Learn how to expertly execute global payments for streamlined accounts payable and business efficiency.

Fill out the form to get your free eBook.

There are numerous options for paying international suppliers, from prepaid debit cards to international ACH to wire transfers and more. Each has benefits and drawbacks that impact the satisfaction of your suppliers and the workload of your finance team Download the eBook to discover: 1. The current state of supplier payments 2. Today’s top global payment methods 3. Comparing Wire Transfers, Domestic ACH, Global ACH, Paper Checks, Prepaid Debit Cards, and PayPal 4. How automation enables multiple payment methods

Have you ever had your paycheck direct-deposited? Paid your mortgage or utility bills automatically through your bank account or paid a supplier without writing a physical check? Then chances are you are already well acquainted with ACH. An ACH (Automated Clearing House) transfer is a process that allows businesses and consumers to move money between accounts quickly and safely.

But as popular as ACH transfers have become, with over 29 billion transactions and over $72 trillion in payments transferred in 2021, many businesses and consumers still don’t understand the complex behind-the-scenes mechanics of ACH transfers.

In this guide, we’ll explain what an ACH transfer is, outline the different types of ACH transfers, and supply some basic steps on how to set up ACH transfers for you or your business.

What is an ACH Transfer?

An ACH transfer is a payment made between bank accounts through the ACH (Automated Clearing House) network. An ACH transfer is one of the most popular types of electronic bank transfers and is used by consumers for direct deposit or automatic bill payment. Businesses use ACH transfers for B2B and direct debit transactions and mail or telephone orders (MOTO). ACH transfers typically take 3-4 business days to complete.

ACH (or Automated Clearing House) is a network used for transferring money payments electronically across the United States. The ACH network is governed by Nacha (National Automated Clearing House Association) and may also be referred to as the ACH scheme.

What Information Is Needed for an ACH Transfer?

To make an ACH transfer, you’ll need to provide the following details:

1. Name

2. Routing/ABA number

3. Account number

4. Whether the bank account is a business or personal account

5. Transaction amount

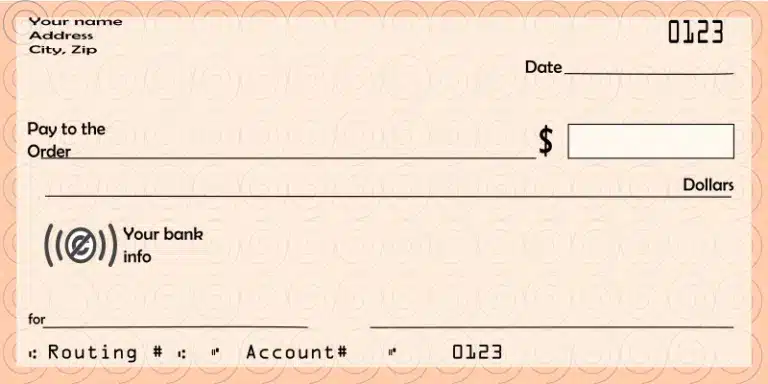

ACH Information on a Sample Check

If the account has check-writing privileges, you should be able to locate the account and routing numbers at the bottom of a check.

It should be noted that accounts at credit unions can also be used to make ACH payments.

The account nickname is optional, but the other pieces of information are not. Your personal information should already be attached to the financial account, so there will be no need to include those details.

The payment amount is not considered one of the ACH instructions but will need to be included when making an individual transaction.

Now that you have this background knowledge under your belt, it’s time to look at actually making a digital payment. Here are the steps you need to take to successfully complete an ACH transfer.

ACH vs Wire Transfers

The main differences between ACH and wire transfers are speed and cost.

Wire transfers typically take a shorter amount of time to complete. In some cases, they can be completed within a day. Wires can also be sent internationally. ACH transfers, on the other hand, can only be used between U.S.-based accounts.

However, ACH transfers are generally much cheaper than wire transfers. Wire transfers can run from $25 – $30 for transfers within the U.S. and between $45 – $50 for transfers outside of the U.S. An ACH payment could be less than a dollar for businesses and free to consumers.

How to Make an ACH Payment

Setting up an ACH transfer is as easy as these simple steps.

Step 1: Gather the Necessary Information

To make a transfer, you’ll need to provide your name, routing/ABA number, account number, account type, and transaction amount. The bottom of the check (as previously noted) should have all of that information.

Step 2: Choose Between ACH Debit and ACH Credit

To properly set up an ACH transfer, you’ll need to distinguish between an ACH debit and an ACH credit.

- ACH credit is the type of payment used in bill pay services. With this transaction, you give authorization to your financial institution to send a payment to a payee, such as a utility company or car loan servicer. Your bank account details remain with your financial institution and are not sent to the payee.

- With ACH debit, you establish the transaction with the payee. In this situation, you submit your payment details (including account and routing numbers) to the payee. This type of digital payment entails a greater risk than ACH credit.

Both types of e-payments provide the same level of convenience and cost-effectiveness.

Now that you have this background knowledge under your belt, it’s time to look at actually making digital payments. Here are the steps you need to take to successfully complete an ACH transfer.

Step 3: Execute the ACH Transfer

Before you pull the trigger and transfer funds through the Automated Clearing House, you must first complete some paperwork, which in many cases will be e-paperwork, although some financial institutions may still use hard-copy forms. In either case, here are the actions you should take:

1. Link accounts. This essential step isn’t too complicated, but it can’t be skipped. To complete this step, you’ll need to supply the ACH instructions mentioned above to the financial institution responsible for initiating the transaction.

2. Specify if the transaction will be a credit or debit to the account where the transaction originates.

3. Enter the payment amount.

4. Specify the payment date. Most financial institutions will let you post-date a payment.

Step 4: Be Prepared to Accept ACH Payments From Customers

If you’re running a large or small business, you may want to accept ACH payments from customers. To do this, you’ll need to sign up with a payment processing company like PaySimple, Plaid, or Stripe. They will provide all the necessary tools that business owners need to accept electronic fund transfers.

How Long Does an ACH Transfer Take?

The processing time for a normal ACH transfer is around 1-2 days. The originating financial institution submits ACH payments in batches each day. There’s a cutoff time, and if you miss that, the payment isn’t processed until the next business day.

Each payment must go through these steps before it’s completed::

- A payment processor collects data from the party that initiates the transaction.

- The information is submitted to the financial institution that will be debited.

- That bank/credit union will send the ACH details to the Federal Reserve.

- The Federal Reserve transmits the transaction details to the receiving bank.

In response to this tedious process, Nacha has rolled out same-day ACH payment processing. As the name implies, this allows for much speedier transaction times, although payments must be submitted by strict deadlines.

The current ACH Network offers to process ACH credits as either:

- Same-day payments

- Next-day payments

- 2-day payments

Some employers choose to organize payroll Direct Deposits 1-to-2 days in advance so that workers paid via Direct Deposit have money available in their employees’ accounts by 9 a.m. on payday.

The Benefits of ACH Transfers

ACH transfers offer several advantages for a business of any size or industry.

Compared to older payment methods, like paper checks, ACH payments are eco-friendly, offer greater convenience, and are easier to research and track. But there are other advantages as well.

Lower costs – ACH transfers have lower transaction fees than other electronic payment options, such as credit card and debit card transactions. Processing fees are also lower when compared to virtual payment platforms like Venmo or PayPal.

Security – Check writing is still the most fraud-susceptible payment method, according to the 2021 AFP Payments Fraud and Control Survey report. ACH requires validation through a processing center. ACH validation can supply a history of a customer’s checking account, including bounced checks or bogus payments.

Convenience – Automated payments ensure a business receives money on time and removes the step of hassling customers about missed payments. It eases the burden for the consumer as well — remembering to mail physical checks is time-consuming and requires constant reminders.

Processing time – A physical paper check has to go through the postal system. It could take days to get to a business. Delays on the delivery end could result in a missed payment. On the other hand, ACH payments are processed as a priority over traditional checks, which can be placed on “hold” while your bank confirms the check’s validity.

Wider acceptance – Payment by check declined from 40 billion transactions in 2000 to 20 billion in 2018. Consequently, ACH transactions saw their annual growth rate increase to 17.4% in 2021, their best year ever.

The Drawbacks of ACH Transfers

Before setting up your business for ACH transfers, you should know there are some slight disadvantages associated with the system:

Associated fees – ACH transfers are not completely free for businesses. Nacha charges a per-transaction fee and an annual fee to join their network. The per-transaction fee is currently $ .000185, and the annual fee is $264.

Limited overseas accounts – ACH is a U.S.-based entity, so U.S. payments can only be transferred between U.S. accounts. Global ACH is a limited version of ACH transfers that allows the direct deposit of funds into a cross-border bank account via that country’s clearing mechanism. In Europe, the clearinghouse is the Single Euro Payments Area (SEPA) and consists of 35 participating countries (with specific exclusions).

Some processing time – We mentioned that ACH has a processing time advantage over traditional check processing. This doesn’t mean ACH transfers are instantaneous (although ACH debit payments are transacted immediately). ACH transactions may take up to three days, depending on the amount and when your payment is processed. ACH transactions use a clearinghouse to establish payment validity, and that validation is performed in batches, which accounts for the delay. But ACH transfers are still quicker, more reliable, and less dependent on external factors for delivery than putting a traditional check in an envelope and mailing it.

Amount limits – Some banks impose a daily, weekly, or monthly limit on ACH transactions, depending on the amount and type of transaction. Individuals may also be restricted from transferring money using ACH according to federal guidelines.

Are ACH and Direct Deposit the Same?

ACH is the system that makes a direct deposit possible. A direct deposit is an electronic payment of funds from a third party in which the transaction is requested by the receiver. An example might be an electronic transfer of a paycheck or Social Security benefits.

Direct deposits are sent through the ACH network, which is why the two are sometimes confusing. Not all ACH transfers are direct deposits. The ACH network can be used for a wide variety of other electronic funds transfers, including when moving money from one account to another.

Nacha requires strict adherence to transaction protocols. Failure to supply the necessary ACH instructions will result in an electronic payment being declined.

Discover today’s top global payment methods and learn how to optimize your global payments with our Global Payments Method Guide.

What Are ACH Direct Deposits?

ACH direct deposits are ACH transfers where individuals acquire payments directly into their bank accounts. Ninety-six percent of employees receive their compensation through direct deposit, according to Nacha. These most common payments include:

- Employee expense reimbursements (i.e., travel, health and wellness stipends)

- Pension/401(k) allocations

- Annuities

- Interest payments (royalties, stock dividends, etc.)

- Bonuses and commissions

- Social Security and other government payments

- Taxes and other refunds

What Are ACH Direct Payments?

ACH direct payments are when funds are moved electronically to cover or receive payments from individuals or companies. This may include:

- Sending money to family or friends

- Paying bills

- Buying a product (including subscription services, like Netflix or Microsoft Office 365)

- Donating to charity

Total dollars transferred through ACH direct payments topped $8.89 trillion in 2021 — easily becoming the most common method of B2B electronic payment, outdistancing both check and traditional wire transfers.

How Do I Accept ACH Payments from Customers?

No matter the type of business you run, accepting ACH payments from customers broadens your horizons. To do this, you’ll need to sign up with a payment processing company like PaySimple, Plaid, or Stripe. They will provide all the necessary tools that business owners need to accept electronic funds transfers. Many credit card companies also provide ACH processing services. Check with your provider and see if they have ACH processing capabilities.

Then, just follow these easy steps:

- Choose your provider – research the provider’s fees, how long it takes them to forward payments, and if they offer a straightforward way to view your account details. You should also be clear on the steps required to pull money from customer accounts.

- Create your account – follow the instructions to create an account with your chosen provider.

- Investigate payment details – third-party processors usually provide you with a business account with different account and routing numbers than your regular bank account.

- Let the customer know you set up an ACH transfer account and now accept ACH payments – to receive payments, you can automatically enter your customer information on file to initiate the transaction or allow your customer to enter their information themselves.

Your processor then handles the rest of the transferring of funds automatically.

The ACH Network Makes Money Movement Easier and Simpler

If you’re looking for a method to make the transfer of electronic funds quicker and smoother, the Automated Clearing House provides one viable option. This is especially the case if you’re on a budget and need to keep costs as low as possible. And with the introduction of same-day ACH transfers, the primary drawback (processing time) has now been eliminated.