Key Takeaways

- Return on investment (ROI) is a percentage calculated by dividing gains or losses minus costs by the initial cost of an investment.

- The initial cost includes all costs or expenses incurred in investing.

- ROI can be positive or negative, indicating a successful or negatively-performing investment.

- ROI can be computed and annualized if not measured over one year. Annualization is possible for short-term investments held under one year or multiple-year investment periods.

- Benchmarking ROI to alternative investments or projects provides perspective in making choices.

- The ROI formula doesn’t consider the time value of money or investment risks. Discounted cash flow methods can incorporate these factors, possibly resulting in a different business investment choice when evaluating alternative investment projects.

What is ROI (Return on Investment)?

Return on investment (ROI) is a financial ratio expressed as a percentage, used as a metric to evaluate investments and rank them compared to other investment choices. ROI is computed as forecast or actual investment gains or losses minus costs, divided by initial investment cost. Another name for ROI is return on investment.

For securities investment, business investment decisions, and real estate projects, ROI is derived from the gain or loss from the asset’s value compared to the investment cost.

ROI can evaluate potential investment opportunities or show how actual investments perform as a percentage return on investment.

How to Calculate ROI

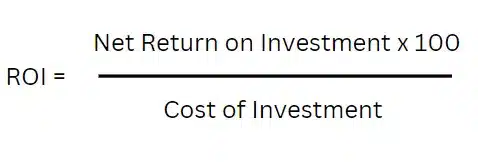

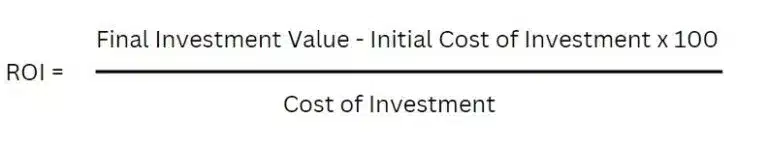

You can use a basic or expanded ROI formula to compute return on investment. All relevant costs should be considered when computing return on investment (ROI). By multiplying by 100 in the formula, ROI becomes a percentage.

Note that you also need to subtract the investment cost from the numerator of the basic ROI formula.

Basic ROI Formula

Expanded ROI Formula

How to Calculate Annualized ROI

When you calculate ROI for other than one year, you can use the formula below or an ROI calculator to determine the annualized return on investment.

Unless you’re an expert at superscript math or fully understand how to apply compounding tables to this formula, consider using an accurate online ROI calculator to determine the annualized ROI.

Annualized ROI = [(1+ROI)1/n − 1] ×100

Where n = number of years (or partial years) for an investment

How Often Should You Calculate ROI?

One of the advantages of the simple ROI calculation is that you can compute return on investment as often as you like to track the performance of an investment. You can annualize ROI if you’re not computing it for one year.

Investment firms issue annual reports that include return on portfolio investment performance over a one-year and five-year (or other) period being measured. As an investor, you may want to track your stock performance frequently. And you may decide to track ROI when you sell a stock and recognize capital gains.

Businesses generally track ROI monthly, quarterly, or annually and evaluate the success of a business investment as a rate of return (ROR) upon project completion.

Using an Online ROI Calculator

Although calculating ROI is easy, you may use an accurate online ROI calculator to perform the ROI calculation or check your calculation result. An online ROI investment calculator also provides annualized ROI (in addition to overall return on investment) for a multi-year or less than one-year period.

How To Interpret ROI

To interpret ROI (return on investment), a positive ROI means the investment is profitable. A negative ROI means that you have incurred a loss on the investment over the period included in the calculation.

Because ROI is often expressed as a percentage, you can compare the ROI percentage to your company’s desired percentage hurdle rate. Some business investments take time to reach a positive return. Use discounted cash flow analysis, besides ROI, to justify investing in a substantial business project and perform ongoing and post-project evaluations.

For mutual fund investments, compare the ROI to your investment goals and the portfolio performance of other investment funds.

What are ROI Alternatives for Investment Evaluation?

Besides ROI (return on invested capital), investors may use return on equity (ROE) to measure stock investments.

Besides ROI, businesses use discounted cash flow methods like net present value (NPV) or internal rate of return (IRR) to evaluate potential and actual investments financially.

Discounted cash flow considers cash flow timing, the time value of money, weighted-average cost of capital (WACC), interest rates, and investment risk. ROI doesn’t consider the time value of money or an investment’s risk profile.

Another method for calculating business project investment returns that doesn’t consider the time value of money is the payback period. However, the payback method can be modified by using a discounted payback calculation to consider the time value of money.

Businesses also use general profitability ratios and measures, as well as asset utilization ratios, including percentages for bottom-line net income and return on assets (ROA), to optimize their results.

Real estate investors may use ROI as a metric. However, they often include discounted cash flow methods and cap rates for real estate valuation to determine an initial purchase price.

ROI Examples

We provide two examples of how to calculate ROI. As one example, calculate ROI to periodically measure the results of a stock market investment or your overall portfolio. As a second example, use ROI to evaluate and measure a business investment in a project that results in cost savings or net profit.

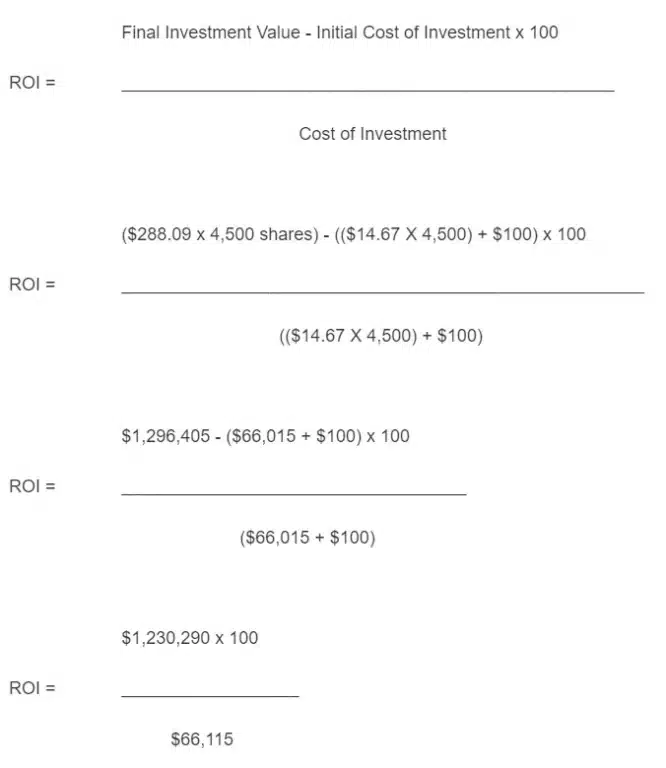

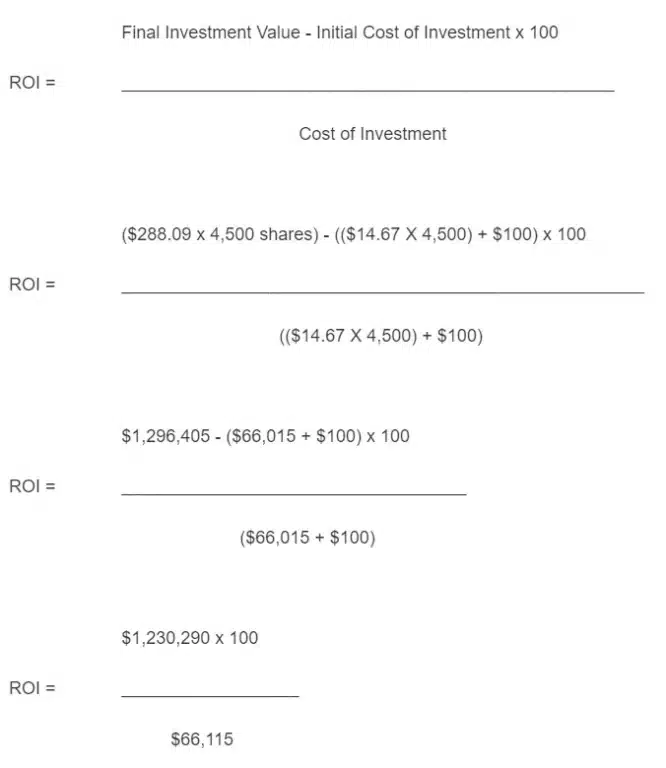

- ROI Example: Measuring Stock Performance

Let’s use ROI to evaluate the performance of 300 shares of Tesla stock you purchased on August 26, 2016, at a split-adjusted price of $14.67 per share over a six-year holding period. During this period, Tesla had a 5:1 stock split on August 31, 2020 and a 3:1 stock split on August 25, 2022. For this example, we’ll measure results using the $288.09 post-split closing price on August 26, 2022, your sixth anniversary of holding the stock.

When you bought Tesla stock, you used a traditional brokerage firm with a $100 transaction fee (brokerage commission). You haven’t bought or sold shares since the initial investment. Tesla is a tech stock that doesn’t pay dividends.

We use an adjusted number of shares and cost per share in our ROI calculation, reflecting both stock splits by multiplying the initial number of shares purchased by 15. You now hold 4,500 shares at an adjusted initial cost of $14.67 per share and a post-split closing price of $288.09 on August 26, 2022.

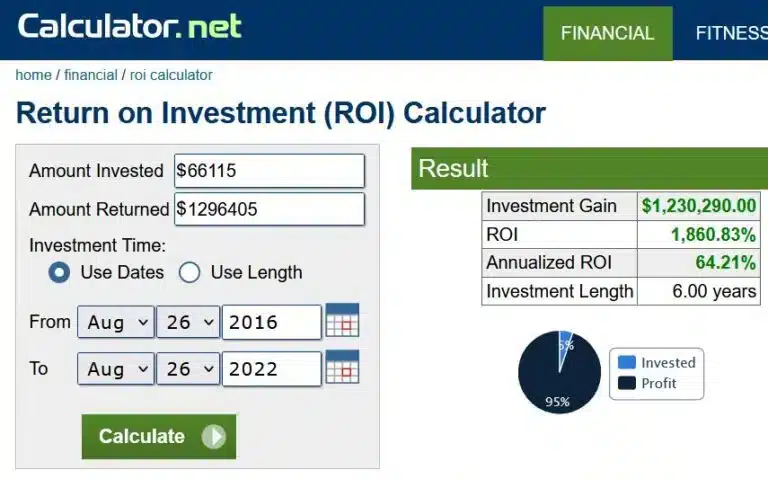

ROI = 18.6083 times initial investment x 100 = 1,860.83% for 6 years. Annualized ROI = 64.21% per the ROI calculator from Calculator.net (as shown below)

Investment Performance: An investment in Tesla stock over six years has produced an exceptionally high ROI, proving Tesla was an excellent investment choice.

Investment mutual funds often benchmark their ROI to the S&P 500 Index performance over the last five or ten years. As a comparison of S&P performance, from YCharts (sourced from Standard & Poor’s), an investment in the S&P 500 provided an ROI of 67.2% for the five years ended July 31, 2022, and 199.4% for the ten years ended July 31, 2022. The one-year return of the S&P 500 Index was -6.03% for the year ending July 31, 2022.

Per S&P Global, the one-year return of the S&P 500 index was -9.22% as of August 26, 2022. The annualized 5-year return as of August 26, 2022, was 10.68%; the annualized 10-year return as of August 26, 2022, was 11.14%.

An investment in Tesla stock, which is riskier, has vastly outperformed S&P 500 Index performance. Note that ROI doesn’t measure investment risk.

- ROI Example: Measuring Business Project Investment

If the project is implemented, the estimated and actual return on business investments is calculated as a forecast and post-project performance evaluation. ROI can be periodically calculated to determine how the project is performing. This example is a capital expenditure decision.

Initial Cost

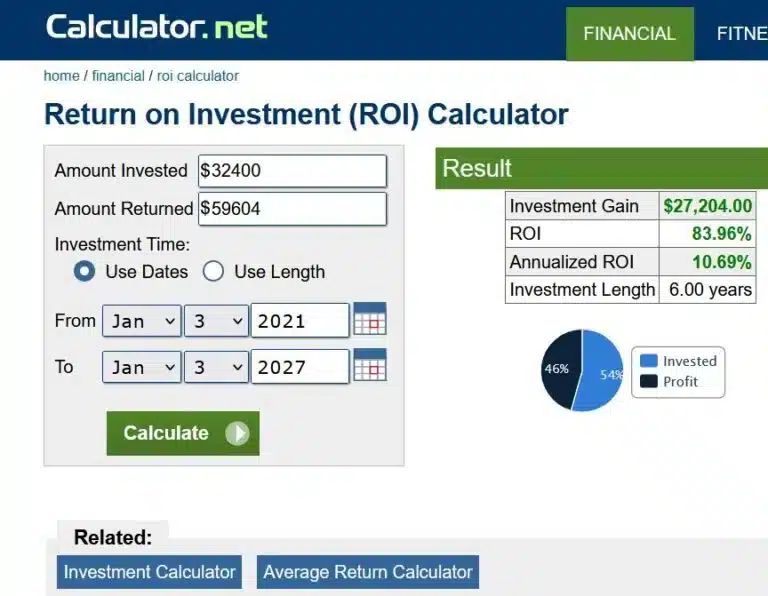

On January 3, 2021, Novula Tech obtained a quote for (delivered) test equipment costing $31,400 to launch a new service. Installation costs will be $1,000, increasing the total cost of the equipment to $32,400. The estimated useful life of the equipment is six years.

Revenue

Novula service revenue will be $500 per customer test. Novula forecasts it will perform 85 tests annually, producing $42,500 in revenue during the first year of equipment use and $255,000 for the six years of its estimated life.

Cost of Service

The average total labor, supply parts, and overhead cost of performing these tests is $265 per test, equal to $22,525 for 85 tests per year. The service cost for six years is estimated at $135,150. The annual maintenance cost for the equipment is $2,000, which is $12,000 over six years.

Depreciation

Non-cash depreciation expense will be $5,400 per year.

Assumptions

To simplify this example, we assume:

- Over the six years, the annual number of tests, test prices, or costs will not increase.

- The company will pay for the equipment with cash, incurring no financing fees for the equipment investment.

- Novula is based in Texas, a state with no income tax. Its corporate federal tax rate is 21% or 0.21 in this ROI calculation example.

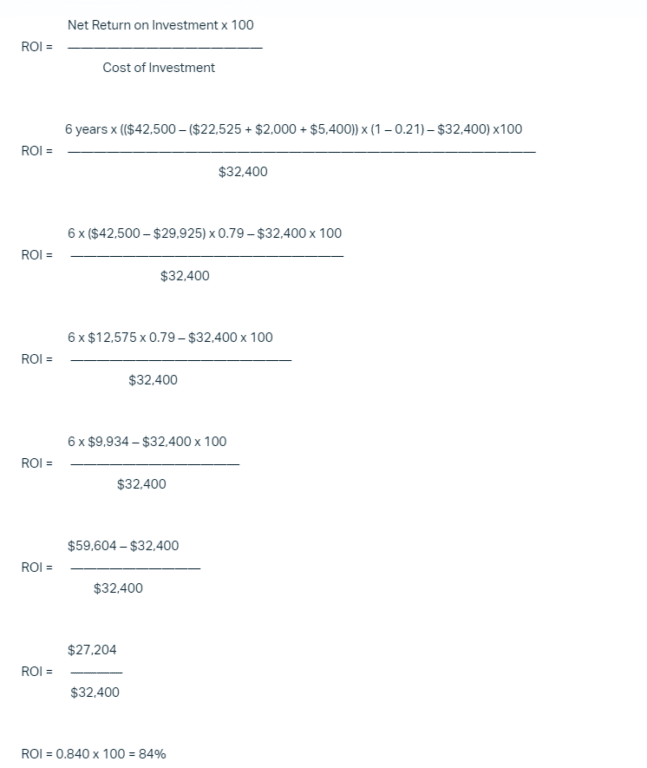

ROI Calculation – End of Year 6

Annualized ROI (per the ROI calculator from Calculator.net) =10.69%

Evaluation Decision: The Novula investment in equipment makes financial sense for the company because it can quickly result in an attractive annualized ROI of 10.69%, which exceeds its 7% annual investment hurdle rate.

When is ROI a Useful Performance Measure?

ROI is a valuable financial percentage metric measuring the positive or negative performance of stock and portfolio investments. It can also be used to evaluate business investment projects, especially when the returns can be quickly realized.

A quick return example is business investment in add-on AP automation software and global mass payments software integrating with your ERP system. AP automation software increases productivity and reduces costs. The Tipalti invoice processing and payment cost calculator helps you evaluate potential cost savings to determine ROI on your SaaS software investment.

ROI can be used to rank the profitability of an investment compared to different investment choices.

Businesses and commercial real estate ventures can combine the ROI metric with other evaluation techniques that discount cash flow to consider the time value of money and the risk of an investment. The evaluation methods to apply depend on the type of investment.