What is a Trial Balance?

A trial balance is a report used during the accounting close process to verify the accuracy of its bookkeeping processes. It ensures that all general ledger accounts have equal debit and credit totals, as double-entry bookkeeping requires.

Its formula is: Assets = Liabilities + Equity

During the accounting cycle, accountants use the trial balance report to ensure the books balance for debits and credits by double-entry bookkeeping. The trial balance documents adjusting and closing entries to the general ledger accounts before closing the books and preparing financial statements.

Key Takeaways

- A trial balance lists general ledger accounts in numerical order with debit or credit balances or totals.

- The trial balance shows summed columns for debits and credits that should be equal.

- The trial balance is used to detect accounting errors before closing the books.

- Accountants adjust a trial balance for corrections and closing entries.

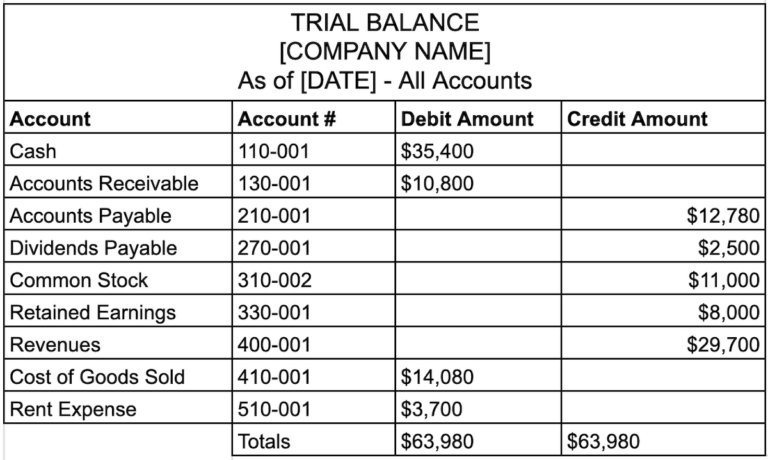

Example of a Trial Balance Document

A trial balance document is often referred to as a trial balance report. This trial balance example includes an image and a description of a trial balance.

Listing of Debits and Credits by Account

In a trial balance, each general ledger account is listed with:

- Account number

- Account name as description

- Debit amount in the Debit column

- Credit amount in the Credit column.

At the bottom of the trial balance report document, the Debit and Credit column totals are presented. According to the rules of double-entry accounting, total debits should equal total credits.

Trial Balance Columns

The trial balance, which indicates debits and credits, may contain columns for:

- Unadjusted Balance

- Adjusting Entries with debits and credits

- Adjusted Balance.

Balance Sheet Accounts

Balance sheet asset accounts include:

- Cash accounts

- Marketable Securities

- Accounts Receivable

- Inventory

- Fixed Assets

- Prepaid Expenses

- Intangible Assets.

Balance sheet liabilities include:

- Accounts Payable

- Accrued Liabilities

- Short-term Portion of Notes Payable

- Notes Payable-Long Term

- Deferred Revenues.

Shareholders’ Equity Accounts in the balance sheet include:

- Retained Earnings

- Paid-In Capital

- Treasury Stock

- Accumulated Other Comprehensive Income (Loss).

Typical Debit and Credit Account Types

The typical type of balance for an asset on the balance sheet is a debit balance. The typical balance for a liability account is a credit balance.

Examples for Balance Sheet Accounts

Cash and Accounts Receivable, Net of the Allowance for Doubtful Accounts, typically have a debit balance, and the Accounts Payable account typically has a credit balance.

Although Accounts Receivable, Net of the Allowance for Doubtful Accounts has a debit balance, the Accounts Receivable balance sheet account typically has a debit balance, and the balance sheet account, Allowance for Doubtful Accounts, that offsets it as a contra-account has a credit balance.

Examples for Income Statement Account

Income statement accounts include Revenues, Cost of Goods Sold and Cost of Services, Expenses, gains, and losses.

Common types of account totals for income statement accounts are credits for sales and other types of revenue and debits for cost of sales and expenses. Gain accounts typically have credit balances, whereas loss accounts usually have debit balances.

Correcting Causes of an Unbalanced Trial Balance

If the trial balance doesn’t balance, your accounting team should investigate and correct errors. Scan and review the trial balance for reasonableness to detect errors. During the accounting close process, check that the trial balance line items are included in the general ledger.

Rules and Principles Governing a Trial Balance

What Are the Rules of a Trial Balance?

To ensure accuracy and uphold the integrity of double-entry accounting, trial balances are governed by several fundamental rules:

- Every debit must have a corresponding credit: This is the foundation of double-entry bookkeeping. If total debits and credits don’t match, it signals an error.

- Only accounts with balances appear: Accounts with a zero balance are typically excluded from the trial balance.

- Accounts are listed systematically: Accounts follow a logical order—assets, liabilities, equity, then revenues and expenses—to mirror financial statements.

- Temporary accounts reset post-closing: After closing entries, revenue and expense accounts should show a zero balance in the post-closing trial balance.

Why These Rules Matter

These rules help maintain financial accuracy and simplify the process of identifying discrepancies, ensuring the general ledger is complete and balanced before preparing formal financial statements.

Steps to Prepare a Trial Balance

Accountants use their accounting software and ERP systems to run trial balance reports from the general ledger data before closing the books.

The seven steps to prepare a trial balance are:

- Prepare transactions and record journal entries.

- List general ledger account balances for all balance sheet and income statement accounts with ending balances or totals.

- Total the debit and credit columns.

- Determine if the debit and credit totals are equal.

- Investigate differences and make correcting journal entries as adjusting entries.

- Prepare an adjusted trial balance to reconcile the unadjusted trial balance. (Show adjusting entries as debits and credits.)

- Rerun the trial balance as a final post-closing trial balance after preparing adjusting and closing entries.

What’s the Role of a Trial Balance in Accounting?

A trial balance is an essential tool for closing the books and migrating to new systems.

Does a Business Have to Use a Trial Balance?

No, a business doesn’t need to use a trial balance, but it should. A trial balance can help a company detect some types of errors and make adjustments to the trial balance and accounting ledgers before the books are closed for the accounting period and financial statements are prepared. Rerun the trial balance after making adjusting entries and again after making closing entries.

Using the Trial Balance for System Migration

It’s important to run a trial balance report and check it during the testing process of migrating from an existing accounting system to a new system that will replace it or add new functionality. The business needs to ensure that all accounts are mapped and included and will be posted to the general ledger. Otherwise, the general ledger and financial statements will be inaccurate.

Lay the foundation for a smarter, faster close

Understanding trial balances is just the start. Discover how AP automation transforms your accounting workflows—cutting manual tasks, reducing errors, and helping you close faster with greater confidence.

What are the Different Types of Trial Balance?

Bookkeepers and accountants or small business owners use different types of trial balance, depending on the stage of the accounting cycle close. Accounting software and ERP systems often generate trial balance reports. Some small businesses use Google Sheets or Excel worksheets or templates for preparing their trial balance documents.

Three different types of trial balance are:

- Unadjusted trial balance

- Adjusted trial balance

- Post-closing trial balance

Unadjusted Trial Balance

What it is

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for account totals in the general ledger are equal. The trial balance includes balance sheet and income statement accounts. The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger.

Its purpose

After the preliminary Unadjusted Trial Balance, also known as the Trial Balance, is prepared, accountants review it and determine if corrections are required for determining adjusted balances.

Adjusted Trial Balance

What it is

The Adjusted Trial Balance is a second type of trial balance, set up like a worksheet, that includes debit and credit columns for each category: Unadjusted Trial Balance, Adjusting Entries, and Adjusted Trial Balance. Adjusting entries will consist of debit entries and credit entries. The total of the debits and credits should be equal if the books are in balance.

Its purpose

The purpose of an adjusted trial balance is to document correcting debit and credit entries that adjust accounts included in the original unadjusted trial balance.

Post-closing Trial Balance

What it is

After making any required adjustments and closing entries in the accounting records, the trial balance is run again as the Post-closing Trial Balance.

Its purpose

A Post-closing trial balance is used to ensure that debits and credits are in balance and the financial statement reports can be prepared.

As a comparison tool, the following table shows an unadjusted trial balance vs. adjusted trial balance and post-closing trial balance.

| Unadjusted Trial Balance | Adjusted Trial Balance | Post-closing Trial Balance | |

|---|---|---|---|

| When prepared | This first trial balance run is used to identify needed corrections | When identifying adjusting entries for corrections | Finalized trial balance after making correcting and closing entries |

| Total debits and credits balance? | Not always | Yes | Yes |

| Shows adjusting entries in debit and credit columns? | No | Yes | No |

Trial Balance vs Balance Sheet

Comparing balance sheet vs. trial balance: The balance sheet has line items for high-level account balances, containing fewer details than a trial balance and not including income statement accounts. A balance sheet is a financial statement for reporting assets, liabilities, and equity at a point in time.

The trial balance report lists all balance sheet and income statement summary accounts with account numbers and descriptions. The trial balance also shows related debit or credit balance amounts for the balance sheet accounts or income statement account totals by debit or credit.

Is the Trial Balance Considered a Financial Statement for SSARS?

A trial balance is not the same as a financial statement. The AICPA’s Accounting and Review Services Committee (ARSC) issues SSARS (Statements on Standards for Accounting and Review Services). SSARS are rules on Preparation, Compilation, and Review Standards relating to financial statements. According to a Today’s CPA article from the Texas Society of CPAs, these accounting standards for financial statement preparation don’t apply to CPAs providing their clients with a trial balance.

The Pros and Cons of Using a Trial Balance

| Pros | Cons |

|---|---|

| Ensuring total debit account balances equal total credit account balance amounts as a mathematical proof test | Not having all trial balance accounts included in the general ledger (in error) |

| Reviewing account balances as a list with account numbers/descriptions and debit and credit column totals that should be equal, as grand totals | Not recording all necessary entries to include in the trial balance will result in the wrong amount on the financial statements |

| Having the ability to investigate and correct errors before closing the books if debits don’t initially equal credits or for other reasons | Needing to spend time investigating differences when the trial balance total debits and credits totals don’t balance |

| Reconciling and viewing the adjusting entries for corrections and closing entries in an adjusted trial balance. | Not detecting that transactions were miscoded to the wrong account or that debits and credits were to the wrong accounts, if total debits and credits still balance |

| Increasing financial statement accuracy | Delaying the financial close when errors occur |

Know which account should be coded as a debit and which as a credit when recording transactions. Get enough training to handle relevant GAAP accounting principles correctly.

Ensure that all trial balance accounts are posted to the general ledger as part of your review process. When you migrate to new accounting software systems, errors can occur without proper field mapping during the software conversion process.

Trial Balance FAQs

How does a trial balance differ from a general ledger?

Trial balance differs from the general ledger in purpose, detail, and organization.

Trial balance proves that all listed ending account balances are equal for debits and credits before closing the books. General ledger, organized by balance sheet or income statement category, includes all accounting transactions by account for financial statements.

Can a trial balance detect all errors?

No, reviewing a trial balance won’t help you detect all errors. You can check whether total debits equal total credits. From the trial balance alone, you can’t detect missing transactions, general ledger accounts not included in the TB list, or transactions coded to the wrong accounts.

Are cash flow line items included in the trial balance?

Although companies also prepare a cash flow statement for cash flow management purposes and financial reporting, line items in the cash flow statement aren’t included in the trial balance.

Simplify Financial Closes with Tipalti’s Automated Solutions

Tipalti’s unified platform of finance automation software products streamlines accounts payable, mass payments to creatives and freelancers, and other processes, including Procurement and employee Expenses. Tipalti offers advanced FX solutions and the Tipalti Card, a corporate spending card for approved users.

Tipalti AP automation functionality offers AI-driven digital transformation (eliminating paper and manual processes), automated account coding, approval routings, global electronic payments, and payment reconciliation. It results in tax and regulatory compliance simplification, error and fraud reduction, better financial controls, and real-time spend visibility for decision-making.

Ready to accelerate your company’s accounting close through automation but not sure where to start?

Familiarize yourself with the ins and outs of AP automation by downloading our eBook, “Dummies Guide to AP Automation.”