See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

Simply put, a disbursement is money that is paid out from a dedicated fund. This includes operating expenses like rent, interest paid on loans, and cash dividends to shareholders.

Although disbursements are commonly found in business spending, there are other forms of disbursement in escrow, education, and special funds. Analyzing your disbursements is essential when determining your organization’s spending levels to manage your cash flow.

Understanding every part of cash flow, including disbursements, is crucial to your business’s success. Any mistakes in your payments could lead to failed audits, penalties, and other charges but these mistakes are easily avoided if you know how to handle disbursements.

How do Disbursements Work?

Disbursements are paid in cash or an equivalent method by your company during a specific period of time, like a quarter or a year. If you use the accrual method of accounting, you would report your disbursements when they occur, not when they are paid.

During this process, your accounting department records each transaction, then posts them to a cash disbursement journal or the general ledger. The overall cash balance of your business is adjusted accordingly to account for the disbursement. Each entry includes:

- Date

- Payee name

- Debited or credited amount

- Payment method

- Purpose of the payment

- Account coding

What is a Cash Disbursement Journal?

Sometimes known as a cash payments journal, a cash disbursement journal is an itemized record of all of a company’s financial expenditures. Your accounting department usually records payments in a cash disbursement journal before posting them to the general ledger.

A cash disbursement journal typically includes double-entry bookkeeping debit and credit entries. Cash paid is recorded as a credit to a cash account. Once invoices are paid, they are recorded as a debit to accounts payable to reduce the credit balance in that account. An immediate cash payment not billed for later payment is a debit to the expense account or asset.

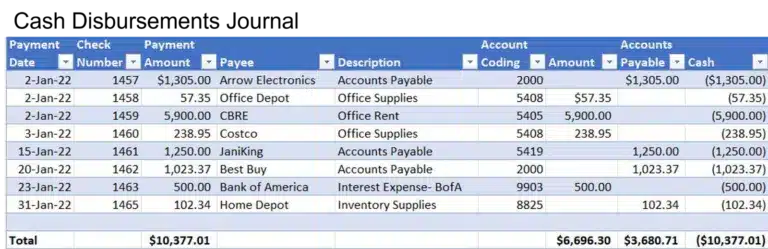

Accounting software and ERP systems can automatically generate cash disbursement journals, as shown below:

Besides generating a monthly cash disbursement report, accounting software can also create a cash disbursement report for specific dates. For example, you can filter by month-to-date, quarterly, or year-to-date cash disbursements and prepare real-time reports for analysis.

A cash disbursement report can help you keep track of cash-based spending during the year to better manage your company’s cash flow.

Types of Disbursement

Disbursement is a more general term that refers to payments made in cash or a cash equivalent. But some forms of disbursement apply only in specific financial situations. Below are five different types of disbursement you’re likely to encounter during the accounts payable process:

Cash Disbursement

Cash disbursements measure how much money actually flows out of the company, which can be separate from profit and loss. These payouts are made in several ways, including checks and electronic funds transfers.

Controlled Disbursement

This type of disbursement is only available to companies. As the name implies, controlled disbursements allow a company to manage disbursements over a controlled period of time, usually on a daily basis.

A controlled disbursement enables a company to review and structure payments while maximizing earned interest. Companies can leave assets in high-interest accounts to keep on generating profit, while lower interest-earning assets are used to make immediate or short-term payments.

Delayed Disbursement

Also known as remote disbursement, delayed disbursement deliberately drags out the payment process by issuing a check from a bank located in a remote region.

This practice originated in the days when banks could only process a payment after receiving the physical check, which could delay the debit to a payer’s account for up to five business days. However, the widespread use of electronic checks has made this technique less practical.

Disbursement Check

When you write a check from a business account, that form of payment is typically referred to as a disbursement check. This term is never used for personal finance, only company payments.

Disbursement Voucher (DV)

A cash disbursement voucher is a method used by some organizations to authorize cash payments to vendors for goods and services, to individuals for petty cash fund reimbursement, or for other special fund disbursement payout purposes. Automated online payment systems that offer other online disbursement controls may not require paper-based voucher forms.

What are Examples of Disbursements?

Disbursements can be found in contexts other than corporate finance, such as legal costs and student loans. For example, when a law firm pays for billable expenses on behalf of a client that will later be reimbursed to them, those payments are considered disbursements. A startup could also receive a disbursement from a dedicated venture capital fund.

Another form of disbursement is payment from financial aid funds like grants, scholarships, and student loans to a student’s account (after tuition to the university is deducted). For example, students or “borrowers” who receive federal student aid might get a loan disbursement from the U.S. Department of Education.

The example below covers disbursements of funds for purchases, including related disbursement accounting procedures:

TechNoGadget (TNG) buys $5,000 in raw material inventory from a vendor for the top-selling product that it manufactures. The inventory is purchased using an approved purchase order. The vendor offers 2/10 net 30 credit terms to its customer TNG.

When TNG receives the inventory and the vendor invoice, it records the invoice at the gross invoice amount before the early payment discount. The entry before payment is a debit to inventory-raw materials and a credit to accounts payable.

When TNG takes the early payment discount, it:

- Records a $100 credit to purchase discounts for the amount of the early payment discount

- Debits accounts payable for the gross invoice amount originally recorded to reach a zero balance

- Makes a credit to cash for the actual amount paid (net of the $100 discount)

An entry to record the payment is included in the cash disbursement journal when the disbursement or cash payment is made. The cash disbursement journal is posted to the general ledger every month.

FAQs About Disbursements

Although disbursement seems pretty straightforward, the concept might be confusing in practice. The term is often found in many financial situations, so let’s go over some commonly asked questions about disbursements:

Are Disbursements Considered Expenses?

No, disbursements are different from expenses. For vendor invoices with credit terms, expenses or asset purchases like inventory or fixed assets may be recorded before a disbursement or remittance pays the cash to a supplier. Some expenses like depreciation and amortization are non-cash expenses that are not considered disbursements.

Is Disbursement a Refund?

In certain situations, yes. When students and parents receive financial aid, a disbursement is the payment of funds to support a student’s education for the next semester. If the amount disbursed exceeds the actual cost of tuition and fees, the excess is refunded directly to the student.

What is the Difference Between Disbursement vs. Reimbursement?

Disbursement isn’t the same as reimbursement. Disbursements are payments in cash or cash equivalents. In comparison, reimbursement refers to the actual payment to cover the original disbursement.

For example, when attorneys pay expenses on behalf of a client, the money paid to a third party is a disbursement. When a law firm bills their clients for repayment of these expenses, and the clients pay their invoice, that’s a reimbursement.

What is the Difference Between a Payment and a Disbursement?

All disbursements are payments, but not all payments are disbursements. A disbursement is a finalized payment that has been officially recorded as a debit by the payer and as a credit by the payee.

What are Digital Disbursements?

Digital disbursements are all types of electronic funds transfer (EFT) payments, including:

• ACH bank transfers and global ACH

• Wire transfers

• Card payments

• Wallet app money transfers like Venmo and PayPal

Some mobile apps can only process types of digital disbursements using an email or phone number. A digital disbursement to a payee doesn’t use a paper check for payment.

Additionally, a digital disbursement via ACH can include one-time or recurring ACH transfer payments between bank accounts and direct deposit into a bank account.

The timing of money received depends on the payment method. With digital disbursements, receipt of the disbursement can vary from instant payment with eWallets, to the same/next business day with ACH or domestic wire transfer, to several days for an international wire transfer.

What is a Disbursement Fee?

A disbursement fee is an additional charge from a vendor to cover payments made on behalf of their clients. For example, a courier service may pay the duty and taxes for a package on behalf of a customer, then charge a disbursement fee to cover those payments.

Stay On Top of Disbursements To Monitor Business Spending

Disbursements are part of your cash flow and form a record of your daily expenditures, but they may differ from actual profit and loss. If you find that your revenue exceeds those outflows, it could be an early sign of insolvency.

Automating your accounts payable processes frees up your team’s time and resources and enables you to rapidly scale and adapt to changing business needs. To learn more about how Tipalti can transform your business with a single automated AP solution, book a free demo today.