Tipalti Expands International Supplier Tax Form Validation To 47 Additional Countries

3,200+ New Validation Rules Ease Global Tax Compliance Burden

San Mateo, CA, February 22, 2017 – Tipalti, the leading provider of global supplier payments automation, announced today that it now supports 3,200+ new tax validation rules across 47 countries to help finance teams keep up and stay compliant with the complex and ever-changing tax and regulatory rules across the globe.

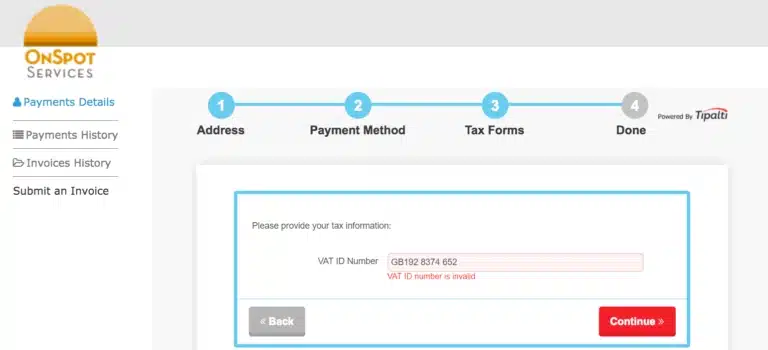

Companies based in these countries can now use Tipalti to easily and securely collect their supplier tax IDs and use Tipalti’s built-in tax rules engine to help prevent tax ID errors and issues. Suppliers in these countries can now provide their tax forms through Tipalti’s self-service portal that is seamlessly integrated with Tipalti’s holistic supplier payments automation platform. The company previously announced AP tax compliance support for companies in the United States, Brazil, and Argentina, as well as VAT ID and document collection.

In total, Tipalti now has tax ID and document collection capabilities for 50 countries, drastically reducing the burden and risk of accounts payable tax compliance, in accordance with each country’s set of unique rules and requirements. With tax compliance requirements becoming more complicated for financial operations departments to navigate, Tipalti’s tax compliance module has grown to apply over 4,000 tax validation rules to supplier tax data. Collected supplier tax IDs and values are also automatically passed to a client’s ERP system with Tipalti’s ERP bundles. Tipalti supports tax ID/form collection methods and validation including:

- Local tax ID support

- European VAT IDs

- IRS Tax Forms (W-8, W-9, etc.)

“Tipalti’s latest international tax compliance capabilities enable our clients to reduce tax compliance penalties and fraud by automating one of the most burdensome areas of modern finance – abiding by the ever-shifting set of tax laws around the world while sending supplier payments in accordance to each country’s unique payment requirements” said Chen Amit, CEO of Tipalti. “We firmly believe that fintech and regtech are intimately tied and given the current state of geopolitical economics, it’s more important than ever to deploy dynamic, always-compliant financial operations technology that helps your finance organization easily adapt to the changing world.”

Seamless Integration with Accounts Payable Workflow

This tax compliance capability is seamlessly integrated within Tipalti’s end-to-end supplier payments platform, allowing finance departments to automate their entire global accounts payable and supplier payments workflow. Tipalti holistic solution streamlines every core AP process from supplier onboarding and management, to tax and regulatory compliance, invoice processing, global supplier remittance, to proactive payment status communications, and instant payment reconciliation and AP financial reporting.

The complete list of countries that Tipalti now collects and validates tax IDs includes: Argentina, Australia, Austria, Azerbaijan, Belgium, Brazil, Bulgaria, Canada, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Dominican Republic, Estonia, Finland, France, Germany, Greece, Honduras, Hong Kong, Hungary, India, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Malta, Mexico, Netherlands, Paraguay, Peru, Poland, Portugal, Romania, Russian Federation, Saudi Arabia, Singapore, Slovakia, Slovenia, Spain, South Korea, Sweden, Ukraine, United Kingdom, United States, and Uruguay.

For more information on Tipalti’s international tax compliance offerings, please visit: tipalti.com/product/tax-regulatory-compliance/