See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

The faster you pay an invoice, the faster people can pay their own bills. It’s that simple. When money moves quickly, everyone is happy. If you’re not processing invoices in a timely manner, vendors will notice, and things can slide downhill quickly.

This is one reason why it’s critical to calculate accounts payable days and always strive to tighten that window.

A timely accounts payable process leads to stronger supplier relationships, fewer interruptions in the supply chain, and a better brand reputation. One of the most efficient ways to ensure your AP is on track is to calculate the accounts payable days ratio. This helps to improve invoice processing and realize cost savings from early payments.

In this article, we’ll look at what accounts payable days is, how to calculate it, why it’s important, and how automation can bridge the gap to help your business grow.

What is Accounts Payable Days?

Accounts payable days is also referred to as AP days or days payable outstanding (DPO). It is a financial ratio that shows the average number of days it takes for a business to pay its vendors over a certain amount of time. This ratio is calculated to measure the overall effectiveness of the AP process.

Much like the metric days sales outstanding (DSO), your DPO is a measurement of how fast and effective an operation can run. However, the ratio is inversely proportional, so the higher your DPO, the more cash flow problems you’re likely to experience.

Having a thorough comprehension of days payable outstanding helps to determine where improvements can be made, and fosters a deeper understanding of payment trends.

For example, late payments not only damage supplier relationships, they lead to costly late fees and penalties. When you quickly find areas to improve, more timely payments go out, and the business saves more money.

Why Should You Care About Accounts Payable Days?

How is your AP department functioning? Are vendors satisfied? What does your cash flow look like? The answer to these questions begins with calculating your accounts payable days (as well as your AP turnover ratio). This helps a business determine the state of its cash flow and approximately how long it’s taking to pay vendors back.

The next step is to answer the “why.” If you have a high DPO, is there a good reason? For example, the company may be holding onto cash for potential investments. Or, it could be that the business is struggling to repay suppliers; which can cause liability.

A low DPO means you’re paying suppliers back fast. Too low, and your business may be losing out on investment opportunities with limited cash flow. However, with a low DPO, you can also take advantage of early payment discounts, nurturing stronger supplier relationships and improving production times.

Whatever your DPO, it should be continually checked. If it’s too high or too low, try and think of possible reasons why. This is something that can be used in discussions with suppliers, whether it’s to give reasons for late payment (high DPO) or ask for early payment discounts (low DPO).

Rather than spot-checking every vendor payment and the entire paper trail (including POs, invoices, and receipts), it’s much easier to run a single calculation. This gives you a basic understanding of the overall financial health of a company as well as how to streamline your AP department.

How to Use the AP Days Formula

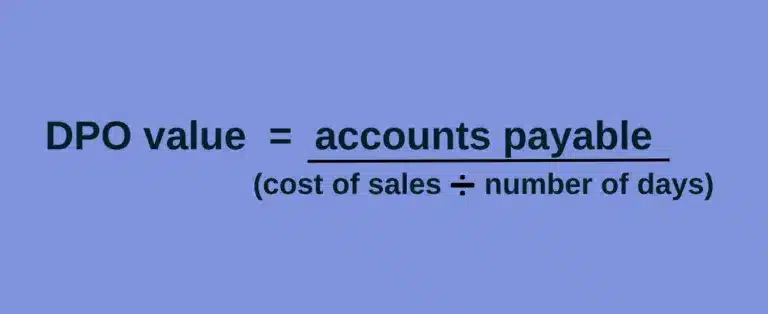

The AP days formula shows the average number of days an invoice remains unpaid. The end result is a number that represents the average time it takes for the AP department to settle an invoice. In simple terms, the formula for days payable outstanding is as follows:

DPO value = accounts payable/(cost of sales/number of days)

In this formula, you add up all the purchases from suppliers in a specific accounting period, and then divide that by the average amount of accounts payable during that same time period. This information, like the cost of goods sold, can be found on your balance sheet, general ledger, and other financial statements.

Beyond this calculation, you may also want to consider only including credit purchases (not cash payments) to suppliers, to ensure the AP days are high enough.

To calculate the accounts payable turnover in days:

365 days/ payable turnover ratio

Understanding how long it takes to pay suppliers determines the creditworthiness of an organization. It also helps a business make the necessary changes to improve its cash flow, drive working capital, and increase creditworthiness.

Using AP automation simplifies the entire process, making critical financial data instantly accessible for reporting and analysis. Technology helps you take a deeper dive into the cash conversion cycle and your established credit terms.

It’s about more than just eliminating paper. It’s the freedom to focus on growth.

Find out the best ways to take a holistic approach to AP automation today

Calculate AP Days: An Example

To demonstrate the equation in action, let’s say a business owner or controller wants to calculate AP days for the last 12 months for Company ABC.

The beginning accounts payable balance is $300,000, and the ending accounts payable balance is $500,000. Over the past 12 months, purchases were $3,000,000. Using this data, you can easily calculate the accounts payable days ratio as follows:

$3,000,000 purchases / (($300,000 beginning AP + $500,000 ending AP) / 2)

$3,000,000 purchases / $400,000 average accounts payable

7.5 = accounts payable turnover ratio

This number indicates that accounts payable turned over 7.5 times in the last 12 months for Company ABC.

In order to convert this into AP days, we simply put that number into 365 days, as such:

365 days / 7.5 days = 48.7 days

This number represents the average number of days Company ABC takes to pay a supplier invoice in a fiscal year.

Remember to exclude all cash payments in this calculation, otherwise, your DPO will skew too low.

How to Reduce Your AP Days

A high DPO isn’t always negative. It can indicate your business has extra cash in hand to make more short-term investments. However, if your higher DPO is a liability, there are some actions you can take to bring that number down.

Balance the Cash Outflows and Cash Inflows

This starts by reconsidering your payment terms, for both vendors, as well as your own. For example, if your payment terms are 60 days and your vendors’ payment terms are 30 days, there’s going to be a slight mismatch.

The closer your own payment terms match suppliers’, the more of a balance your outflows and inflows will have. So it might be time to negotiate some better terms.

Optimize Accounts Payable Workflows

Accounts payable issues cause cash flow forecasting problems and missed opportunities to streamline AP workflows. If your AP operations have been documented and bottlenecks identified, then chances are your business is a good fit for AP automation. Technology will help to reduce AP days and remove the cogs in your wheel

Using Automation to Speed Up Your AP Process

Spend hours less on invoice processing and uncover opportunities for discounts with accounts payable automation software.

An AP platform offers a multitude of benefits to speed up your accounting process and reduce DPO. It provides real-time financial data for instant analysis and reporting, leading to more informed decision-making. Some additional benefits you can expect are:

- Improves supplier relationships.

- Uncovers opportunities for early payment discounts

- Saves time to focus more on forecasting

- Reduces invoice errors and human mistakes

- Cuts invoice processing times in half

AP automation can drastically improve your AP days metrics and increase efficiency across all AP workflows.

Summing it Up

Understanding DPO and learning how to quickly calculate your turnover ratio facilitates a deeper understanding of payment patterns. This leads to improvements based on production needs and your current cash flow.

It paints a picture of the state of your finances right now, and helps future-proof your business for higher productivity and profitability.

This is crucial for modern businesses competing in a constantly evolving global marketplace. It allows an organization to make sensitive financial decisions when they matter the most.

Closely tracking your accounts payable metrics and benchmarks creates a higher-functioning AP department with better cash flow and a deeper sense of supplier satisfaction. AP automation allows teams to collaborate at any time, from any location, and make important financial decisions that support production and improve business reputation.

Tipalti is an incredible tool to help an AP team optimize their DPO, increase cash flow, and automate tedious manual processes. We can help you get your AP train back on track fast. Try a free demo today.

The more an AP team comprehends how to calculate accounts payable days, the easier it will be to gauge success every step of the way. Not only does it help to improve cash flow and boost your bottom line, it further cements strong vendor relationships and encourages people to consistently refer your business.