Save time and empower your finance team with Tipalti. The most complete AP solution loved by 5,000+ businesses.

By switching from AP manual entry to best practices with robust automation software for accounts payable, your business can lower costs and save time. Integrating third-party AP automation for QuickBooks improves internal control and reduces the payment of duplicate, erroneous, or fraudulent vendor invoices.

Corporate governance, including over accounts payable and cash, is your responsibility. Use an automation add-in integrated with Intuit’s QuickBooks Online software for the best AP integration for QuickBooks accounting automation.

In this article, we cover QuickBooks, AP automation, Tipalti’s top QuickBooks accounts payable automation platform, and how to select the accounts payable automation system that best meets your business needs.

A Brief Overview of QuickBooks

QuickBooks is accounting software owned by Intuit, with QuickBooks Online (QBO) and QuickBooks Desktop (QBD) product lines. QuickBooks is used by startups for bookkeeping, small businesses, and some mid-sized businesses with fewer than the limited number of QuickBooks users allowed in their QuickBooks pricing plan.

QuickBooks includes features outlined in this QuickBooks integration guide. In accounts receivable, QuickBooks lets users accept customer payments. In QuickBooks accounts payable, companies pay supplier invoices, but the right add-on AP automation improves your ROI.

According to the QuickBooks Online Advanced FAQ, it’s designed for growing companies and can handle up to 25 users. QuickBooks Online Advanced is a step up from QuickBooks Online Pro. QuickBooks Online Advanced users include customers who have used QuickBooks Desktop Enterprise software.

Automate AP and Invoices for QuickBooks

One of the most beneficial types of add-on integration apps for QuickBooks is AP automation.

Accounts payable automation streamlines the entire payable process from digitally capturing invoice data from vendor invoicing to global payment and reconciliation. Although QuickBooks has recently added AI Agents, other AI features, and SaaS Bill Pay plans that capture some invoices through its network, QuickBooks Online requires some manual data entry and use of paper invoices in addition to the PDF supplier invoice files received.

By integrating new features into QuickBooks Online or QuickBooks Desktop, you can get your medium-sized or small business to the level of a top performer on the Accounts Payable Cost metric. What you need is the seamless API integration of a QuickBooks App that looks and feels like you’re using the QuickBooks Desktop or QuickBooks Online software.

Best AP Automation Features

AP automation should enable best practices and offer the following features.

1. Artificial Intelligence/Machine Learning

AP automation uses AI/ML and data science rules or algorithms to validate suppliers and invoices, reducing fraud. Robotic process automation (RPA) automates routine AP workflow processes. Automation effectively handles the approval process by approver level and responsibility.

2. Automated Workflows

AP automation can efficiently code and batch-process supplier invoice payments or other business payments and instantly reconcile very large, multi-payment method, multi-currency batch payments.

3. Numerous Cost-Effective Supplier-Preferred Payment Methods

The best AP automation for QuickBooks software uses a vendor’s preferred payment type and global currency. Payment types may include credit cards, prepaid cards, PayPal, checks, Global ACH payments, and U.S. ACH payments. Most of these payment methods are types of electronic funds transfer (EFT). Although the AP automation software vendor may offer wire transfers as a payment method, electronic ACH payments are often less expensive and safer than old-school wire transfers. Fraudsters may use wire transfer information to defraud.

4. Self-Service Supplier Onboarding with Tax Compliance

The best AP automation software includes self-service vendor onboarding through a software interface called a Supplier Hub (portal). Suppliers enter contact information, email or upload vendor invoices into the system, and provide W-9s or other required tax reporting forms like W-8s. Supplier entry reduces errors and shifts part of the AP workflow to vendors, reducing your accounts payable processing costs.

5. Invoice Data Capture and 3-Way or 2-Way Matching

AP automation can include AI-driven optical character recognition scanning (OCR) to capture invoice data with line items and headers. AP automation software matches paperless invoices with digital purchase orders and receiving documents for 3-way or 2-way matching.

6. Invoice Processing

The best AP automation for QuickBooks ERP is an add-on accounting system that uses vendor verification databases and rules to trigger exceptions. Automating AP includes an electronic push approval workflow with PDF documents attached.

7. EFT Batch Payments and Real-Time Reports

You can choose to pay invoices without inefficient and costly paper checks. Use either efficient large batch electronic payment processing or on-demand electronic cash disbursement. That’s called bill pay. A finance automation platform can handle payment data for independent contractors, such as freelancers. AP automation produces informative real-time reports for the AP process.

8. Internal Control, Compliance, and Fraud Monitoring

Internal control features that you should seek in accounts payable automation software include:

- KPMG-certified tax engine

- Audit trails

- Role-based access and views for segregation of duties

- Enterprise-grade security

AP automation software gives only authorized personnel, like the CFO and Controller, access to cash accounts.

The Tipalti AP automation tax engine calculates supplier income tax withholdings for backup withholding and provides FATCA tax compliance. Consider adding Tipalti Detect® for monitoring supplier behavior to detect potential fraud, mitigate risk, and ensure compliance.

Benefits of QuickBooks AP Automation Integration

AP automation software integrates with QuickBooks Online or QuickBooks Desktop accounting software to provide the following benefits:

1. Efficiency and Cost Savings

- Replaces manual workflow, paper documents, and siloed systems with integrated, synced digital automation

- Reduces processing cost per invoice

- Allows you to take early payment discounts on time and avoid late payment fees

- Speeds accounting close with instant, automated batch payment reconciliation

- Frees finance teams to focus on higher-value strategic work

2. Compliance and Control

- Strengthens internal controls

- Reduces fraud risks, errors, and duplicate invoices through extensive exception flagging and supplier validation

- Enables better and simpler global regulatory and tax compliance

3. Accuracy and Automation

- Improves vendor file accuracy with self-service supplier onboarding through a Supplier Hub

- Automates invoice coding using AI and routes approval workflows automatically

4. Cash Flow and Visibility

- Provides real-time spend visibility and cash requirements for better cash flow forecasting

5. Supplier Experience

- Offers more payment method choices for cost-effective global payments in local currency

- Sends automatic payment status updates to suppliers

Does QuickBooks Have AP Automation?

QuickBooks recently introduced some in-house, optional automated Bill Pay features (with B2B not yet offered). As an alternative, QuickBooks provides an upgrade option to third-party apps that automate AP.

Although QuickBooks offers some Bill Pay automation, its features for accounts payable automation and global payment capabilities are limited (and not fully developed) compared to more robust and established third-party integrations like Tipalti. When your business outgrows QuickBooks, it will retain its Tipalti data for migration into a new ERP system.

Turn QuickBooks into a full end-to-end AP solution

Even with QuickBooks, AP teams still chase invoices and handle payments manually. Learn how automation solves the 7 biggest payables challenges, from global payments to AP risk.

Top AP Automation Integration for QuickBooks: Tipalti

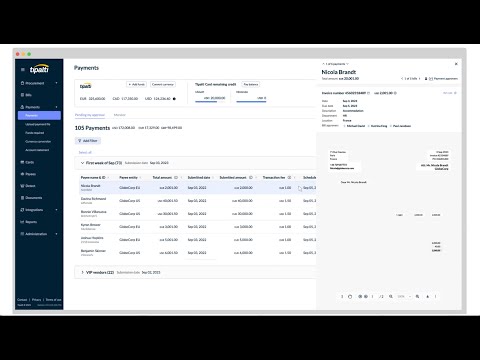

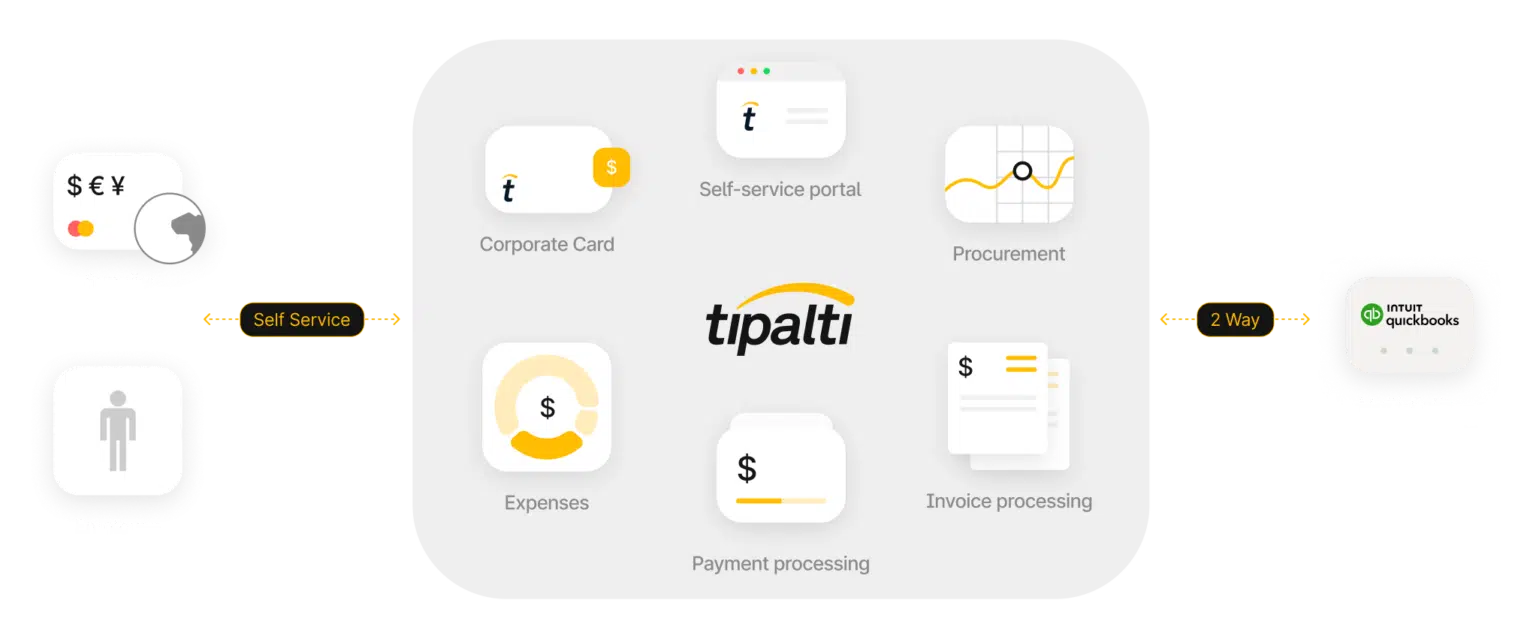

Tipalti is a cloud-based AP automation solution that streamlines the entire accounts payable cycle—from invoice processing to global payments—within QuickBooks or any ERP/accounting software. It eliminates manual data entry, reduces human error, and accelerates payment cycles, all while offering enterprise-grade security and scalability to support business growth.

Tipalti’s AP Automation Capabilities

Supplier Onboarding and Compliance

- Self-service supplier onboarding through the Supplier Hub

- Built-in W-9/W-8 collection before first payment, with KPMG-approved tax compliance engine

- Automated vendor validation with TIN matching and blacklist scanning (OFAC)

- Optional Tipalti Detect® fraud detection to monitor behavior patterns and risk checks

Invoice Processing

- AI-driven OCR (Tipalti AI Smart Scan) captures invoice data by line item in 145+ languages via upload or email

- Automated 2-way or 3-way matching to POs (and receiving reports) with tolerance settings

- Auto-routing for approvals with guided workflows

Global Payments

- Six payment methods in 200+ countries, 120 currencies

- Executed through major banks and Tipalti’s MTL license

- Built-in FX with live, transparent exchange rates

- Electronic batch payments with automated reconciliation

- Supplier choice of payment method and currency, plus automated status notifications

Reporting and Intelligence

- Real-time spend visibility, reports, and metrics

- AI-driven business intelligence for forecasting and budgeting

- Multi-entity workflows with combined corporate oversight

Security and System Integration

- Enterprise-grade security with role-based access and automated audit trails

- High uptime, reliable performance, and multi-tenant cloud architecture

- Bi-directional sub-ledger syncing with QuickBooks and other ERPs

Pricing

Tipalti’s SaaS pricing model starts with a monthly fee for the basic platform in the Starter plan. The Premium and Elite plans use custom pricing quotes and extend AP automation to either limited or fully-featured procure-to-pay solutions. Tipalti AP automation software with QuickBooks integration provides scalability, allowing your company to upgrade and add more functionality and users as it grows and becomes more complex.

AP Automation with Tipalti

End-to-end AP automation for QuickBooks with Tipalti integration is the best way to implement accounts payable automation that meets your business needs. Tipalti AP automation is a time-tested and scalable solution that offers robust features and simpler global payments for growing single or multi-entity corporations.

Automate AP in QuickBooks for faster, smarter vendor payments

Cut 80% of manual AP work, sync seamlessly with QuickBooks, and pay vendors in over 200 countries on time.

FAQs

Which versions of QuickBooks does Tipalti integrate with?

Tipalti integrates with QuickBooks Desktop and these versions of QuickBooks Online: QuickBooks Online Advanced, QuickBooks Online Plus, and QuickBooks Online Essentials.

Mid-market companies using QuickBooks Online Advanced and QuickBooks Desktop Enterprise are ideal for Tipalti AP automation integration.

What is the implementation effort and pricing structure for Tipalti?

Adopting AP automation and implementing Tipalti is a process that takes weeks rather than years. Tipalti has prebuilt integrations with many systems, including QuickBooks. For a fee, Tipalti’s experienced implementation consulting team or Tipalti partners can guide your company to achieve a smooth Tipalti implementation.

Tipalti’s pricing structure is based on your business needs. Tipalti lets your company add more software features as it grows. With Tipalti, customers pay per-transaction fees for payments in addition to the SaaS plan. Contact Tipalti for a custom quote.

What other accounting systems does Tipalti integrate with?

When your company outgrows QuickBooks or would benefit from using a robust ERP system or different accounting software, Tipalti offers accounting system or ERP integrations with NetSuite, Microsoft Dynamics, Acumatica, Infor SyteLine, Sage Intacct, Sage ERPs, SAP Business One, Xero, SAP S/4HANA, and many other ERPs.

Tipalti is scalable for growth. During ERP implementation, your Tipalti data can be migrated to your next system if you upgrade from QuickBooks to a new ERP.