Explore the top 7 ways you can solve common Quickbooks problems with automation.

Fill out the form to get your free eBook.

There comes a time in every business when you have to find better ways of doing things. This is especially true with accounts payable processes, which has traditionally meant paying people to pay people. Even with QuickBooks, organizations still have to extract information from suppliers and vendors, manage invoices, and make payments. Thankfully, there’s hope in the form of automation technology. In 7 QuickBooks Payables Problems Solved with Automation, learn the biggest payables problems automation solves for QuickBooks users. Read the eBook to discover: – The challenges of global payables – How to reduce exposures to AP risk – Missed strategic opportunities within finance – The growing impact of payables transformation

One of the most essential processes when using QuickBooks accounting software is receiving a customer’s payment for sales transactions. Your business should also know the benefits of automating supplier payments in accounts payable.

You may be using QuickBooks Online or QuickBooks Desktop. This guide shows you how to receive and accept payments through QuickBooks Online, which is real-time cloud software. With QuickBooks Online, your business can receive payments with different payment methods, such as credit card, debit card, ACH bank transfer, or PayPal.

QuickBooks Online automatically receives and records customers’ online payments when connected with QuickBooks Payments (Merchant Services). When not using QuickBooks Payments (through its parent company’s Intuit QBO Merchant Services) for QuickBooks online payments, use the QuickBooks Online menu steps indicated to receive and record customer invoice payments.

QuickBooks Payments in QBO: Receiving Customer Payments

Small businesses and medium-sized businesses use QuickBooks Online bookkeeping and accounting software. Intuit owns QuickBooks and TurboTax. Suppliers using QuickBooks Online can invoice and accept customer payments.

The QuickBooks receive payments service is very affordable for its small business users. QuickBooks Online charges a transaction fee for credit card payments, debit card payments, and ACH payments. As you can see in the Intuit QuickBooks web page, transaction fees for QuickBooks Online vary by the type and transaction method used. ACH bank transfers, card swipes, invoices, or keys have different processing fees. (Rates differ for QuickBooks Desktop users.) You’ll learn how to process credit card payments in QuickBooks Online through Intuit payment processing.

Paying Supplier Invoices with Tipalti’s AP Automation App for QuickBooks

Tipalti is an AP automation application that integrates with QuickBooks Online and QuickBooks Online Advanced. Use Tipalti with your regular QuickBooks Online login and software interface. Tipalti handles the entire accounts payable processing workload. It automates online payments to suppliers and vendors using a choice of global mass payment methods. Using Tipalti saves you up to 80% of accounts payable processing time. It shortens the time to close the financial books by 25%. Tipalti is available as a SaaS subscription with a monthly fee.

The Tipalti AP automation app for QuickBooks Online provides the interface portal for suppliers to onboard themselves. Vendors enter their contact information, supply their online tax forms data (W-9 or W-8 forms), and select their preferred payment method. Suppliers will later email or upload invoices to submit for payment and can view their invoice payment status and history through the Supplier Hub. Self-service supplier onboarding saves your accounts payable department a significant amount of time. It also increases data accuracy.

How to Set Up QuickBooks Online to Receive and Accept Payments

As a QuickBooks Online user, it’s essential to know how to apply for QuickBooks Payments through QuickBooks Online software, properly set it up, and use it to accept customer payments.

Register with Intuit through your QuickBooks Online account in the software by providing information about the business, business owners, and merchant account to use the QuickBooks Payments feature. Not every small business that applies is accepted for QuickBooks Payments.

How to Apply and Start Using QuickBooks Payments with QuickBooks Online

To start receiving payments in QuickBooks Online, click the Settings gear icon at the top right of the toolbar.

When the Settings menu opens, choose Accounts and Settings, then Payments. You’ll see this screen:

If you’re already using Intuit Merchant Services or GoPayment for payment processing, press the Connect button. Otherwise, press the Learn More button to set up Payments through QuickBooks Online.

Steps for How to Set Up QuickBooks Payments Within QuickBooks Online

The steps include signing up for QuickBooks Payments and Connecting QuickBooks Payments with QuickBooks Online after approval for a QuickBooks Payments account.

Applying for QuickBooks Payments Within QuickBooks Online

To apply for QuickBooks Payments, follow these steps:

- Administrator logs in to QuickBooks Online

- Go to Settings > Account and Settings > Payments

- Choose Learn more in the QuickBooks Payments section

- Choose Set up Payments

- Complete the form and select Next for each section

- Select Get Set Up

Filling out the Forms to Apply for QuickBooks Payments

QuickBooks Online steps for filling out the business information in a form include:

- Go to the next screen labeled Business to enter your business information

- Go to the second screen, Owner/Proprietor, to enter owner information

- Go to the third screen, Bank, to connect your bank account for depositing payments

- Complete authorization, agree with Intuit Merchant Agreement, and consent to use of credit report

- Click Activate Payments button to complete the application process

The next screen, labeled Business lets you enter business information in a form. The second screen, labeled Owner/Proprietor, is a form for entering business owner information. Intuit uses business and owner information to verify your business.

The third screen, labeled Bank, asks you to connect to your bank account (by entering your bank username and bank password). QuickBooks asks you to enter the bank account for depositing payments. On the Bank screen, Intuit states:

“By selecting Next, I authorize Intuit to debit my bank account on file for payment services fees on a daily basis, starting the day after my first transaction. I can cancel at any time in my QuickBooks account settings.”

You’ll see another Intuit notice near the bottom of the Bank screen and the following screen:

“By selecting Submit, I agree to the Intuit Merchant Agreement, the privacy policy, and the pricing. I provide my “written instructions” to authorize Intuit to pull my credit report to use for this service. “

If you agree, press the Activate Payments button. This completes the process of signing up to accept QuickBooks Payments.

Intuit, the parent company of QuickBooks, reviews each application for QuickBooks Payments within about three business days. QuickBooks will email you when you’re approved to use the service.

Connecting QuickBooks Payments to QuickBooks Online

After you have a QuickBooks Payments account, follow these steps to Connect it to QuickBooks Online:

Steps to set up QuickBooks Payments for QuickBooks Online are:

- Administrator logs in to QuickBooks Online

- Go to Settings > Subscriptions and billing

- Connect your payment account

- Choose a QuickBooks Payment account for connecting

- Choose the bank accounts for depositing customer payments

Intuit Merchant Services is the payment processor for QuickBooks Intuit Payments. Online stores use payment gateways for e-commerce. A payment gateway lets your online store connect to your merchant bank account to transfer transaction proceeds. It acts as a ‘virtual terminal,’ instead of a card-swipe terminal.” If you need a payment gateway, you can set it up after you get your QuickBooks Payments account to receive customer payments, as described in this guide.

You may already have a merchant account for QuickBooks Payments with Intuit’s Merchant Services and QuickBooks’ GoPayment app for accepting payments on the go. You still need to follow this process to connect it with QuickBooks to accept customer payments.

If approved for QuickBooks Payments, you’ll receive your first customer payment in your bank account within five business days. After receiving your first payment, you’ll get customer payments much quicker to help your cash flow. That’s by the next business day (or even the same business day for eligible accounts).

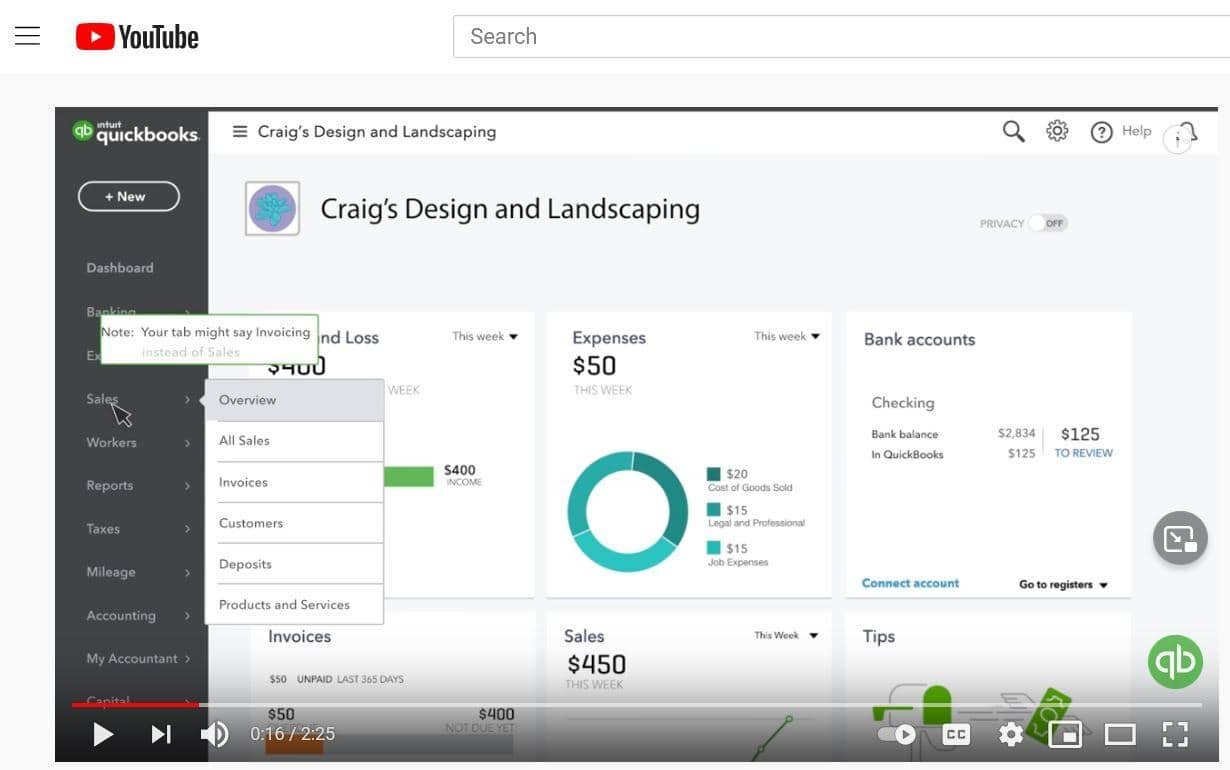

Screenshots for Receiving and Accepting Payments in QuickBooks Online

The following explanation includes screenshot steps to apply for and use QuickBooks Payments with QuickBooks Online from a tutorial. The screenshots are from a November 6, 2019 QuickBooks Online YouTube video titled How to Set Up QuickBooks Payments | QuickBooks Online.

Your business receives and accepts customer payments differently when it isn’t using QuickBooks Payments. These screenshots are from a QuickBooks Online December 9, 2019 YouTube video titled How to Record an Invoice Payment | QuickBooks Online.

Receiving Payment through QuickBooks Payments

You can accept payments through QuickBooks, emailed online invoices, and mobile. Mobile devices include your iOS or Android phone or tablet. The bank transfers are ACH payments.

Accepting and receiving payments from customers through QuickBooks Online is easy. Use the Payments feature to automatically match and apply customer payments your business collects to invoices. Don’t enter customer receipts as deposits.

For QuickBooks Online users approved and enrolled in QuickBooks Payments, QuickBooks Payments processes the customer’s payment. Recording customer payments in the appropriate accounts is handled automatically by QuickBooks Online software.

QuickBooks Payments users can insert payment links in customer invoices or messages using the Sales menu in QuickBooks to receive online customer payments.

Payment link functionality makes it easy for customers to pay the invoice online using a specified payment method. QuickBooks users can select to process their customers’ payments through credit card processing or ACH. Businesses with QuickBooks send the payment link via email, text, social media, or a QR code.

Ways to Accept Payments in QuickBooks with QuickBooks Payments

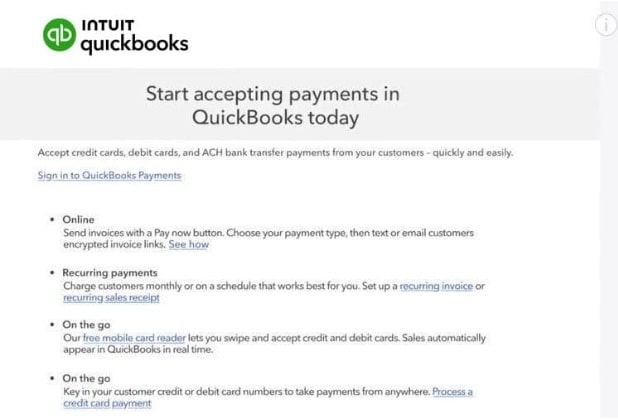

The following screenshot shows how you can use QuickBooks Payments:

Using QuickBooks Payments, you can select your favorite payment type and send online invoices to your customers with a Pay Now button.

You can set up recurring invoices and recurring sales receipts for recurring customer payments.

Choose to accept PayPal payments by issuing e-invoices with QuickBooks Online.

Make supplier payments in QuickBooks Online faster and more efficient

Tipalti AP automation streamlines invoice processing and reconciles global payments, saving time, reducing costs, and enhancing financial controls.

Receive Payment through QuickBooks Online without QuickBooks Payments

If you don’t use QuickBooks Payments, follow these steps to accept, record, and receive invoice payments from customers in QuickBooks Online.

If customers pay immediately, discover how to create a sales receipt that records the transaction in the linked QuickBooks Online support page.

After you’ve finished invoicing customers who pay on account, you can choose which of two menu sequences you prefer to use for a customer’s payment.

Receive Payment through the Sales or Invoicing Menu Sequence in QuickBooks Online

The steps when you start with the Sales or Invoicing menu in QuickBooks Online are:

> Sales (or Invoicing) from the side menu

> Customers in the pop-up menu

> Select the customer’s open invoices being paid

> Receive payment

> Save and close.

Receive Payment through the Customer Menu Sequence in QuickBooks Online

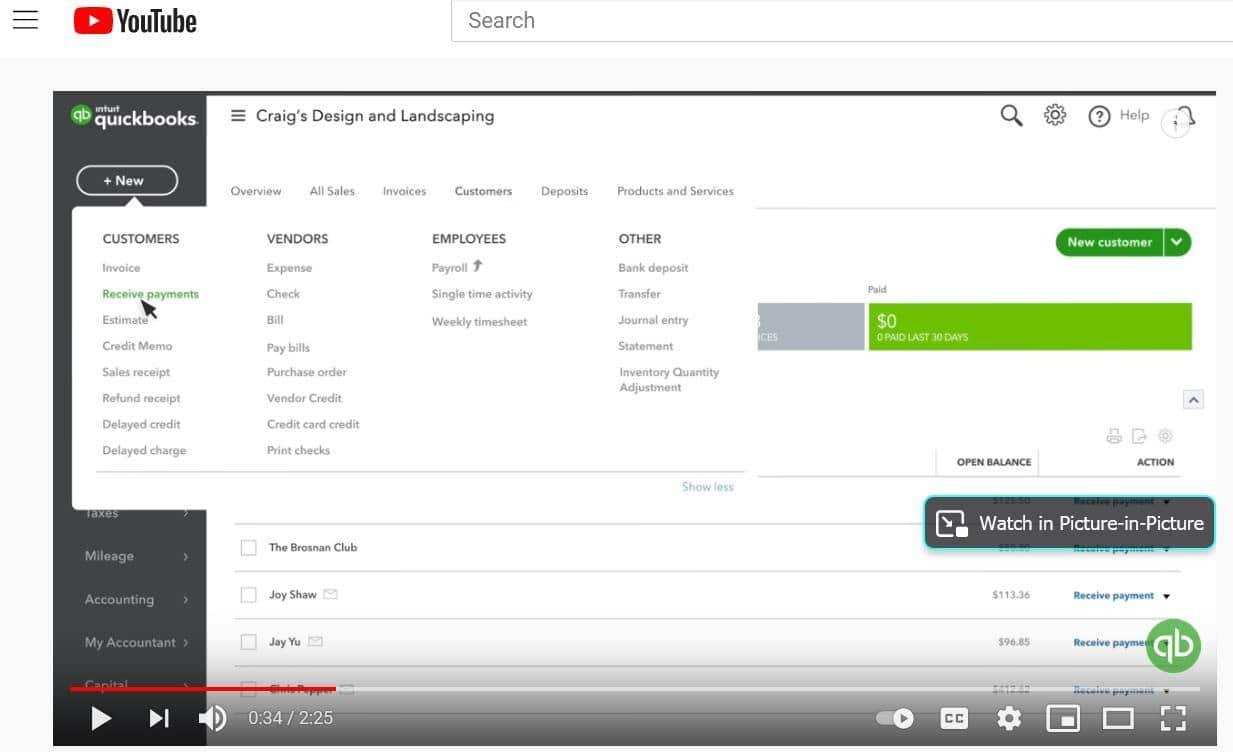

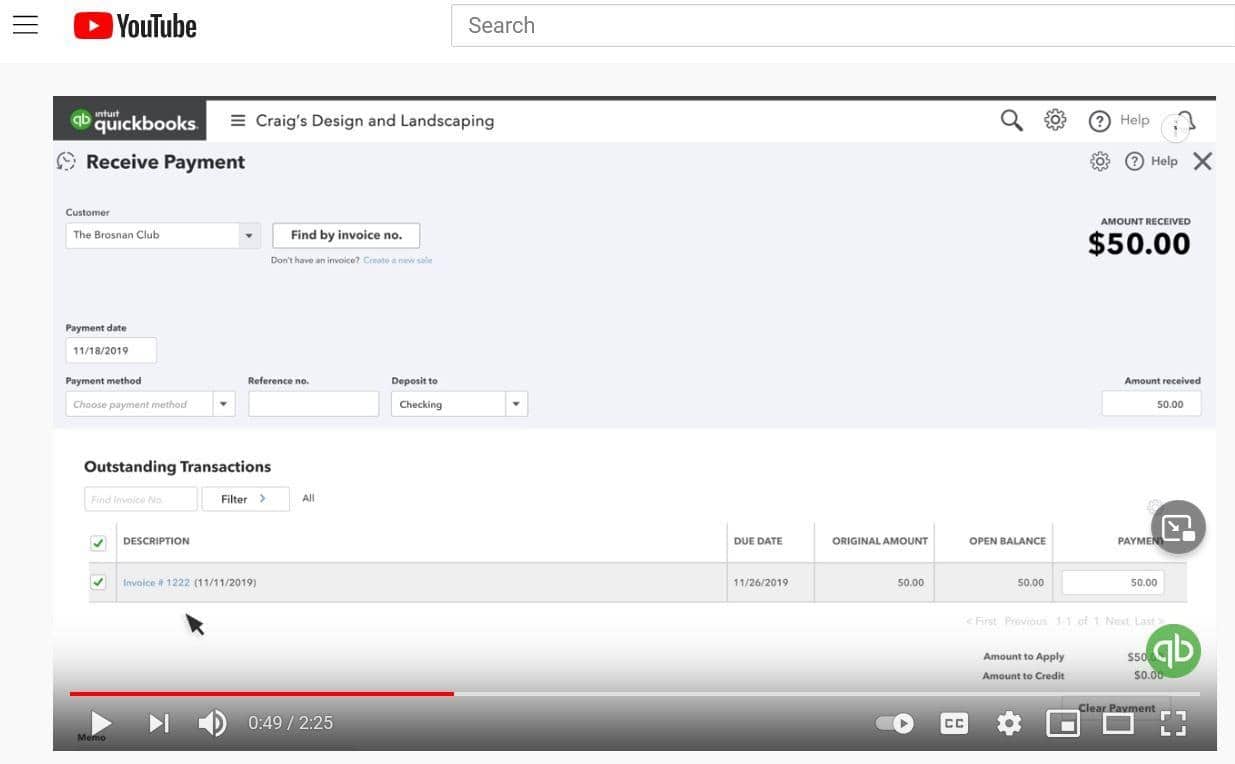

The steps when you start with the + New button, then Receive payments in QuickBooks Online are:

> New button from the side menu in QuickBooks Online

> Receive payments

> Type in the Customer’s name

> Select the invoice that the customer paid in the Outstanding Transactions section, using the checkbox

> If the invoice is fully paid, QuickBooks Online automatically includes the full amount

> For partial payments, enter the amount of the partial payment in the Payment box instead

> Enter the Payment date

> Choose the payment method and add any reference number needed, like the check number

> In Deposit to, choose an option from the drop-down menu for customer payments:

> If the invoice is not already deposited, choose a temporary Undeposited funds account (also in your chart of accounts) until the single deposit or batch bank deposit of multiple invoice payments is made

> Record payments when you record the bank deposit you’ve made.

> If you choose Checking account for a deposited payment instead of Undeposited funds, then the invoice balance is shown as zero if paid in full, and the payment is recorded. The accounts receivable balance is reduced by the invoice payment amount as part of the transaction.

> Save and close.

To check for accuracy, you can run a Customer Balance Summary report in QuickBooks Online from the Reports menu to check a customer’s open accounts receivable balance.

Accepting Card Payments in QuickBooks Online

You have choices in how to accept card payments through QuickBooks Online (credit or debit).

If you don’t already have the point-of-sale equipment, Merchant Services will send you a free mobile card reader to receive mobile payments. You can request the free mobile card reader from a link in your QuickBooks Payments approval email. Use this QuickBooks point-of-sale device for customer card processing. Insert chip cards, swipe, or tap to capture customer debit or credit card information and processing.

QuickBooks card payment options available through Intuit payments include:

- Visa

- Mastercard

- Discover

- American Express

- Apple Pay

- Bank cards

Besides credit and debit card transactions, you can choose ACH payments to receive payments from customers you’ve invoiced. You may also want to check out our guide to understanding how much QuickBooks charges to process credit & debit card payments.

Integration with PayPal and Other Payment Platforms

The QuickBooks Online App Store offers a choice of apps to connect with PayPal and other payment platforms. Although the Connect to PayPal app no longer appears to be offered through the QBO App Store, you may choose other alternatives for QuickBook payments connecting sources such as PayPal, Stripe, and WooCommerce. QuickBooks cautions to review each of these apps carefully before selecting and connecting them to QuickBooks (to ensure security through a possible third-party online app-connected QuickBooks payment source).

Pros and Cons of Using QuickBooks Payments

QuickBooks Payments has some advantages and drawbacks.

Pros

Pros of using QuickBooks Payments include:

- Convenience

- Native integration with QuickBooks Online

- Streamlined accounts receivable

- Payment links embedded in customer invoices and sent via messages

Cons

Cons of using QuickBooks Payments include:

- Doesn’t accept international credit cards from customers

- Payment processing fees may be high

- Occasional server downtime for maintenance or capacity issues

QuickBooks Payments in QuickBooks Online is designed only to accept U.S. and Canadian credit cards. QuickBooks Payments doesn’t accept international credit cards (other than Canada-based cards).

American Express Vendor Pay has noted QuickBooks Online sync errors related to service that is temporarily unavailable due to maintenance or capacity issues.

Alternative Payment Processors

Through integration, QuickBooks customers should consider alternative or additional payment processing options for specific needs and business processes.

For example, Tipalti AP automation software is a third-party add-on for QuickBooks Online (or QuickBooks Desktop) that automates supplier invoice processing, including global payments. Tipalti offers a choice of 50+ payment methods (including domestic and many international credit cards, debit cards, ACH, global ACH, PayPal, and wire transfers) to 200+ countries in 120 currencies. The Supplier Hub for Tipalti AP automation software provides suppliers with real-time payment statuses.

Tipalti offers a secure payment platform and is a licensed Money Services Business (MSB) in the United States. Tipalti is an Electronic Money Institution in the UK and EU.

Common Issues and Troubleshooting

Customers may experience the following issues with QuickBooks Payments that cause payment delays and may require troubleshooting.

Common problems with QuickBooks Payments include:

- Payment delays from customers may occur as a payment hold: if the customer’s payment account is incorrect or hasn’t been updated after a change

- Paid not deposited status: if the customer enters an incorrect credit card number or security code to pay an invoice

- Expired credit card: if the credit card on file for the customer is expired, you may need to fix it in QuickBooks Online with the customer’s permission

- Authorization problems with customer credit cards: the customer may need to use a different credit card or a debit card for payment instead.

- Debit card not accepted: Customer debit cards must be associated with a large credit card company like Visa, MasterCard, American Express, or Discover and have adequate funds to cover the transaction

- Not receiving timely payment status: this issue is related to the QuickBooks Payments system and may require customer follow-up

Your accounting staff can follow up with the customer on these exceptions to correct their QuickBooks Payments payment method information or get paid through a valid account or payment card with adequate funds available. Unfortunately, this troubleshooting takes time.

Final Thoughts

We’ve covered how to receive customer payments in QuickBooks Online, both with and without a QuickBooks Payments connection.

This guide explained how to set up QuickBooks Payments from QuickBooks Online through Intuit Merchant Services. Our simple explanations include step-by-step instructions and screenshots. You can accept and receive online payments, including PayPal, in-person payments with a mobile card reader, or debit or credit card numbers manually keyed in. You can also accept ACH payments from customers.

If you’re not using QuickBooks Payments with QuickBooks Online, see the steps for receiving payment and recording a customer payment transaction. By automating your accounts payable with the Tipalti app for QuickBooks Online or QuickBooks Online Advanced, you’ll have significant time savings and labor savings that favorably impact your bottom line and cash flow. Learn more about solving QuickBooks Online payables problems with Tipalti AP automation.