Learn how to expertly execute global payments for streamlined accounts payable and business efficiency.

Remittance advice sounds like some complex counsel, but it’s really a simple concept that goes hand in hand with an invoice.

A supplier invoices a customer to detail and request payment for services or goods, while remittance advice indicates a payment was processed—it comes from the customer to the supplier.

What is Remittance Advice?

Remittance advice is a proof of payment letter sent by a customer to a supplier that verifies they have paid their invoice–sometimes, the payment is sent with the letter if they pay by check.

Remittance advice adds an extra layer of clarity and security to the invoicing process for both customers and suppliers. To “remit” a payment is to simply send it back. Think of any type of payment or funds transfer between friends and family, for businesses, or even overseas.

Remittance advice is proof that this remittance has happened or is going to happen.

Remittance Advice Basics

Remittance advice is a proof of payment letter sent by a customer to a supplier that verifies they have paid their invoice. Remittance advice may be an electronic notification or a paper-based document.

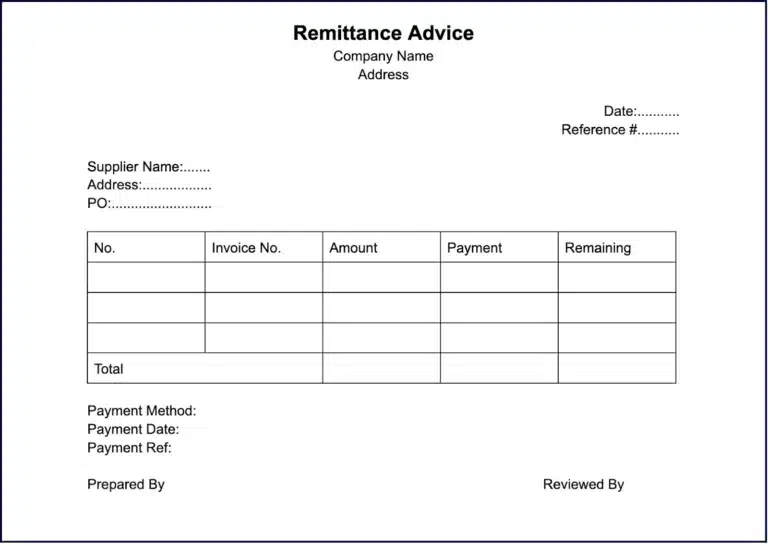

What Does Remittance Advice Look Like?

Remittance advice notifies the recipient of a payment, with the details included. Paper remittances include a detailed check stub, perforated invoice, or billing account statement section that is detached and mailed with the payment indicating the amount paid. If the customer pays by check, for example, the payment may be sent with the remittance letter.

An Example of Remittance Advice

How a Seller Handles a Customer Remittance Advice

When a seller gets remittance advice from their customer, they run through a detailed process to make sure the payment was received properly. The seller:

- Receives a detailed bank account deposit

- Enters or reviews an automatic software transaction to record the customer’s payment

- Debits (increases) cash account

- Credits (reduces) accounts receivable in the customer’s account

- Researches and follows up on any payment discrepancies

- Runs and reviews accounts receivable aging report by customer

Other Common Remittance Advice Questions

These are other questions accounting professionals have about remittance advice.

Is Sending Remittance Advice Required?

Customers are not required to send remittance advice to suppliers, but it is best practice. For the senders, they are doing their due diligence by notifying the supplier that an invoice has been paid. For the seller, it eliminates confusion over bill payments.

If there are issues with the account or transaction, the remittance also reveals the step in the payment process where something went wrong. If a customer has paid an invoice and sent remittance advice, but the seller has not received the funds, the sender can contact the payment issuer to see if there has been a delay or if the payment was processed incorrectly.

Is a Remittance Advice Proof of Payment?

No, remittance advice is a notification to the payee that a payment was sent. The payment may not reach the intended receiver, which is the very reason remittance advice is important.

For example, wire transfer funds don’t always reach the recipient because of information errors or problems completing a global transaction. Auditors don’t rely on payment remittance advice to confirm the existence of a cash receipt—for that, they go by the transactions in the ledger and the bank statement.

Send Remittance Advice to Keep Transactions Transparent

Remittance advice can add an extra layer of clarity to complex transactions and keep accountants better organized. A statement of payments remitted is helpful in the short term to make sure invoices are paid month to month, as well as in the long run when it comes to reviewing the books for quarterly and year-end reporting.

With Tipalti, payment remittance is simple and efficient. Our platform brings outdated, manual accounts payable processes into the future with end-to-end automation. If you’re interested in learning more, reach out for a demo here.