Tipalti Card

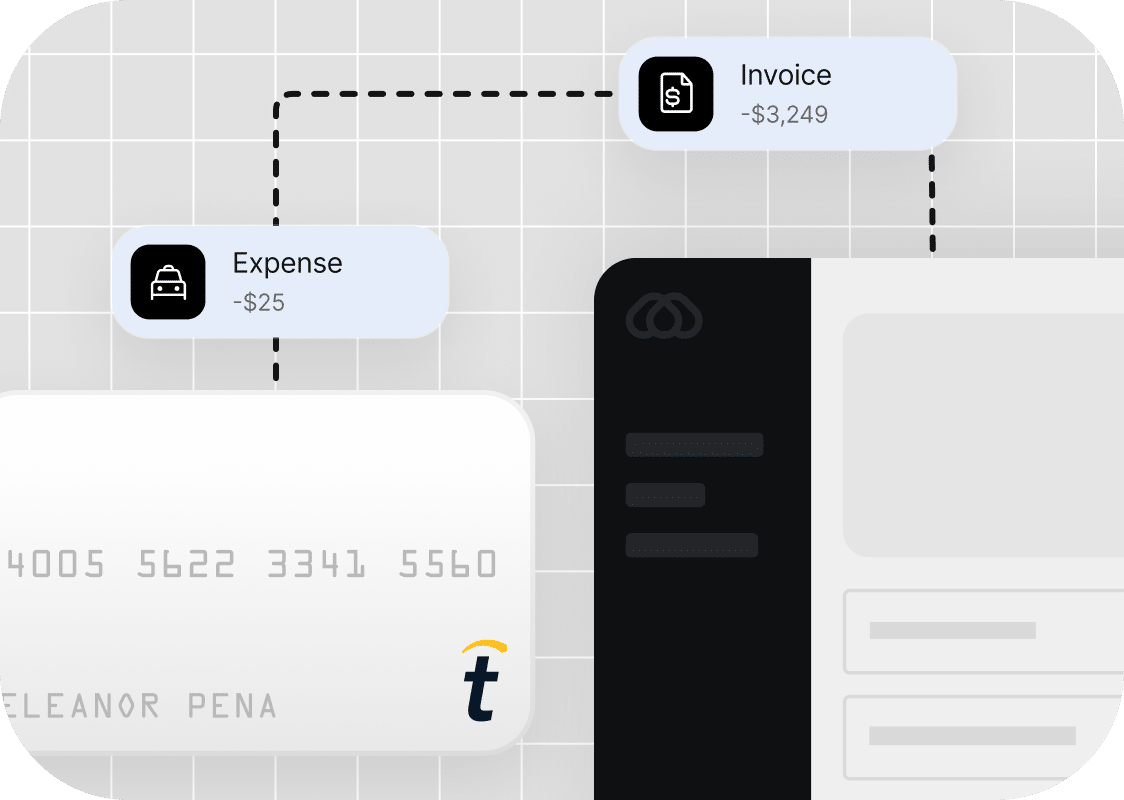

All Your Card Needs in One Platform

Integrate card payments into your invoice and expense workflows – all while earning cashback.

Tipalti Card Features

The Only Card Native to Your Tipalti Workflow

Tipalti Card is the easier and more rewarding way to manage payments—from vendor invoices to employee expenses—right inside the platform you already use.

Testimonials

Hear from Our Card Customers

Tipalti Card Options

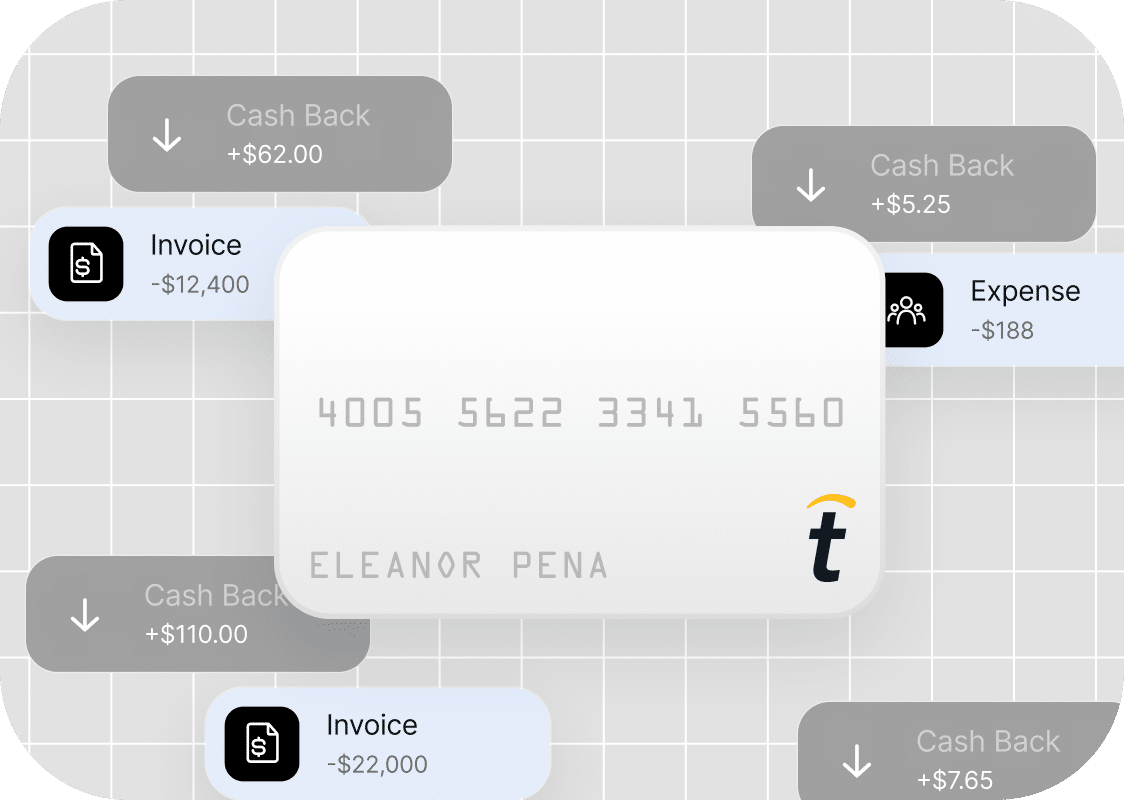

From Invoices to Subscriptions to Expenses, Pay More with Tipalti Card

Invoice Payments

Earn cashback by paying vendor invoices with Tipalti Card. The entire setup is managed by our team with minimal effort needed from you and no changes to your Tipalti workflows.

Online Transactions and Subscriptions

Pay recurring bills—like software subscriptions or online ad spend—with a stored virtual card on file. The transactions are matched and approved just like your other Tipalti workflows.

Employee Expenses

Tipalti’s corporate debit cards are accepted in over 200 countries and territories, and you earn cashback with every qualified purchase. Embed unique spending rules into each virtual or physical card, and reconcile everything in Tipalti.

Customer Stories

See How Teams are Using Tipalti Card

Platform Features

Work Smarter, Not Harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

Awards

#1 Award-Winning Finance Automation Solution

The Fintech Awards

Best SaaS for FinTech 2025

2025 Deloitte Technology

Fast 500

Awarded to Tipalti for the 8th consecutive year

2025 CNBC World’s Top Fintech Company

Awarded to Tipalti for the 3rd consecutive year

Leader in the IDC 2024 MarketScape

Worldwide Accounts Payable Automation Software for Midmarket

Ready to Save Time and Money?

Book a demo to get started today and take control of your finance operations with Tipalti.

Tipalti Card FAQs

How does Tipalti Card work, and how is it different from other card solutions?

For Tipalti prospects and customers who are currently relying on standalone card solutions or fragmented payment methods, Tipalti Card is a powerful card solution available to streamline more of your spend. Tipalti Card offers a unified experience across our AP and Expense modules that includes end-to-end reconciliation and centralized visibility and control of your card activity. Unlike other limited corporate card offerings, Tipalti’s virtual and physical cards solve for a broader range of card scenarios including vendor invoice payments and recurring bills, along with traditional employee expenses. Tipalti further offers payment optimization services to assist our customers and, of course, helps those customers maximize cashback.

Can I use a Tipalti Card as a standalone product?

No, Tipalti Card is fully designed to work within Tipalti Accounts Payable in a single unified system, so we don’t currently offer Tipalti Card without it. Note that for Tipalti AP customers, there’s no additional cost to issuing unlimited physical and virtual Tipalti Cards.

Can I use Tipalti Card to pay vendor invoices (but NOT as a Corporate Card)?

Absolutely. Customers can use Tipalti Card for any or all of the use cases we support. This includes paying invoices by card, a program that lets customers earn cashback by paying vendor invoices with single-use virtual Tipalti cards. The entire setup is managed by our team with minimal effort needed from customers and no impact to your Tipalti workflows.

What are corporate cards and virtual cards?

A corporate card is a payment card issued by companies to employees for business-related expenses. Using these cards help businesses manage and control spending, streamline expense reporting, and improve financial oversight.

Virtual cards provide control and security, but exist as digital-only card numbers. They are ideal for managing online subscriptions or one-time vendor payments, as they can be issued in a snap and embedded with specific controls to catch rogue spending before it happens.

An organization can use company policies to set spending limits, vendor limits, and restrictions, with all transactions monitored and recorded. This not only simplifies the reconciliation process but also streamlines procurement.

Additionally, corporate and virtual cards offer robust security features like fraud prevention and the ability to deactivate instantly if a card is compromised.

What are the different types of corporate cards?

Tipalti categorizes corporate cards into two primary types based on their specific use cases, both of which can be handled with Tipalti Card:

AP cards (Accounts Payable/Virtual Cards) are typically digital-only cards used for procurement and vendor payments. They are ideal for managing online subscriptions and high-volume vendor spend.

T&E Cards (Travel & Entertainment) are physical or digital cards used by employees for daily business expenses, such as airfare, hotels, and client meals. They integrate with Tipalti Expenses to automate receipt submission and policy compliance.

What features should I look for in a corporate card for my business?

Several key factors must be considered when choosing a corporate card for your business expenses. Some important aspects to evaluate include:

- Spend controls and limits: Ensure the provider allows for individual spend limits and restrictions.

- Security features: Make sure the card offers robust fraud detection, transaction monitoring, and the ability to freeze cards instantly.

- Expense management: The card should seamlessly integrate with your existing expense management software or ERP system.

- Fees and rewards: Consider annual and transaction fees. Also, reward programs like cashback and travel points should be considered.

- Compliance and reporting: Ensure the card provider complies with relevant financial regulations and standards. There should be easy reporting for audits.

- Customization and scalability: Choose a card that can grow with your business, allowing you to add users and adjust limits as needed.

The card you select should also offer an easy-to-use interface with intuitive workflows and simple onboarding.

Is Tipalti Card secure?

Yes, the Tipalti Card is designed with enhanced security features that allow finance teams to maintain precise control over business spend. You can issue new cards instantly and embed specific spend controls to catch rogue spending before it occurs. These built-in policies and limits ensure that every transaction aligns with company guidelines, providing a proactive layer of defense against unauthorized use.

To further mitigate risk, Tipalti Card offers real-time visibility into all card-related activity, allowing for immediate intervention if necessary. For instance, cards can be deactivated in a snap if they are lost or compromised. This centralized approach ensures that all transactions are monitored and recorded within a secure, integrated environment.

What are the most common use cases for Tipalti Card (physical and virtual cards)?

Corporate cards are versatile financial management tools used by business owners to manage a wide range of expenses quickly and efficiently.

Here are some of the more common use cases for corporate card programs:

T&E (travel or entertainment) expenses allow employees to use corporate cards for things like business travel, flights, hotels, meals, and more.

Cards can be used to purchase office supplies, furniture, and equipment. Startups with business credit cards will often use them for accounting software subscriptions and other digital tools.

Employees can use a corporate card to pay for conference registrations, seminar fees, and other types of training sessions.

Online advertising expenses, such as Google Ads and social media are covered under corporate cards, too. They can also be used for traditional media like billboards, print, and sponsorships.

Here are other use cases for corporate cards:

- Holiday and birthday celebrations or gifts

- Utilities, rent, and other operational expenses

- Contingencies for unexpected events

- Employee engagement and team-building activities

Are there international transaction fees for corporate cards?

Yes, international transaction fees may apply to corporate cards, but it depends on the card issuer and the specific card program. These fees are typically charged when a purchase is made in a foreign currency or when a transaction is processed by a merchant located outside the card’s home country.

International fees usually range from 1% to 3% of the transaction amount and may include currency conversion and cross-border processing costs. Some corporate card programs waive these fees entirely, while others offer preferential rates for certain regions or transaction types.

For accurate details, it’s best to review your cardholder agreement or contact your card provider directly, as fee structures can vary by issuer, card type, and negotiated corporate terms.

How does Tipalti Card integrate with Tipalti Expenses?

Tipalti Expenses is part of Tipalti’s connected portfolio of financial automation solutions and integrates seamlessly with Tipalti Card.

Tipalti Expenses also integrates with Visa, Mastercard, and American Express (Amex). This enables a business to manage all reimbursable expenses and card transactions in one place (regardless of the issuing entity).

A business can automatically reconcile all purchasing card transactions regardless of issuing entities or card types, simplifying finance workflows.

This employee-friendly solution helps boost adoption with intuitive mobile or web interfaces. It allows staff to quickly snap and upload receipts, while card limits help them stay within budget.

Key integration features include:

- Spend controls and built-in compliance

- Real-time expense tracking

- Expense report automation

- Enhanced security and fraud protection

- Seamless data synchronization