At Tipalti, our innovation philosophy is rooted in expanding the breadth, depth, and simplicity of our platform so finance teams can move beyond manual work and focus on strategic growth. That’s why we’re excited to recap the innovations we delivered so far in 2025 across our suite of finance automation solutions.

Our 2025 product innovation theme centers around three core pillars: supercharging productivity, elevating the user experience, and helping our customers grow with confidence. These goals are based on the real-world challenges our customers face today and are supported by our commitment to leading the vision and shaping the future of finance automation.

Let’s take a closer look at how these themes come to life through the key innovations we launched across our Accounts Payable, Procurement, Expenses, and Card products.

Supercharge Finance Productivity with AI

As we recently announced, we’ve been investing heavily in AI innovation to help our customers boost productivity and eliminate manual work. At the center of these efforts is a more capable Tipalti AI Assistant, our conversational agent that combines deep Tipalti Knowledge with advanced reasoning to save time on routine tasks, deliver insights, and uncover opportunities.

The Tipalti AI Assistant gives finance teams instant access to our platform’s full power through a simple, multilingual chat interface—making it easy to answer finance questions, onboard faster to become Tipalti power users, and generate reports in seconds.

We also introduced more specialized AI Agents designed to address critical finance workflows. The Tax Form Scan Agent automates the processing of US W-9 tax forms by scanning and digitizing them in seconds, eliminating manual entry, reducing errors, and accelerating supplier onboarding.

To simplify ERP troubleshooting, the ERP Sync Resolution Agent jumps in when sync issues occur, quickly identifies the cause, and walks finance teams through how to fix it—no more error logs or guesswork.

Finally, the Reporting Agent brings natural language reporting to finance. Controllers can simply ask, “Show me unapproved purchase requests from last month with details,” and receive a tailored report in seconds. Currently in beta, the Reporting Agent continues to evolve rapidly with improvements driven by customer usage and feedback.

Reporting Agent

ERP Sync Resolution Agent

Tax Form Scan Agent

In Procurement, we’ve rolled out several enhancements to give teams more control and flexibility:

- Contract signature workflows: Embed signature steps directly into purchase request approvals, blocking PO creation until contracts are fully signed.

- Post-approval editing: Modify purchase requests even after approval without restarting the process.

- Item-level splitting: Allocate budgets more accurately by assigning different expense codes to individual items.

- Inline editing during approvals: Make quick adjustments without disrupting the workflow.

Elevating the User Experience for Accounts Payable

In addition to productivity, we’ve focused on making Tipalti more intuitive and enjoyable to use.

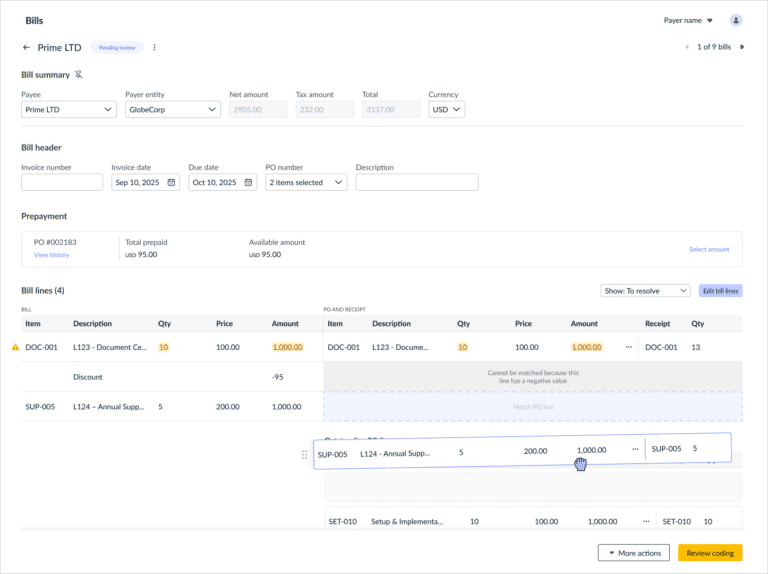

We continue to modernize the key areas of the AP workflow to reduce friction and help teams complete tasks with greater clarity and ease. One of the biggest updates is a redesigned PO-matching experience with a clean, side-by-side layout. This makes it easier to select POs, match line items, and apply coding—all from a single view.

We also introduced a new header-level PO matching view to simplify the process for service-based invoices, enabling teams to complete matches more quickly and with greater confidence.

To bring more control to the AP process, we’ve added approval rules for PO-backed invoices, helping teams enforce consistency across all invoice types.

We revamped the Payments list view with a centralized, information-rich layout to provide more clarity and visibility into your payment workflows.

Finally, we rolled out automated tax rate calculations. When tax codes are applied, the system now auto-calculates tax amounts and clearly tracks any changes, saving time and improving accuracy during review.

Focus on Better Experiences for Expenses

Over the past six months, we’ve rolled out several user experience enhancements to our Expenses offering, all designed to make the lives of employees and finance teams easier.

On the employee experience side, we now have the Expense Receipt Scan Agent to streamline the expense creation process. Employees can instantly create an expense directly from a photo, including the auto-filling of taxes and VAT, which saves time for not only employees but also finance teams.

For busy executives, we now support delegate access, allowing an assistant or proxy to assist with expense creation on a mobile device. We also streamlined the web onboarding process to make it easier for new employees to enter their payment details and onboard quickly.

Additionally, we added several new self-service expense settings to provide finance teams with more control when setting up company policies, categories, and mileage reimbursements. We’ve also made it easier and faster to pay multiple expense groups in bulk.

Growth with confidence: Expanded Virtual Card innovation

We’re really excited about our Pay Bills By Card program, which strengthens our AP offering and can provide an additional source of growth for finance teams.

Pay Bills by Card helps customers earn cash back by paying invoices using virtual card technology. The best part is that the entire virtual card setup is managed by Tipalti with minimal effort needed from customers. Hundreds of Tipalti customers are already taking advantage of our new program—with some earning enough cash back to completely offset their annual SaaS fees.

Fund by Card is a new funding method for US-based Tipalti Customers that allows them to use third-party corporate cards, such as Visa or Mastercard, to fund their Tipalti Virtual Account.

As a result, Fund by Card provides Tipalti payers with fast, short-term liquidity by allowing them to pay now and settle later. It also funds quickly, making it a smart alternative to slower funding methods.

Coming Soon: What’s Next at Tipalti

In the remainder of 2025, we’ll continue to innovate around our core themes of boosting productivity, enhancing user experience, and driving confident growth. :

We have several exciting features on the horizon, including an enhanced Home tab to help finance teams organize tasks and manage cash flow. There’s also greater flexibility ahead in Tipalti Expenses, such as expanded delegation capabilities and customizable approval flows, and a more seamless reconciliation experience with virtual Tipalti Card. Stay tuned for upcoming updates.

Try These Features and Let Us Know What You Think

If you’re a Tipalti customer, many of these new features are already available in your account. We invite you to explore them today and experience the impact firsthand. For a deeper dive, reach out to your Tipalti representative to access a full webinar recording.

New to Tipalti? We’d love to walk you through these new capabilities in a short, personalized demo and show how AI-powered automation can simplify your AP, Procurement, and Expenses workflows.