PayPal has revolutionized digital payments since starting in 1998. It now enables hundreds of millions of consumers and business accounts globally to send and receive money securely. PayPal allows users to connect bank accounts and cards to make purchases and transfers. It acts as an intermediary, keeping financial details private.

Our guide explores the core functionalities of PayPal for US users, covering its services for consumers and businesses, key products, and how to navigate its ecosystem.

What is PayPal?

PayPal is an online payment system that lets people and businesses send and receive money securely through its website or app. In 2024, it processed over 26 billion transactions totaling $1.68 trillion in payment volume showing the huge scale it operates at.

When you connect your bank account, debit card, or credit card to your PayPal account, it can facilitate online purchases and other digital payments safely. PayPal acts as a trusted intermediary, keeping your financial details private from sellers during transactions. You can use PayPal online, through its mobile apps, or even for in-person payments using certain services.

A Few Key Facts about PayPal

The company is headquartered in San Jose, California, and allows users to transact in over 100 currencies. The company also owns brands like Braintree, Venmo, and Xoom. Key facts about PayPal include:

- Supports receiving payments in over 100 currencies

- Enables withdrawals to bank accounts in numerous local currencies

- Lets users hold balances in 25 currencies

- Owns brands like Braintree, Venmo, and Xoom

- Supports philanthropy through PayPal Giving Fund

- Has its own font called PayPal Sans

Who Uses PayPal?

PayPal is used by a wide range of individuals and businesses. It first became popular for eBay but now has expanded far beyond that. Its reliable service over decades has made it a leading digital payment solution. PayPal offers easy signup compared to traditional banking processes for payment services, letting almost anyone start using it quickly.

How Does PayPal Work as a Consumer?

PayPal acts as a digital wallet and intermediary between users’ bank accounts/cards and merchants. Users link their financial accounts to their PayPal account. For online purchases, they select PayPal at checkout, keeping their bank/card details private.

Money received into a PayPal account is held as a PayPal balance. This can be used for purchases, transferred to a bank account, or replenished from a linked account.

Key features include money transfers, buying/selling cryptocurrencies, debit/credit cards, and check cashing for individuals. Merchants get payment processing, invoicing, shipping help, and business financing.

Basic PayPal Personal accounts are free for many common activities like sending domestic personal payments funded by a bank account or PayPal balance, but fees apply for certain services like currency conversion.

PayPal offers a website, apps, and integrations with shopping carts and POS systems. Security is a priority including protection programs and two-factor authentication.

Making Payments with PayPal

Sending money to another PayPal user is easy. You just need their email or mobile number linked to their PayPal account. In your account, click “Send”, enter the recipient’s info, amount, choose funding source, review details and fees, and confirm the payment.

PayPal tracks all your transactions and uses encryption and fraud monitoring to protect payments.

Receiving Payments with PayPal

To receive money, give the sender your PayPal email or mobile number linked to your account. Or use the “Request” feature by entering the sender’s details and amount.

Businesses can use PayPal Invoicing to create and send professional customized invoices by email or link. It allows tracking invoice status, sending reminders, and accepting partial payments or tips.

Receiving money through PayPal is simple for both individuals and businesses.

Withdrawing Funds to Your Bank Account

To transfer money from your PayPal balance to your linked bank account, log into PayPal and look for the “Transfer Money” or “Wallet” section. Select “Transfer to your bank” and choose the desired bank account. Enter the transfer amount, review details like fees and processing times, and confirm the transfer. Standard transfers are typically free but take a few days while instant transfers are faster but have a fee.

Other PayPal Products for Consumers

PayPal has a number of additional products for consumers, some of the most relevant ones are:

PayPal eChecks (Electronic Funds Transfer)

A PayPal eCheck or electronic funds transfer (EFT) is a payment directly from the buyer’s bank when they don’t have enough PayPal balance or linked card, or choose this method. eChecks take 3-6 days to clear the buyer’s bank before the seller receives the funds, like a digital check. The buyer must have sufficient funds to avoid declines and fees.

Instant Bank Transfers

With instant transfers, the payment is credited to the seller immediately while PayPal withdraws the funds from your bank account. You typically need a confirmed US bank account linked to PayPal and a backup funding source in case the bank transfer fails.

PayPal Credit and “Pay Later” Solutions for Consumers

The PayPal Cashback Mastercard offers 3% cash back on PayPal purchases and 2% on all other Mastercard purchases, with no annual fee.

PayPal Credit provides a reusable digital line of credit to pay over time interest-free if paid in 6 months.

Pay in 4 allows splitting purchases into four interest-free installments.

Pay Monthly is for larger purchases paid monthly over 6-24 months with interest.

Cryptocurrency

PayPal allows customers to buy, sell, and hold select cryptocurrencies directly within their PayPal account. Customers can also use their crypto balance as a funding source at checkout when paying merchants. PayPal will automatically convert the crypto to fiat currency at the point of sale with no additional fees. Exchange rates, which include a spread, will apply to these conversions.

There is also a PayPal-created stablecoin called PayPal USD (PYUSD) that customers can use to buy, sell, and hold value and make payments while avoiding crypto volatility.

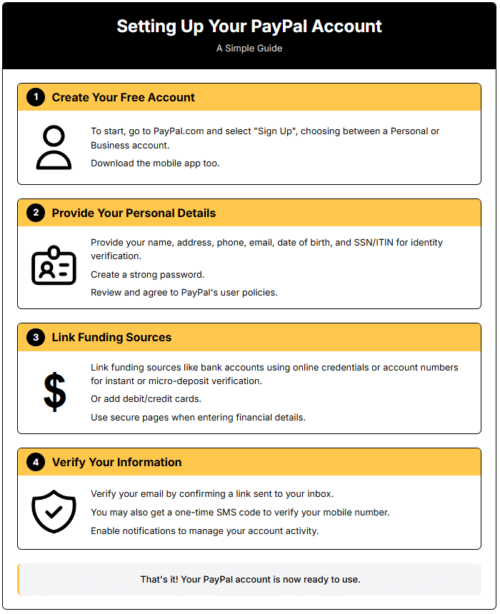

Setting Up Your PayPal Account: A Simple Guide

1. Create Your Free Account

To start, go to PayPal.com and select “Sign Up”, choosing between a Personal or Business account. Download the mobile app too.

2. Provide Your Personal Details

Provide your name, address, phone, email, date of birth, and SSN/ITIN for identity verification. Create a strong password. Review and agree to PayPal’s user policies.

3. Link Funding Sources

Link funding sources like bank accounts using online credentials or account numbers for instant or micro-deposit verification. Or add debit/credit cards. Use secure pages when entering financial details.

4. Verify Your Information

Verify your email by confirming a link sent to your inbox. You may also get a one-time SMS code to verify your mobile number. Enable notifications to manage your account activity.

How does PayPal Work for Businesses?

PayPal’s core payment processing works similarly for businesses as personal accounts. But it is enhanced by specialized products for commercial needs like:

PayPal Checkout

PayPal Checkout integrates into e-commerce websites, offering customers a streamlined way to pay using Smart Payment Buttons that present relevant options like PayPal, Venmo, Pay in 4, major cards, etc. This flexibility can reduce shopping cart abandonment.

PayPal Zettle

PayPal Zettle provides POS hardware and software for in-person transactions. Includes card readers for chip, tap, and swipe payments. Allows businesses to accept major cards, PayPal, Venmo QR codes, and contactless payments.

Online Invoicing

Online Invoicing allows businesses to create and send professional digital invoices, track payments, and send payment reminders. Ideal for service providers, freelancers, and wholesale businesses.

PayPal Business Debit Mastercard

The PayPal Business Debit Mastercard provides access to PayPal balance for purchases anywhere Mastercard is accepted online and in-stores. Often includes benefits like cashback and ATM access.

Shipping and Business Management

Businesses can access discounted shipping rates with carriers like USPS and UPS and streamline purchasing/printing shipping labels and tracking packages through PayPal. Tracking info can help with Seller Protection.

Business Financing Options

PayPal also offers several financing solutions to help eligible businesses manage cash flow and invest in growth.

PayPal Business Loan

PayPal Business Loans are traditional term loans requiring operating history and revenue minimums. Offers fixed weekly payments automatically deducted over several months to a year.

PayPal Working Capital

PayPal Working Capital provides cash advances to businesses based on their PayPal sales history. The advances are repaid through a percentage of the business’s daily PayPal sales. This service can provide businesses with access to capital needed to grow, manage cash flow, or cover expenses.

Understanding PayPal Fees

PayPal charges fees to businesses for receiving online and in-person payments, typically around 3-4% plus a flat fee per transaction. In-person card present rates are lower than manually entered cards. As fees change over time, you may want to check most up to date fees in their official fee schedule for consumers and merchants.

Consumers sending personal payments in the U.S. are often free from bank/PayPal balance, but a 2-3% fee applies from debit/credit cards.

International payments incur transaction fees, cross-border charges, and currency conversion fees if PayPal exchanges the currency. Conversion fees are based on a spread applied to wholesale exchange rates.

Sending money internationally directly to a bank account or for cash pickup using Xoom also has specific fees based on country, currency, and amount.

Exact fees vary and frequently change. Always check PayPal’s website for current rates based on account type, payment method, currency, and transaction details to avoid surprises.

Security and Protection on PayPal

PayPal implements a robust range of security measures and protection programs designed to create a safer environment for both buyers and sellers:

- Encryption technology secures sensitive financial information during transactions.

- 24/7 fraud monitoring with advanced technology helps detect suspicious activity.

- Two-factor authentication provides extra login security via codes sent to your phone.

- Purchase Protection can reimburse buyers for eligible items not received or significantly different than described. Buyers need to file timely claims.

- Seller Protection can cover merchants against claims, chargebacks, and reversals for unauthorized transactions or unreceived items, given certain requirements are met like proof of delivery.

In essence, there are multiple layers of security and protection to enable safe transactions and guard against fraud.

The PayPal Ecosystem: More Than Just Payments

PayPal’s impact goes far beyond just payment processing, it offers various financial services and tools:

- Venmo for peer-to-peer payments and debit card

- Braintree payment gateway for businesses, supporting multiple methods like PayPal, Venmo, Apple Pay

- Xoom international money transfers to bank accounts, cash pickup, mobile wallets

- PayPal Giving Fund charity donations, often with no fees so 100% goes to cause

- Honey browser extension finds coupons, offers cashback rewards

This expansive ecosystem provides diverse payment solutions and financial utilities that extend PayPal’s capabilities and reach.

What’s Next? Maximize PayPal—Then Know When to Expand Beyond It

This overview covers key aspects of how PayPal works today, focusing on U.S. consumers and businesses. PayPal offers a diverse suite of financial services and payment solutions that continue evolving to meet customer needs globally. From money transfers to e-commerce to business tools to cryptocurrency, PayPal provides convenience, security, and flexibility. It remains a major force in digital payments, empowering individuals and businesses alike. But fees, terms, and capabilities change frequently.

As your company grows, you may need payment options beyond PayPal. Our eBook, Beyond PayPal’s Tipping Point, covers knowing when to add other global payment methods and helps you decide what fits your expanding business needs.