It’s easy to be unsure of the differences between a purchase order and an invoice, especially if you’re a new business owner. Purchase orders from the buyer’s procurement department and invoices from the vendor’s billing department have similarities and differences.

It’s important to know the differences between these two documents in your procurement, AP recording, and payments processes. Understand how they’re matched to avoid wasted organizational spend.

Purchase Order vs. Invoice

The difference between a purchase order and an invoice is that the buyer issues a purchase order, which is to be fulfilled by the vendor. In contrast, the vendor issues an invoice after fulfilling a purchase order, and the buyer must pay it.

Main Differences Between POs and Invoices:

| Comparison Factor | Purchase Order | Invoice |

|---|---|---|

| Purpose | To place an order with a supplier to purchase goods or services | To pay for goods or services with credit terms |

| Timing | Before purchase | Issued to the customer upon shipment or service performance |

| Created By | Customer | Supplier |

| Approved By | Purchasing manager and accepted by the supplier to create a legally binding contract | Designated manager with budgetary control; may require two approvers depending on the invoice amount vs. company policy |

| Triggers Payment | No | Yes |

A purchase order is sent by the buyer to the vendor in order to track and manage the purchasing process, whereas an invoice is sent by the vendor to the buyer as an official payment request for the goods or services that the vendor has provided.

Although a purchase order and an invoice contain much of the same information, they serve two distinct purposes.

Key Information Found on a PO vs an Invoice:

| Shipment date | No | Yes |

| Has the order shipped yet? | No | Yes |

| Invoice number | No | Yes |

| Balance due | No | Yes |

| Payment methods | No | Yes |

| Approval signature | Yes | No |

| Purchase requisition number | Yes | No |

| Serial numbers | No | Yes, if applicable |

What is a Purchase Order?

At the beginning of a business transaction, the buyer issues a purchase order (PO). This document records the client’s expectations for the products or services needed, as well as the quantity, pricing, and terms. Then, the purchase order is sent to the supplier for approval. After it has been approved, the purchase order is a legally binding contract.

When the purchase order terms are met, the seller issues an invoice. An invoice contains the previously agreed-upon amount, which the buyer must now pay once the order is fulfilled. It can also specify payment choices for the seller, like electronic payments (EFTs), among others like higher fraud-risk paper checks.

For reference, an invoice contains the original purchase order number. This will demonstrate to the buyer’s finance team that this transaction had previously been budgeted for and approved, and could help the vendor or supplier get paid faster.

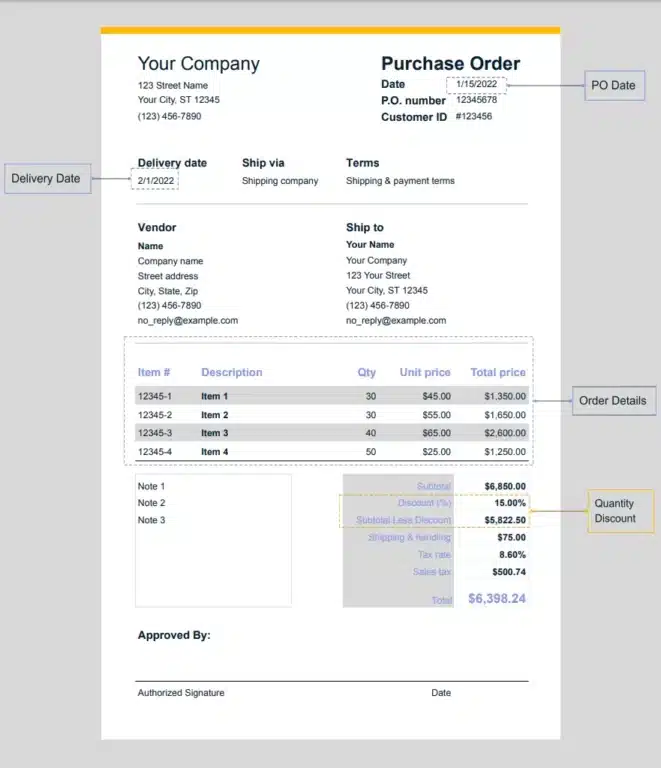

A purchase order form is a sequentially numbered, legally binding contract for a business procurement transaction after acceptance by the vendor. A purchase order includes order details, shipping and contact information, and contract terms, including payment terms. The purchase order is prepared by procurement, approved, and submitted to a supplier or vendor to initiate a purchase.

Information a Purchase Order Contains

The purchase order contains this information:

- Unique PO number

- Terms of purchase, shipping, and payment

- Expected delivery date

- Contact information for the buyer and seller

- Billing and shipping address

- Line items by item number, description, quantity, price, extended price (quantity x unit price)

- Discounts applied (if any)

- Subtotal

- Sales tax

- Total

When a Company Uses a PO

A company uses purchase orders for order placement at these times:

- After the purchase requisition is approved

- After vendor selection from competitive bidders

- For a release of goods under a blanket purchase order

For lower-cost items like office supplies not ordered in bulk, a business may not require purchase orders because the cost of preparing a PO in procurement is costly relative to the price of the item.

After the Purchase Requisition is Approved

Any underlying purchase requisition and the purchase order form are approved before submitting the PO to a vetted and approved vendor.

After Vendor Selection from Competitive Bidders

A company uses a purchase order prepared by the procurement or purchasing department to order goods from a vendor after bids are obtained, and the vendor is selected to fill an order.

For a Release of Goods Under a Blanket Purchase Order

When the business can get volume discounts for all orders from a vendor within a specific time period, the company may issue a blanket purchase order and then release underlying sub-purchase orders periodically when it’s time to order goods from the vendor under the large blanket purchase order.

What is an Invoice?

An invoice (also known as a billing statement or payment request) is a bill from a supplier to a customer to request payment for goods purchased and shipped or received in person. The invoice status may be open for customer billing on an account until it is paid, or the status is paid if the customer pays immediately in a store or through online e-commerce.

Information an Invoice Contains

An invoice includes:

- Unique sequential invoice number

- Invoice date

- PO number

- Date of the order (order date)

- Shipment or purchase date

- Shipping address

- Shipping and payment terms

- Due date

- Terms of payment

- Vendor contact information

- How and where to pay

- Line items

- Product numbers

- Description of goods or services

- Quantity of goods, price, discount, extended line item amount

- Subtotal

- Sales tax rate and amount (if applicable)

- Shipping costs

- Total invoice amount

- Less: Payments to date (if any)

- Total amount due

Invoice templates are available in accounting software and online as examples.

When to Use an Invoice

A company uses an invoice at these times:

- Upon shipment or receipt of goods

- When a customer uses a credit card for later payment

- For invoice processing in accounts payable or accounts receivable

- For ongoing subscription billings or other recurring invoices

- For down payments or progress payments

- When a proforma invoice is needed for business reasons

Upon Shipment or Receipt of Goods

A company uses an invoice to bill the customer upon shipment or in-person receipt of the goods or services by the customer from a retailer or online software download or SaaS or media subscription launch.

If the invoice is issued on account, it’s an open invoice in the seller’s accounts receivable and the buyer’s accounts payable aging detail. When paid, it’s a paid invoice or closed invoice.

When a Customer Uses a Credit Card for Payment

Customers often have the option to pay an invoice later with a credit card if offered credit terms by the supplier.

The purchase is considered paid if a customer uses a credit card for immediate payment. In this case, an invoice isn’t included in the seller’s accounts receivable account or the customer’s accounts payable account, and it is usually called a receipt.

For Invoice Processing in Accounts Payable or Accounts Receivable

The invoice-to-pay cycle includes vendor invoice processing, approval, and payment. Vendor invoices received for payment on account are included in accounts payable. The sellers include each sales invoice sent to customers in accounts receivable, using accounting software.

For Ongoing Subscription Billings or Other Recurring Invoices

Businesses may issue recurring invoices when the customer is obligated to make multiple payments. An example is recurring invoices for monthly software subscription payments.

Sometimes, instead of issuing recurring invoices for each payment, the vendor may issue receipts to verify they’ve received the customer’s payment. Customer payments may be set up as automatic recurring ACH (in the U.S.) or credit card payments.

For Down Payments or Progress Payments

A customer may be invoiced for a down payment or progress payments on a construction contract or high-cost equipment purchase.

When a Proforma Invoice is Needed for Business Reasons

A proforma invoice is a preliminary invoice like a quote that isn’t legally binding. The seller may issue a proforma invoice to the customer to confirm the proposed terms of sale or when it’s needed for specific business purposes.

According to the U.S. government’s International Trade Administration within the Department of Commerce:

A pro forma invoice is a quote in an invoice format that may be required by the buyer to apply for an import license, contract for pre-shipment inspection, open a letter of credit or arrange for transfer of hard currency.

Master PO and invoice processes with seamless automation

Discover how AP automation can streamline your entire accounts payable workflow—from purchase orders to invoices—boosting efficiency, reducing errors, and enhancing compliance.

Purchase Order vs Invoice: Similarities

Some similarities between a purchase order and an invoice are presented in a table.

| Similarity | Purchase Order | Invoice |

|---|---|---|

| Sequentially numbered | Yes | Yes |

| PO number | Yes | Yes |

| Buyer and Vendor name and contact information | Yes | Yes |

| Terms | Yes | Yes |

| Line items information for items shipped to the customer | Yes | Yes |

| Shipping address | Yes | Yes |

| Sales tax | Yes | Yes |

Importance of Both Purchase Order and Invoice

A purchase order and an invoice are important for small businesses, mid-size, or larger companies because they establish budgeting, spending, and internal control over purchasing goods and services through tracking, approval, and adherence to company policy. Good purchasing management and finance department management improve cash flow.

Purchase orders and invoices control billing and procurement (purchasing processes) through issuing and accounting for a sequence of invoice numbers and purchase order numbers. Having a reliable purchase order process and receiving process are essential for ordering inventory, contributing to effective inventory management.

Why a Purchase Order is Important

There are a variety of reasons why you might wish to use purchase orders for order placement, whether you run a small or large organization. You can do the following things with a purchase order:

Place an Order for Goods or Services

A purchase order is most commonly used to place an order for goods or services. When you create a purchase order, you specify the items you need and the quantities of each item. You may also include specific instructions for the supplier, such as delivery date or payment terms.

Get Approval for the Order

A purchase order is not a binding contract, but it does serve as an official request for goods or services. The supplier cannot begin fulfilling the order until they have received written confirmation from your organization, typically in the form of a purchase order acceptance.

Track the Order

A purchase order can help you track the status of your order, from the time it is placed until it is delivered. This information can be helpful in compiling reports and analyzing spending trends.

Effectively Manage Your Inventory

Companies frequently lack clear inventory visibility, which leads to issues such as inventory stockouts. A purchase order system will assist you in determining how much stock to maintain and when to replenish it, allowing you to optimize your operation and improve your inventory management.

Improve Company Budget

You’ll need to determine order quantities and costs before the project is initiated in order to issue accurate POs for a large project. This should help you budget for such initiatives more effectively.

Serve as a Reminder of What was Ordered

If there are any changes to the original order, a purchase order can serve as a reminder of what was originally requested. This can help avoid any confusion or miscommunication between your organization and the supplier. For example, you risk generating duplicate requests and losing money if you don’t have a purchase order in place.

Serve as Evidence of an Agreement Between Your Organization and the Supplier

These legal documents include payment terms and other contractual terms that are effective once the purchase order is accepted by the vendor and the goods are shipped to the customer and received. Purchase orders set clear expectations shared by buyer and seller, including financial terms.

As a legally binding document, if there is a dispute between your organization and the supplier, a purchase order can be used as evidence of the agreement between both parties.

Why an Invoice is Important

Invoices are important for businesses for these reasons:

- Manage current liabilities and plan cash flow

- Standardize the payments process

Manage Current Liabilities and Plan Cash Flow

Receiving invoices lets your business manage current liabilities, know when invoices will be due, and plan cash flow for payments.

Standardize the Payments Process

With invoices, you can streamline the payables and payment processes using AP automation software’s best practices for invoice processing.

Spend after PO Approval and Receipt of Goods or Services

Invoices include the purchase order number so the invoice details can be compared and checked for discrepancies when the invoice and PO matching occurs as part of the verification of a vendor invoice process before payment. Businesses match invoice details with PO details and a packing slip/receiving report corresponding to items received from the purchase order to verify and approve valid invoices for payment.

Take Early Payment Discounts

Due dates and early payment terms included on invoices can lead to paying vendors (or collecting accounts receivable) on time and earning early payment discounts.

Make Tax Season Less Complicated

Keeping track of your invoices protects you and your business, and it makes auditing and settling your accounts easier later.

What Is a Purchase Order Number?

A purchase order number (PON) is a unique identifier assigned to a purchase order document. The PON is typically composed of numbers and letters and is used to track the progress of the order from creation to delivery.

The purchase order number should be referenced in any communication between suppliers and buyers regarding the order. Doing so will help to ensure that all parties are on the same page and avoid any confusion.

A PON is also important for reconciling orders with invoices. The invoice should include the invoice number and the purchase order number. Match the invoice with the purchase order to confirm that the items listed on the invoice were actually ordered and received by the company.

Types of Invoices

Purchase Invoice

A purchase invoice serves as a record of the goods received and shipped, documents the terms of the purchase agreement, and requests payment.

A purchase invoice records the purchase of goods or services by a company. The purchase invoice will include the same information as a regular invoice, but it will also list the terms of the purchase agreement and any discounts negotiated.

A purchase invoice is a document that specifies the products or services purchased by a customer and the corresponding price. The invoice is sent to the buyer after the purchase has been made and is matched to the corresponding purchase order and goods received note before payment is issued.

Sales Invoice

Sales invoices are issued and sent by the seller to the buyer after they have delivered products and services.

A sales invoice’s aim is to detail the items and services delivered, the quantity of each, and the conditions of sale, including delivery method and payment due date.

PO vs Invoice vs Receipt vs Quote vs Sales Order

A quick breakdown of other common terms that often get mixed up with purchase orders and invoices:

| Document | Purpose | Issued By | Issued To | When Issued |

|---|---|---|---|---|

| Quote | Provides an estimated cost for goods or services | Seller | Buyer | Before the purchase agreement |

| Purchase Order (PO) | Authorizes the purchase of goods or services | Buyer | Seller | Before the purchase |

| Sales Order | Confirms the sale of goods or services to the buyer | Seller | Buyer | After the buyer accepts the quote or order |

| Invoice | Requests payment for goods or services provided | Seller | Buyer | After goods/services are delivered |

| Receipt | Proof of payment or delivery of goods/services | Seller | Buyer | At the time of delivery or payment |

Understanding the distinct roles of purchase orders, invoices, sales orders, receipts, and quotes is crucial for streamlining procurement processes, ensuring clarity, and maintaining accurate financial records.

Managing Your Company’s Purchase Orders and Invoices

Efficiently and adequately managing purchase orders and invoices requires a switch from manual preparation to automation.

Manual POs and Invoices

Manually managing purchase orders and invoices is simple initially when a business is still small, and the quantity of purchases is moderate. However, as the business grows, so do the purchases.

Knowing the distinctions and similarities between purchase orders and invoices won’t assist you much here. Even if you use an invoice template, manually creating a large number of such documents can be time-consuming and error-prone. Furthermore, manual records have the tendency to become disorganized — or even worse, disappear — causing issues during disputes or audits.

According to the online education company, Accounting Tools, manual purchase orders come with a few drawbacks:

- Time-consuming for the staff to prepare

- Labor costs for preparation

- Non-value-added activity

Automating Purchase Orders and Invoice Processing

Fortunately, you may eliminate cumbersome, paper-based operations with digital purchase orders and invoicing. You won’t have to make a photocopy of the documents, which might add up quickly if you’re sending out a lot of POs and invoices every day.

Good accounting software integrated with AP automation software can streamline AP workflows and essential time-consuming tasks, including thorough invoice verification. Automated global mass payment processing for accounts payable with a payment schedule can be used with AP automation software. Overall, it’s more cost-effective, secure, and convenient to use a digital solution like purchase order management for procurement with purchase order automation and AP automation software. To learn more about automating POs and invoices, download our eBook, “The Accounts Payable Survival Guide.”

FAQs

Is a PO an invoice?

No. A purchase order, abbreviated PO, is not an invoice. A purchase order represents the submission of an order for goods or services by the customer. An invoice bills for items or services sold to the customer and shipped or received.

Can you invoice without a purchase order?

Yes, but only if company policy allows invoicing without a purchase order for routine, low-cost items.

What does a purchase order do?

A purchase order form becomes an approved official document from the purchasing department that establishes the terms for a vendor order and requests the vendor to fulfill the order upon vendor acceptance of the purchase order to make it legally binding.

Is a purchase order proof of payment?

No. A purchase order is prepared before goods are shipped by the vendor and received by the customer. At that time, the customer isn’t required to pay unless the vendor invoices them for a down payment. A receipt or statement received after customer payment that’s marked paid from the supplier is proof of payment.

Do you need both?

Yes. Your business needs a purchase order to place an order and an invoice to pay for the goods or services after receipt.

Can a PO replace an invoice?

No. A PO can’t replace an invoice because it doesn’t show the items shipped or services performed for which customer payment will be required, as detailed in an invoice.

What’s a 3-way match?

A 3-way match is matching line items on an invoice with the purchase order (PO) and goods received note (GRN) to ensure the items were ordered, received, and billed at the agreed pricing.