A statement of operations is used by some companies for financial reporting. Businesses prepare the statement of operations on both an actual basis and a proforma basis in a business plan to forecast future results.

According to Harvard Business School:

“A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn’t yet occurred…pro forma financial statements are defined as ‘financial statements forecasted for future periods.’”

Learn how a statement of operations helps businesses track, analyze, and forecast their financial health–and if it’s different from an income statement.

What is a Statement of Operations?

A statement of operations is a financial statement businesses use to report revenues, cost of goods sold, operating expenses, operating profit, non-operating expenses, and net income (loss). Accountants report results from continuing and discontinued operations in different sections. The statement of operations is also known as an income statement or a profit & loss statement.

A statement of operations is one of the essential financial statements. It’s often presented with a balance sheet (statement of financial position), cash flow statement, and statement of retained earnings. A Statement of Operations is prepared by accounting on a regular basis. The accounting period is monthly, quarterly, and at each fiscal or calendar year-end.

Statement of Operations vs Income Statement

The difference between a statement of operations and income statement may be in the level of detailed line items reported for operating expenses and operating profits before showing net income on the financial statement. An income statement may show less information than a statement of operations. Sometimes businesses use the financial statement title of Statement of Operations or Income Statement to describe the same type of financial statement.

Key Elements of an Operating Statement

Key elements of an Operating Statement are:

- Sales and Service revenue as separate line items combined as Total Revenue

- Cost of goods sold and Cost of services as line items combined as Cost of Sales and Services for operating costs

- Gross Profit Margin (Revenues minus Cost of Sales and Services)

- Operating Expenses:

- Selling & Marketing

- General & Administrative

- Research & Development (R&D)

- Manufacturing

- Profit (loss) from Operations

- Interest expense (net)

- Non-operating items, including a line item for net interest income

- Profit (loss) before taxes

- Income taxes

- Net income (loss) or net profit (loss)

- Other comprehensive income (loss)

To maintain an advantage by not disclosing too much information to competitors, some companies combine Sales & General & administrative expenses as SG&A. The total of these selling expenses on their statements of income includes marketing expenses.

Expenses from business operations include non-cash expenses, including depreciation and amortization. The Statement of Operations doesn’t include a subtotal for EBITDA, which is used for financial analysis like a valuation. EBITDA is calculated by adjusting earnings before interest and taxes (EBIT) by adding back depreciation and amortization expenses.

Examples of a Statement of Operations

Following are two examples of statements of operations. One is Raytheon’s, and one is Microsoft’s, from their 10-K SEC filings. Both examples show operating profit as a subtotal. Raytheon’s more complex financial statement for comparative calendar years is titled Consolidated Statement of Operations, whereas Microsoft chooses to title its financial statement for multiple comparative fiscal years as Income Statements.

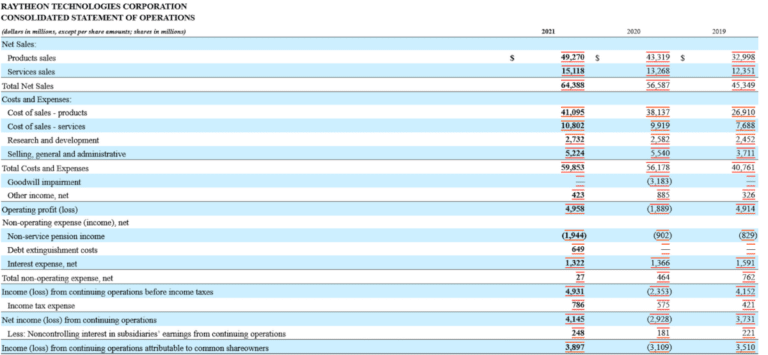

Raytheon Technologies Corporation

A screenshot of Raytheon Technologies Corporation’s Consolidated Statement of Operations for the years ended December 31, 2021, 2020, and 2019, was filed on February 11, 2022 with the Securities and Exchange Commission (SEC) as part of its 10-K for the year ended December 31, 2021. Raytheon’s financial statement is accessible through the SEC’s EDGAR company filings database.

Raytheon’s Consolidated Statement of Operations (click on images to enlarge)

Raytheon submitted this Consolidated Statement of Operations as its required income statement.

It’s interesting that Raytheon didn’t include subtotals for Total Cost of Sales and Services and Gross Margin.

Instead, Raytheon shows Total Costs and Expenses that includes its operating expenses for Research & development and Selling, general and administrative. To reach the total for Operating profit (loss), Raytheon next lists Goodwill impairment (if relevant for the year) and Other income, net.

To give stakeholders, including investors, more valuable key information, I recommend reporting Cost of sales and services, Gross margin, and Operating expenses as separate sections with subtotals.

Next, Raytheon lists and totals Non-operating expense, net. Non-operating expense, net includes a line item for Interest expense, net besides Non-service pension income and Debt extinguishment costs. The next subtotal is Income (loss) from continuing operations before income taxes. Income taxes is a line item to subtract to reach the Net income (loss) from continuing operations subtotal.

Raytheon shows Non-controlling interest in subsidiaries’ earnings from continuing operations and subtracts it to reach another subtotal. That subtotal is Income (loss) from continuing operations attributable to common shareholders.

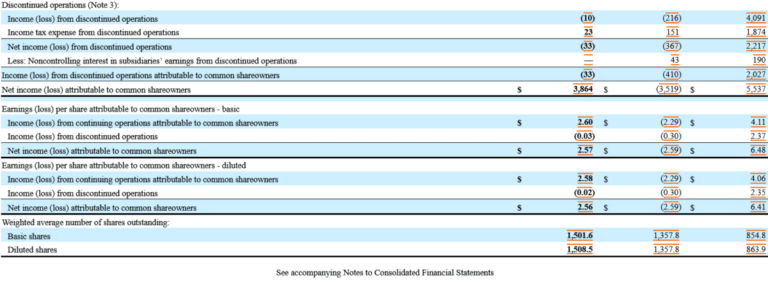

The next step in the Raytheon Consolidated Statement of Operations is to consider discontinued operations, which are described further in a note to the financial statements. To calculate Net income (loss) from discontinued operations, two line items are included: Income (loss) from discontinued operations and Income tax expense from discontinued operations. Next, Non-controlling interest in subsidiaries’ earnings from discontinued operations is subtracted. The immediately following subtotal is Income (loss) from discontinued operations attributable to common shareholders.

The next subtotal considers net income for both continued operations and discontinued operations. It’s called Net income (loss) attributable to common shareholders.

The final section of Raytheon’s Consolidated Statement of Operations shows Earnings (loss) per share, separately showing line items for basic and diluted Earnings per share and for continuing operations and discontinued operations, followed by the weighted average number of shares outstanding for basic and diluted EPS.

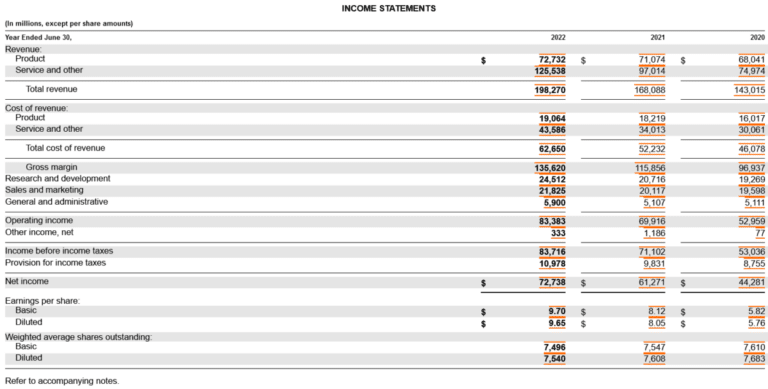

Microsoft Corporation

The following screenshot of Microsoft Corporation’s Income Statements for the years ended June 30, 2022, 2021, and 2020, was filed on July 28, 2022, with the Securities and Exchange Commission (SEC) as part of its 10-K for the year ended June 30, 2022. Although Microsoft calls it Income Statements, the financial statement has enough details to be titled Statement of Operations.

Note that Microsoft includes separate sections for Cost of revenue and a subtotal for Gross margin. Microsoft shows a subtotal for Operating income in a middle section before considering additional items to reach net income. It uses the net income to calculate basic and diluted Earnings per share and presents Weighted average shares outstanding.

Perks of Using a Statement of Operations

Perks of using a statement of operations are:

- The statement of operations can be used both as an actual financial statement and on a forecasted basis in a strategic business plan.

- The statement of operations shows many detailed line items and separates continuing operations from non-operating expenses and discontinued operations.

- An actual statement of operations can be benchmarked to industry statistics and analyzed to cut costs and operating expenses and improve financial performance using strategic finance techniques.

- A statement of operations can show trends for the month, quarter, or year, compared to corresponding prior periods.

- A statement of operations can be used to calculate the return on sales (ROS) ratio because it includes EBIT as operating profit to divide by net sales or net revenues.

How can you implement strategic finance?

Download our Research Report: “CFOs Drive Business Value: How Strategic Leaders Transform Financial Operations to learn how strategic CFOs think.

Use best practices to cut costs and achieve digital transformation that AP automation software provides.

Pitfalls of Using a Statement of Operations

Pitfalls of using a statement of operations are:

- A statement of operations may need customized report formatting or a higher-level software system if your small business uses entry-level accounting software.

- Because a statement of operations is prepared on an accrual basis for US GAAP (generally accepted accounting principles) reporting, it doesn’t provide cash flow analysis, as does a statement of cash flows.

- A statement of operations takes longer for stakeholders to read and understand than a simple income statement with fewer details.

- A proforma statement of operations may use erroneous assumptions and business judgments about future events, resulting in significant inaccuracy.

You can somewhat mitigate the non-cash weakness of the statement of operations, though. A statement of operations prepared with actual financial results or to forecast financial results can be used to prepare an indirect cash flow statement by reconciling net income from operations to total cash flow from operations. Accounting standards apply to both actual and projected financial statements.

Note that EBITDA (earnings before interest, taxes, depreciation, and amortization) isn’t equal to cash flow because it doesn’t consider the changes in working capital assets and liabilities.

For more cash management details, use the cash flow forecasting software provided by or integrated with your ERP system or accounting software.

Statement of Operations + Automation

Your ERP system or accounting software automates the preparation of basic financial statements, including the statement of operations.

When you integrate AP automation and global payments automation software with your ERP or accounting software, you gain significant advantages, including:

- Gaining efficiency with algorithmic rules and AI/ML robotic process automation

- Eliminating paper documents

- Providing a self-service supplier onboarding and payment status portal

- Automating tracking of vendor payments for preparing tax compliance information returns like 1099s

- Automating global regulatory compliance for payments

- Reducing fraud risk and errors

By eliminating paper documents through uploading, emailing, or scanning invoices and performing other payables automation steps, your company will have enough time to take early payment discounts like 2/10 net 30, to reduce its cost of purchases.

Tipalti AP automation software instantly reconciles global payments using several payment methods. Automated payment reconciliation and other automation features in end-to-end payables and global payments software can help you reduce accounting month-end close time by up to 25%.

With extra time available beyond the monthly and year-end close, you can shift your finance team’s emphasis to value-adding strategic finance, planning, and decision support to improve operational efficiency, reduce costs, and achieve business development goals.

Conclusion

A statement of operations is a detailed income statement that reports net income from operations (before and after income taxes) as a subtotal. Some businesses may call it an income statement or profit & loss statement.

To improve statement of operations results, read our eBook: “The CFO’s Guide to Payables Automation.”