Read IDC’s MarketScape Report for Top Global AP Automation Solutions.

Fill out the form to get your free eBook.

For a second time, Tipalti has been named a Leader in the IDC MarketScape: Worldwide Accounts Payable Automation Software for Midmarket 2024 Vendor Assessment. This recognition highlights our ability to automate, derisk, and scale payables workflows while keeping finance teams informed. Analysts noted PO matching capabilities and effective invoice collaboration as standout strengths at Tipalti.

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of technology and suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each supplier’s position within a given market. The Capabilities score measures supplier product, go-to-market and business execution in the short-term. The Strategy score measures alignment of supplier strategies with customer requirements in a 3-5-year timeframe. Supplier market share is represented by the size of the icons.

IDC Copyright

IDC MarketScape: Worldwide Accounts Payable Automation Software for Midmarket 2024 Vendor Assessment (Doc # US52378624), July 2024, Kevin Permenter and Jordan Steele

Stakeholders and financial analysts read and analyze financial statements, including balance sheets, income statements, and cash flow statements. Balance sheets include essential financial reporting information presented at a specific point in time and are supplemented by required disclosures in the Notes to Financial Statements.

What is a Balance Sheet?

A balance sheet is a financial statement showing assets, liabilities, and shareholders’ equity (stockholders’ equity or owners’ equity) at a certain point in time. A balance sheet date is the end of an accounting period for financial reporting. And balance sheets are projected into the future for business plans or financial modeling in M&A and other decision-making.

Assets are business resources. Liabilities include debt financing and other obligations, including accounts payable, accrued payroll, benefits, and taxes, lease obligations, and deferred revenue. Shareholders’ equity includes retained earnings or deficit and equity capital used to finance the company.

The 3 Types of Financial Statements

The 3 types of core financial statements are:

- Balance sheet

- Income statement

- Cash flow statement

The balance sheet may also be called the Statement of Financial Position or Statement of Financial Condition because it presents assets, liabilities, and shareholders’ equity as a snapshot in time, on a date at the end of the accounting period.

The income statement shows revenues, costs of goods or services, expenses, and net income (loss) for an accounting period. The income statement may also be called a Profit and Loss Statement. Net loss is shown as a negative number.

The cash flow statement shows beginning and ending cash and cash equivalent balances, including restricted cash and operating activities, investing activities, and financing activities for an accounting period.

Besides these three core financial statements, companies may present a detailed Statement of Retained Earnings (Deficit) for the accounting period and a detailed Statement of Accumulated Other Comprehensive Income (Loss).

What is the Purpose of a Balance Sheet?

The purpose of a balance sheet is to paint a clear picture of a company’s financial standing at a point in time, in conjunction with other core financial statements that report financial results for a period of time.

A multi-year future periods balance sheet is also prepared with the income statement and cash flow statement as a projected financial statement used for business plans or M&A financial modeling decisions.

The balance sheet is used for financial analysis by applying ratios using amounts from the balance sheet and income statement. These financial ratios include liquidity ratios like the current ratio using working capital components and the more stringent acid test ratio that excludes inventory from the calculation. Companies compute their return on assets (ROA), equity (ROE), or investment (ROI) to measure performance.

Businesses compute Days Receivable Outstanding (DRO) and Days Payable Outstanding (DPO), which relate to accounts receivable and accounts payable turnover.

Balance Sheet Example

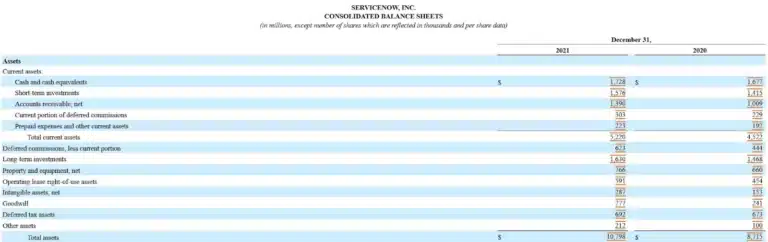

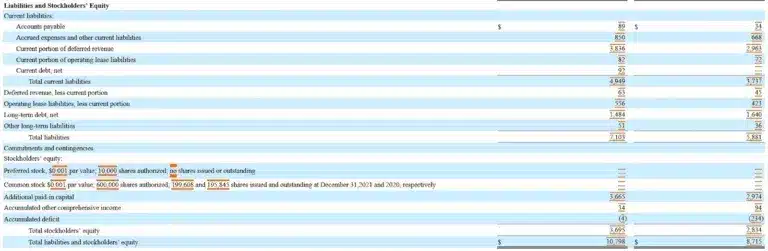

A screenshot of ServiceNow, Inc.’s comparative Consolidated Balance Sheets for December 31, 2021, and December 31, 2020, is shown below. The source is its 10-K annual report in an SEC company filing dated February 3, 2022.

The Balance Sheet Accounting Equation

The accounting equation formula for a balance sheet is:

Assets + Liabilities = Shareholders’ Equity

If you know two accounting equation variables, you can rearrange the accounting equation to solve for the third.

Accounting uses double-entry bookkeeping and the accounting equation to keep the balance sheet in balance. Every accounting transaction involves at least two accounts. Debits must equal credits.

When accountants close the books for an accounting period, known as the accounting cycle, they prepare a trial balance that lists and totals all accounts and presents the debit balances and credit balances in two columns. Before accountants post transactions to the general ledger, total debits must equal total credits on the trial balance. The financial statements are automatically created from the general ledger, using standalone accounting software or ERP systems.

Components of a Balance Sheet

The three main components or sections of a balance sheet are assets, liabilities, and shareholders’ equity. A multi step balance sheet classifies business assets and liabilities as current or long-term (over twelve months).

Balance sheets list line items in each section, including subtotals and total assets, liabilities, and shareholders’ equity. Most balance sheet items are reported at book value, although GAAP specifies fair value accounting for certain balance sheet accounts.

Assets

Cash is a vital asset shown in the balance sheet that can be further analyzed through details in the cash flow statement. Cash and other liquid assets indicate the ability to pay bills and service debt when due and remain a viable going concern.

Current assets include marketable securities, accounts receivable (net of the allowance for doubtful accounts), inventory, intangible assets, and prepaid expenses. Non-current assets or long-term assets include long-term investments, property, plant, and equipment (net of accumulated depreciation), also known as fixed assets, and operating lease right of use assets.

Intangible assets include patents, copyrights, customer lists, trademarks, goodwill from purchased companies, and more. Goodwill is analyzed for impairment annually.

Liabilities

Current liabilities are short-term liabilities, including accrued liabilities, accounts payable, the current portion of operating lease liabilities and long-term debt, and deferred revenue (if completion is within twelve months). Long-term liabilities or non-current liabilities include long-term debt and operating lease liabilities, other long-term obligations, non-current deferred revenue, and deferred tax liabilities.

Deferred revenue represents cash received from customers as deposits before goods are shipped or services are performed. Deferred revenue is a liability because the company still has a performance obligation.

Shareholders’ Equity

Shareholders’ equity includes retained earnings, other comprehensive income (loss), treasury stock (issued shares reacquired), and preferred and common stock. Each type of stock is shown in two parts: at its nominal par value and as additional amounts received upon issuance, called paid-in capital.

For a sole proprietorship, shareholders’ equity may be called owner’s equity. Small business owners sometimes prepare personal financial statements, including a balance sheet, to get financing.

Retained earnings for a business primarily represent cumulative net income or loss minus dividends declared (and later paid). If cumulative retained earnings is negative, it’s called deficit instead.

Accumulated other comprehensive income (loss), abbreviated AOCI, is shown below retained earnings in the equity section of the balance sheet. AOCI includes unrealized gains or losses from holding available-for-sale debt securities investments, foreign currency translation gains or losses, and certain pension gains or losses.

The 3 Types of Balance Sheets

The 3 types of balance sheets are:

- Comparative balance sheets

- Vertical balance sheets

- Horizontal balance sheets

Comparative Balance Sheets

Comparative balance sheets for more than one time period are often presented in the same financial statement to indicate trends. Companies may present comparative balance sheets with horizontal analysis to determine the amount and percentage changes in line items and totals, showing trends over time.

Vertical Balance Sheets

Vertical balance sheets show assets at the top, with the balance sheet’s liabilities and shareholders’ equity sections presented below. A vertical balance sheet has only one column of balances for a year. Vertical balance sheets may be presented with columns for multiple years as comparative balance sheets.

Horizontal Balance Sheets

Horizontal balance sheets show Assets on the left side and Liabilities and Shareholders’ Equity on the right side of the balance sheet.

Who Uses Balance Sheets?

Business management and employees, the Board of Directors, lenders, suppliers, customers, investors, equity analysts, debt analysts, M&A analysts, accountants, and auditors at CPA firms use balance sheets.

Who Creates Balance Sheets

Accountants, bookkeepers, and financial analysts create balance sheets using accounting or planning software and ERP systems.

Importance of Balance Sheets

Balance sheets are important because they provide a snapshot of a company’s assets, including cash and liquid assets, compared to amounts payable by a business. Balance sheets also show financing, income tax liabilities, and cumulative retained earnings or deficit. Balance sheets can be analyzed with the income statement to determine ratio trends, liquidity, and performance metrics like rates of return and KPIs.

Balance sheets are one of the core financial statements presented in business plans and financial models for analyzing potential M&A transactions and establishing a valuation. These balance sheets are prepared with assumptions as estimated projections of future assets, liabilities, and shareholders’ equity.