Businesses use accounts payable aging reports automatically generated by their accounting software to manage accounts payable balances, identify early payment discounts, and determine when payments to suppliers offering credit terms are due.

Definition: Accounts Payable Aging Report

An accounts payable aging report is a critical accounting document that summarizes the bills and invoices owed by a business, broken down by vendor and due date. It shows columns with amounts grouped into Current, ranges for the number of days past due, and a Total amount column.

A detailed AP aging report shows invoices with reference number, due date, payment terms, and balance due. The opposite of accounts payable aging report is the accounts receivable report, which outlines when a business can expect payment from its customers.

Key Takeaways

- An accounts payable aging report is an important financial document that summarizes unpaid vendor invoices by due date and aging buckets (e.g., Current, 1–30 days, 31–60 days).

- It helps companies manage short-term liabilities, cash flow, and vendor payment timing. This often reveals early payment discount opportunities or potential financial red flags.

- The report includes both detailed and summary formats, showing invoice numbers, due dates, credit terms, credit/debit memos, and total balances by vendor.

- In order to ensure accurate preparation, you must match AP aging data to vendor statements and the general ledger, including adjustments for partial payments, credits, and accruals at month-end.

- Manual spreadsheet prep is prone to errors and is generally discouraged in favor of ERP-integrated or automated reporting from AP automation software.

- Aging reports help identify financial risks, such as vendor disputes, outdated invoices, and prolonged overdue balances that can signal cash flow issues.

- The AP aging report complements the AR aging report, offering a full picture of a company’s payables vs. receivables and informing working capital decisions.

Automating AP processes, including aging reports, reduces manual workload, improves data accuracy, strengthens audit readiness, and supports financial forecasting.

Understanding Accounts Payable Aging Reports

Understanding accounts payable aging reports requires knowing how much your business owes its trade creditors (vendors or suppliers offering credit terms), what payment terms mean, early payment discounts offered, and when the invoices are due or past due. You should also understand the relationship between the accounts payable aging report and cash flow.

The AP aging report, which applies to vendor invoices for purchases, is similar to the accounts receivable aging report that determines the balance due of open (not yet collected) customer invoices.

How do You Prepare an Accounts Payable Aging Report?

Steps for preparing an accounts payable aging report for a specific date are:

- List each new unpaid supplier invoice with credit terms by vendor: For the Detail Accounts Payable Aging Report, include the invoice date, invoice number, due date, payment terms (2/10, net 30), and amount due.

- Apply payments to remove invoices or reduce invoice balances due: Remove Invoices from the AP aging if fully paid in cash or using any early payment discount offered. Apply partial payments to individual invoices to reduce the outstanding amounts.

- Categorize unpaid invoice amounts by Current or number of days past due range: Enter new invoice amounts not yet due in the Current column; enter past due invoice amounts in the column for the applicable number of days past due.

- Enter credit memos and debit memos as line items by vendor. Enter credit memos with identifying information as negative amounts and debit memos as positive amounts in the Current column for the applicable supplier.

- Total all invoice date range amounts: For each invoice, credit memo, or debit memo line, enter the total amount of combined Current or date range amounts in the horizontal Total column.

- Subtotal and total accounts payable amounts due: For each aging column and the Total column (usually on the right), calculate subtotals by vendor and the Total of all vendors’ accounts payable balances on the bottom of the report.

- Reconcile the accounts payable aging report to vendor statements and the general ledger: Record any correcting adjustments to the accounts payable aging detail or general ledger (using journal entries) as necessary.

- Finalize the Detail Accounts Payable Aging Report: Modify the final Accounts Payable Aging Report for any corrections.

- Prepare a Summary Accounts Payable Aging Report: The Summary report displays totals by vendor with the same columns for Current or date ranges and Totals (excluding invoice, credit memo, and debit memo details).

Considerations for Preparing an Accounts Payable Aging Report

Because the AP aging only includes invoices with credit terms on account, bills paid immediately by credit cards, cryptocurrency, or cash payment methods aren’t included in the accounts payable aging report.

The accounting system considers vendor invoice amounts, credit memos or debit memos issued, and any partial payments to compute the remaining balance due to each vendor. If your company takes an early payment discount, the accounting software will remove the entire invoice amount from the accounts payable aging upon payment.

Small businesses may want to use Excel template spreadsheets to prepare an accounts payable aging report manually. But it isn’t efficient or recommended. Excel AP aging preparation could result in missing vendor invoices in the aging report or incorrect vendor invoice numbers, due date information, and calculation errors.

To ensure financial reporting and accounts payable completeness at each month-end, record vendor invoice amounts relating to the accounting period through the monthly cut-off date (after the end of the month) in the system or initially as an accrual journal entry for accounts payable. The AP aging is a journal reflecting recorded accounting transactions for accounts payable.

The CPA firm auditing or reviewing your company’s financial statements will ensure that balance sheet account reconciliations are regularly completed for adequate bookkeeping, business accounting, and internal control.

Is your business efficient at accounts payable processing?

Tipalti AP automation performs efficient, digitized AP invoice processing, checks for fraud and errors, syncs data with your accounts payable aging report, and instantly reconciles payments.

What Information is Included in an Accounts Payable Aging Report?

A Summary Accounts Payable Aging Report lists the totals of outstanding (unpaid) invoice balances by vendor, including a total for all vendors.

A detailed Accounts Payable Aging Report includes this information:

- Vendor Names: names of vendors (suppliers) with outstanding invoices in the Vendor Name column

- Invoice line items by supplier: a list of invoices with identifying information and unpaid balance due, grouped by supplier

- Invoice number

- Purchase order (PO) number

- Invoice date

- Invoice balance due in the Current or other relevant days range aging column for past due, and in a Total column (on the right)

- The due date for each payable supplier invoice

- Payment terms, such as 2/10 net 30

- Credit memos and debit memos: similar line item information for credit memos and debit memos

- Credit memo or debit memo number

- Credit memo amount as negative; debit memo amount as positive in the specific aging column and Total column

- Total by vendor (throughout AP aging report): total balances due to each vendor for every report column

- Total (bottom of AP aging report): total for all vendors in every column with amounts

Accounts payable aging report column titles for current, past-due aging ranges, and total are:

- Current

- 1 – 30 days

- 31 – 60 days

- 61- 90 days, and

- Over 90 days

- Total

The number of days ranges are the number of days past due based on the invoice date and credit terms. The Current column shows by-vendor totals of the newest invoices with unpaid balances that aren’t yet past due for payment. The AP aging report may show columns for 91 – 120 days and over 120 days columns instead of the column for over 90 days.

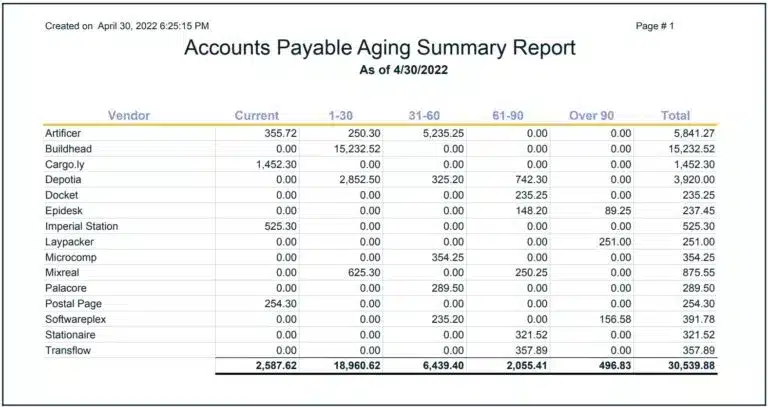

Example of an AP Aging Report

An example of an Accounts Payable Aging Report Summary is shown as of month-end. With modern accounting systems, you can run an accounts payable report daily or anytime on demand to manage your company’s accounts payable and required payments.

Example Summary Accounts Payable Aging Report Image

How Do You Read AP Aging Reports?

Read AP aging reports by looking at the total balances due that are current or by the date range of days past due to determine approximately when your business needs cash to pay vendors or the extent of past due invoice amounts owed to vendors. Pay attention to dates for earning early payment discounts.

Then focus on invoice balances owed to each vendor in the detailed AP aging report. Do the vendor names look reasonable for your business needs? Search for duplicate invoices and negative balance due amounts shown for a vendor. If the report is accurate, decide whether to request a vendor refund for these negative balances.

Liability Risks of Each Aging Bucket

When reviewing an accounts payable aging report, consider the liability risks associated with each aging bucket, as outlined in the following Table.

| AP Aging Column | Significance | Risks and Steps to Take |

|---|---|---|

| Current (1-30 days) | Invoices not yet due; research early payment discount opportunities | Minimal risk of nonpayment by customer to supplier; determine cash requirements for making a batch payment when invoices are due, or when an early payment discount can be taken |

| 31-60 days past due | Invoices with net 30 payment termsone to two months past due | When possible, pay past due invoices without errors or corrected invoices received from the supplier. Continue to work with the supplier to resolve outstanding errors. Collect accounts receivable from customers to improve your business cash balances. Obtain or use credit line financing if possible. |

| 61-90 days past due | Invoices with net 30 payment termstwo to three months past due | Aggressively collect accounts receivable from customers and obtain financing when possible. Keep the supplier informed about the intended payment date. Consider making partial payments and renegotiating payment terms with the supplier if you are experiencing cash flow timing issues. |

| Over 90 days past due | Invoices with net 30 payment termsover three months past due | The company may be experiencing cash flow problems. Its supplier is at risk of not receiving payment for invoiced goods or services. The company may be cut off from receiving supplier shipments until it pays its outstanding invoice balance due. |

What 4 Transactions are Reflected in the Accounts Payable Aging Report?

The accounts payable aging report reflects 4 types of transactions in the calculation of outstanding accounts payable balances requiring payment:

- Vendor bills invoicing your business as a customer for purchases

- Vendor credit memos

- Vendor debit memos

- Invoice payments your business makes to vendors (reduced by early payment discounts used)

Vendor invoices (vendor bills) are digital (or paper) documents with credit payment terms requesting payment for goods shipped or services provided by the supplier to a customer.

Vendor credit memos are documents that reduce the customer’s balance for returned or damaged items or price corrections. Customers subtract credit memos from the total of invoice balances due when making payments, or request a refund from the supplier when no invoice balance is outstanding.

Vendor debit memos are documents that require your business to pay additional amounts for invoice corrections.

Credit Memo Example

As a vendor credit memo example, AZ company purchases 20 raw material parts for $50 each, invoiced at $1,000 from the supplier, ST. A quality control inspection reveals that two parts do not meet the specifications. AZ informs its supplier that the two parts are defective.

AZ requests an RMA (Return Material Authorization) from the supplier to ship back the damaged goods and issue a refund for the faulty parts. The vendor, ST, issues a $100 credit memo to AZ.

AZ enters the original invoice for $1,000 as a positive amount in its accounts payable aging. When AZ receives the credit memo from the supplier, it enters the credit memo (in the same aging bucket as the original invoice) with a negative amount due in the AP aging, reducing the balance due to that supplier for the invoice to $800.

Aged Payables Report vs. Accounts Receivable Aging Report

The difference between the aged payables report vs. accounts receivable aging report is vendor invoice vs customer invoice. The AP aging report reflects the total of unpaid invoice balances due by vendor and current amounts or the number of days past due in 30-day ranges. The AR aging report shows amounts for customer invoices billed with credit terms but not yet collected.

AP Aging Report vs. AR Aging Report Comparison Table

| Accounts Payable Aging Report | Accounts Receivable Aging Report | |

|---|---|---|

| Purpose | Details and summarizes outstanding invoices for supplier payments by the current due date or the range of days overdue for payment, organized by vendor name. | Details and summarizes outstanding invoices due for payments from customers by the current due date or the range of days overdue, organized by customer name. |

| Timing | Columns for Current, 1-30 days, 31-60 days, 61-90 days, over 90 days | Columns for Current, 1-30 days, 31-60 days, 61-90 days, over 90 days |

| User Type | Customer | Seller |

Benefits of AP Aging Reports

Benefits of AP aging reports include:

- Review for errors and past due amounts: Ability to review the report before payment for possible errors like duplicate invoices, and for overdue payments that should be paid soon, when prioritizing available cash

- Schedule invoice payment dates and obtain needed financing: Plan and schedule vendor invoice payment dates for cash flow timing and needed financing

- Maximize early payment discounts and avoid penalties: Save money by identifying early payment discounts and avoiding late payment penalties

- Use for business plan and cash forecasting: Use to forecast accounts payable balances and cash flow in your business plan

- Achieve greater accuracy: Reconcile AP aging vendor balances with vendor statements received and the general ledger

- Audit tool: Auditors can trace the AP aging report balance to the general ledger and perform other audit steps for accounts payable

When establishing the company policy for setting vendor invoice payment dates for your company, a company should consider its accounts receivable collection time (days receivable outstanding, DRO) compared to days payable outstanding, DPO.

According to The CPA Journal, the financial team can achieve a smoother audit for nonprofits (and businesses) when they “prepare accounts payable aging, review subsequent disbursements to verify proper cutoff for the year, and gather documentation for selected transactions likely to be assessed.”

Importance of AP Aging Reports

The accounts payable aging report is an important and useful tool to identify:

- Incorrect vendor invoices: Notify suppliers of the incorrect invoices that need to be reissued upon correction before paying those invoices.

- Disputes: Significantly past-due invoices may indicate disputes with the supplier over the order quality, quantity received, or billing amount that require requesting refunds.

- Vendor product quality issues: One type of dispute with the vendor may be product quality issues. Vendor performance and the need for their replacement must be continuously monitored to ensure effective supplier management.

- Potential cash flow problems: Significant cash flow issues in your company could result in vendor bad debt and delays in new product shipments from suppliers, leading to business disruptions.

AP Aging Report FAQs

What aging buckets are most common?

The most common aging buckets for accounts payable invoices are Current (invoices before due date), 1-30 days, 31-60 days, 61-90 days, and over 90 days for past-due invoices.

Can AP Aging Reports Be Automated?

Accounting software and ERP systems provide the functionality to automatically generate accounts payable aging reports each month as a Detail report and Summary report.

Accounts payable processes can be automated end-to-end with:

• Self-service supplier onboarding

• Digital invoice capture

• Supplier validation and fraud detection

• Invoice error checking with 26,000+ rules

• 3-way matching or 2-way matching

• Guided approvals

• Choice of 50+ global payment methods in 200+ countries and territories and 120 currencies

• Global batch payments with cash flow requirements

• Spend visibility with AI-driven analysis

• Syncing with sub-ledgers and instant payment reconciliation

• Multi-entity and real-time with those ERP or accounting software capabilities

Simplify AP aging with smart automation

Tipalti eliminates 80% of manual AP work by automating invoice intake, approvals, payments, and reconciliation, ensuring your aging reports are always accurate, timely, and audit-ready.