Home / AP Automation / Invoice Management / Invoice Flow

The Best Way to Pay Invoices

Tipalti provides a complete end-to-end workflow that ensures efficient, accurate processes and finance-protecting controls.

Invoice-Based Workflow Features

Elevate Your Finance Team

Tipalti’s accounts payable automation process for invoice-based workflows is a comprehensive solution that minimizes manual effort, maximizes self-service, and dramatically increases scalability and auditability.

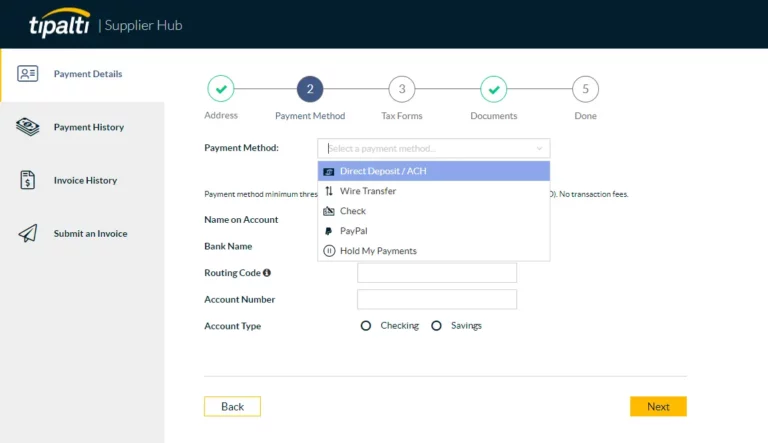

The most critical step comes first: ensuring your vendors are payable

You invite them to register on your Supplier Hub to provide their contact, billing details, and tax identification.

- The responsibility is on the vendor to provide information, incentivizing them to do it right in order to be paid.

- This step is vital to ensuring that no one is paid that your business hasn’t authorized.

- Reduce data entry

- Ensure supplier identity

- Collect and verify tax IDs

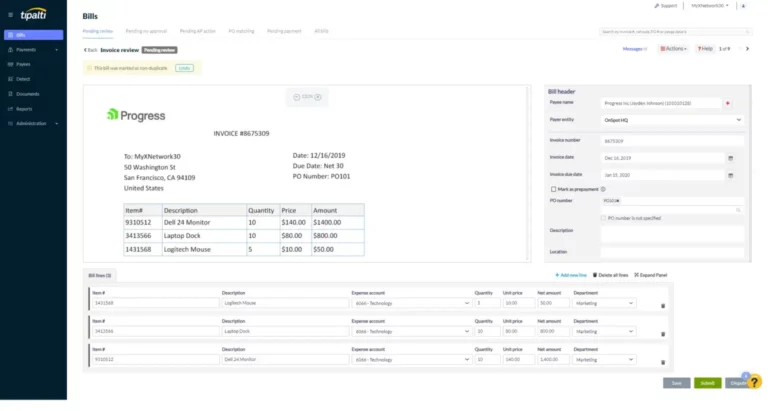

The vendor can upload their invoice from the Supplier Hub or email it to your payables alias

The invoice is processed seamlessly using OCR (optical character recognition), machine learning, and managed services and automatically populated into Tipalti.

- Any missed characters by the cloud-AI are human-validated by Tipalti.

- If it is a PO-based invoice, Tipalti performs a 2-way and 3-way PO-match.

- Machine learning prefills much of the accounting and approval routing data based on past invoices.

- Maintain invoice records

- Set up straight-through processing and approvals

- Frees up manual effort

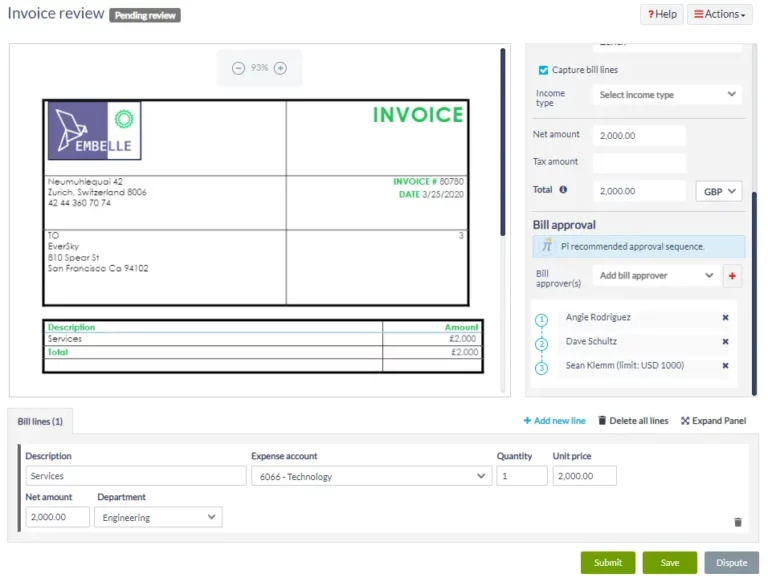

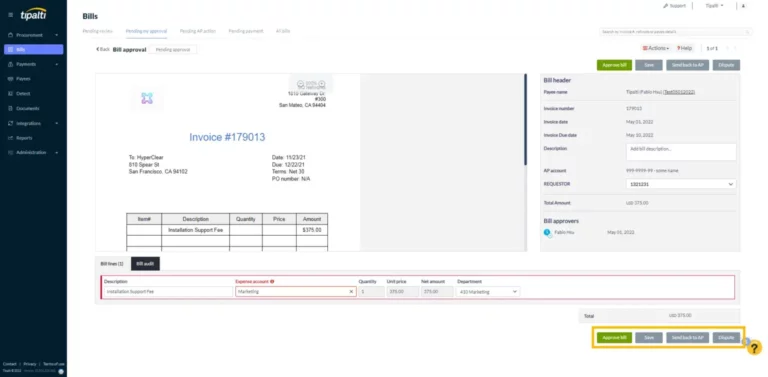

As the payer, review the invoice that has been automatically keyed in

Until now, other than inviting the vendor to the portal, your finance team hasn’t had to do any data entry – including keying in bill data.

- Review the invoice to start the approval process.

- Approvers will get an email for approval.

- Approval audit trail

- Minimizes manual effort

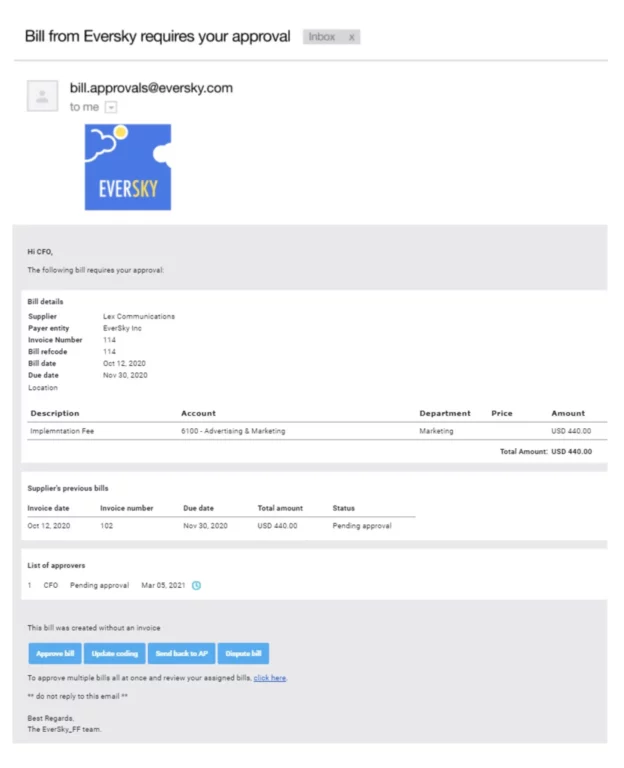

Approvers in the workflow receive a request to approve the invoice

Approvers receive a branded email, including a copy of the invoice to be approved and which ledger account it will be filed under.

- The approver can:

- Approve the bill

- Update the account (GL) on the bill

- Send the invoice back to AP for a different routing process

- Dispute the bill

- Authorized approvers do not need to log into a separate portal and can perform these actions from any email client, including mobile.

- Potential duplicate bills are detected and flagged on top of the email, ensuring approvers are fully aware of the duplicate bills.

- Hassle-free approvals for stakeholders

- Clear audit trail for bill workflow

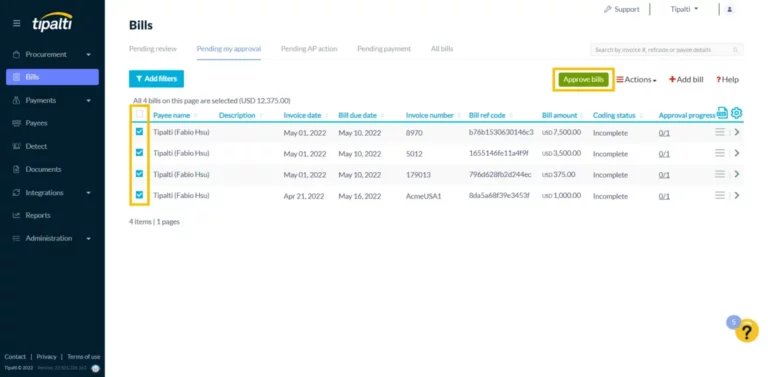

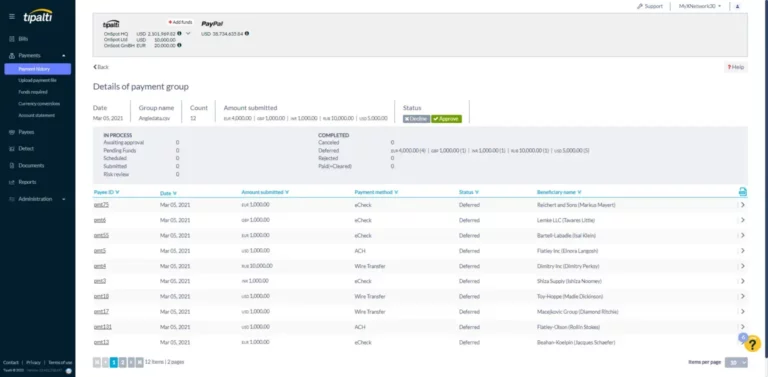

Schedule the invoice for payment

Once all approvers have signed off on the invoice, your finance team can schedule the invoice for payment, along with any other bills in the system.

- Bills can be grouped for bulk scheduling

- Bills can be grouped regardless of payment method (wire, ACH, eCheck, etc.)

- Questionable bills can be flagged and send back to AP or disputed

- Easily manage payment runs

- Preschedule payments

- Easier global payments across varied methods

Add approval requirement for payments

Payments can also be set up to require executive approval as an added financial control. Tipalti handles all the payment account execution.

- All payments are performed according to their scheduled due date once your executive approves

- Executives quickly log in to execute final approval

- Flexibility to put on-hold specific invoices from payment batches for paying them later

- No more logging into individual bank portals

- All payment execution is logged and auditable

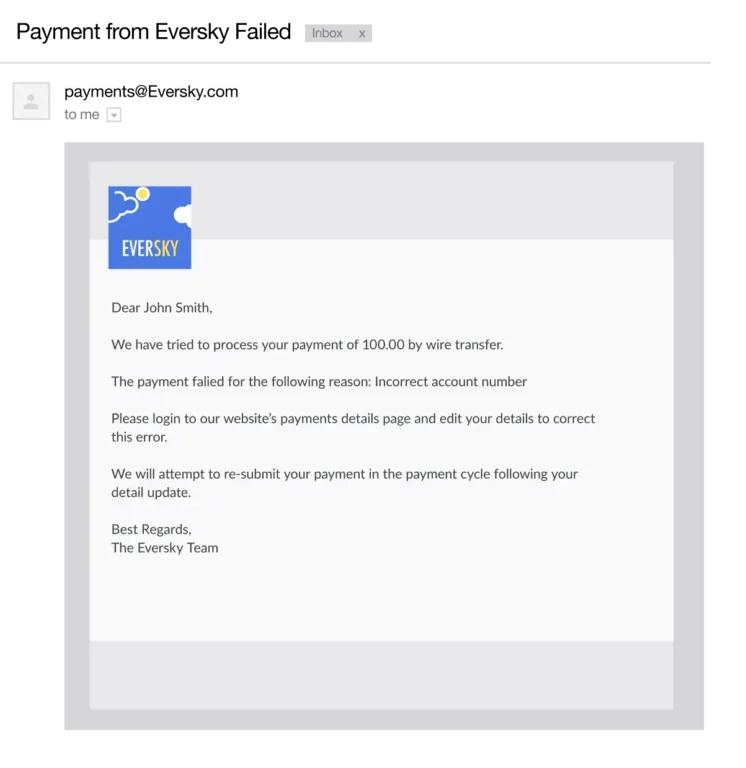

Vendor communications are automated

Vendors will be notified immediately when a payment is made or if there’s a problem.

- Emails come from your business and have your branding to ensure trust

- If there’s a problem, the email prescribes a solution, often asking the vendor to update or provide additional information through the Supplier Hub

- Reduced payment inquiries

- Proactive communication

Reconciliation happens in real time

Once the payment lands and clears, Tipalti is automatically updated with the successful result. No manual bank reconciliation is required.

- Payment data is sent to any connected ERPs or accounting platforms (e.g. NetSuite, QuickBooks Online, etc.)

- Complete details of transfer or conversion fees are included

- Faster reconciliation to accelerate the financial close

- Accurate, updated payment data

Integrations

Pre-built connections to extend automated workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Testimonials

Don’t just take our word for it,

see what our customers are saying

Customer Stories

Explore our customer success stories

Platform Features

Work smarter, not harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

How It Works

Up and running in weeks, not months

Collaborative customer support with customized onboarding to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimize

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Compare

See how we stack up

| Features | Tipalti | BILL | Stampli | Concur |

|---|---|---|---|---|

|

Supplier Management |

|

Limited functionality | Limited functionality |

|

|

Payments Network |

|

Limited functionality | Limited functionality | Limited functionality |

|

Cards |

|

|

|

Limited functionality |

|

Invoice Management |

|

Limited functionality |

|

Limited functionality |

|

Tax and Regulatory Compliance |

|

Limited functionality |

|

|

|

Global Multi-Entity |

|

|

Limited functionality | Limited functionality |

|

Reconciliation and Reporting |

|

Limited functionality | Limited functionality | Limited functionality |

|

Procurement |

|

|

|

Limited functionality |

|

Expense Management |

|

|

Limited functionality |

|

|

FX Solution |

|

|

Limited functionality |

|

|

Corporate Cards |

|

|

|

Limited functionality |

Awards

#1 award-winning finance automation solution

The Fintech Awards

Best SaaS for FinTech 2025

2025 Deloitte Technology

Fast 500

Awarded to Tipalti for the 8th consecutive year

2025 CNBC World’s Top Fintech Company

Awarded to Tipalti for the 3rd consecutive year

Leader in the IDC 2024 MarketScape

Worldwide Accounts Payable Automation Software for Midmarket

Ready to save time and money?

Book a demo to get started today and take control of your finance operations with Tipalti.