Learn how to protect and maximize your investment in SAP Business One.

Fill out the form to get your free eBook.

A SAP Business One migration is a major step forward—but it often leaves critical gaps in accounts payable and global payout processes. While SAP B1 tracks financial data, many finance teams still rely on manual spreadsheets to manage payments, reconciliation, and compliance, slowing the close and increasing risk. The SAP Business One Migration Playbook shows you how to automate the last mile of finance after go-live. This practical guide outlines where SAP Business One’s limitations are most pronounced and provides a clear blueprint for integrating AP and global payouts. Learn how to eliminate manual workarounds, embed compliance controls, achieve real-time reconciliation, and scale finance operations alongside your business. If you want to fully protect your SAP Business One investment and modernize AP post-migration, this playbook shows you how.

SAP Business One automation is essential for processing end-to-end accounts payable. SAP Business One needs add-on third-party AP automation software integration to digitize and automate supplier invoice processing and global payments.

Accounts payable automation with SAP integration makes payables processes more streamlined and efficient, with fewer fraudulent and erroneous payments in your business or nonprofit organization.

A Brief Overview of SAP Business One

SAP Business One is a real-time on-premises or cloud-based ERP system for small businesses and midsized companies using a unified database for managing multi-functional business operations and using its accounting system. SAP B1 uses optional modules and third-party software integration to add needed functionality that includes AP automation for SAP Business One.

SAP Business One is an entry-level software product from SAP. Other SAP ERP products include Business ByDesign and high-end SAP S/4HANA ERP. SAP HANA ERP with SAP modules is used by large enterprise companies and growing mid-sized companies.

Mid-sized growth companies may instead choose a SAP competitor, NetSuite or Microsoft Dynamics 365, as their next ERP system. ERP integrations for AP automation also enhance these ERP systems.

The Accounts Payable Process in SAP Business One

The accounts payable process in SAP Business One requires manual processes performed by the AP team. These payables processes include manual data entry of new suppliers, vendor invoices, invoice matching to purchase orders and goods receipts, invoice approval routing, and invoice payments.

The result is time-consuming and expensive invoice processing that may result in making duplicate and erroneous payments, missing deadlines for earning early payment discounts from suppliers, missing or lost paperwork, interruptions to respond to suppliers about expected invoice payment dates, and paper invoice storage costs.

The AP automation solution from Tipalti solves these accounts payable problems and provides more functionality when integrated with the SAP Business One ERP system for enhanced accounting and finance operations.

Tipalti AP automation integrates with SAP Business One to reduce business costs and hiring needs

AP automation software fills the SAP Business One accounts payable gaps.

Optimize SAP Business One with Tipalti AP Automation

To understand how Tipalti AP automation can optimize SAP Business One, consider its functionality and the benefits its features provide users.

Tipalti AP Automation Overview

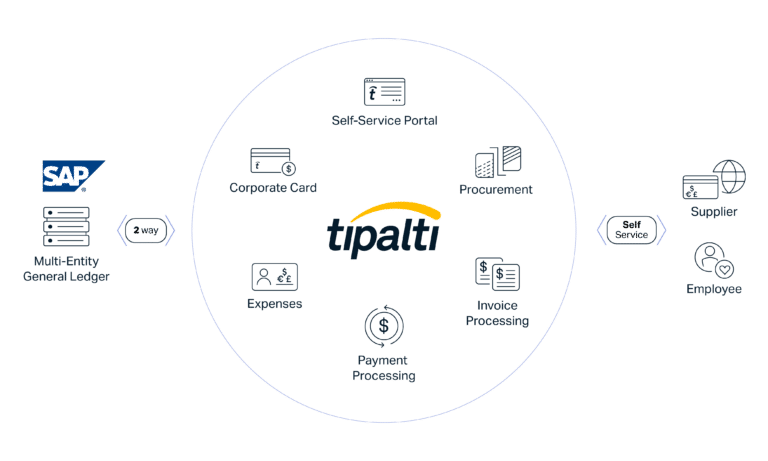

Tipalti AP automation for SAP Business One is a cloud software product in Tipalti’s unified finance automation software platform for streamlining and performing end-to-end AP processes. Tipalti AP automation has seamless integration with SAP Business One to eliminate manual invoice processing when you automate accounts payable.

Self-Service Supplier Hub Portal

Tipalti AP automation starts reducing your AP staff costs and increasing efficiency through a guided self-service supplier portal. Your suppliers enter their own contact information, W-9 or W-8 tax form data, and preferred payment information. They can view the status of invoices and payments through the Supplier Hub.

Supplier Validation

Tipalti AP automation software performs supplier validation with TIN numbers to prevent payment fraud and penalties for incorrect taxpayer ID numbers on 1099 forms. The supplier hub will show payment status with submitted and paid invoice history, which reduces supplier inquiries to AP for repeated communication about expected invoice payment dates.

Touchless Invoice Processing Automation

Tipalti supports touchless invoice processing to replace human intervention and paper-based, manual accounts payable. To complete data capture, Tipalti AP automation uses artificial intelligence/machine learning technology with OCR (optical character recognition) for invoice capture by heading and line item. Tipalti handles PDF files and other data formats to extract invoice data and CSV for file transfers to process payables. To match invoices,Tipalti automates 3-way or 2-way matching and invoice verification using 26,000+ payment rules. Tipalti AISM functionality includes generative AI account coding and Ask Tipalti AISM analytic queries about real-time spend for better decision-making. In the approval process, Tipalti automatically routes invoices through automated approval workflows to your designated approvers.

Global Payments

Tipalti’s global payment process automation tools use large batches for efficient payments. Your finance team can view the cash requirements for these multi-payment method batches before scheduling and authorizing the batch payment to improve cash flow management. Tipalti syncs data with SAP Business One and performs real-time automatic payment reconciliation to your company’s general ledger.

Security Features

Tipalti AP automation software has enterprise-grade security and provides an audit trail.

Global Regulatory Compliance and Tax Compliance

Besides invoice automation, Tipalti performs automated global regulatory compliance with screening against OFAC/SDN sanctions lists and other blacklists.

Tipalti AP automation includes 1099 and 1042-S tax preparation reports for simple tax form filing by your business. Alternatively, you can prepare automatic tax eFilings with 12 calendar months of supplier payment data if you can choose the option of buying partnered Zenwork Tax 1099 software with native Tipalti payments integration. Tax 1099 automates eFiling with the IRS and applicable states and distributes recipient copies of 1099-MISC and 1099-NEC.

Benefits of Tipalti AP Automation for SAP Business One

1. Digital transformation to a paperless system

Tipalti adds digital transformation to SAP Business One, eliminating manual data entry and paper from your financial operations relating to accounts payable and adding operational efficiency.

2. Cost savings

Tipalti AP automation provides cost savings from system efficiency, less hiring required to perform accounts payable workflows, and early payment discounts that can be taken on time.

3. Reduced fraud and payment errors

Tipalti’s supplier validation, screening against blacklists, invoice matching, and automated payment rules detect and avoid payments to fraudulent or sanctioned suppliers, double payments for duplicate invoices, and flag invoice errors before making payments.

4. Improved supplier communications

The Supplier Hub and payment notifications used in Tipalti AP automation keep suppliers informed about their submitted invoices and payment status. Through the Supplier portal, suppliers can immediately update their contact information when changes occur. This requires less staff time for inquiries and vendor master data file updates. Letting suppliers choose their preferred payment method and local currency improves supplier relationships.

5. Real-time spend visibility, control, and analysis

AI-driven Tipalti AP automation provides multi-instance and multi-entity features with SAP Business One, enabling users to automate and view accounts payable from each individual entity and with combined views. Real-time spend visibility is viewable by each supplier and spend category. Ask TipaltiAI℠ provides business intelligence through queries.

6. Easy supplier tax compliance

Tipalti AP automation collects W-9 or W-8 forms before the first payment to each supplier, meaning the AP team will not need to chase down these forms later. Simple tax preparation reports can be used to prepare 1099 and 1042-S forms. Or, users with 12 calendar months of data can optionally use Zenwork Tax1099 for automated eFiling of IRS forms 1099-MISC and 1099-NEC. With validated TIN, businesses should not expect IRS penalties for incorrect taxpayer ID numbers on their 1099 information returns.

7. Accelerated financial close from automated payment reconciliation

Because Tipalti AP automation software automatically prepares real-time batch payment reconciliations to the general ledger, companies can speed up their accounting close by up to 25%.

How To Get Started

The accounts payable process in SAP Business One needs a digital transformation that can be achieved by integrating scalable Tipalti AP automation, an efficient, cost-reducing, AI-driven end-to-end payables system. Tipalti AP automation improves accuracy. It provides real-time business spend visibility and analysis for decision-making to make your business more competitive. Tipalti AP automation integrated with SAP Business One simplifies tax compliance and makes it more efficient.

To get started with SAP Business One AP automation, learn more about the benefits of bridging the last mile of ERP for payables and request a Tipalti software demo.