Banking as a service (BaaS) technology is a digital transformation that embeds multiple types of real-time financial services and products into the business offerings of non-bank businesses. BaaS is also a solution for FinTech companies providing payment services.

Banking as a Service links these businesses with online customers to the systems of licensed banks via an API (Application Program Interface) connection for integration. It often uses third-party BaaS platform providers with middleware software and financial applications.

What is Banking as a Service (BaaS)?

Banking as a Service (BaaS) is a start-to-finish process that digital banks and third parties use to connect their own business infrastructure to a bank’s system via APIs, which allows the digital banks or third parties to offer full-banking services directly through their own non-bank business offerings. BaaS lets the brand’s end customer readily obtain banking services at the same source when buying a product or service. Embedded bank services include FinTech payments and getting product financing, loans, and credit cards through a seller’s website.

Understanding Banking as a Service

Understanding Banking as a Service (BaaS) requires knowing basic concepts and where it’s used.

BaaS is based on an API software connection between banks and non-banks, including FinTech companies. BaaS providers seamlessly embed financial services in the online interactions of brands and their customers. Authentication and online security are essential in a BaaS system.

The embedded BaaS financial services can be co-branded or implemented as white label banking (meaning it doesn’t show the bank’s branding).

Financial institutions in the banking industry are licensed and regulated. These regulations include Know Your Customer (KYC), anti-money laundering (AML), OFAC sanctions lists, and data privacy and security. For Banking as a Service to function as expected and banks to remain in regulatory compliance, RegTech should be part of the BaaS process. RegTech can also help detect online fraud.

The major consulting firm, McKinsey & Company, lists types of non-bank companies adopting BaaS. And McKinsey covers more BaaS trends in its Insights article titled What the embedded-finance and banking-as-a-service trends mean for financial services:

Today, companies of all types and levels of maturity—including retailers, telcos, big techs and software companies, car manufacturers, insurance providers, and logistics firms—are considering and preparing to launch embedded financial services to serve business and consumer segments.

FinTech companies are financial technology companies using software to introduce better financial apps with more functionality and efficiency. FinTech uses advanced technologies, including AI/ML and RPA, to automate processes and create business intelligence. FinTech may incorporate RegTech.

Companies using BaaS include neobanks. Neobanks are online-only banking platforms without branches or a banking license, according to a Forbes Advisor article (What is a Neobank? ). Neobanks may be called “challenger banks.” These neobanks are non-bank FinTech companies specializing in certain aspects of banking like checking and savings bank accounts and issuing credit cards instead of making loans.

The five types of banking offered by full-service licensed banks include:

- Checking and savings accounts

- Issuing credit cards to customers

- Making loans, including business loans, personal loans, and mortgages

- Wealth management

- Overdraft protection

Neobanks don’t provide all five types of banking. Examples of neobanks in the U.S. are Chime and Current.

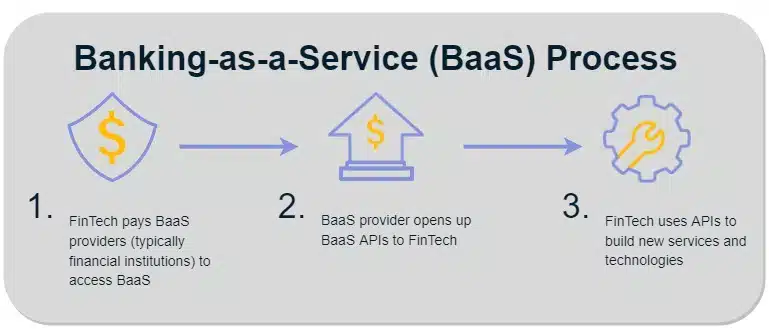

How Does BaaS Work?

Regulated banks and financial institutions with licenses securely link to a non-bank entity’s embedded financial services through an API (Application Programming Interface), enabling seamless communication. The customer doesn’t need to go to a different bank website to get financial services, including loans, making payments, product financing, credit cards, or digital wallets.

Alternatively, a third-party Banking as a Service provider, working with banks, offers the BaaS platform to FinTech and companies in other industries, embedding financial services for their customers to use.

What is the BaaS Model?

The BaaS model lets non-bank FinTech and other third-party providers (TPPs) embed financial services in their business model offerings. With the licensed bank or middleman FinTech software company as a BaaS provider, these partners use API integration to connect with a bank’s infrastructure system. The BaaS model creates revenue streams and enables customer sharing for the participants.

What is a Banking as a Service Provider?

A Banking as a Service provider is a FinTech or other third-party company offering businesses a software platform solution for embedding BaaS financial services for customer use. The BaaS provider links business brands with banking infrastructure systems via APIs. Some banks, including BBVA, directly offer BaaS provider services.

BaaS providers enable these brands to offer many types of financial services and products to ultimate customers.

Examples of Top-Rated BaaS Providers

Examples of top-rated BaaS providers include the non-banks, Railsbank, Finastra, and Marqueta, and the bank, BBVA. They offer BaaS embedded finance services in the U.S. and globally. Third-party BaaS providers improve the user experience through their BaaS platforms.

Railsbank

Railsbank, a London-based BaaS provider, serves the U.K., Europe, and the U.S. Railsbank developed proprietary infrastructure in-house that doesn’t run on top of legacy software stacks, unlike its competitors. Railsbank offers a variety of BaaS products and makes faster payments by directly connecting to payment rails. Railsbank offers Buy Now Pay Later (BNPL) functionality.

Railsbank, funded through debt and venture capital rounds with impressive investors (including Visa), is seeking an additional $100 million of financing in 2022.

Finastra

Finastra is a BaaS provider offering FusionFabric.cloud, an open developer platform, and an app marketplace through its FusionStore. Finastra, headquartered in London, has global operations, including U.S. offices. Finastra serves 90 of the top 100 world banks and has launched Finastra Managed Services (FMS) on Amazon Web Service (AWS), according to a May 4, 2022 press release.

Marqueta

Marqueta issues physical, virtual, and tokenized credit cards, debit cards, and prepaid debit cards providing customized rewards, card controls, and customer preferences. Marqueta is also a payments processor, using its modern, embedded, open-API BaaS platform to serve digital bank and non-bank customers in many industries. Marqueta is a card-issuing partner of Uber and Uber Eats, DoorDash, and other well-known brands through strategic partnerships.

BBVA

BBVA is an innovative first mover bank in the BaaS space. BBVA Open Platform is a BaaS platform serving the U.S. and global customers. The Uber app integrated BaaS from BBVA into its app in Mexico.

This Mexican Uber app from BBVA provides a Driver Partner debit card. It lets Uber drivers and delivery partners receive earnings and access loans and gas discounts. BBVA Open Platform, a bank-created BaaS system, powers digital-only banks and non-bank applications in the U.S.

Power your platform with smarter global payouts

Offering embedded finance or BaaS? Discover how to enhance your payout infrastructure to support scalable, compliant, and seamless global transactions.

Future Trends for BaaS

Future trends for BaaS (Banking as a Service) include:

- Impressive adoption rate of BaaS in many industries

- More FinTech companies and financial services applications

- Modernization and digitization of bank systems to support BaaS

- More banks and BaaS platform providers with BaaS connections to non-banks

- More types of embedded financial products and services (including Buy Now, Pay Later)

BaaS adoption shows remarkable momentum. Banking as a Service will grow into a $7 trillion industry by 2030, according to the March 2022 report from a Finastra survey titled Banking as a Service: Outlook 2022 | Paving the Way for Embedded Finance.

The global BaaS platform market (one layer of the BaaS stack) is growing at a CAGR of 15.7%, expected to reach $12.2 billion in 2031, according to the Future Market Insights Banking as a Service (BaaS) Platform Market Report summary.

FAQs

Is Banking as a Service (BaaS) the same as Open Banking?

No. BaaS is different from open banking, which refers to the permissioned sharing of bank customer data and information in FinTech (financial technology) products and services. Open banking serves as one catalyst for deploying BaaS applications.

What is a BaaS stack?

A BaaS stack is comprised of three levels:

1. Brands deploying embedded financial services

2. BaaS platform providers

3. Licensed banks

In Banking as a Service, an API connection to licensed banks and BaaS software platforms from third-party providers lets these brands offer their end customers embedded financial services.

What does Brand mean in Banking as a Service (BaaS)?

BaaS terminology uses brand(s) to mean businesses in multiple industries, including retail, that introduce ebbed finance products to customers within the same online channel in which they offer goods to customers. With Banking as a Service, customers don’t need to seek these financial services or products separately through a traditional bank’s website, mobile app, or branch location.

Importance of Banking as a Service

Banking as a Service (BaaS) is important because it improves the end customer experience by providing comprehensive BaaS solutions as partnered ecosystems. BaaS provides traditional banks with new customers and enhanced revenue streams. FinTech companies and other providers of the BaaS experience launch small businesses with substantial growth potential, new products, and business models.

Banking as a Service is an incentive for banks to digitize and modernize. Banks are upgrading legacy banking systems. Bank technology needs to work in BaaS to embed financial services and financial products into many industries. A bank’s customer acquisition cost (CAC) is lower when BaaS partners have existing relationships with customers. The brands funnel their customers to the bank.

BaaS partners expand the number and quality of banking applications available to customers. Their speed to market for embedded banking technology is quicker than a traditional bank, which is more bureaucratic.

Banking as a Service is a modern solution. BaaS often incorporates cloud-based artificial intelligence (AI)/machine learning (ML) and robotic process automation (RPA) technologies for data-based credit decisions, more accurate results, fraud reduction, and automation of simple repetitive processes.

Companies are rapidly adopting Banking as a Service. They range in size from startups and small businesses to Fortune 500 enterprise companies. These businesses, directly benefiting from BaaS, offer their customer base convenient access to embedded financial services and banking products. BaaS can help them close sales faster without losing pipeline leads, attract new customers, and grow revenues.

Banking as a Service (BaaS) seamlessly provides essential services and financial products to customers, contributing substantially to economic growth.