected due to manual processes or disconnected systems. Investing in the right mix of accounting software, automation, and external expertise—when it adds value—helps reduce errors and improve reliability across financial reporting.

Modern finance teams are also beginning to apply AI to support accounting best practices, using it to help manage exceptions, improve accuracy, and maintain oversight as transaction volumes grow. When combined with automation, AI can further strengthen control and efficiency without replacing established governance or human review.

When you use Tipalti AP automation and mass payment software with your ERP system or accounting software, your business will:

- Substantially increase efficiency by eliminating time-consuming manual work

- Reduce costs on your quest towards business profitability

- Reduce fraud risks and errors

- Gain tax and global regulatory compliance

- Apply AI-driven capabilities to help surface exceptions, improve accuracy, and support more controlled, scalable payables workflows

- Have a finance software solution that scales with your growing company

- Have more time to analyze financial data and make valuable company contributions.

See how AP automation can help put accounting best practices into action across invoice processing, approvals, and payments in our AP Automation Playbook.