Sending or receiving money internationally through PayPal can seem easy but their fee structure is complicated. Our summary covers the key fees that US PayPal users need to know for personal and business cross-border transactions. It explains PayPal’s fees for exchanging currencies and sending funds abroad or receiving money from international customers and family and friends.

Can PayPal be Used for International Transactions?

The short answer is… yes! Paypal is available in over 200 different countries, giving companies the option to make cross-border payments and transfers via the app or website at PayPal.com. However, the process differs slightly depending on whether or not both the sender and recipient have a PayPal account.

If both users have a PayPal account, the transaction can be processed through PayPal. If the recipient does not have a PayPal account, the payment can be sent directly to their personal account (depending on the country they are in) via Xoom, another payment service owned by PayPal.

Both options offer relatively fast payment, and Xoom conveniently links with your PayPal to make tracking payments easier.

PayPal International Fee Calculator

Try Tipalti’s PayPal Fee Calculator to quickly and accurately calculate your fees for any domestic or international transaction. Simply enter the transaction amount, the country of the transaction, and whether you want to view the total amount of fees or the total amount you’ll receive after fees.

The PayPal fee calculator is a handy tool for businesses looking to reduce manual processing and human error and spend more time strategizing on the bigger picture.

Does PayPal Charge a Fee to Send Money?

For domestic personal transactions within the U.S. to friends and family, there is generally no fee if you use your PayPal balance or a linked bank account. However, if you use a credit card, debit card, or PayPal Credit to fund such a domestic personal payment, a fee of 2.9% of the transaction amount plus a fixed fee based on the currency will apply.

International money transfers have a different fee structure. Sending money internationally to friends and family, or making/receiving international commercial payments, almost always incurs fees. These fees can vary based on the funding source, destination country, and whether a currency conversion is involved.

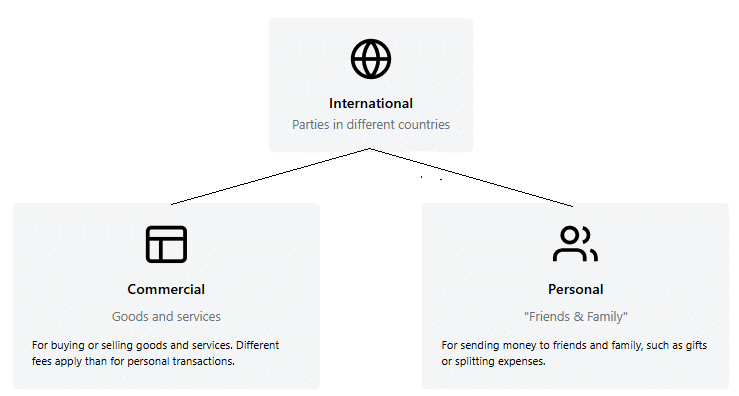

Different Treatment Of Personal and Business Transactions

Personal payments like above are for sending money to friends/family — things like gifts or splitting expenses, while commercial transactions involve buying or selling goods or services. For such transactions, different fees apply. It’s important to correctly identify the payment type. Using personal payments for business can cause account problems and loss of purchase/seller protections.

PayPal Fee Structure for International Transfers

PayPal’s International Fees can be broadly split into Currency Conversion Fees, Fixed Fees and Others

PayPal’s Currency Conversion Fee

PayPal charges a currency conversion fee on top of the exchange rate used. Currently, when sending a payment and PayPal converts the currency, the fee for personal payments is typically 4% added to their wholesale rate. For other conversions like balance transfers, business payments and receiving payments in a foreign currency, the fee is around 3% added to the wholesale rate.

Importantly, PayPal’s exchange rate may not always be the mid-market rate, so the effective rate you get may be less favorable than the mid-market rate at the exact time of conducting a transfer.

Fixed Fees

The term “fixed fee” in PayPal’s international fee structure shows up primarily in two cases:

1) For personal payments funded by a credit or debit card, a fixed fee is charged in addition to the 2.9% funding percentage fee. This fixed fee depends on the currency used – for example, it is $0.30 USD for payments made in US dollars and it applies to cover the card processing cost. This is separate from any international transaction fee.

2) For commercial transactions received by a business, the fee sellers pay includes a fixed portion based on the currency of the payment. For instance, this fixed fee is $0.49 USD for transactions received in US dollars.

This fixed fee is separate from any additional currency conversion fees or international transaction surcharges applied by PayPal. Understanding when these fixed fees apply helps clarify PayPal’s international payment fee structure.

Other Fees

In addition to the primary transaction and conversion fees, there are some other less common fees to be aware of when using PayPal internationally. Card withdrawal fees may apply if withdrawing PayPal funds to certain debit or credit cards..

Dispute fees can be charged to sellers if a customer dispute is resolved in the buyer’s favor through PayPal’s resolution process, and the transaction was not eligible for Seller Protection.. Specialized services like PayPal Payouts and invoicing may also carry distinct fee structures. It’s always best to consult PayPal’s user agreements and fee pages to see a comprehensive list of all potential fees that could apply based on your specific account type and usage.

Key Fees for US Businesses Using PayPal Internationally

It’s vital for businesses to know the difference between fees for personal and commercial transactions. For a US business, common international scenarios are receiving payments from overseas customers and occasionally sending payments to international suppliers or contractors.

Fees for Receiving International Payments for Goods and Services

When a US business receives a payment from an international customer for goods or services, PayPal applies several fees. These typically include

1) The standard commercial transaction rate, which is the base fee for processing the payment, often around 2.99% or 3.49% depending on transaction type plus a fixed fee like $0.49 for US dollar transactions.

2) An additional percentage fee, currently around 1.5%, for international commercial transactions.

3) A currency conversion fee of 3% based on the currency received, if the customer pays in a different currency from the business’s primary holding currency and PayPal performs the conversion.

It’s important to consult PayPal’s current fee schedule for precise rates.

Are Cross-Border and International Seller Fees the Same for PayPal?

Yes–PayPal uses “cross-border” and “international” interchangeably. For US sellers, cross-border and international PayPal fees are the same, so long as the buyer and seller are based in different countries.

Non-US sellers should double-check PayPal’s cross-border fee structures, since some regions are grouped together by PayPal, such as the European Economic Area (EEA). In such cases, a transaction may be treated as a domestic transaction if it occurs between two countries that are part of the same region, so an international seller’s fee may not apply.

Sending International Payments as a Business

If a US business needs to send money internationally, for example to pay suppliers or freelancers abroad, the fees differ from receiving payments.

Using PayPal Payouts to send multiple payments involves per-transaction fees, which can be a percentage of the transaction or a fixed amount, depending on the country and currency.

Currency conversion fees (typically 3.0% for businesses if PayPal converts the currency) would also apply if you send funds in a currency other than your funding source.

For sending an individual payment to another business’s PayPal account internationally (not using Payouts, but as a standard commercial payment), if you are sending money for goods or services, you as the sender do not typically pay a PayPal fee if you fund it with your PayPal balance or bank account (unless a currency conversion is involved). The recipient pays the commercial transaction fee.

Businesses rarely use the personal transaction structure for these payments due to PayPal’s terms and lack of protections.

PayPal International Fees for US Businesses

To summarize potential international transaction fees for a US business using PayPal:

| Scenario | Typical Fee | Currency Conversion Fee |

|---|---|---|

| Receiving International Payment | Standard domestic commercial rate (e.g., 2.99% or 3.49% + fixed fee like $0.49 USD) + International commercial transaction fee (e.g., 1.5%) | Usually 3.0% fee applied to the exchange rate if PayPal converts the currency received to your primary holding currency (e.g., USD). |

| Sending Payment via PayPal Payouts | Varies; often a per-payment fee (percentage or fixed amount). | Usually 3.0% fee if sending a currency different from your funding source. |

| Transferring via Xoom | Transaction fee (varies widely) + Exchange rate markup (Xoom determines its own rate). | Markup is built into the Xoom exchange rate. |

| Converting Balance in PayPal | N/A directly for a transaction, but if you convert a currency balance you hold. | Usually 3.0% fee applied to the exchange rate. |

Please note: These are example scenarios – check PayPal for current merchant rates specific to your account.

International Personal Transactions (Friends and Family)

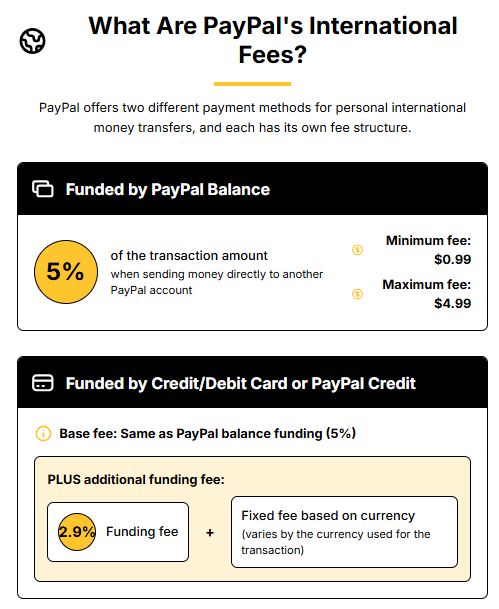

For sending money abroad to friends or family from a US PayPal account, the fee is typically 5% of the amount, with a minimum of $0.99 and a maximum of $4.99, if funded by PayPal balance or bank account.

If funded by credit card, debit card, or PayPal Credit, an additional 2.9% plus a fixed fee is charged on top of the 5% fee. It’s important to understand these personal international payment fees, as they differ from business transaction fees.

If PayPal performs a currency conversion when you send the money, PayPal’s currency conversion spread (typically 4.0% or as disclosed during the transaction) also applies.

Receiving Personal International Payments

When receiving personal international payments as a consumer in the US, there is usually no fee if the money is sent to you in USD to your USD PayPal balance. However, if the sender uses a different currency than your account’s primary currency, PayPal will convert it when you receive the funds.

In this case, PayPal’s currency conversion fee (typically 3% for personal payments) is applied to the exchange rate. So if your friend sends you money from Europe in EUR, PayPal would convert it to USD when it arrives in your account, and you’d pay a 3% conversion fee.

Sending International Payments as a Consumer

Sending international payments as a consumer through PayPal follows the fee structure for personal international transactions to friends and family. If the payment is funded by your PayPal balance or bank account, the fee is 5% of the send amount, with a minimum of $0.99 and a maximum of $4.99.

If the payment is funded by a credit or debit card, the fees are 5% (with minimum and maximum), plus 2.9% of the transaction amount, plus a fixed fee based on the currency used.

In both cases, PayPal’s 4% typical currency conversion fee for personal accounts also applies if they need to convert between currencies.

Summary of Potential PayPal International Fees for Consumers

To illustrate potential international transaction fees for a US consumer using PayPal:

| Scenario | Typical Fee | Currency Conversion Fee |

|---|---|---|

| Sending Personal Payment (funded by PayPal balance/bank) | 5% (min $0.99, max $4.99) | 4% conversion fee may apply |

| Sending Personal Payment (funded by card) | 5% (min $0.99 USD, max $4.99 USD) + 2.9% + fixed fee (e.g., $0.30 USD) | 4% conversion fee may apply |

| Receiving Personal Payment | No fee from PayPal if received in USD to USD balance. | 3% conversion fee may apply |

| International Purchase from a merchant | No transaction fee charged by PayPal to the buyer for the purchase itself, but the merchant pays a fee. | 4% conversion fee may apply |

| Transferring via Xoom | Variable transaction fee + exchange rate markup | Built into Xoom’s rate |

| Converting Balance | N/A (balance management) | 3% conversion fee may apply |

Using Xoom for International Transfers

Xoom, a PayPal service, allows sending money directly to a recipient’s bank account or for cash pickup in many countries. This is an option if the recipient doesn’t have PayPal or prefers these delivery methods.

Xoom fees involve a transaction fee based on the amount sent, payment method, destination, and currency. Sending from a bank account or PayPal balance often has lower fees than using a card.

Xoom also makes money on the currency exchange by applying a markup over the mid-market rate, so the recipient gets less in local currency than at the mid-market rate. It’s important to check Xoom’s rate calculator for the specific costs before sending.

Scaling global payments beyond PayPal

Discover when it’s time to rethink your approach to international fees. Whether you’re minimizing PayPal costs or ready to scale mass payments with smarter automation, learn if you’ve reached PayPal’s limits.

How Do I Avoid PayPal Fees?

PayPal is free only for personal payments made to friends and family within the United States. For international transfers and business transactions, there are transfer fees as described above, as well as merchant fees for goods and services.

Depending on the size and frequency of international transfers, the cost starts to add up. While there isn’t a way to avoid PayPal’s transaction fees altogether, there are ways to mitigate costs.

Here’s how you can best avoid paying full costs with PayPal’s international transaction fees:

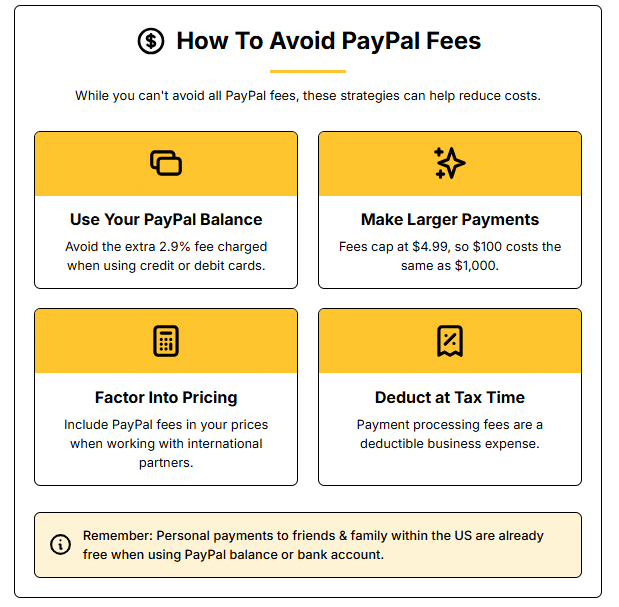

Fund transactions using your PayPal account

This is the easiest way to reduce PayPal’s various fees. Funding transfers with a Paypal account avoid the additional card funding fees (2.9% + fixed fee) when using credit and debit cards.

This might not make a major impact in one-off situations, but over time, those fees add up.

Make larger payments (for international personal transactions to friends and family)

The fee for transferring money directly to another PayPal account is capped at $4.99. This means that sending $100 costs the same as sending $1,000, and so on.

Making fewer payments in larger amounts keeps the relative cost low. Xoom, on the other hand, is not capped in this way.

Factor PayPal costs into pricing

When working with international partners, the cost of payment should be factored into the pricing of the service, especially when transactions are large and/or frequent.

It’s important to work the details out beforehand. The frequency of payments, transaction amounts, and exchange rates should all be factored into the cost of the service. That way, there are no surprises down the road.

Deduct fees at tax time (for businesses)

PayPal and other payment processing fees are considered a necessary cost of doing business and can be deducted from your taxable income at the end of the year. While this doesn’t necessarily reduce the cost of using PayPal, some of that loss can be recouped in the form of tax savings.

What’s Next: Minimize PayPal Fees or Find a Better Fit

Because of PayPal’s global popularity, the convenience of PayPal is hard to beat, but there are a number of options for transferring money abroad.

However, the fee structure, especially for cross-border transactions and currency conversions, can be complex.

At some point, your company may outgrow PayPal. How will you know when it’s time to add other options to the mix? Read more about it in our eBook: Signs You’ve Reached PayPal’s Tipping Point.