See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

Automating accounts payable with OCR invoice processing prevents slowdowns and human errors associated with manual accounts payable data entry. OCR invoice processing extracts data from invoices using optical character recognition (OCR) and artificial intelligence (AI)/machine learning (ML) technologies.

For the past several years, accounts payable has evolved from a cost center into a revenue-generating driver. OCR technology and automated invoice processing are essential to this transformation.

In this article, we take a closer look at OCR invoice processing with AP automation, including what it is, how it works, the key benefits, and the top accounting software solutions you can count on today.

Key Takeaways

- OCR invoice processing scans read-only documents, such as PDFs, extracts and captures data, and converts it to a machine-readable format to complete automated AP workflows.

- To improve speed and accuracy, smart OCR invoice software utilizes AI agents with built-in validation rules to accept data or generate exceptions for human review and follow-up.

- AI-powered OCR is more accurate and scalable than template-based systems.

What is OCR Invoice Processing?

OCR invoice processing uses optical character recognition and AI to extract data from invoices and other documents, converting them into machine-readable, searchable, and editable text for efficient digital invoice processing and invoice management.

OCR Feature in AP Automation Invoice Processing

OCR means text extraction. However, in broader terms, finance teams utilize an OCR technology feature within their AP automation system. AP automation, combined with OCR and machine learning, enables businesses to scale their invoice volume and expedite the accounts payable process, resulting in reduced hiring needs.

OCR Data Extraction Examples

Examples of invoice OCR processing data extracted are:

- Vendor information

- Invoice headings and line items

- Quantities and unit pricing

- Invoice totals and net amounts

- Sales tax

- Tax IDs

- Purchase order (PO) number

How Is OCR Invoice Processing Used in Accounts Payable?

Optical character recognition (OCR) invoice processing automates the extraction of invoice data (data capture) for accounts payable. OCR captures data from financial documents and converts it into digitized information in real time.

Every automated accounts payable system has OCR invoice processing capabilities. The optical character recognition functionality enables AP software to extract data automatically from digital invoices. OCR eliminates manual data entry to streamline AP workflows.

For efficient invoice processing, businesses utilize searchable and machine-readable OCR-captured invoice data. OCR invoice processing systems also provide searchable invoice management, with AI digital assistant queries and ERP accounting system syncing from AP automation software.

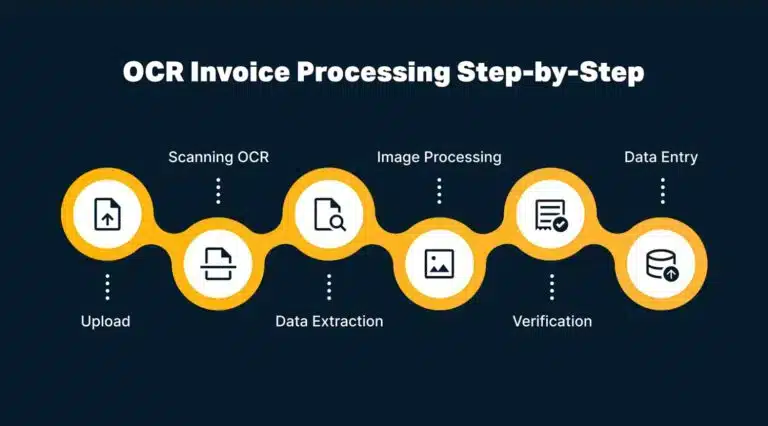

OCR Invoice Processing Steps in AP Workflow

OCR invoice processing steps in the accounts payable workflow are:

- Digitization

- Preprocessing

- Recognition

- Validation

- Export/archiving

1. Invoice Digitization

Without AP automation software, AP team members scan or upload invoices into traditional OCR software for digitization. AP automation with self-service supplier onboarding enables your suppliers to email invoices in PDF or other accepted formats or upload invoices through their supplier portal.

2. Image Preprocessing

For digital invoice enhancement, the OCR software utilizes built-in preprocessing tools to clean the image and improve its quality before extracting text. Other OCR procedures at this step include noise removal, rotation correction, and cropping the image.

3. Text Recognition

After preprocessing the image to enhance its quality, the OCR software converts the invoice image into machine-readable text. OCR invoice processing software captures essential invoice data for retrieval and digital processing.

The best OCR for invoice processing is AP automation software that also incorporates machine learning technology to capture and improve the quality of captured invoice data.

The system will scan the image for text characters and automatically convert it into machine-readable text. This can include details from a manual invoice, like:

- Vendor name

- Invoice number

- Due date

- Invoice date

- Line items

- Invoice total

- Description

- PO number

It may also indicate any early payment discounts that the vendor invoices offer to encourage early payments. The technology uses predefined templates and machine learning algorithms to identify and extract data points.

4. Validation and Verification

Many OCR systems have built-in validation rules to ensure consistency and accuracy of the extracted data. AI/ML-powered OCR software, embedded in an accounts payable automation system, automatically validates and verifies invoice data for accuracy and completeness.

Validation methods include:

- Rules-based verification

- Document matching as a cross-reference

Rules-based verification ensures that invoice data is logically correct. For example, the invoice date must precede the invoice due date.

Document matching includes 3-way or 2-way invoice matching. Matching involves comparing invoices with purchase orders (POs) and goods received notes (GRNs) to ensure accurate matches with items ordered and received before making invoice payments.

Sometimes human-in-the-loop supervision is required to resolve exceptions related to OCR-captured invoice data, such as incomplete or inaccurate data. AP automation software utilizes agentic AI and generates follow-up notifications to facilitate human resolution, thereby maintaining control over invoice capture processes.

5. Data Export/Archiving

Once the data is accurately extracted and verified, it is exported to an accounting or enterprise resource planning (ERP) system for further processing and payment.

AP automation performs the next invoice processing steps, including AI-generated general ledger account coding, guided approval workflows, global payment, and instant payment reconciliation with more bi-directional data syncing when required.

Digital invoice archiving provides an efficient and cost-effective searchable database for auditing and reference purposes. An audit trail improves internal controls.

Template-Based vs AI-Powered OCR

| Template-Based OCR | AI-Powered OCR | |

|---|---|---|

| Structured document | Yes | Structured or unstructured document |

| Uses a fixed template and rules | Yes, only fixed template and rules | Machine learning (ML) |

| Uses context | No | Yes |

| Machine learning improves OCR data accuracy | No | Yes |

| Deployment method | Either cloud-based or on-premises | Cloud-based |

Predefined templates are created for known vendors to extract data from consistent invoice formats.

ML algorithms recognize and extract data from invoices without relying on fixed templates. Machine learning data capture is more adaptable to varying invoice layouts.

Note: Cloud-based OCR solutions can be accessed remotely and are often more flexible and scalable than on-premises OCR software deployments.

How to Automatically Extract Invoice Data

How to automatically extract invoice data with OCR:

- Get AI-assisted OCR software, such as AP automation.

- Scan, upload, or email digital invoices in PDF or other accepted formats into your OCR invoice processing software.

- Automatically extract headings and line items for invoice details. Invoice data fields include supplier, invoice number, invoice date, due date, PO reference number, quantities, and amounts.

- Validate extracted data using OCR invoice processing software.

- Correct any errors to ensure accuracy and improve machine learning results.

The Advantages of OCR Invoice Processing for Businesses

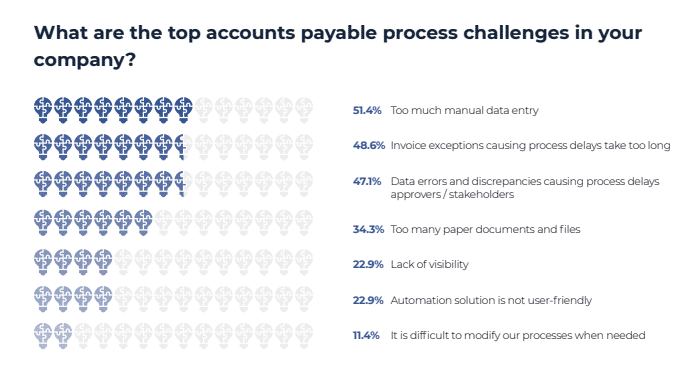

OCR invoice processing enables businesses to automate invoice data entry, enhance efficiency, and minimize manual errors. It minimizes risks, saves time and resources, and provides better control over financial data management.

The top benefits of OCR invoice processing are:

Increase Efficiency for Time and Cost Savings

OCR reduces the need for human intervention by automating the extraction of data from invoices. This significantly speeds up invoice processing. OCR-generated supplier invoices can be managed more efficiently than paper invoices, which require time-consuming manual data entry.

OCR invoice processing improves cash flow and profitability. Companies reduce labor costs through efficiency and hiring needs, capitalize on early payment discounts, and avoid late payment penalties.

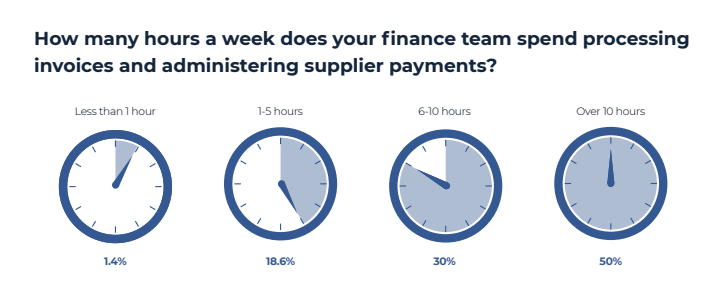

IFOL Research Statistics

50% of accounts payable professionals spend over 10 hours a week processing invoices, according to a research report by the Institute of Financial Operations & Leadership (IFOL).

Spending too many hours manually processing invoices is stressful, consumes excessive labor resources, and results in numerous errors.

Reducing the time to complete accounts payable workflows with OCR invoice processing enables employees to shift their focus to more value-added and strategic tasks that enhance analysis and drive improved business results.

DreamHost Boosts Efficiency with Tipalti AP Automation

DreamHost, a mid-market Tipalti AP automation customer providing global web hosting services, uses Tipalti integrated with NetSuite ERP. To achieve scalability and efficient supplier payments, DreamHost needed to modernize its outdated, siloed systems and streamline its accounts payable processes.

DreamHost appreciates Tipalti’s end-to-end self-service supplier onboarding, OCR/AI invoice capture for streamlined invoice processing, guided invoice approvals, and simplified global payments, which reduce manual processes and unify accounts payable workflows.

Tipalti AP automation software provides enhanced vendor visibility, allowing DreamHost employees to allocate additional time to strategic planning and priorities that drive growth and operational efficiency.

Tipalti has solidified our financial operations as an enabler of growth. Their robust automation and vendor-centric capabilities empower us to scale efficiently while maintaining a focus on innovation.

Samantha Olyaie, Finance Team, DreamHost

Note: Businesses can earn more early payment discounts (such as 2/10, net 30) to reduce their purchased goods costs by 2% when they pay vendor invoices within 10 days of the invoice date.

How Automated Payments Work

The following image shows how automated payments work and integrate through an API connection between AP automation, OCR invoice processing software, and your ERP system.

Reduce Errors to Avoid Overpayments

To avoid costly mistakes, OCR improves accuracy and minimizes the risk of human errors in data entry compared to performing manual, repetitive tasks. Improved accuracy enables businesses to maintain more accurate financial records and make payments for the correct amount due.

OCR invoice processing software, as AP automation, tracks supplier payments and automatically performs TIN matching for more accurate tax compliance when preparing 1099 and 1042-S forms.

OCR technology can be used to automatically:

- Find typos and transpositions.

- Detect incorrect date formats and currency symbols.

- Flag subtotals, sales tax, shipping, and totals mismatch exceptions.

- Identify duplicates in your ERP or accounting software.

Improve Supplier Relationships

Prompt invoice processing means more satisfied vendors and suppliers. The risk of not paying promptly is that shipments may be delayed, resulting in revenue losses and additional costs due to delays. Your company can potentially leverage its prompt invoice processing advantage into better payment terms and discounts.

Automate Validation

Many OCR tools include validation rules to check for discrepancies or inconsistencies in extracted data, further reducing errors.

Enhance Compliance

OCR solutions often include archiving and document management features. This helps to maintain an audit trail of financial transactions. AP automation for OCR invoice processing helps ensure compliance with global regulatory requirements and tax compliance.

Additional Benefits

- Data Security: Storing invoices electronically can enhance data security and access control.

- Searchability: OCR invoices are digitized and easily searchable, making them more accessible for audit purposes.

- Scalability: OCR tools can manage a high volume of invoices, making it a scalable solution and reducing hiring needs.

- Data Insights: OCR systems can automatically generate custom reports with an AI reporting agent, providing valuable insights into accounts payable processes.

- Remote Access: Cloud-based OCR can process invoices with various formats and

Automate Your AP Workflow from Invoice to Payment

See how Tipalti uses AI-powered OCR and invoice matching to eliminate manual data entry, reduce errors, and close faster—without adding headcount.

How Accurate Is OCR Invoice Processing?

OCR invoice processing with modern AP automation software accelerates AP workflows and provides high accuracy that reduces your error rate. But OCR acting alone to produce scanned images (e.g., scanned document images) has limitations as a technology.

Standalone OCR is estimated to be accurate 85–90% of the time, whereas human accuracy typically ranges between 96% and 99%.

Traditional OCR technology is not designed explicitly for invoices. Therefore, OCR may struggle to read data from low-quality invoices that produce blurry scans or contain unreadable handwriting on paper documents. OCR alone does not intuitively understand invoices, requiring human involvement 10–15% of the time to generate accurate data for specific fields.

OCR invoice processing is substantially better because OCR doesn’t work by itself. Instead, OCR is typically a feature of a comprehensive automated invoice processing solution that utilizes machine learning and other forms of artificial intelligence to enhance OCR results. This combined solution achieves accuracy rates of around 98–99%, comparable to those of humans, without requiring manual invoice processing.

Combining OCR with AI for Complete Invoice Processing

Machine learning is a subset of artificial intelligence that enables software applications to solve ongoing problems by analyzing data with little intervention. OCR extracts the data while machine learning analyzes the structure of an invoice for patterns and can adapt to new invoice formats.

AI agents can automate invoice capture tasks and work almost autonomously, but they need to generate exception handling notifications when human control is required to complete the data capture for unreadable, incomplete, or missing invoice data that is not adequately obtained by the AI agent alone.

Together, these OCR + AI tools can discern data, such as the difference between an address number and the amount due. The technologies enable an AP software platform to place the invoice data into the correct fields for processing within the system.

Automated ML tasks can:

- Use generative AI for automatic coding

- Match up the correct general ledger codes to a specific vendor or transaction type

- Transfer invoice information (i.e., invoice number, supplier identification, and total amount) into the automated accounts payable system for payment processing

- Send the invoice without manual effort to the correct approver for sign-off

Traditionally, setting up an automated accounts payable workflow required configuring rule-based logic before launching a new platform; however, machine learning enables the AP software to learn the workflow logic on the job. This means it learns as it performs the work.

Managed Services for Manual Reviews

Although OCR invoice processing and machine learning have significantly reduced the need for manually inputting data and managing each step of the AP workflow, the automated features sometimes summon human assistance from managed services to resolve invoice capture exceptions.

What if OCR invoice software reads and extracts incorrect invoice amounts? Does the invoice scanning software know what to do when vendor tax information is missing?

When considering an automated accounts payable solution, look for a platform that addresses one-off situations. For example, the AP platform could offer a managed service dedicated to conducting manual invoice reviews, as Tipalti does.

Invoice scanning software from Tipalti uses AI agents, including the Invoice Capture Agent (with its Smart Scan technology), to trigger an alert (e.g., missing vendor identification). The AP system automatically routes the invoice to the managed service team for review and approval. It doesn’t add to the work of your accounts payable staff. Manual intervention from your company is not required, thus creating a touchless accounts payable workflow.

Global OCR Invoice Processing

OCR invoice processing, machine learning, and managed services combine to create a formidable solution within a dynamic, automated accounts payable system. However, companies should also consider how the platform will perform as more payees or vendors are onboarded.

If your invoice recognition software can process data from a variety of languages, you can expand your business beyond domestic operations.

Along the same vein, cloud-based software enables companies to add multiple users and run operations from anywhere with ease. Instead of installing invoice capture software on-premise, businesses that opt for a cloud-based platform allow anyone with an internet connection to access the automated accounts payable system.

It’s understandable to feel that the numerous software solutions for an automated accounts payable system sound all the same. However, the difference lies in the details, particularly in how they leverage various technologies to address repetitive tasks.

OCR invoice processing, machine learning, and managed services work together to transform an AP workflow, creating automated invoice processing and invoice management. OCR invoice processing frees up your accounts payable team to focus on tasks that require a human touch, like customer-facing issues or revenue-generating initiatives.

When you start looking into automating your accounts payable workflow, you’ll notice common features across AP software systems: tax form processing, electronic funds transfers, and, of course, OCR invoice processing. It’s all part of the AP process.

How to Implement OCR Invoice Processing in Your Business

To streamline workflows and optimize cost savings, select the best OCR invoice processing software.

Follow these steps to ensure you deliver value to your company through AP automation:

- Evaluate your current workflows

- Choose the right OCR solution

- Integrate OCR invoice processing with your existing tech stack

- Train your team for effective use

- Track and optimize OCR performance

1. Evaluate Your Current Workflows

Begin by documenting all of the invoice processing tasks that you intend to automate with OCR software. All OCR invoice processing software automates invoice data extraction. But you need to assess your entire supplier invoicing process to identify all your workflow needs beyond data extraction.

Ask and answer these questions:

- Are your invoice intake methods efficient?

- Do you struggle to manage manual data entry?

- Are there delays in invoice validation?

- Are bottlenecks delaying invoice approvals?

Pinpointing areas where accounts payable automation can save processing time and resources will give your search direction.

2. Choose the Right OCR Solution

Find an OCR invoice processing solution that fits your needs. For example, if approval

bottlenecks delay payments, shortlist software that streamlines stakeholder collaboration.

Weigh these features in potential OCR invoice processing (IP) solutions:

| Feature | Key Purpose |

|---|---|

| AI-powered OCR | Reduce manual data entry and improve accuracy. |

| Third-party integrations | Integrate OCR IP automation with ERP. |

| Security controls | Secure portal, role-based access, andfraud protection. |

| Compliance | Automate tax and global regulatory compliance. |

| Payment methods | ACH, global ACH, PayPal, and debit card. |

| Reporting and analytics | Monitor spending for invoice trends anddecision-making. |

| Multi-user support | AP teams manage IP using the same tool. |

| Multi-entity | When ERP or accounting software is multi-entity. |

| User and self-service supplier onboarding | Training – user guides, help resources, and webinars. |

| Technical support | Fast, expert help – phone, email, live chat. |

Pro Tip: Research customer stories and reviews to support your research.

Additionally, make the most of product demos—seeing a tool in action is the best way to decide if it is right for your business.

3. Integrate OCR Invoice Processing with your Existing Tech Stack

AI-powered solutions get smarter and perform better with high-quality data. So it’s essential to

integrate OCR software with as many of your existing finance and marketing automation tools

as possible.

For a complete invoice management workflow, connect a document processing solution with

your:

- ERP or accounting system to sync invoice data with supplier, transaction, and performance data (e.g., Oracle NetSuite, Microsoft Dynamics, SAP, Sage, QuickBooks).

- SSO for secure user logins and authentication (e.g., Microsoft Azure, Google Workspace, or another solution).

- Third-party debit or credit cards for fast payment processing (e.g., Mastercard and Visa).

- Human resources information system (HRIS) to enhance AP employee experiences.

- Marketing platforms for efficient communication across teams, affiliates, and external partners (e.g., Slack or HitPath).

Where native integration is available, the setup should enable you to connect tools in a few clicks. Tipalti, for example, offers a wide range of pre-built, seamless integrations and APIs you can access directly without workarounds.

If you want to connect multiple tools quickly, contact your software provider or an implementation expert for support.

4. Train Your Team for Effective Use

Provide your AP team with training materials to enable them to learn and use your software efficiently. While OCR invoice processing does most of the heavy lifting, maximizing value requires human input.

Support your staff with:

- Interactive product demos that let users get hands-on with tasks.

- Onboarding guides that guide users on features, workflows, and setting up validation rules.

- Tutorials for high-quality invoice scanning and generating digital images of paper invoices.

- Access to the software’s customer support and help center for troubleshooting.

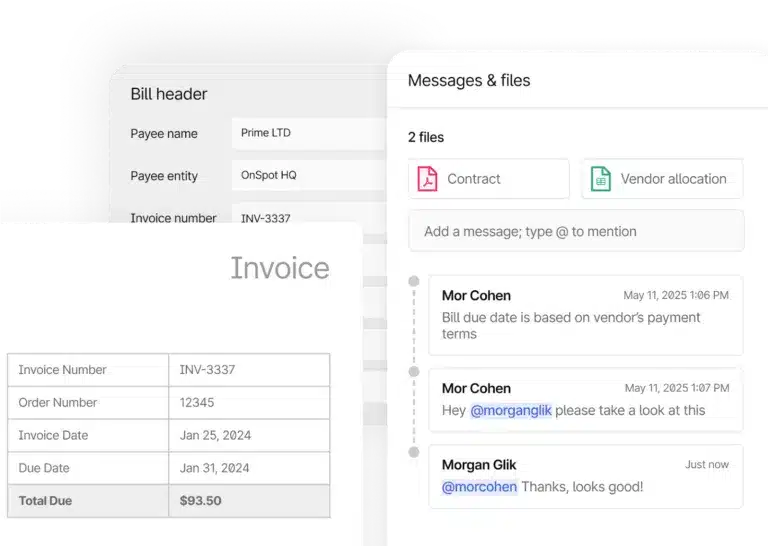

5. Track and Optimize OCR Performance

Establish a process to review and validate extracted data to improve OCR performance overtime.

In the invoice approval process and across your automated workflows, make it easy for AP team members and approvers to collaborate. Tools like Slack or in-built communication features work well for this. For example, Tipalti’s Comments feature enables users to tag colleagues, attach documents, and send messages within the platform.

This real-time collaboration helps teams spot inconsistencies and speed up issue resolutions to increase productivity.

Tipalti’s Invoice Management Solution

One of the best accounting systems for OCR invoice processing is Tipalti AP automation, which incorporates AI with its OCR invoice processing technology. The unified finance automation platform provides comprehensive, integrated processing for your accounts payable needs. Here are just some of the various AP processing tasks that Tipalti software products can accomplish:

Invoice Management

- Invoice capture and coding, using an AI agent

- OCR technology for scanned invoices

- Invoice verification

- Purchase order matching with an AI agent

Workflow Automation

- Invoice approval workflow that routes invoices, using an AI agent

- Multi-level approvals

- Procurement

Payments

- Payment processing

- Mass payments

- Advanced currency management solutions, including Tipalti Multi-FX and FX Hedging

Integrations

- ERP integrations

Reporting and Analytics

- Financial insights

- AI-driven custom reports from conversational queries

- Document management

OCR Invoice Processing FAQs

How do I reduce manual data entry for invoices?

Automated accounts payable OCR software captures invoice data using OCR technology, combined with machine learning to enhance accuracy, and eliminates the need for manual data entry of invoices.

What’s the difference between template-based and AI-powered

AI-powered advanced OCR is intelligent optical character recognition that flexibly utilizes machine learning to extract data with increased accuracy from various document types. In contrast, template-based OCR extracts data from structured documents by applying fixed rules.

The best OCR for invoice processing uses AI-powered OCR.

How do you automatically extract data from invoices?

Extract data from invoices automatically with AP automation software with OCR for invoice processing features, including AI agents or standalone OCR extraction software.

OCR invoice extraction should work in multiple languages.

Modernize Your AP Workflows with OCR

From cost reductions to efficiency gains, improved accuracy, and compliance, OCR invoice processing helps pave the way for more modern, competitive, and agile financial workflows. To future-proof your growing business, use scalable AP automation with AI-powered OCR invoice processing functionality. Explore more about Tipalti Invoice Management.