Global payment processing for business disbursements enables the making of cross-border payments in various currencies. Businesses make these outbound global payouts to international suppliers and other payees, including creators and freelancers.

This guide provides definitions, explains how global payment processing works, its challenges, and why your business needs to build a global accounts payable strategy with automation to solve your global payment challenges.

What Is Global Payment Processing for Outbound Business Payments?

Global payment processing is used for disbursing outbound business payments to freelancers, suppliers, vendors, publishers, or other affiliates with bank accounts outside the country where your business operates.

Your business needs a comprehensive, automated system for global payment processing to efficiently pay overseas suppliers, affiliates, and creator payees.

It’s crucial to choose a global payments processor that supports a wide range of localized payment methods and multiple currencies.

With a SaaS-based payment solution, you can streamline the entire cross-border payment process, plus improve tax compliance. Payees will appreciate the simplicity of your guided registration process.

How Global Payout Processing Works

Global payout processing for cross-border disbursements is most effective when using an automated mass payouts system that integrates with your ERP or accounting system.

One example of global payouts software is Tipalti Mass Payments, which streamlines and automates payments to creators, affiliates, and freelancers. Tipalti also offers a global AP automation product for paying global suppliers. The following steps apply to both Tipalti finance automation products in its unified platform.

How Tipalti Simplifies Global Payment Processing

Tipalti simplifies global payment processing by automating every stage of the outbound payout lifecycle—from onboarding to reconciliation—within a single, unified platform.

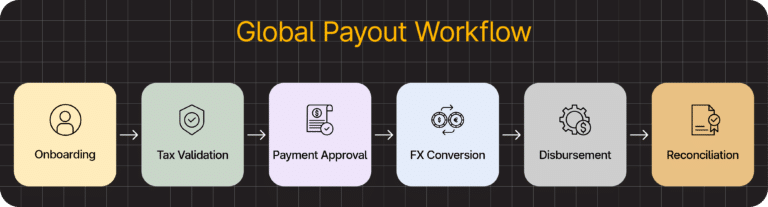

At a high level, the global payout workflow follows this sequence:

Here’s how each step works in practice:

- Payee onboarding: Payees are onboarded through a branded, self-service portal, providing their tax form and payment information.

- Tax validation: Taxpayer IDs are validated with automatic TIN matching.

- Payment approval: An AI agent automatically routes approvals to the correct approver(s).

- FX conversion: Currency conversion is built into the global payouts platform.

- Disbursement: Large multi–payment-method batches of up to thousands of transactions are scheduled and used to make disbursements to payees in their local currencies.

- Reconciliation: The mass payouts software automatically syncs with your ERP and instantly prepares a payment reconciliation.

Tipalti supports a broad range of payment methods, including digital wallets, global ACH, debit cards, wire transfers, and checks, allowing businesses to pay international partners using their preferred options.

Pro tip: Digital wallet payment methods like PayPal can be faster and more cost-effective than international wire transfers for certain cross-border payouts.

Read our PayPal mass payments guide to compare settlement times, transaction fees, and use cases so you can choose the most efficient payment method for each scenario.

Challenges Finance Teams Face With Cross-Border Payments

Managing cross-border payments is inherently complex, especially as finance teams scale globally. Differences in banking systems, currencies, regulations, and tax requirements introduce operational friction that can slow payments, increase costs, and elevate risk.

1. Time-consuming global payments

Traditional global payments processing involves manually entering data into multiple bank portals, resulting in costly overhead due to excessive staff time and effort. Then, manual payment reconciliation is required, which uses more team resources and often delays the accounting close.

2. Late payments

Global payees expect timely cross-border payouts, but slow payment methods or inefficient processing can cause missed deadlines. Payment delays may result in late fees, strained supplier relationships, and lost opportunities for early payment discounts.

3. Payment errors from manual data entry

When using manual data entry, your business risks incorrectly entering the bank account, routing number, or other payment details, including the amount payable. This can result in payments not being processed on time, being made to the wrong recipients, or resulting in overpayment.

4. International banking networks

Setting up several regional banking networks in foreign countries may require the finance team’s travel and management time.

5. Incurring high international wire transfer costs

Businesses may habitually use international wire transfers for all or most cross-border payments, even when not cost-justified.

6. Limited payment methods and currencies

Businesses may currently have system-limited global payment method options and currency choices.

7. High currency conversion costs

When processing global payments to a supplier in a foreign currency, you may also incur heavy currency conversion (FX) fees if you don’t partner with a cost-friendly global payments processor.

8. Fluctuating foreign currency rates

If payments aren’t designated in US dollars, the amount your company owes may fluctuate between the invoice date and the upcoming payment notification date, as well as the payment due date. Companies may consider hedging strategies for better cost control.

9. Global regulatory compliance

Maintaining company-wide expertise in global payment regulations across multiple countries is challenging. Businesses must screen the sanctions blacklists, apply KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, and comply with other international regulations. That’s why automating global regulatory compliance is a stronger solution.

10. Fraudulent payment risk

Fraudulent payment attempts are common in global payments, putting businesses at risk of financial loss, payment delays, and reputational damage.

Pro tip: Automating fraud detection can help reduce risk without slowing payouts. Tools like Tipalti Detect use continuous monitoring to identify suspicious payee activity and flag potential fraud before payments are processed.

11. Avoiding tax compliance penalties

The IRS requires companies to collect W-8 or W-9 tax forms from payees and suppliers who meet its thresholds and to calculate, perform, and report backup withholding of payees’ income taxes when required.

Businesses must also submit and distribute IRS forms 1099-MISC, 1099-NEC, and 1042-S to taxing authorities and recipients by deadlines. Incorrect taxpayer identification numbers (which can be verified through TIN matching) and late information return filings result in tax compliance penalties.

Automate Global Payment Processing at Scale

Tipalti streamlines global payment processing for business payouts—automating mass payouts to creators, affiliates, and freelancers in 200+ countries and 120+ currencies. Trusted by leading global companies, Tipalti helps finance teams reduce manual work, errors, and cross-border complexity.

How to Reduce Cross-Border Transaction Fees in Global Payment Processing

Businesses can reduce their cross-border transaction fees by using an end-to-end global payment processing platform, such as Tipalti, to make their payouts and accounts payable invoice disbursements.

A finance team using the best finance automation software for global accounts payable or payouts can reduce its global transaction fees by:

- Selecting lower-cost options from more available payment methods

- Receiving the cost-saving benefits of routing payments via local rails

- Accessing transparent and competitive FX rates

- Optionally centralizing global payments for all subsidiaries

- Set up configurable advanced payment options

- Using large batch payments to reduce per-transaction costs

For example, Tipalti enables users to reduce their transaction costs through advanced configuration. The advanced configuration setup encourages payees to select cost-effective payment methods and users to set thresholds that hold payments until a minimum batch amount is reached.

PayPal international transaction fees are lower than the pricing of international wire transfers, but still somewhat high.

PayPal is a digital wallet payment service that offers various alternative payment methods, including bank transfers, credit and debit card payments, and buy now, pay later (BNPL) options. (PayPal also provides merchant services with credit card processing and payment acceptance at checkout for eCommerce and other businesses.) PayPal is a payment gateway and payment processor.

What to Look for in a Global Mass Payments Platform

When selecting a global payments platform, look for a global mass payments solution with enterprise-grade financial controls. Also, check for the ability to schedule thousands of payments at the same time and whether the platform supports multiple payment methods. The global mass payments platform should perform instant payment reconciliation.

Capabilities for Different Global Payout Types

With Tipalti Mass Payments, your business can pay global freelancers, make online marketplace payments, and royalty payments, plus other types of payouts to creators, influencers, affiliates, and other partners.

It should offer the ability to integrate with your ERP, performance marketing platforms, and your pay-in providers.

Payment Method Choices

Different suppliers and other payees will have varying payment preferences. Paying them according to their preferred method makes it easier to do business with them and streamlines the entire payment process.

Some suppliers may prefer Global ACH (eChecks for global payments), while others request PayPal or a wire transfer. Their preferred method will impact the information you need to collect, but with automated global payment processing, you don’t have to concern yourself with collecting this information because the automation software will do it for you. Look for ways the system can incentivize a payee’s choice of lower-cost payment methods.

AI Agents and AI Assistant

Look for payment technology, including AI agents and other AI-driven features, to enhance the efficiency of the online payments platform.

For example, Tipalti’s AI Assistant uses AI technology to facilitate conversational queries for generating customized report analysis.

Compliant Global Payments

Meeting cross-border remittance requirements is essential for global payments. Tipalti uses built-in compliance and banking rules to minimize errors and ensure regulatory adherence, while intelligently routing transactions to enhance approval rates and expedite payment processing.

Tax Compliance

Tipalti provides simple tax compliance, with W-9 or W-8 tax form collection during payee onboarding, automated TIN matching, a tax preparation report, and optional eFiling of 1099-MISC, 1099-NEC, and 1042-S tax forms through partnered and integrated Zenwork Tax1099 software. Tipalti calculates any required backup withholding of income taxes.

Optional Currency Management (FX) Products

Tipalti offers optional software products for advanced currency management. Multi-FX enables your company to make centralized payments for all subsidiaries from a centralized virtual payment account. Your business doesn’t need to set up a regional international banking network. Tipalti FX Hedging enables your business to hedge its payables for fluctuating foreign exchange rates.

Audit and SOX Compliance Controls

Look for audit trails and SOX compliance features that include user activity and user permissions reports.

Businesses that make mass global payments will greatly benefit from using an automated mass global payables platform. An end-to-end global payment engine that automates the numerous and intricate tasks involved in international payments will result in faster payments, lower processing costs, and better cash flow management. It improves customer experience.

Fraud Detection and Reduction through Authentication

Look for integrated behavioral fraud detection software offerings by payment processing companies and global payment platforms to authenticate domestic and international payees and reduce fraud risks.

For example, Tipalti offers behavioral fraud detection and monitoring with Tipalti Detect. TIN matching also helps prevent your business from making fraudulent payments through a payment network. Tipalti Detect flags suspicious payees for follow-up and creates an audit trail.

Multi-Entity and Multi-Language

Seek functions enabling multi-entity use and spend visibility, and multi-language onboarding from your selected global payment processing platform.

Pro tip: If your business operates across multiple entities or subsidiaries, choosing a global payment processing platform with built-in multi-entity support can simplify spend visibility and financial controls.

Learn how mid-market businesses manage this complexity in our guide to multi-entity finance transformation.

Why Tipalti Is the Trusted Payout Partner for Global Businesses

Tipalti is a trusted global payment processing partner because it continues to provide innovative products and deliver desired results for its customers, making them more effective and reducing manual work.

As a licensed money services business in the US, UK, EU, and Canada, the company operates under regulatory oversight that strengthens trust in its global payment capabilities.

Its product strategy is built around three core pillars: breadth, depth, and simplicity, helping remove operational hurdles so finance teams can focus on higher-value, strategic priorities.

Recent Tipalti Product Developments

To stay aligned with evolving global payment requirements, Tipalti continues to invest in enhancements to its Mass Payments automation software.

Tipalti’s product roadmap for Mass Payments includes:

- Integrating your pay-in providers with Tipalti mass payments for transparent, real-time cash flow management of inflows and outflows.

- New developer tools for customized API-driven payee onboarding.

- User Activity Report and User Permissions Report, for SOX compliance and audit trail.

- Tipalti Canada Inc. is a FINTRAC-licensed money services business in Canada that will provide a local payment experience for Canadian entities.

- Expanded Zenwork Tax1099 integration to add automated IRS Form 1042-S eFiling in addition to 1099-MISC and 1099-NEC forms eFiling (with 12 calendar months of data).

- Centralized payee document management (including uploading contracts to payee records) within Tipalti Hub.

These ongoing investments are designed to reduce operational complexity while improving accuracy, compliance, and the overall payee experience.

Customer perspective:

Tipalti takes the pain out of manual payouts with automated payee onboarding, payments, tax compliance, fraud prevention, and reconciliation—with a best-in-class experience for valued payee networks.

RWS at Illuminate Conference

Result: Businesses using Tipalti Mass Payments gain greater operational efficiency, stronger compliance controls, and higher payee satisfaction as they scale global payouts.

Together, these product developments reinforce Tipalti’s commitment to simplifying global payout operations as businesses scale. By continuously investing in automation, compliance, and payee experience, Tipalti enables finance teams to manage global payments with greater confidence, efficiency, and control.

Take Control of Global Payouts with Tipalti

Tipalti Mass Payments gives finance teams the tools to automate payouts, strengthen compliance, and scale global payment operations with confidence.

Global Payment Processing FAQs

What is a global payment processor for businesses?

A global payment processor for businesses enables them to send cross-border payments to international recipients in different countries and currencies.

How is it different from accepting payments?

Global payment processing differs from accepting payments in that it involves disbursing funds to international payees or suppliers, rather than accepting and receiving payments from customers.

What are the challenges of sending international payouts?

Challenges of businesses sending international payouts through global payment systems include efficiency, cost-effectiveness of the payment method, currency conversion, reducing fraud risks and errors, and achieving global regulatory and tax compliance.

Can a global payments platform reduce compliance risk?

A global payments platform for mass payouts or supplier invoice payments reduces compliance risk through payables workflow automation.

An end-to-end payments platform automates global regulatory compliance by screening against sanctions blacklists, handling KYC and AML requirements, and other regulations. It also simplifies tax compliance, including tax form collection, TIN matching, and compliance reporting through automation.

Can you automate global mass payouts for royalties?

Yes, global mass payments software from Tipalti, integrated with your ERP system, automates and facilitates global payouts for royalty payments and other types of payouts.