Tipalti provides preventative fraud monitoring for the modern accounts payable team with Tipalti Detect

Tipalti Detect has stopped over 7,000 fraud attempts, amounting to over $4 million in estimated savings

San Mateo, CA – September 25, 2017 – Today Tipalti, the leading global supplier payments automation solution, announced the addition of Tipalti Detect™, a sophisticated module for preventative fraud monitoring, to its accounts payable platform. Detect tracks all payee activity and performs in-depth risk checks to flag suspicious activity, such as identifying payees with previously blocked behavior and multiple accounts, giving finance teams peace of mind that they aren’t losing money to fraud while improving network quality.

Digital companies, including advertising networks and online marketplaces, often deploy various tools and processes to mitigate their risk exposure in many areas, but few monitor risk at the actual transaction point or during the payee onboarding process. Tipalti Detect, as an integrated solution within the Tipalti platform, helps identify and prevent potential fraud in the payee/supplier network. This significantly reduces the risk of potential losses from fraudulent activity.

Detect is the first of its kind in the payouts space, offering the only solution that screens for payee risk tied to the payables process. To date, Detect has already blocked more than 7,400 payees and estimates it has saved approximately $4 million in potential fraud risk across its customer-base.

Fraud Detection for Digital Partners

Key features include:

- Identifying blocked payees who are trying to create, or have created, other accounts using misleading information

- Managing a blocked and suspended payees list, while making it easy to monitor this list more diligently

- Blocking or suspending a payee from receiving any payments

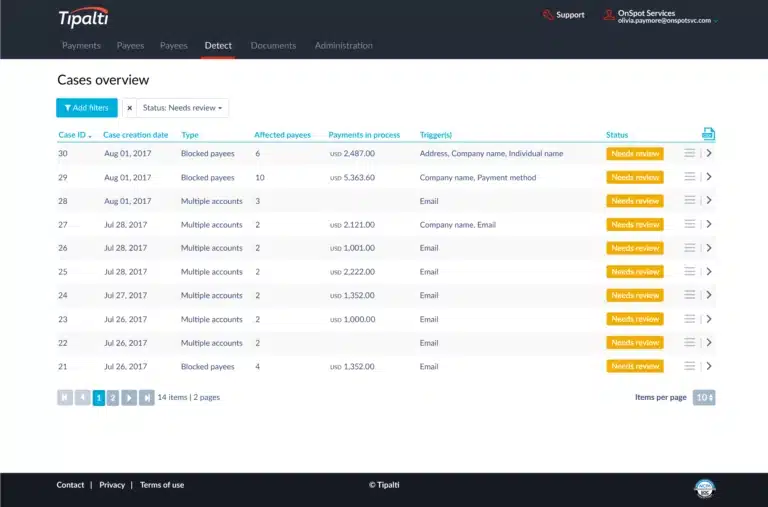

- Allowing finance to manage all fraud and suspicious issues easily via a simple case-management dashboard with detailed notes and audit trail

“Detect’s ability to proactively screen fraudsters in our network has potentially saved thousands in bad payments,” says Jeff Magnolia, VP of Product, Content.ad. “Tipalti’s unique approach to screening payees during onboarding and payment cycles gives us peace of mind in helping reduce fraud risk.”

“Tipalti is focused on the needs and processes of mass payers. Recovering from any fraudulent activity can be very expensive; particularly when you factor in cross-border transactions and certain payment methods, it might even be impossible,” added Chen Amit, CEO and co-founder of Tipalti. “Detect fits holistically into the payment process to identify fraud and validate payees prior to payment, keeping their payments safe while also delivering a better service to payees.”

Businesses that lack an adequate payee onboarding process or a diligent verification process may miss fraud attempts entirely or not realize they’re being exploited. For example, fraudulent activity in the advertising network space is expected to reach $16.4 billion in 2017, up dramatically from the $7.2 billion lost in 2016. The most common types of fraud to affect electronic goods networks are click-fraud and attempts at money laundering. CPA, CPC, and CPM networks are especially prone to such fraudulent activity.