Electronic billing (e-Billing) eliminates paper invoices and replaces them with digital versions, ramping up business and system efficiency for the supplier and customer. Bill payment is done electrically within the e-Billing process. Electronic billing reduces costs, streamlines workflows, and improves cash flow.

What is Electronic Billing (e-Billing)?

Electronic billing (e-Billing) is a method of sending and paying bills electronically, rather than through paper billing processes. Billing electronically makes it easy for customers to receive bills online, in a supplier portal, via email, or in machine-readable data formats.

Electronic billing lets customers and businesses digitally send invoices and payments to each other, providing clear insight for each party.

The eBilling process is fast, efficient, and streamlined for customers and vendors alike, which is why electronic billing is more suitable for modern accounts payable teams.

An e-Billing and e-Payment portal usually allows the payer to access copies of their e-bills and manage or update information. E-billing is a fundamental component of modern finance. It’s leveraged by both accounts payable (AP) and accounts receivable (AR) departments to help automate workflows and reduce reliance on paper-intensive processes.

Self-billing in Electronic Billing

Self-billing is a unique type of electronic billing (e-Billing) where the payer actually generates the invoice or bill on behalf of the supplier or payee. Self-billing is sometimes used to expedite the AP process because it reduces the time that the payer must wait for the supplier to generate the bill.

Certain supplier relationships exist where the payer determines the amount to be paid to the supplier; therefore, traditional invoice and purchase order workflows don’t apply. Online marketplace payments, royalties, and affiliate commissions are all examples of non-invoice spend.

In these situations, self-billing is a fundamental component of the AP workflow, ensuring that a proper audit trail exists and making reconciliation less difficult. Self-billing is especially common in Europe and countries where payments are required to be supported by an invoice. In certain situations where a Valued Added Tax (VAT) is required, self-billing is beneficial to suppliers because it ensures that the payer is accurately assuming responsibility for the associated VAT.

What is an e-Bill?

An e-bill (electronic bill) is a digital invoice generated by the supplier in an accounting or financial software solution. It’s instantaneously sent to the payer in digital format by email or a web-based portal for processing the payment electronically in their software system.

What’s Included in an e-Bill?

E-bills typically look a lot like paper bills. In many cases, an electronic bill is merely a digital version of the physical bill, often presented in PDF format. E-bills generally contain all pertinent information that relates to the payment, such as date, amount, due date, and payment terms. In a fully electronic billing system, the e-bill will also contain a link or instructions to access a payment portal where the bill can be viewed and settled or paid.

e-Bill Example

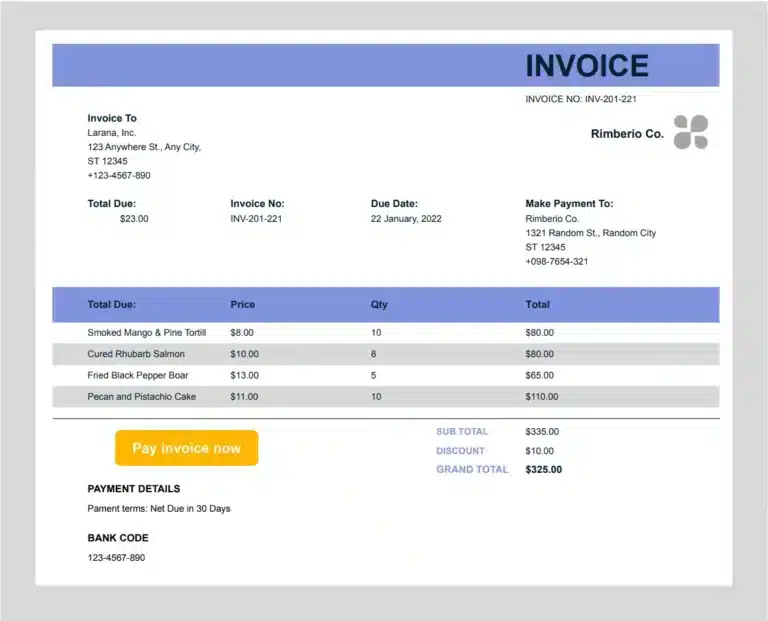

The following invoice is a digital e-Bill example that includes a Pay invoice now button for the customer to use for sending an electronic payment. It’s not provided by the supplier as a paper document to request payment.

What is an Electronic Billing System?

An electronic billing system (e-Billing system) is integrated with the accounting software or ERP system, providing invoicing and accounts receivable functionality to quickly send digital invoices to customers via email, through a supplier portal, or another digital method instead of paper invoices requiring mailing. An electronic billing system includes electronic payment and notifications.

Understanding the Electronic Billing Process

The electronic billing process includes these steps:

- Creating a bill or invoice

- Electronically sending the invoice to the customer

- Customer processing the invoice for approval and payment

- Automatically notifying the supplier that the invoice was received

- Sending automatic payment reminder notifications to the customer

- Customer issuing electronic payment to the payee

- System-generated reports and information, including payment status and history

Bill pay software programs automate the steps within the electronic billing process for the supplier and the customer. The paperless invoice captures integrated system pricing data for the items shipped to approved customers or services performed by the service provider. Bill delivery is electronic. An electronic remittance is sent to the payee once the invoice is processed and approved. The bill pay software includes electronic status notifications within a portal system or through email notification.

Standards for Electronic Billing and Coding

Standard computer data formats for electronic billing include EDI (electronic data interchange), XML (extensible markup language), or CSV (comma-separated values) to export files. CDFI is another e-invoicing format that’s used in Mexico and some Latin American countries.

In health care, electronic billing and coding standards using EDI (electronic data interchange) are used for HIPAA compliance, including e-Billing and electronic claims payments.

The Nacha organization establishes and enforces Nacha Operating Rules for bank-to-bank electronic ACH payments in the U.S. made through member financial institutions of the National Automated Clearing House network.

Benefits & Drawbacks of e-Billing

E-Billing has benefits and drawbacks. The benefits are enormous, outweighing the drawbacks.

Benefits of e-Billing

The benefits of e-Billing include:

- Efficiency and time savings for the payee and payer

- Error reduction

- Employees focus on less monotonous and more strategic activities

- Invoice approval in time for early pay discounts

- Faster accounts receivable collection

- Provides a system of record (SOR) with system integration

Efficiency, Time Savings, and Error Reduction

Electronic billing improves efficiency, while also reducing error rates.

Historically, bills have been delivered through the mail by the seller. The process of data entry and invoice-generation, putting bills in envelopes, mailing those envelopes, and then waiting for them to be received is a very time-consuming and labor-intensive process.

For the vendor, electronic billing reduces payment status follow-up time. A supplier portal in an AP automation system automatically generates payment status notifications.

Electronic billing significantly reduces the customer’s accounts payable and payments processing time and improves the invoice 3-way matching and approval process.

Customers have fewer lost documents and less follow-time with suppliers regarding past due bills due to paperwork issues. Errors and duplicate invoices are reduced when manual keying of supplier invoices isn’t required.

Employees Focus on Less Monotonous and More Strategic Activities

While time-saving is a major benefit, the reduction of manual labor on monotonous tasks allows finance employees to focus their time on more strategic activities. The shift from paper-based to electronic bills also inherently creates better organization and results in fewer errors.

Invoice Approval in Time for Early Pay Discounts

When invoices are quickly included in the accounts payable system, customers can take more early payment discounts for cost savings.

Faster Accounts Receivable Collection

Electronic billing speeds up accounts receivable collection time, improving cash flow.

Provides a System of Record (SOR) with System Integration

Traditional billing and payment methods relied heavily on paper and checks. This process made organization a difficult task with no clear system of record (SOR). Modern finance and accounting applications allow for digital SORs to exist for both the payer and the payee.

Billing and invoicing systems often integrate directly with payment platforms, banking systems, and ERP or accounting systems, furthering the ability to keep a clean, organized system of record.

Drawbacks of e-Billing

Drawbacks of e-Billing include:

- The possibility of security and data privacy issues

- Not receiving all emailed e-Bills if filtered out as spam

- The need to handle both e-Bills and paper invoices in the system

By using add-on AP automation software integrated with your accounting software or ERP system, you can mitigate most of these drawbacks of e-Billing.

For example, an AP automation system enhances security, automatically handles electronic invoices, and uses built-in OCR technology to convert any paper invoices received to electronic invoices. Suppliers can upload their invoices through the customer’s supplier portal, which includes a repository of documents related to the supplier and transactions with the customer.

Who uses e-Billing?

E-billing adds efficiency to multiple business units, ranging from accounting to customer service. E-bills are generally created by the AR department, which acts as the payee, and are paid by the AP department of the payer. E-bills make it easy for accounting personnel to balance and reconcile the books and for customer service representatives to access electronic records and resolve issues.

What is the Difference Between e-Billing and e-Invoicing?

E-Billing and e-Invoicing are related but not exactly the same. E-invoicing (electronic invoicing) is a type of e-Billing (electronic billing) with a narrower definition or use case.

Whereas e-Billing encompasses the entire process of generating the bill and then submitting and receiving the payment, e-Invoicing is generally a function of the AP workflow. The AP department, which is responsible for approving and processing supplier payments, uses e-Invoicing to electronically process invoices and submit them to the system of record (generally a bookkeeping or financial solution such as an ERP or accounting software).

Electronic Billing in the Context of AP Automation

Electronic billing (e-Billing) existed long before the term “accounts payable (AP) automation” was coined.

Electronic bills and payments exist within almost all automated AP workflows and help to streamline the invoice-to-pay process because the necessary documents are already digitized. Technology such as OCR (Optical Character Recognition) invoice processing allows the AP automation platform to digitize, process, and pay paper-based bills as well as electronic bills.

With electronic billing and OCR digitization of paper bills, invoices are accessible to both the supplier and customer through an online supplier portal provided by payables and global mass payments automation software.

Electronic Billing Takeaway

Electronic billing (e-Billing) has replaced paper billing to make the process more efficient for both the supplier and the customer. The result is fewer labor hours for invoice processing and a shift to more strategic work with a higher payoff. Paper and printer use is eliminated, contributing to the environmental goal within ESG and saving money.

Electronic billing results in cost savings for both payer and payee. It improves cash flow and speeds up accounts receivable collection time. Customers process and pay bills on time and can apply more early payment discounts. This improves supplier relationships.

The benefits of electronic billing are optimized when used with an add-on AP automation and payments system integrated with the ERP or accounting software.