Businesses and the financial services industry are rapidly evolving toward an algorithmic future, powered by artificial intelligence (AI), machine learning (ML), and other advanced technologies, such as robotic process automation (RPA). Companies are leveraging these powerful tools for AI in finance to revolutionize how they manage processes, from forecasting market trends to making workflows more efficient, including AI agents and chatbots, and analyzing results.

AI-driven data science can enhance decision-making in real time, while automation provides cost savings and faster transactions. By deploying accurate algorithms and predictive models with new software technologies, financial institutions and businesses can automate their operations and gain valuable insights into customer behavior.

In this article, we explore how AI in finance is revolutionizing the future of financial management. We’ll discuss its applications in detecting anomalies, transaction processing, and leveraging data science to gain better insights and assess risk, thereby aiding decision-making.

Understanding AI in Finance

Before we dive into the world of AI applications in finance, it is essential to understand the core concepts and principles that drive this technology.

AI and Automation

Financial Artificial Intelligence (AI) is a broad term that refers to any system or machine capable of completing tasks without human intervention through finance automation and algorithms.

Machine Learning

Machine learning (ML) is a subset of AI that allows machines to find patterns in data by using various methods, such as deep learning. Machine learning powers natural language processing (NLP), a form of AI.

For example, if a business wants to implement AI solutions to enhance its customer experience, it would utilize ML tools to process customer data and automate tasks such as budgeting and forecasting.

Additionally, the business could leverage AI models for fraud detection and anti-money laundering by utilizing datasets of transaction-based activities.

Chatbots

Chatbots are becoming increasingly popular in the financial services industry. Based on ML techniques, they can provide customers with personalized advice or recommendations regarding their financial decisions. Businesses can also use chatbots for business intelligence queries.

Blockchain Technology

Financial institutions are also utilizing blockchain and cryptocurrency technology more extensively for risk management, as it enables secure and transparent transactions. By leveraging AI solutions, financial institutions gather insight into customer behavior, which helps them gain a competitive advantage in the market.

Data scientists play a crucial role in developing and implementing AI models for financial applications. They are responsible for creating datasets that will train the models.

Data-driven decisions enable organizations to make more accurate predictions about financial trends and develop more effective strategies for their business operations.

Applications of AI in Finance

How has AI been used in finance?

There are various effective ways businesses and financial institutions utilize AI to enhance their services and operations. Here are just a few AI applications in finance:

Risk Management and Fraud Detection

Risk management and fraud detection are among the most critical applications of AI. For example, PayPal’s machine learning algorithms analyze and assess risk in real-time. It scans customers’ transactions for fraudulent activity and automatically flags any suspicious activity.

Another AI-driven tech company, Kensho Technologies, is a leader in AI and innovation, helping transform the business world with cutting-edge technology. They have developed machine learning algorithms that can rapidly analyze large datasets and provide valuable insights for more informed investment decisions.

By partnering with S&P Global, Kensho has access to a massive dataset to help train its machine learning algorithms and create solutions for some of the most challenging issues facing businesses today.

Credit Scoring and Insurance Considerations

Financial institutions utilize AI for credit scoring when making lending decisions, such as issuing credit cards and providing loans. Insurance companies use AI when determining risks, setting prices, and issuing policies.

Investment and Portfolio Management

AI-driven investment strategies are becoming increasingly popular in wealth management. AI systems enable financial advisors to tailor their advice based on a customer’s risk profile.

For example, in the finance industry, Wealthfront’s AI-driven investing platform considers a customer’s risk tolerance, goals, and preferences to create an optimized portfolio. Answers to a risk assessment questionnaire are used to create a customized investment portfolio of cash and exchange-traded funds (ETFs) via AI.

Robo-advisors are automated investment advice platforms that utilize algorithms to manage portfolios tailored to a customer’s specific needs. These automated tools offer personalized asset allocation and portfolio optimization recommendations tailored to a user’s risk profile, age, income level, and other relevant factors.

As these technologies become more advanced, they will help financial advisors better serve their clients by providing more accurate and timely advice.

Automation in Accounting and Bookkeeping

AI in accounting and finance is a powerful application that offers numerous benefits, including increased efficiency, cost savings, enhanced analysis, and real-time visibility.

When it comes to automation in accounting and bookkeeping, several AI-powered solutions are available. These AI accounting solutions aim to reduce manual errors, enhance compliance, and streamline financial processes.

Invoice Processing

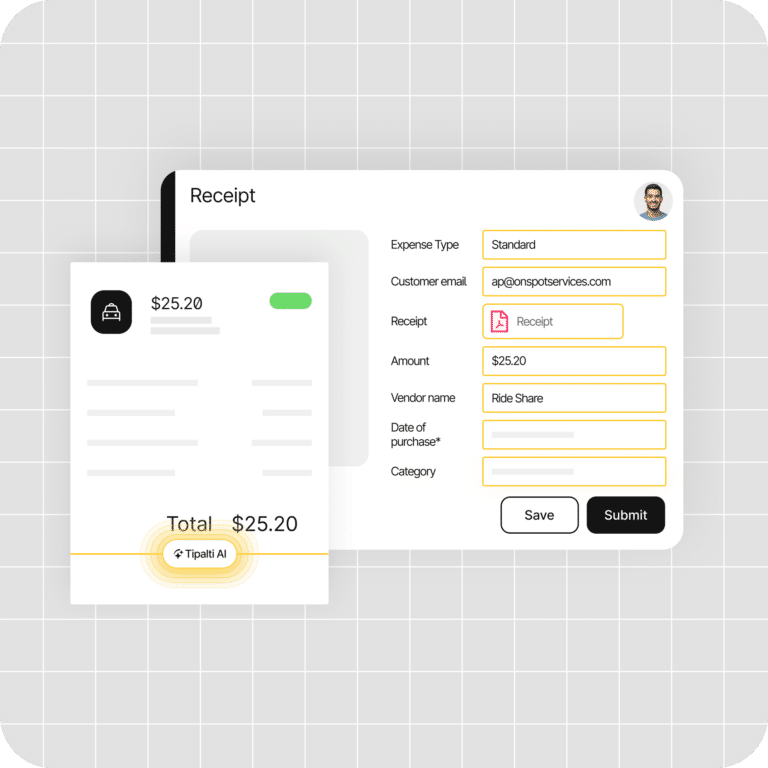

Say you need to automate your invoice processing. With cutting-edge AI-powered technology, Tipalti automates the entire invoice processing cycle, from invoice receipt to payment, ensuring unparalleled precision and seamless workflows. This replaces manual processes with digitization.

Tipalti automates messaging, including potential exceptions detected by AI and payment status. Tipalti also offers advanced AI-based fraud detection features, including payee pattern behavioral monitoring and TIN matching for supplier validation.

Reporting

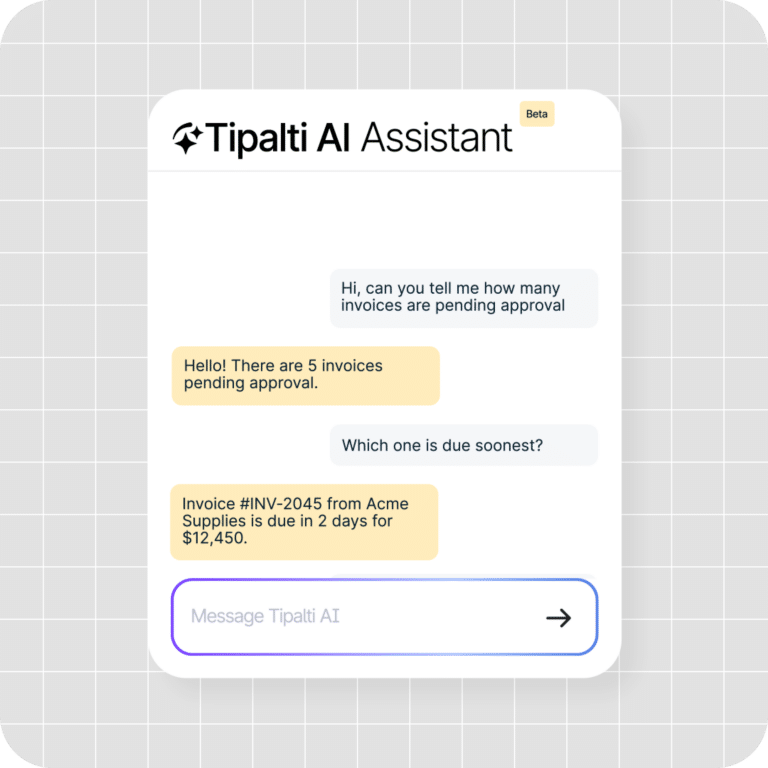

AI is used to automate financial reporting, determine anomalies in data patterns, and analyze data. Tipalti AP automation software features a Tipalti AI℠ tool that enables the quick identification of trends in data using artificial intelligence and machine learning algorithms. With Tipalti AI Assistant, businesses can make more informed decisions based on up-to-date information about payables and spending data.

Tipalti AI Assistant natively integrates with the generative AI product ChatGPT and utilizes other AI methodologies, including those beyond ChatGPT, for finance and accounting applications.

Anti-Money Laundering and Fraud

AI also automates and assists in anti-money laundering (AML). Companies are leveraging AI models and algorithms to detect suspicious transactions and flag them for further investigation. Tipalti automation software includes AML capabilities to reduce fraud risk.

Budgeting

AI has revolutionized the budgeting process by identifying areas where money can be saved or invested in more profitable projects.

Accounts Payable Automation and Purchase Order Management

Other areas where AI is making a significant impact are Purchase Order (PO) management, starting with employee purchase requisition intake workflows to create and approve PRs for automatic purchase order creation. In Accounts Payable (AP) automation, processes for artificial intelligence (AI) in accounts payable involve managing and tracking purchase orders, matching them with invoices, automatically coding invoices, detecting errors and fraud risks, and ensuring timely vendor payments.

Benefits of Adopting AI in Your Finance Operations

Benefits of AI in finance operations include:

- Automating back office workflows (like AP invoice processing) to gain efficiency and achieve cost savings

- Detecting and reducing errors and fraud risks

- Improving global regulatory and tax compliance

- Detecting anomalies in data that may require follow-up

- Using chatbots and other AI technologies for business intelligence, analysis, and messaging

- Using better credit scoring to reduce credit losses from accounts receivable /trade receivables and loans

- Developing new products and services

Smarter Spend Visibility and Stronger Controls With AI

AI isn’t just about efficiency—it’s about unlocking smarter financial insights. With Tipalti AI Assistant and AI Agents, you can cut manual work, flag risks faster, and generate real-time spend reports that guide better decisions.

Enhancing Financial Decision-Making with AI

Various frameworks and use cases exist for AI in the finance industry and businesses. The following are some common business models leading the charge in digital transformation.

Predictive Analytics and Forecasting

Companies can enhance their market insights and asset pricing accuracy by developing predictive models using machine learning algorithms.

Such models can predict future market trends based on historical data, enabling businesses to make more informed decisions and enhance profitability.

Generative models also simulate various outcomes for financial scenarios, such as macroeconomic events or regulatory changes that impact a company’s performance. This allows lenders and borrowers alike to understand how potential changes affect their finances.

Algorithmic Trading and Market Insights

AI technologies are also increasingly used for algorithmic trading in financial markets, with companies utilizing AI bots to automate trading processes and optimize strategies for maximum returns.

By accounting for market trends, news sentiment analysis, technical indicators, historical data points, and more, AI algorithms can make decisions faster and more accurately than human traders.

These algorithmic trading systems used in the financial sector also have the potential to provide companies with more insights into the markets, enabling them to stay ahead of their competition and identify new growth opportunities.

Real-Time Risk Assessment and Compliance

Regulatory compliance is another area where AI technologies make a big difference in finance. Cloud computing services such as AWS or Google Cloud Platform are helping companies develop innovative AI solutions that quickly assess market risks in real-time and accurately identify potential compliance issues.

AI can enhance credit scoring systems, which are crucial for lenders when evaluating the creditworthiness versus the potential risk of any borrower for credit decisions, as well as for companies when acquiring new customers and assessing a current customer’s ability to pay. AI algorithms will analyze data points like

- Income

- Financial history

- Social media activity

This enables them to make more accurate predictions about a potential customer’s ability to repay debt or whether they pose a risk to the lender.

Insurance companies are applying AI to underwriting to assess risks that could lead to claims and determine insurance premium pricing that compensates for these risks, or exit a geographic market with an excessively high risk profile.

Examples of Startups Leading Digital Transformation

The use of AI technologies in finance is rapidly increasing, with startups leading the charge in digital transformation within this sector.

As an example of AI, New York-based startup Kensho Technologies offers various AI-based services for financial institutions, including algorithmic trading and risk analysis tools.

Another example is Digitize.AI, a Canadian startup that utilizes natural language processing (NLP) to rapidly assess customer data analytics and offer personalized financial advice to millennials. The company utilizes an AI-driven loan origination system that automates the entire application process.

Challenges and Risks of AI in Finance

Businesses using AI in finance should understand these challenges and potential risks:

- Data quality and bias: Poor or biased data can lead to flawed or unfair outcomes.

- Transparency and explainability: Complex models are often difficult to interpret or justify. Explainable AI helps meet higher standards.

- Security risks: AI systems can expose firms to new types of cyberattacks.

- Regulatory uncertainty: Evolving rules make compliance harder to navigate.

- Job displacement: Automation shifts routine work, requiring new strategic skills.

Data Quality and Bias

AI considerations should include an adequate model design to minimize bias to the extent possible, as well as the use of recent, clean data. For generative AI, employee training in the use of high-quality prompt engineering with context improves results.

Explainable AI

Explainable AI (XAI) is crucial in finance to foster trust, ensuring that decisions made by AI and machine learning models are transparent, interpretable, and comprehensible to humans. AI in finance bridges the gap between AI performance and regulatory and ethical requirements.

Explainable AI is transparent and traceable. It provides:

- Clarity on why a model made a prediction or recommendation.

- Traceability of inputs to generated outputs.

- Confidence and accountability for regulators, financial institutions, auditors, and users.

Reducing Security Risks

When selecting an AI system, ensure that it has enterprise-grade security for risk reduction. AI agents alone can’t avoid all cybersecurity risks. That’s why human-in-the-loop interventions are required, and eliminating all accounting jobs is not a current threat.

Regulatory Uncertainty

Keeping up with current regulations worldwide is difficult for humans. Therefore, automated global regulatory compliance using AI is helpful in meeting compliance regulations.

Job Displacement

While some job roles may change (especially the need for some entry-level positions), AI enables accountants to take on more challenging and strategic tasks that require critical thinking and decision-making skills.

Ethical Considerations in Finance AI

As AI technologies become more prevalent in the finance industry, it’s crucial to consider the ethical implications of these tools.

While AI and automation can be the industry’s most significant assets, with the potential to increase efficiency and accuracy, concerns have arisen about unfair or exploitative practices.

For example, some fear that AI-driven credit scoring systems may lead to unfair decisions based on biased algorithms or data points such as race or gender.

Additionally, algorithmic trading bots sometimes act erratically during market volatility, potentially leading to losses for investors if not adequately monitored by humans.

To combat these issues, many industry leaders advocate for the adoption of ethical frameworks when deploying AI technologies in finance, such as those outlined by the United Nations Global Compact.

Organizations should also regularly test and monitor their AI models to ensure they comply with ethical standards and relevant legal regulations.

Adoption and Future Trends in Finance AI

According to a McKinsey study, half of all organizations have already implemented AI in at least one of their operations.

AI has the potential to spur innovation and foster growth across various business activities, including spend management, cost and procurement optimization, waste minimization, and future spend prediction.

When looking ahead for trends in financial AI applications, fraud detection and prevention are key areas. Additionally, AI agents and AI-driven chatbots are revolutionizing the customer service experience.

Even the popular ChatGPT, a natural language processing (NLP)- based AI technology that can analyze unstructured data, is a prime example of the future of finance and the use of generative AI in the financial sector. This technology offers conversation-based automated customer service and even generates financial advice. ChatGPT is also used for business analysis.

The future of AI is exponential. AI’s potential to revolutionize how businesses manage their finances has become increasingly evident as organizations adopt it more significantly.

As more companies adopt AI technologies, there will be an increased focus on understanding how their implementation can enhance existing processes. More fintech apps will be developed to address the need to solve specific problems.

Strong data governance and privacy policies must support this digital transformation to ensure companies can use AI technologies safely and responsibly. Employees should be provided with training and support to use AI-based technologies most effectively.

Can AI Replace Finance?

AI enhances finance through efficiency and cost savings from business process automation, detecting data pattern anomalies, and improving controls and risk management. Although your company will not need to make as many hires with the right finance automation solution, your company’s entire finance team will not be replaced.

Resolving exceptions requires human intelligence and judgment. When the time to perform routine tasks is reduced, finance teams have more time for strategic finance initiatives, enabling them to increase profitability through recommended revenue growth and cost reductions.

In the financial services industry, humans must monitor algorithmic trading and exercise judgment as financial advisors utilize AI.

Unlock Finance AI at Scale with Tipalti

AI in finance is revolutionizing industries by automating operations, providing valuable insights, and enabling data-driven decision-making. A business that adopts the right tools today will gain a sharp competitive edge in tomorrow’s race.

Tipalti is a leader in AI finance automation solutions that integrate with your ERP or accounting system, as well as some performance marketing platforms, for mass payouts. Tipalti helps eliminate pain points in payables and invoice processing that users experience with manual finance and accounting systems that don’t incorporate Tipalti’s advanced AI tools.

Tipalti Capabilities

Tipalti’s AI-powered finance automation delivers:

- End-to-end automation: AI tools to streamline AP, payments, and compliance.

- Error and fraud reduction: AI-driven detection of anomalies and duplicate invoices.

- Smarter decision-making help: embedded AI tools (e.g., Tipalti AI Assistant that surfaces insights in real-time custom reports.

- Global compliance: AI validation for tax forms, KYC/AML monitoring, sanctions list screening, and regulatory reporting.

- Strategic impact: freeing finance teams to focus on growth and profitability, not manual processing.

- Scalability: ability to handle complex, multi-entity, global finance operations and facilitate global expansion.

Tipalti AI Agents and AI Assistant

For invoice processing in AP automation, Tipalti utilizes AI agents to perform tasks autonomously, while automating notifications for human exception handling when necessary. Tipalti AI Assistant is another AI tool embedded in Tipalti’s finance automation software.

Tipalti AI Assistant

The Tipalti AI Assistant conversational tool uses deep knowledge of your Tipalti finance workflows (including invoices) and advanced reasoning to save time on routine tasks, produce insights, and help your business uncover opportunities.

Tipalti AI Assistant enables NLP-based custom report generation to analyze spending and payments or respond to other user queries.

Tipalti AI Agents

Tipalti AI Agents for accounts payable automation include:

- Invoice Capture Agent: to automatically capture, verify, and code invoices.

- Bill Approvers Agent: using machine learning to automatically route approval workflows.

- PO-Matching Agent: using contextual descriptions to match invoices with purchase orders by line item.

- Reporting Agent: using your natural language prompts to automatically create the real-time reports your business needs to analyze its spending and payments.

Beyond finance, Tipalti uses an AI agent named the Purchase Request Agent in its Procurement automation software for PR and PO management. This AI agent can auto-generate purchase requests (PRs) from employee descrip

Next Step

Harness AI to transform finance. See how Tipalti helps you cut costs, streamline processes, and unlock strategic value from your finance data.

Unlock Finance AI at Scale with Tipalti

AI in finance is transforming efficiency and decision-making. With Tipalti AI Assistant and AI Agents, you can automate routine tasks, surface real-time insights, and keep teams focused on growth.