The cash flow statement is a valuable financial statement that shows cash inflows and cash outflows by category prepared using the company’s income statement and balance sheet.

The cash flow statement, combined with financial analysis of ratios and metrics, helps a company assess its liquidity, which is the ability to pay obligations when due with short-term liquid assets convertible to cash.

We provide a definition of a cash flow statement, including its components and examples that will help your business better understand how to prepare a cash flow statement.

What is a Cash Flow Statement?

A cash flow statement is a financial statement that shows the sum total of a company’s cash inflows from their ongoing processes and external investments. The statement also provides cash outflow data, showing how much a company has spent on business activities and expenses.

Components of a Cash Flow Statement

Operating, investing, and financing activities are each presented as a separate section of the cash flow statement, besides beginning cash & cash equivalents, ending cash & cash equivalents, and certain non-cash activities disclosures on the face of the statement of cash flows.

Operating Activities

The operating activities section of a cash flow statement shows cash inflow and outflow categories and the total net cash flow from normal business operations. When the indirect method is used, net income, adjustments for non-cash items, and changes in working capital are included as activities in the operating section of the cash flow statement.

Examples of cash inflows from transactions considered operating activities:

- Revenue collected from customers

- Interest income from loans

- Dividend income (in cash received)

- Lawsuit cash awards received

- Insurance proceeds received

- excluding property, plant & equipment insurance proceeds as investing activity

- Amount of cash from the sale of trading securities

Examples of cash outflows from transactions considered operating activities:

- Cash paid for operating expenses and inventory purchases

- Cash for payroll transactions and accrued liabilities

- Interest expense paid in cash

- Income tax payments

- Insurance payments

- Lawsuit damages paid in cash

The list of cash items representing inflows and outflows of cash for the operating section isn’t all-inclusive.

Investing Activities

Cash flow from investing activities includes long-term asset (fixed asset) cash purchases and sales and fixed asset insurance proceeds. Furthermore, investing activities are investments in securities of other companies, loans to other entities, and M&A cash transactions to buy businesses.

Examples of cash inflows from transactions considered investing activities:

- Sales of fixed assets like property, plant & equipment for cash

- Insurance proceeds related to fixed assets loss or damage

- Cash purchases of businesses through M&A activities

- Sales of available-for-sale or held-to-maturity debt or equity securities

- In other companies

- Cash receipts from collecting principal from debtors on loans

Examples of cash outflows from transactions considered investing activities:

- Purchases of fixed assets like plant, property, and equipment for cash

- not installment payments, which are financing activities

- non-current assets

- Purchases of available-for-sale or held-to-maturity debt or equity securities

- In other companies

- Cash loans to borrowers

Financing Activities

The financing activities cash flows relate to company debt and equity transactions. Cash dividends paid are financing activities. However, dividends declared but not yet paid with cash are non-cash expenses disclosed as non-cash activities on the face of the cash flow statement instead.

An example of cash inflows from transactions considered financing activities:

- Cash transactions for the issuance of debt and equity securities

Examples of cash outflows from transactions considered financing activities:

- Repurchase of company shares as treasury stock (outflows)

- Repayment of short-term and long-term debt principal with cash

- including capital lease obligations (outflows)

- Paying cash dividends

- Paying debt issue costs

Cash Flow Statement Example

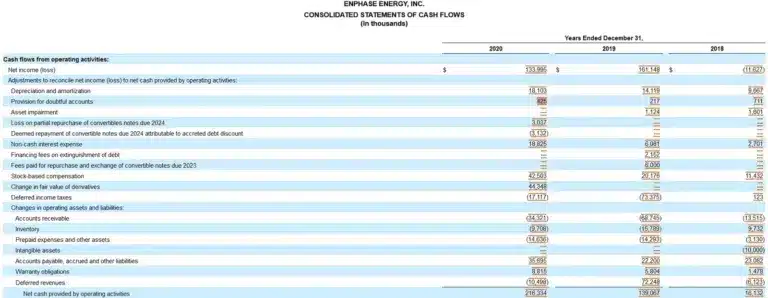

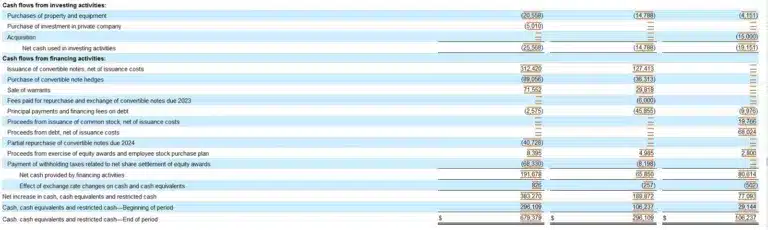

A cash flow statement example is the comparative Consolidated Statements of Cash Flows for Enphase Energy, Inc. from its Form 10-K SEC filing for the year ending December 31, 2020, which is shown in the following screenshot.

You may use your accounting software or an Excel template to see more examples of cash flow statements.

How Cash Flow on a Statement is Calculated

Businesses create a cash flow statement in either of two ways. We explain the cash flow statement direct vs indirect methods.

Direct method

The direct method format used for the cash flow statement includes beginning cash & cash equivalents balance. It adds cash inflows and cash outflows without reconciling net income in the operating activities section.

Indirect method

The indirect method for preparing a cash flow statement shows beginning cash & cash equivalents, including restricted cash. The indirect method formula begins the operating activities section with net income (loss) from the income statement. The operating activities section reconciles to cash flow from operating activities by adjusting for non-cash items and changes in working capital balances.

Non-cash items used as adjustments to net income (loss) in the operating activities section of the statement of cash flows include depreciation and amortization.

Investing and financing activities are also included as sections in the indirect method cash flow statement to reach the ending cash & cash equivalents balance from the balance sheet.

The indirect method, which is easier to use for creating a cash flow statement, is more widely used by companies.

Accounts Receivable, Accounts Payable, and Cash Flow

In the indirect format of a cash flow statement, changes in working capital balances (current assets and current liabilities), including accounts receivable and accounts payable are used to adjust net income (loss) in the operating activities section. Accounting standards usually require accrual accounting to record transactions when recognized, not when cash payments occur.

Accounts Receivable

When the accounts receivable balance decreases for the accounting period of the cash flow statement, it signifies that cash receipts from accounts receivable collections occur when customers pay their invoices. The accounts receivable balance decrease should be added to net income (loss) in the cash flow statement to reconcile to cash flow from operating activities.

Accounts Payable and the Inventory Effect

When accounts payable increases during the accounting period, purchases from suppliers on account, including inventory, are increasing, but cash isn’t yet used. Later, when vendor invoices for inventory are paid, money is used, and accounts payable balances decrease.

A net increase in accounts payable balances should be added to net income(loss) because it doesn’t use cash (in total). A net decrease in accounts payable balances reduces cash and should be subtracted from net income (loss).

The Value of a Cash Flow Statement

The cash flow statement has importance because it helps financial management, creditors, lenders, investors, and other stakeholders assess the company’s financial health. The cash flow statement provides more information than income statement and balance sheet financial reports prepared on the accrual basis of accounting that doesn’t reflect the timing of cash inflows and outflows.

The cash flow statement is prepared on both an actual and forecast basis that projects future cash flows. A business plan used by a small business to raise venture capital includes projections of the company’s cash flow in future years. And companies of all sizes analyze actual cash flow statements, perform cash management, and forecast cash flow statements.

Companies can use free cash flow (in combination with a discounted cash flow analysis) as a metric to determine how much cash the company can spend on new projects or other uses for outflows of cash. The free cash flow formula is Operating Cash Flow – Capital Expenditures.

When companies project negative cash flow instead of positive cash flow in projections for a period of time, they can determine when new financing (or tapping an existing bank line of credit) is needed to bridge the gap to reach positive cash flow to pay financial obligations when due.