PayPal is a widely used platform for sending and receiving money online, facilitating payment services transactions for individuals and businesses worldwide. While convenient, using PayPal often involves fees, which are essential for the company to operate, innovate, and maintain its services. This guide provides an overview of common PayPal fees relevant to users in the United States (US), focusing primarily on business transactions but also covering key consumer fees. Understanding the price structure can help users manage their total amount spent on payment fees.

Why Does PayPal Charge Fees?

While some peer-to-peer personal domestic PayPal transfers funded by a PayPal balance or bank account are free of fees, other uses of PayPal typically incur a transaction fee. As a for-profit financial technology company, PayPal needs to generate revenue through transaction fees. These fees feed into the costs of secure payment processing, platform maintenance, fraud protection measures, customer support, product development, and delivering returns to its investors.

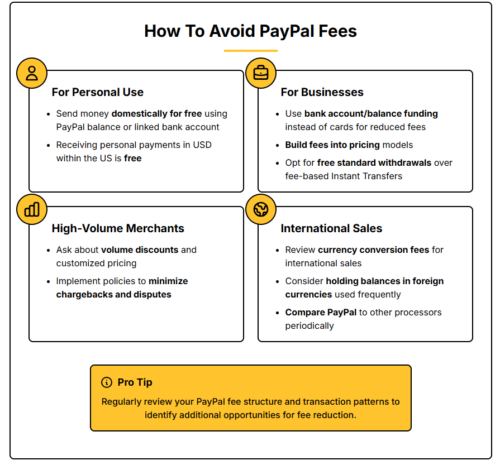

Top Ways to Avoid PayPal Fees

For personal use, sending money domestically through PayPal is free when using your PayPal balance or linked bank account. Receiving personal payments in USD within the US is also free.

For businesses, choose bank/balance funding over cards for eligible international payments to reduce fees, and incorporate average fees into pricing models. Opt for free standard withdrawals over Instant Transfers, which have fees.

High-volume merchants can inquire about volume discounts and customized pricing. Implement policies to minimize chargebacks and disputes.

Review currency conversion fees for international sales and consider holding balances in foreign currencies often used. Periodically, compare PayPal to a solution like Tipalti to ensure it remains cost-effective.

Paying creators, freelancers, or contractors globally?

Try a smarter PayPal alternative.

Understanding How PayPal Fees Work

Before diving into specific transaction rates, it’s helpful to understand a few key concepts regarding how PayPal’s commercial model distinguishes between the types of transactions done and the structure of fees levied for its payment services transactions:

1. Transaction Types

Domestic vs. International

A domestic transaction occurs when both the sender and receiver are registered with PayPal as residents of the United States. An international transaction involves parties in different markets (e.g., a sender in the US and a receiver in the UK). International fees are typically higher due to additional percentage-based fees. The specific country of the recipient can impact the fee.

Commercial vs. Personal

Commercial transactions involve buying or selling goods and services, often through a business account. Personal transactions (often called “Friends and Family”) are for non-business purposes, like splitting a dinner bill. Fees are generally much higher for commercial transactions, and each payment type is assessed differently.

2. Fee Structures

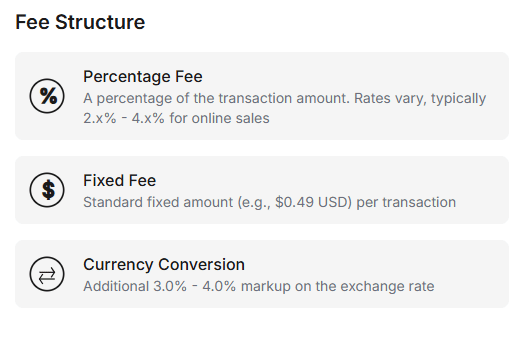

Percentage Fee + Fixed Fee

Most US commercial transactions are charged a payment fee calculated as a percentage of the transaction amount plus a fixed fee. This fixed fee amount varies depending on the currency received; for transactions received in US Dollars (USD), the standard fixed fee for many commercial transactions is $0.49 USD.

For micropayments, the fixed fee can be as low as $0.09 USD for USD transactions, depending on the specific service. For APM transactions, the fixed fee can be $0.29 USD or $0.49 USD for USD transactions, depending on the integration. For PayPal Online Payment Services, the fixed fee for USD transactions is typically $0.49 USD or $0.29 USD, depending on the specific service (or $0.39 USD for Interchange Plus).

Currency Conversion

When a transaction involves converting currencies (e.g., receiving Euros from a sale and converting them to USD in your PayPal account, or paying a foreign payee), PayPal applies a currency conversion spread. This is essentially a markup on the wholesale exchange rate, acting as an additional fee, often around 3.0% to 4.0%, depending on the specifics of the type of transactions. This is separate from any cross-border transaction fee.

PayPal Fee Structure for Business Fees and Personal Fees

Source: Consumer Fees and Merchant Fees

PayPal Fee Calculator

Use our simplified PayPal fee calculator to calculate international fees for your PayPal business transactions or personal payments to determine the final fee payable.

Result:

$0.00

PayPal international fee calculator

PayPal Merchant Fees: Costs for US Businesses

Understanding PayPal’s merchant fees or commercial transaction fees is crucial for managing costs for businesses operating in the US. These fees apply when customers pay for goods or services.

Standard Digital Payments

Receiving payments through methods like PayPal Checkout, Pay with Venmo, and PayPal Credit typically incurs PayPal’s standard commercial transaction rate for digital payments.

This includes payments made using cards like American Express, Visa, and Mastercard, though American Express may sometimes have distinct processing agreements with PayPal for certain services.

Those payments incur a fee of 3.49% + a fixed fee of 0.49 USD for USD transactions.

Send/Receive Money for Goods and Services are priced a bit lower, at 2.99% (plus a fixed fee of 0.49 USD for USD transactions). All Other Commercial Transactions are 3.49% + a fixed fee ($0.49 USD for USD transactions).

In-Person Payments (QR Code and Card Readers)

PayPal offers solutions for accepting payments in person.

QR Code Transactions

Fees for payments received via PayPal QR codes can vary.

- QR Code Transactions (via PayPal):

- 2.29% + fixed fee ($0.09 USD for USD transactions)

- QR code Transactions through third-party integrator: 2.29% + $0.09 USD

Card Reader Transactions (Card Present)

Using a PayPal card reader for chip or tap payments (sometimes referred to under the Zettle brand) typically has a different rate, often lower than online “card-not-present” transactions.

- PayPal Zettle:

- Card Present Transactions: 2.29% + $0.09 USD

- Manual Card Entry Transactions: 3.49% + $0.09 USD

- QR code Transactions (Zettle): 2.29% + $0.09 USD

Standard Card Payments

If customers pay directly using their debit or credit card through your website integration (without logging into a PayPal account, sometimes called Guest Checkout), the fee for standard domestic debit/credit card payments processed by PayPal is 2.99% + the standard fixed fee of $0.49 USD for USD transactions.

Advanced Card Payments and Gateway Fees

Businesses needing more features might use services under PayPal Online Payment Services like Payments Pro, Advanced Credit and Debit Card Payments, or Virtual Terminal.

Advanced Credit and Debit Card Payments

The standard rate is 2.89% + a fixed fee of $0.29 USD for USD transactions. For confirmed charities, this rate is 2.19% + a fixed fee of $0.29 USD for USD transactions. An Interchange Plus Plus option is available at Interchange Pass-through Costs + 0.49% + a fixed fee of $0.39 USD for USD transactions. These services may have monthly fees; Advanced Credit and Debit Card Payments and ACH Services currently list no monthly fee in this specific context.

Virtual Terminal

Allows manual entry of card details. Fees are 3.39% + a fixed fee of $0.29 USD for USD transactions, plus a monthly fee of $30.00 USD. For confirmed charities, the Virtual Terminal rate is 2.69% + a fixed fee of $0.29 USD for USD transactions.

Payflow Payment Gateway (Pro and Link)

For merchants needing only gateway services:

- Payflow Pro: $25.00 USD per month, plus $0.10 USD per transaction.

- Payflow Link: No monthly fee, plus $0.10 USD per transaction.

- Additional services like PayPal Recurring Billing Service, Payflow Pro, Payflow Link, and PayPal Fraud Protection Services may carry additional monthly and per-transaction fees.

International Commercial Transactions

When receiving payment from a customer outside the US, an additional cross-border fee (an international fee) is usually added to the standard domestic percentage rate, which is typically 1.50%. Remember that this is in addition to any currency conversion fees, if applicable.

Receiving Donations

Verified non-profit organizations (501(c)(3) status in the US) can apply for lower charity rates. The standard rate for receiving donations (e.g., via a donate button) is often 2.89% + a fixed fee of $0.49 USD for USD transactions. Confirmed charities may receive a lower rate (e.g., 1.99% + a fixed fee of $0.49 USD for USD transactions domestically). International donations incur the additional 1.50% cross-border fee.

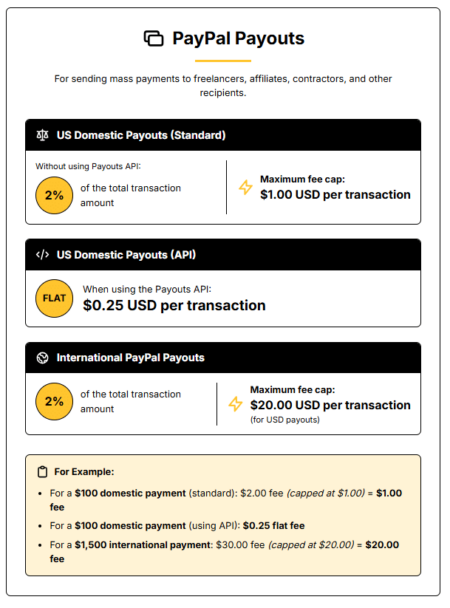

PayPal Payouts for Mass-Payments

PayPal Payouts has specific fees for sending mass payments (e.g., to freelancers, affiliates, and contractors).

- US Domestic Payouts (not using Payouts API): 2% of the total transaction amount, not to exceed a maximum fee cap of $1.00 USD per transaction.

- US Domestic Payouts (when using the Payouts API): A flat rate of $0.25 USD per transaction.

- International PayPal Payouts: 2% of the total transaction amount, not to exceed a maximum fee cap of $20.00 USD per transaction (for USD payouts).

Chargeback Fees

If a customer files a chargeback (requests a refund from their card issuer) and you lose the dispute, PayPal charges a chargeback fee. In the US, this payment fee is $20 USD, though it may be waived under certain Seller Protection conditions.

Dispute Fees

PayPal may also charge a separate Dispute Fee for handling disputes above a certain threshold, designed to discourage high rates of customer claims. Check PayPal’s terms for current applicability and fees in the US.

- Standard Dispute Fee: $15.00 USD for USD original transactions.

- High Volume Dispute Fee: $30.00 USD for USD original transactions.

Withdrawing Funds (Merchant)

- Standard Transfer to linked bank account: Generally free (takes 1-3 business days typically).

- Instant Transfer to an eligible linked bank account or debit card. This option allows faster access to funds but incurs a service fee. This fee is typically 1.50% of the transfer amount, with a minimum fee (e.g., $0.50 USD), and may be subject to limits and/or caps.

- Micropayments: Merchants processing many small-value transactions can apply for micropayments pricing. If approved, the US domestic rate is 4.99% + a fixed fee of $0.09 USD for USD transactions. This can be more cost-effective than standard rates for very small transactions. International micropayments add 1.50% to this rate.

PayPal Consumer Fees: Costs for Personal Use

Here’s a brief overview of common US consumer fees according to PayPal’s consumer fee schedule. These fees are for personal use, distinct from fees business users might encounter with a business account.

Buying Online or In-Store

Making a purchase in USD from US merchants using your PayPal balance, linked bank account, or card via PayPal is generally free for the buyer (the seller pays the fee). Currency fees apply if buying internationally in a different currency.

Sending Personal Payments (Friends and Family) within the US

- Using PayPal balance or linked bank account: Free.

- Using a linked debit or credit card: A fee applies, often 2.90% + a fixed fee of $0.30 USD for USD transactions.

Sending International Personal Payments

Sending money to friends or family outside the US incurs international fees. This typically involves a percentage-based international fee (e.g., 5% of the amount, subject to minimums like $0.99 USD and maximums like $4.99 USD) plus any fee for the funding method (like the card fee, if applicable). Currency conversion fees also apply if the currencies are different.

Receiving Personal Payments

Generally free to receive USD from friends/family in the US into your PayPal balance.

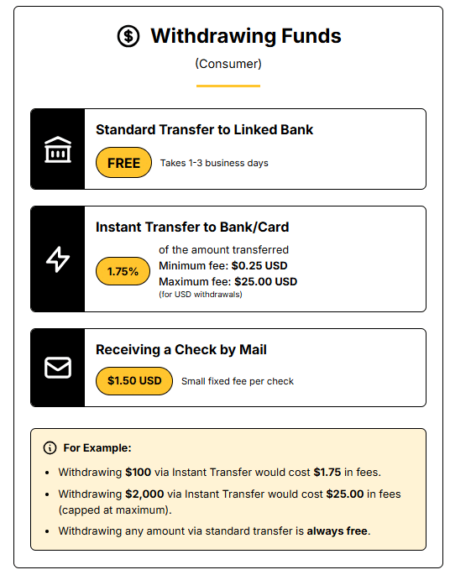

Withdrawing Funds (Consumer)

- Standard transfer to linked bank: Free.

- Instant Transfer to bank/card: The fee is 1.75% of the amount transferred, with a minimum fee of $0.25 USD and a maximum fee of $25.00 USD (for USD withdrawals)

- Receiving a Check by Mail: A small fee of $1.50 applies.

Cryptocurrency Fees

Buying, selling, or holding cryptocurrencies via PayPal involves transaction fees that vary based on the transaction amount. This depends on whether you are directly converting USD into a cryptocurrency or using PayPal’s own Stablecoin PYUSD:

| Buying or Selling Crypto (USD) (excluding PYUSD) | Fee for Buying/Selling | Converting PYUSD to/from Other Crypto (USD) | Fee for Conversion |

|---|---|---|---|

| $1.00 – $4.99 | $0.49 USD | $1.00 – $9.99 | $0.49 USD |

| $5.00 – $24.99 | $0.99 USD | $10.00 – $29.99 | $0.99 USD |

| $25.00 – $74.99 | $1.99 USD | $30.00 – $79.99 | $1.99 USD |

| $75.00 – $200.00 | $2.49 USD | $80.00 – $249.99 | $2.49 USD |

| $200.01 – $1000.00 | 1.80% | $250.00 – $1000.00 | 1.75% |

| $1000.01 + | 1.50% | $1000.01 + | 1.45% |

PayPal Fee Table for Cryptocurrencies

Managing and Understanding Your PayPal Fees

Managing and understanding PayPal fees is important for businesses to control costs. You should regularly review PayPal’s official fee schedule to know the costs of how you mainly receive payments. Make sure your pricing for products or services includes payment processing fees. Be aware of extra fees for international customers, including the 1.50% international commercial transaction fee and the 4.00% currency conversion markups (or 3.00% for non-payment conversions).

Learn about PayPal’s Seller Protection to minimize losses from eligible chargebacks and disputes. Use free standard bank transfers instead of Instant Transfers, which cost extra (1.50% with a $0.50 USD min fee for merchants; 1.75% with a $0.25 USD min / $25.00 USD max fee for consumers), unless you absolutely need immediate access to funds.

If your business transactions are high volume, contact PayPal’s sales team to ask about potential customized or volume-based pricing. While PayPal is convenient, compare its effective rates and features to other payment processors or merchant services to ensure it remains the best option for your specific business needs when choosing payment methods.

Minimize PayPal Fees or Move Beyond Them

Because PayPal fees can and do change, as stipulated in the User Agreement, always refer back to PayPal’s official US website for the most current and definitive information.

PayPal fees can be overwhelming, especially if you’re running a business that’s growing fast and taking on international clients. Things can get complicated. It may be time to branch out and consider a flexible payment solution that can grow with you. Find out if there’s a method that works best in our ebook: Signs You’ve Reached PayPal’s Tipping Point.

FAQs

What are the PayPal fees for businesses?

PayPal typically charges 2.99% to 3.49% + $0.49 per transaction, with higher fees for international and credit card payments.

How can I avoid PayPal fees as a merchant?

Use bank-funded transfers, apply for volume discounts, and consider platforms like Tipalti for mass payouts with lower costs.

Are there better alternatives to PayPal for global payouts?

Yes. Tipalti offers 120+ currencies, tax compliance, and lower cross-border costs—it is used by Twitch, Roblox, and more.