Tipalti’s Research Reveals Gaps in International Supplier Payment Processes

Study Shows Executives Highly Prioritize Streamlining Payment Operations

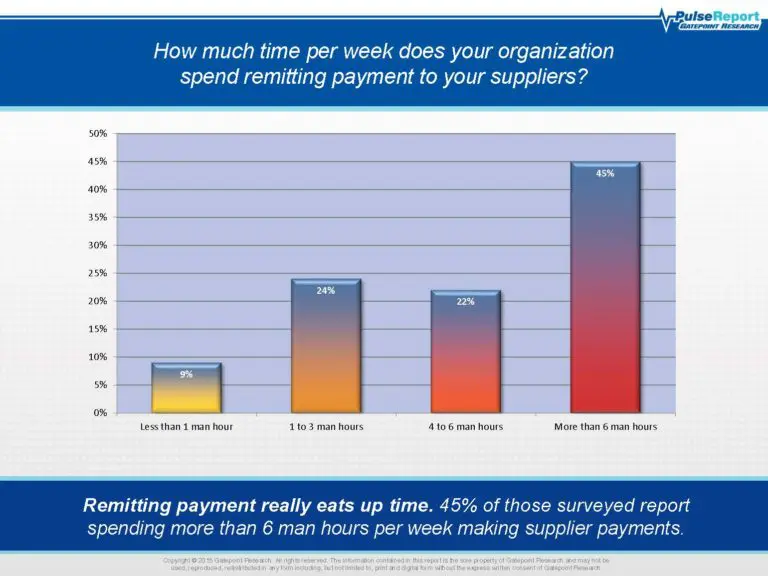

Palo Alto, CA, August 8, 2016 – Tipalti, provider of the leading global supplier payments automation platform, has released findings from a survey of finance and business executives that identifies operational trends for supplier payments in 2016. The study, “Global Payments Operational Trends,” conducted by market research firm Gatepoint Research and sponsored by Tipalti, found that 45 percent of respondents spend more than six hours per week making supplier payments. Additionally, according to the survey, another 22 percent of those surveyed spend an excess of four hours a week onboarding new payees.

The survey found that this workload impacts profitability and productivity since supplier payment operations are essentially a cost center. Many finance teams must trade off time spent on more strategic, analytical, and value-added finance activities in order to manage day-to-day supplier payment processes effectively.

Additional findings from the “Global Payments Operational Trends” survey include:

- The highest organizational priority was to stay compliant with accounts payable tax and regulatory requirements, with 48 percent of respondents saying this was their top AP business goal.

- 82 percent of respondents said that streamlining supplier payment processes is high priority. Automating supplier payment processes was the second highest priority of accounts payable teams overall, with 44 percent of respondents identifying this as their top top near-term business goal.

- 98 percent of respondents organizations send payment to North American suppliers, but the majority also pay suppliers throughout the world. Respondents also foresee an increase in payments to Asia Pacific, Latin America, the Middle East, and Africa.

- Many types of payments are used worldwide. Respondents report making payments by check (86 percent), wire transfer (83 percent), ACH (82 percent). Another 49 percent used Global ACH / eCheck to pay their international suppliers.

- 79 percent of new suppliers are onboarded using manual processes. New payees are manually onboarded via email (43 percent) or by direct contact (36 percent).

- In terms of technology in place to collect tax information, respondents report collecting tax information via email (43 percent), in-house software (32 percent), or third-party software (18 percent).

“As companies look to grow and scale their businesses, they will either need to invest more in accounts payable resources/personnel or identify technology to help automate their supplier payment processes,” said Chen Amit, CEO and co-founder of Tipalti. “Finance leaders of both small and large companies need to proactively determine the best approach to handle their increasing volume and complexity of global supplier payments. Consider how the costs related to managing supplier payment operations distract from your ability to focus on more strategic and growth-oriented opportunities.”

The “Global Payments Operational Trends” survey was conducted earlier this year between February and May 2016. Gatepoint polled 100 finance executives: including C-level, vice presidents, director and managers. Participants represented U.S. companies across a range of industries including retail, business services, technology and media sectors with annual revenues between $20 million and over $1.5 billion.

The complete Gatepoint Research study can be accessed here.