Read IDC’s MarketScape Report for Top Global AP Automation Solutions.

Fill out the form to get your free eBook.

For a second time, Tipalti has been named a Leader in the IDC MarketScape: Worldwide Accounts Payable Automation Software for Midmarket 2024 Vendor Assessment. This recognition highlights our ability to automate, derisk, and scale payables workflows while keeping finance teams informed. Analysts noted PO matching capabilities and effective invoice collaboration as standout strengths at Tipalti.

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of technology and suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each supplier’s position within a given market. The Capabilities score measures supplier product, go-to-market and business execution in the short-term. The Strategy score measures alignment of supplier strategies with customer requirements in a 3-5-year timeframe. Supplier market share is represented by the size of the icons.

IDC Copyright

IDC MarketScape: Worldwide Accounts Payable Automation Software for Midmarket 2024 Vendor Assessment (Doc # US52378624), July 2024, Kevin Permenter and Jordan Steele

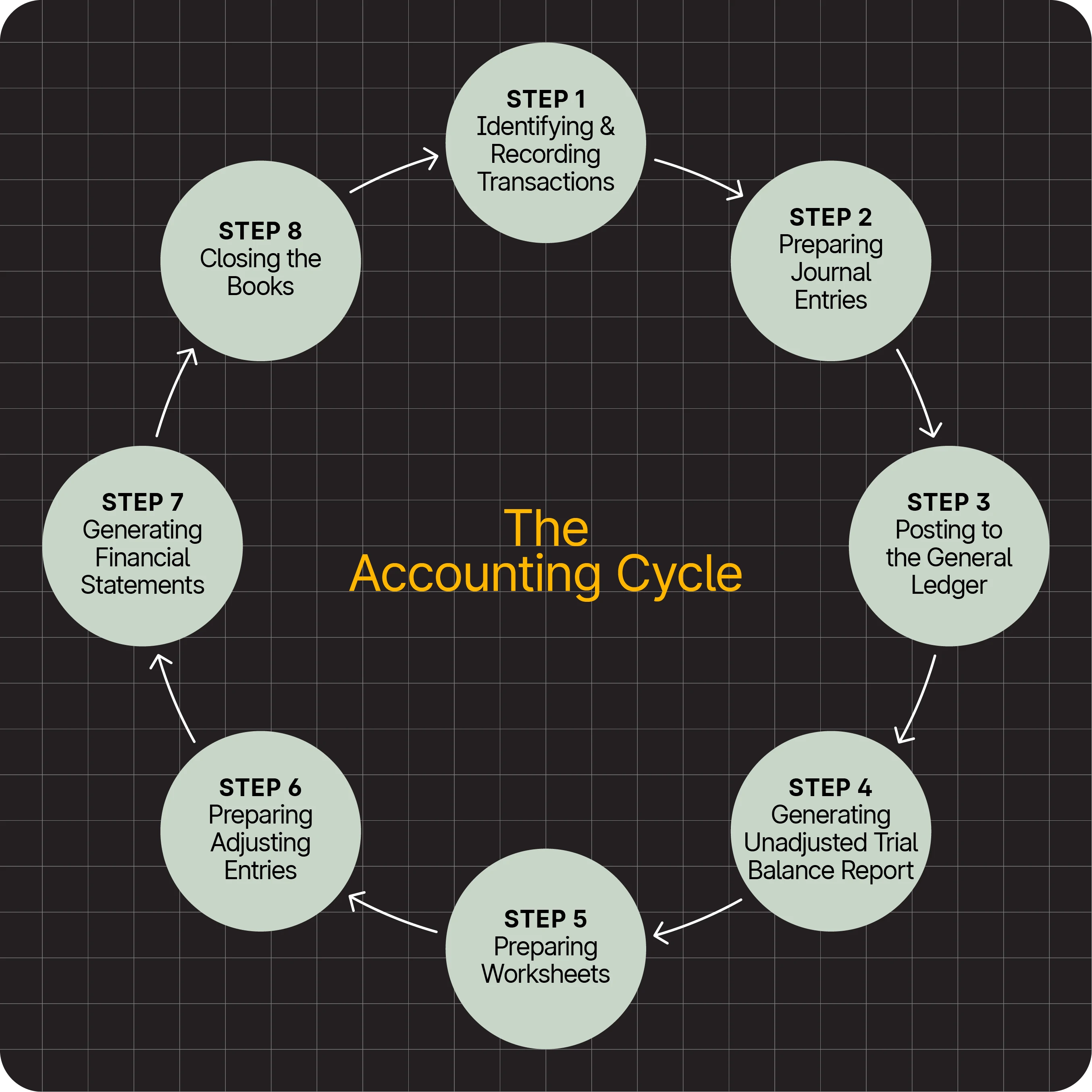

What is the Accounting Cycle?

The accounting cycle is a standard, 8-step accounting process that tracks, records, and analyzes all financial activity and transactions within a business. It starts when a transaction is made, and ends when a financial statement is issued and the books are closed.

The purpose of the accounting cycle is to record transactions and periodically close the books, including preparing financial statements.

Key Takeaways

- The accounting cycle consists of 8 steps to record transactions, periodically prepare financial statements, and close the books.

- After (1) recording financial transactions in the accounting software, which automatically creates subsidiary journals, and (2) making journal entries, (3) complete the posting to the general ledger, and (4) generate an unadjusted trial balance.

- Next, accountants reconcile accounts and analyze them to detect errors by (5) preparing worksheets and (6) making adjusting entries.

- The accounting software or ERP system (7) generates financial statements, and (8) accountants close the books for the monthly or year-end accounting period.

- Ensure that the total of debits and credits is equal when viewing the unadjusted and adjusted trial balance to ensure that double-entry bookkeeping (the accounting equation) is balanced.

- The accounting cycle can be optimized with software automation.

How Does the Accounting Cycle Work?

An accounts receivable or accounts payable team member, full-cycle bookkeeper, or accountant records financial transactions, closes the books for the accounting period, and prepares financial statements, keeping rules of internal control and roles in mind to achieve separation of duties.

In each accounting cycle, the general ledger compares actual amounts for each primary account vs. the budget amounts determined in the budget cycle.

Accounting Cycle Steps

8 accounting cycle steps include:

- Identifying and recording transactions

- Preparing journal entries

- Posting to the general ledger

- Generating an unadjusted trial balance report

- Preparing worksheets

- Preparing adjusting entries

- Generating financial statements

- Closing the books

We examine these important steps of the accounting cycle in more detail.

1. Identifying and recording transactions.

The first step in the accounting cycle is to identify and record transactions through subsidiary ledgers (journals). When financial activities or business events occur, transactions are recorded in the books and included in the financial statements. Types of accounting periods for recording transactions include monthly and annually.

When accounting issues customer invoices, these invoices are issued in numerical sequences for internal control. If a company still issues paper checks, they’re controlled and recorded in sequential numerical series. Any erroneous checks are voided and retained to control the numerical sequence.

As an accounting period example, businesses use a calendar year with an accounting period start date of January 1 and an accounting period end of December 31. Or they may elect with the IRS to use a different month end as a fiscal year for the end of the annual accounting period, also known as the fiscal accounting period. Financial statements may present summarized quarterly and year-to-date information.

Record accounting transactions in the accounting system using double-entry bookkeeping with balancing debits and credits. Generate subsidiary journals and a general journal. Types of subsidiary journals include aged accounts receivable, aged accounts payable, cash disbursements, and fixed assets & accumulated depreciation.

2. Preparing journal entries

To record non-routine accounting transactions, prepare journal entries for a required transaction not recorded through a subsidiary ledger like accounts receivable. You can also use journal entries to make corrections. Use automatic journal entries when possible.

Businesses use accrual accounting rather than cash accounting to follow generally accepted accounting principles (GAAP). The matching principle matches revenue with related expenses by recognizing and assigning them to the proper accounting period in GAAP accounting. Journal entries record accruals and reverse them in the next accounting period when that month’s accruals are determined.

Your accounting system will let you set up automatic recurring transactions for subscription billing like SaaS software. You’ll be able to automatically set up a journal entry for a monthly transaction like prepaid insurance expense that needs to be recognized as insurance expense instead of a prepaid asset as time elapses.

Depreciation should automatically be generated as a journal entry when you correctly set up the fixed asset in the accounting software or ERP system.

For non-routine transactions like M&A transactions, you’ll need to analyze the transaction using worksheets and prepare and record journal entries for the deal.

3. Posting to the general ledger

Your financial accounting system will let you post subsidiary journals and journal entries to the general ledger.

4. Generating an unadjusted trial balance report

When you generate an unadjusted trial balance report from the financial records, you’re checking for errors to ensure that all transactions are recorded in the general ledger. The trial balance format is that every general ledger account balance or total is listed without the details. With a double-entry bookkeeping system, total debits should equal total credits.

Your accounting software creates the unadjusted trial balance report. Use the report to make sure that the sum of the total debits vs. total credits balance and analyze it for later making adjusting entries as corrections.

5. Preparing worksheets

Use worksheets to analyze and reconcile accounts and identify adjusting entries and consolidation entries. When possible, use the capabilities provided by your accounting system.

More manual steps may be required when using a small business accounting system with limited functionality. However, the integration of third-party automation software can automate specific workflow processes to avoid preparing some manual worksheets.

Each balance sheet account should be reconciled at least monthly to find and correct errors with adjusting journal entries. Compare each of the bank accounting statements to its general ledger cash account. Cash reconciling items will include outstanding payments, outstanding deposits that haven’t yet cleared the bank, and bank service fees.

For other balance sheet items, reconcile the accounts receivable and accounts payable aging journals to the general ledger. Reconcile more assets and liabilities, including inventory, fixed assets, prepaid assets, accrued liabilities, retained earnings, and owner’s equity to the general ledger.

To reconcile inventory balances, businesses take cycle counts, which are sample inventory counts during the year. Companies take a comprehensive physical inventory to compare count quantities with perpetual inventory balances in a month with lower business activity. In the physical inventory reconciliation process, cost accounting makes necessary and approved adjustments to the detailed financial records and journal entries.

Note that companies can perform some accounting process reconciliations like payments reconciliation automatically with AP automation software.

In the consolidation process for multi-entity companies, income statements and balance sheets need to be combined. But intercompany profit needs to be eliminated as a worksheet adjustment because these transactions are not third-party transactions with outsiders. Otherwise, the profit would be too high.

6. Preparing adjusting entries

Make adjusting journal entries to correct errors and reflect any differences or discrepancies noted in reconciling balance sheet accounts. Journal entries require review and approval.

After entering adjusting entries and posting them to the general ledger, total debit balances should equal total credit balances (from double-entry accounting) as an accounting control process. You can check by running and reviewing an adjusted trial balance report.

7. Generating financial statements

Choose your customized financial reports to generate financial statements for the accounting period, whether monthly or year-end. Your financial statements can be set up to show quarterly totals in many accounting systems. The SEC requires quarterly financial reporting for public companies.

Financial statements have a management review and approval process before they are issued. The Controller or CFO’s approval process should include an analytical review to ensure that the financial statements make sense and are accurate for decision-making and assessing the business’s financial performance and financial health.

Types of financial statements of a company include:

• Balance sheet (statement of financial position)

• Statement of owner’s equity

• Income statement

• Statement of cash flows (cash flow statement)

The accounting equation for the balance sheet is assets minus liabilities equals owner’s equity.

8. Closing the books

Perform step 8 only at fiscal or calendar year-end, but not for a normal month-end close.

Close income statement temporary accounts into a permanent account. Temporary accounts include the revenue and expense accounts. At year-end, net income or loss is closed into the permanent account, retained earnings. Revenue and expense ledger account balances are reduced to zero through a closing entry in the system.

Prepare a post-closing trial balance report at the end of the accounting period for the year. Again, ensure that total debits equal total credits. The temporary ledger accounts should be zeroed out if you’ve completed the year-end accounting close process correctly. Verify the beginning balance of retained earnings that will be used starting with the next monthly accounting period close in the following business year.

When the post-closing trial balance is good, you’ve reached the completion of the accounting cycle at year-end.

Although you’ve technically reached the last step of the accounting cycle for year-end you may still need to enter adjusting entries from the CPA firm’s financial audit into the accounting system for the year. You can open a new accounting period to begin recording transactions for the accounting cycle of the next month and year.

Ready to transform your accounting cycle?

Discover proven strategies to optimize accounts payable, boost visibility, and confidently guide your team through each stage of the accounting cycle.

Accrual vs. Cash Basis Accounting

The difference between accrual vs. cash basis accounting is: Accrual basis aligns with the GAAP matching principle, ensuring that revenues and expenses are recognized in the same period. In contrast, in cash basis accounting, transactions are recorded upon the payment or receipt of cash.

Automation in the Accounting Cycle

Automation software streamlines and digitally transforms the accounting cycle through integration with accounting software or ERP systems. Automation reduces manual effort and increases accuracy. Modern accounting software and ERP systems automate some processes in the accounting cycle.

Tipalti AP automation software can improve steps in the accounting cycle in the following ways.

Automation in Identifying and Recording Transactions

Tipalti AP automation captures invoice data by headings and line items for accounts payable invoice processing. After self-guided supplier onboarding with tax form collection, it validates suppliers, verifies invoices during invoice processing through 3-way matching (or 2-way matching), and applies 26,000+ payment rules to flag exceptions.

Supplier validation and an AI-driven Tipalti Detect, audit trail, and enterprise-grade security features help your company strengthen its financial controls to reduce payment fraud risks and errors.

Tipalti AP automation automatically routes invoices to approvers for invoice payments. Your business can pay global supplier invoices in 200+ countries and 120 currencies using large batches (that show cash requirements) and 50+ EFT choices.

Tipalti AP automation uses generative AI technology to automatically code these AP invoice transactions. With multi-entity and real-time ERP or accounting software functionality, Tipalti shows accounts payable by entity and combined, providing real-time visibility for better spend control. (Tipalti AP automation also uses AskTipaltiAI℠ to get automatic answers to spending queries for more informed decision-making on how to cut costs.)

Automation in Preparing Journal Entries

Tipalti AP automation syncs data with your ERP or accounting software. Your ERP system creates journal entries to record accounts payable from the accounts payable subsidiary ledger totals.

Automatically Posting to the General Ledger

Accounting software generally offers the ability to automatically post to the general ledger, although it may offer a manual posting option.

Generating Unadjusted Trial Balance Report

With accounting software, users can choose to run the unadjusted trial balance report or set up selected reports to run automatically as part of the month-end financial close.

Automation in Preparing Worksheets and Adjusting Entries

Although the accounting team has historically prepared spreadsheets and adjusting entries for account reconciliations and consolidation, some ERP or AP automation systems have automated processes for these tasks. For example, an ERP system may have an optional consolidation module. Accounting software can set up accruals and automatically reverse the prior month’s accruals each month.

Tipalti AP automation software instantly reconciles global payment batches (using multiple payment methods and currencies). This automated feature can accelerate your financial close by up to 25%.

Automation in Generating Financial Statements and Closing the Books

Accounting software and ERP systems let the financial team automatically set up reports and financial statements to generate and distribute for each accounting close. Then, your authorized team members review the financials and close the books when approved.

Generative AI for accounting and finance helps your company detect anomalies in patterns when reviewing financial statements through automation.

Accounting Cycle vs Operating Cycle

The accounting cycle vs operating cycle are entirely different financial terms. The accounting cycle consists of the steps from recording business transactions to generating financial statements for an accounting period. The operating cycle is a measure of time between purchasing inventory, selling the inventory as a product, and collecting cash from the sales transaction.

The operating cycle can be expressed in a formula as the sum of the financial analysis ratios for days’ sales outstanding and days in inventory. The operating cycle measures the days between purchasing inventory and collecting cash from the sale of inventory items. Understanding the operating cycle of your business is essential for cash flow management.

Why is the Accounting Cycle Important?

The accounting cycle is used by businesses and organizations to record transactions and prepare financial statements. The standardized accounting cycle process (supported by accounting systems) is important because it helps business owners, small businesses, and established companies close their books for the accounting period. It also helps to generate financial information to perform financial statement analysis and manage the business.

The accounting department uses a customized and detailed accounting close checklist that reflects items to be completed during each accounting cycle; with responsibilities and deadlines assigned, and documentation of completion times and approvals for each task. Use of a checklist with deadlines in the accounting cycle improves accountability and process management.

CPA firms can review or audit the financial statements and drill down to the underlying financial transactions and accounting records to test account balances.

Stakeholders, including management, the Board of Directors, lenders, shareholders, and creditors, can analyze the financial statement results for the accounting cycle period.

Optimizing the Accounting Cycle

One way in which companies are investing wisely is with accounting automation software. More and more CFOs are using end-to-end automated solutions to scale and overcome additional complexities, as they enter new markets and add new entities. Start your research with our eBook: The Future Office of Finance.