The AP Automation Playbook: What Every Modern Finance Leader Needs to Know

About the Playbook

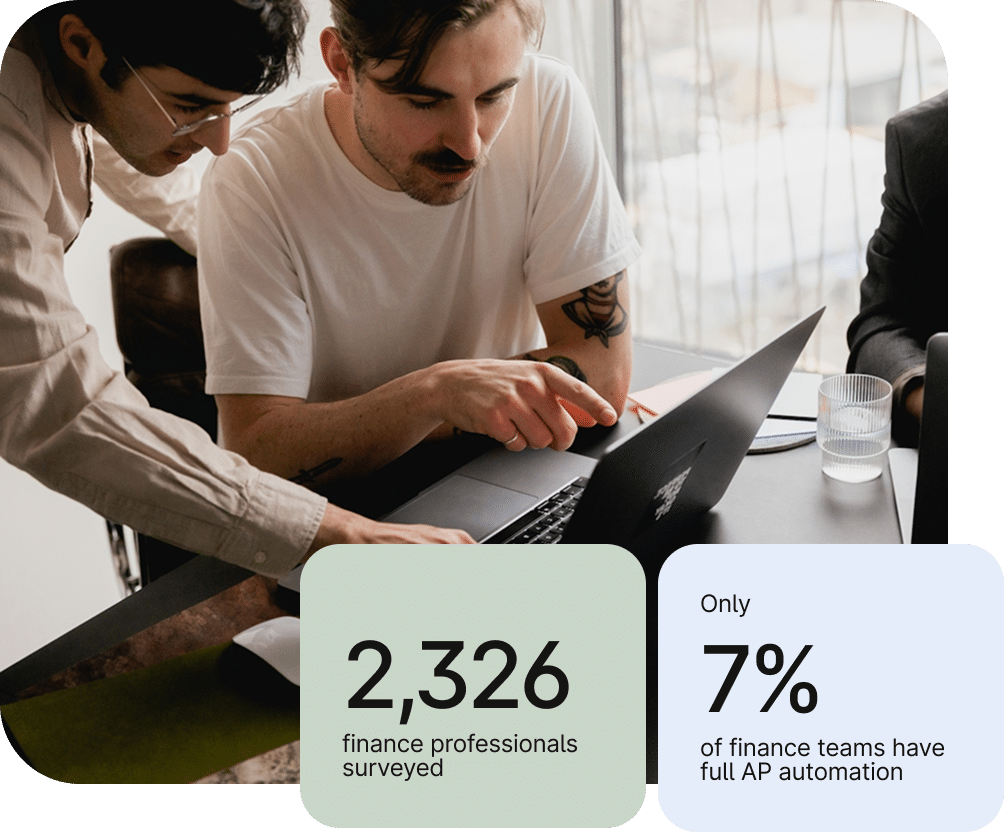

This is based on insights from Tipalti’s Global Finance Outlook research, conducted by Kickstand between July 10 and August 1, 2025. The survey captured responses from 2,326 full‑time finance professionals working at companies with 20 or more employees in Canada, Germany, Spain, the Netherlands, the UK, and the US.

Manual work within finance teams is on the rise, and it’s taking a toll. According to Tipalti research, 66% of finance professionals around the world say their workloads have become more manual over the past year. The result is slower processes, increased burnout, and growing operational risk—especially in accounts payable (AP).

Finance leaders now face a critical question: how can their teams regain efficiency and free up capacity for strategic work? This AP Automation Playbook answers that question, using insights from global finance leaders to outline practical ways to modernize AP operations, reduce manual effort, and scale for growth.

The Expanding Responsibilities of Today’s Finance Teams

As recently as ten years ago, finance departments were primarily focused on processing invoices, writing checks, and reconciling accounts. In essence, they were a supporting element in the larger overall financial strategy.

But today, finance teams do it all: shaping strategy, guiding investments, providing real-time visibility, and enforcing global compliance—and at the end of the day, they still have to close the books.

74%

of finance leaders say their teams have been asked to play a more strategic role in driving business growth.

79%

have seen an increase in the expectations and workload for their team in the past 12 months.

*Data based on Tipalti’s Global Finance Outlook

Additional Responsibilities of Modern Finance Teams

- Co-creating strategies and translating them into budgets, targets, and operating plans

- Allocating capital to the highest-return opportunities and eliminating low‑ROI spend

- Setting pricing and margin guardrails to improve profitability

- Standardizing compliance and controls globally as the business expands

- Modernizing the finance tech stack to enable real‑time visibility at scale

Infographic

Then vs. Now: The Evolution of Finance

Technology and automation have completely transformed classic finance responsibilities, creating entirely new priorities for modern teams. Discover the key differences in our visual breakdown.

How International Growth Is Adding Even More Stress

Doing business across borders means dealing with tariffs, taxes, currencies, and new suppliers—and the more countries you add, the more challenging and complex it all becomes. Of the 2,300+ financial professionals we surveyed, more than half reported that their companies already operate in at least two countries, and this number is expected to grow.

55%

of financial professionals have spent more time focused on international business this year compared to the previous year.

35%

of companies have plans to expand into new countries in the next 12-24 months.

*Data based on Tipalti’s Global Finance Outlook

Tariffs: Growing Financial and Operational Challenges

Since early 2025, tariffs have been a volatile topic, creating uncertainty for finance leaders managing international operations.As a result, global companies are facing rising costs, more compliance issues, and far greater financial risk with cross-border transactions, procurement, and payments.

59%

of finance leaders agree that US-related tariffs affect their company’s international expansion plans.

61%

of finance leaders say their companies have slowed investment or growth due to tariff uncertainty.

31%

say that financial planning for their business has been impacted by US-related tariffs.

*Data based on Tipalti’s Global Finance Outlook

How Tariffs Add Pressure on Accounts Payable Processes

- Unpredictable costs: Tariff hikes or new import duties can suddenly raise the total cost of imported goods. If your AP systems aren’t agile, finance teams may struggle to absorb or reassign those costs appropriately.

- Compliance complexity: Tracking frequent tariff changes and classifying goods under the Harmonized Tariff Schedule (HTS) is a constant challenge. Errors can lead to penalties, audits, and costly payment delays.

- Cash flow strain: Tariffs increase the upfront cost of imports, which tightens liquidity. AP teams often need to manage shorter payment windows, renegotiate terms, or plan around shifting exchange rates.

- Supplier & sourcing shifts: To offset tariffs, many companies diversify their suppliers or move production. Each change means new onboarding, compliance checks, and payment terms—all of which add to AP’s workload.

- Geopolitical risk: Since tariffs are being used for foreign policy, a single government decision can alter who you can pay, how you pay them, and which fees apply. Because of this, your AP department has to be ready to update payment systems, vendor master data, and compliance processes at any moment.

Tax Compliance: Navigating Global Finance and Regulatory Complexity

Globally, from Value-Added Taxes (VAT) and Goods and Services Taxes (GST) to e-invoicing mandates and withholding, global tax rules are shifting fast, placing AP squarely between changing tax rules and day‑to‑day payments.

It’s no secret that regulatory and compliance shifts make global supplier management more difficult. But the challenge isn’t just knowing the rules; it’s enforcing them consistently across countries, entities, and thousands of invoices.

Related article:

Best Practices in Accounts Payable Tax Compliance

Just see how some finance leaders responded when asked what worries them about scaling their finance operations globally to keep pace with their business:

What Finance Leaders Are Worried About

The complexity of managing compliance and regulatory requirements across multiple countries keeps me up at night.

CFO

Ensuring accuracy and efficiency while managing increasing financial transactions worry me the most.

CFO

Making sure we not only spend the budget to make changes, but that everyone is trained well to implement the new technology keeps me up at night.

Finance Director

How Tax Compliance Impacts Accounts Payable Processes

- Invoice formats & fields: Every country requires different data, tax IDs, and languages. AP teams must check each one individually, and even small mistakes can lead to rejections or payment delays.

- E-invoicing & real-time reporting: Clearance systems demand specific schemas and timing. AP is under pressure to catch every error before submission because mistakes delay payments and add penalty risk.

- Withholding & indirect tax complexity: VAT/GST, reverse‑charge, and exemption calculations all vary by jurisdiction. AP teams carry the burden of applying the right treatments to avoid review, fines, and more.

- Supplier tax data management: Ensuring that vendor VAT numbers, TINs, and certificates are valid and current requires constant follow‑up. Missing or outdated information can cause payment holds and urgent cleanup before close.

- Documentation & audit readiness: Keeping complete, accessible tax documentation across multiple systems adds ongoing administrative strain. When audits come, AP teams must be able to locate forms, certificates, and change logs under tight deadlines.

Real-Time Reporting to Meet Global Compliance Standards

E-invoicing and real-time tax reporting are becoming the new standard for global business. More than 50 countries now mandate e-invoicing, and in many of them, those invoices must be approved by tax authorities in real time before payment. They do this to improve transparency and reduce fraud, but it means your team must be faster, more accurate, and always alert.

Related content:

How Tipalti automates financial compliance

How Real-Time Reporting Adds Accounts Payable Pressure

- Tighter deadlines: Some tax authorities require invoice clearance within hours, leaving no room for manual review or late submissions.

- Systems integration: AP must connect directly with government networks and e-invoicing portals, which is an added layer of technical setup and monitoring for your team.

- Accuracy at scale: Even a single data error can trigger a rejection or a penalty. This makes clean, complete data even more important.

- Constant change: Reporting requirements evolve quickly, forcing finance and IT teams to update configurations and processes on short notice.

- 24/7 oversight: Teams now need real-time visibility into submission statuses, error notifications, and more. This can be extremely difficult to achieve manually.

Cross-Border and Currency Management

As businesses expand across borders, managing multiple currencies becomes a daily challenge. Foreign exchange rates shift constantly, payment costs vary by country, and even small fluctuations can impact margins or budgets.

It’s no surprise that most finance teams struggle with currency management. According to our research, 63% say handling exchange rate changes is difficult, and one in four cite the complexity of global growth as their biggest financial challenge.

Without the right systems, teams spend hours reconciling exchange differences manually. That time would be better spent analyzing performance and guiding strategy.

How Currency Management Adds Accounts Payable Pressure

- Exchange rate volatility: Constant rate shifts make it difficult to forecast costs, plan budgets, and more. Finance teams must frequently update calculations or revalue payments.

- Multiple currencies and systems: Each currency comes with its own processes, formats, and timings. Managing them across systems adds complexity and increases the chance of errors.

- Timing gaps: Exchange rates can change between invoice approval and payment, creating unexpected gains or losses that affect cash flow and reporting.

- Multi-currency reconciliation: Managing accounts and reporting across different currencies adds complexity to the monthly close.

- Bank and foreign exchange fees: Conversion costs and intermediary bank fees vary by country and can cut into margins if not tracked closely.

Supplier and Vendor Onboarding

As companies scale globally, supplier and vendor onboarding becomes far more complex than a simple data-entry task. Each supplier has unique tax details, payment methods, compliance requirements, and banking formats. This creates endless manual touchpoints for AP teams to manage.

How Supplier Onboarding Adds Accounts Payable Pressure

- Manual data collection: Growing your supplier and vendor network means collecting more tax forms (e.g., W-9, W-8BEN, VAT/GST IDs), banking details, and contact information across regions. Every variation adds work and makes data inaccuracies more likely.

- Multi-team reviews: Tax, legal, and compliance checks are often needed to verify supplier details. That level of internal coordination can slow some companies down.

- Inconsistent data: Different systems and regional requirements make it harder to keep supplier records up to date. When information falls behind, payments get delayed.

- Cross-border complexity: Every country has its own onboarding forms and tax-reporting requirements, and the more markets you operate in, the more complex the process can become.

Regulatory Fragmentation: Global Finance Governance

When a company operates globally, every market introduces its own tax rules, reporting standards, and data privacy laws. What’s compliant in one country can trigger a penalty in another. As these regulations continue to evolve, AP teams must constantly update internal controls and adjust processes.

The result is a patchwork of policies and systems that’s difficult to manage at scale. Without standardized processes and automation, even small changes in one region can create ripple effects across your global operations, adding work, slowing payments, and increasing risk.

How Regulatory Fragmentation Hurts Accounts Payable Processes

- Constant rule changes: Tax, e-invoicing, and reporting requirements evolve at different speeds in every country. AP teams must keep up with those continuous updates.

- Inconsistent standards: Each market has its own forms, data formats, and compliance standards. As you grow, each new market makes it harder to maintain a single global workflow.

- Increased audit exposure: Keeping policies and systems in sync across regions is difficult. Any inconsistencies can create gaps that surface during audits and require immediate attention.

More Responsibility + Added Pressure = Burnout and Bottlenecks

As responsibilities expand and global operations grow more complex, AP teams are reaching a breaking point. They’re being asked to deliver better data, stronger compliance, and more strategic input—all while managing heavy manual workloads.

According to AICPA & CIMA, more than half of finance leaders report experiencing symptoms of burnout. Our own research even shows that 34% of finance professionals are struggling to manage the challenges of a fast-scaling business.

For some teams, the workloads are growing faster than the systems are evolving, and even the most capable departments have a limit. Too much manual work eventually leads to burnout and bottlenecks.

The fix isn’t more hours—it’s smarter systems. Automating your manual AP processes helps teams reduce stress, speed up approvals, and refocus on the strategic work that actually drives the business forward.

Self-Assessment Tool

How Much Pressure is Your AP Team Really Under?

Use our self‑assessment tool to reveal your personalized pressure score and get tailored insights to help your team.

Why Manual AP Processes Are the Biggest Bottleneck for Global Businesses

Manual AP isn’t just inefficient. It’s the single biggest obstacle to scaling a finance operation. The processes that once worked for a growing business (paper invoices, email approvals, and spreadsheet tracking) become major barriers at scale.

Manual AP Slows Growth. Here’s the Proof.

42%

of companies still have mostly manual AP operations.

7%

have fully automated operations.

24%

of respondents reported errors in team deliverables due to inefficient AP processes.

24%

of respondents reported compliance or risk issues due to inefficient AP processes.

Finance professionals spend an average of 11 hours a week on manual AP tasks like approvals, error resolution, and reconciliation—adding up to nearly 72 workdays a year.

*Data based on Tipalti’s Global Finance Outlook

Here’s why manual AP keeps global businesses stuck:

- It slows everything down: Approvals and payments can’t keep pace with global growth when every step requires human touchpoints.

- It increases risk: Manual data entry creates duplicate payments, fraud exposure, and compliance gaps.

- It blocks visibility: When invoice and payment data live in emails and spreadsheets, finance leaders lose real-time insight into spend and cash flow.

- It hurts compliance: Tracking tax rules, currencies, and formats by hand leads to errors and audit findings.

- It doesn’t scale: As volumes rise, onboarding new suppliers or entering new markets only multiplies the manual work.

Manual AP creates friction at every step of the workflow, from supplier setup and tax validation to approval routing and reporting.

Below, we’ll explain where those bottlenecks occur and show how automation transforms each stage of the process into a faster, more reliable engine for growth.

Where the Manual AP Process Breaks Down

If your business still has a manual (or even partially manual) AP process, it’s likely failing in more than one place, causing issues at every stage of your workflow. That’s why automation is so important.

Let’s take a closer look at the key stages of the process, the risks of handling them manually, and how automation can help.

AP Stage

Manual Process

Challenges

How Automation Solves Them

Supplier Management

Manual Process Challenges:

Vendor details arrive through email or spreadsheets, which requires manual data entry into every system. This leads to errors and creates inconsistent records.

Automated Solution:

A secure self-service portal collects supplier and vendor information, validates it instantly, and syncs accurate data to your ERP. This makes onboarding faster and cleaner.

Tax Compliance

Manual Process Challenges:

Tracking tax forms and rates manually across countries leads to filing errors, missed deadlines, and costly penalties.

Automated Solution:

Built-in logic validates IDs, applies the correct rates automatically, and organizes documents for audit readiness in every jurisdiction.

Purchase Order (PO) Controls

Manual Process Challenges:

Manually matching invoices to POs slows approvals and hides duplicate or unauthorized purchases.

Automated Solution:

Automated matching verifies POs, invoices, and receipts instantly, flagging real exceptions and keeping budgets aligned.

Invoice Processing and Approvals

Manual Process Challenges:

Invoices arrive in various formats, requiring manual entry and email approvals. Errors and delays increase as volume grows.

Automated Solution:

Invoices are captured digitally, validated automatically, and routed to the right approver instantly. This speeds up processing and reduces errors.

Global Remittance

Manual Process Challenges:

Each payment requires re-entry into multiple bank portals, manual currency conversion, and local banking compliance—a slow and error-prone process.

Automated Solution:

A single platform manages all global payouts and mass payments, applies live exchange rates, supports local methods, and tracks every transaction end to end.

Reconciliation and Reporting

Manual Process Challenges:

Data sits in silos and matching is done manually, delaying month-end close and creating reporting inconsistencies.

Automated Solution:

Continuous reconciliation and real-time dashboards provide instant, auditable visibility into spend, status, and variances.

Automation clearly improves speed, accuracy, and control across the entire AP workflow. Yet despite these gains, some finance leaders remain hesitant to automate—often because of common myths and misunderstandings that are easily debunked.

Why Not Automate? Addressing the Concerns

Even with the proven benefits of AP automation, skepticism is natural. Some teams worry that automation will make their roles redundant. Others believe AI simply isn’t accurate or mature enough to handle complex accounting tasks.

Those concerns are completely valid, and they come up often in finance forums and peer conversations. But in most cases, the hesitation stems from how automation is misunderstood, not from how it actually works in practice.

Below, we’ll look at two of the most common fears voiced by finance professionals and explore what’s really true about automation today.

Fear of Job Redundancy or Role Devaluation

According to the Michigan Journal of Economics, “since the 2000s, automation systems have already eliminated 1.7 million jobs,” and AI is only going to raise that number. That stat alone makes this a valid concern.

Here’s what some finance professionals on Reddit had to say about AI and automation.

This concern was even brought up in our recent survey of finance professionals in the US and Europe. When asked what concerns they have about scaling their operations globally to keep up with their business, these were just a small handful of the responses:

- “AI will make us all jobless.”

- “AI taking my job.”

- “AI replacing my job.”

- “AI taking over AP roles.”

The Truth About AI Replacing Jobs

In reality, AI replaces tasks, not talent. It removes repetitive work, like data entry, file uploads, and status updates, so finance professionals can focus on other work. Automation expands the impact of skilled workers rather than minimizing it.

Lack of Trust in Automation and AI

Even if finance teams accept that automation won’t replace their jobs, many still hesitate to trust it with their data. For professionals whose day-to-day depends on precision and accountability, that hesitation makes sense. If a number is wrong or a payment fails, the responsibility still falls on them, so being confident in your AP software is critical.

This concern shows up frequently on finance forums and even in our own finance survey. Many doubt that AI can truly understand invoices and apply business context. Others simply question whether the technology is ready for something as high-stakes as accounting.

Here’s what a few professionals are saying on Reddit:

*From r/Accounting | AI does not work in accounting, not yet anyway **From r/Accounting | AP automation almost got CFO fired ***From r/Bookkeeping | AP automation almost got CFO fired

Respondents from our global survey are concerned about:

- “Accuracy of AI”

- “Whether AI is responsible enough to really be handling the financial inputs we’re providing.”

The Truth About AI Accuracy and Control

Early tools like basic OCR could read text but couldn’t understand it, which left finance teams doing just as much work as before. Modern AP automation is much better. It uses built-in rules, machine learning, and validation checks to streamline every step without requiring you to give up control.

The right automation systems keep people in charge. Your team sets the rules, reviews the exceptions, and signs off before payments go out. The technology simply handles the repetitive steps.

A Practical Framework for AP Modernization

Every finance team is at a different point in its automation journey. According to our research, 42% of companies still rely mostly on manual AP operations, while only 7% have fully automated their process. That means most organizations fall somewhere in the middle, using a mix of digital tools and manual workflows that create both progress and gaps.

The framework below will help you identify exactly where your AP process stands today and what a full modernized function looks like. Use it to benchmark your current state, spot the issues slowing you down, and outline a realistic roadmap that grows with your business.

The AP Modernization Maturity Model

Upgrading your accounts payable functions doesn’t happen overnight—it’s a progression. Most teams move through four key stages as they evolve from manual to fully automated operations.

Stage 1: Manual Chaos

Reactive and Unstructured

Paper invoices, spreadsheets, and email approvals slow everything down. Errors multiply, visibility is low, and reporting is always behind schedule.

Progress starts by digitizing invoices and capturing data electronically.

Stage 2: Fragmented Digitization

Partially Automated

OCR tools and email approvals replace paper, but systems aren’t connected. Processes still depend on people to move invoices forward and fix errors manually.

The next step is connecting systems and automating core tasks like approval routing and PO matching.

Stage 3: Tactical Automation

Structured and Controlled

AP tools handle approval routing, PO matching, and ERP integration. Most workflows are automated, freeing the team to focus on resolving exceptions and managing spend.

Advancing to full automation requires unifying every process, region, and data source into a single, intelligent platform.

Stage 4: End-to-End AP Automation

Scalable and Intelligent

Automation covers every stage, from supplier onboarding to global payments and reconciliation. AI, compliance logic, and real-time reporting keep operations fast, accurate, and audit-ready.

What to Look for in a Modern AP Solution

Once you know where your AP process stands, the next step is finding technology that can take you further. Not every automation tool is created equal. In fact, many still leave gaps that require heavy manual work.

See the information below to help you find the right solution that can modernize your entire accounts payable operation. For a deeper breakdown, see our article about The Non-Negotiable AP Automation Features You Need in 2025.

- Intelligent invoice capture: Look for Intelligent Document Processing (IDP) that interprets invoices, so information flows cleanly into your system without manual entry.

- Automated approval workflows: Routing should reflect your company’s actual approval policies, automatically sending invoices to the right people and removing email bottlenecks.

- PO matching & validation: Strong two-way and three-way matching prevent payment errors while keeping teams focused only on exceptions that truly need attention.

- Built-in compliance & fraud controls: Choose a platform that automates tax validation, supplier verification, and duplicate‑invoice detection within the AP process, so compliance happens continuously.

- Global payment capabilities: The right tool should be able to process cross-border payments in multiple currencies and reconcile them automatically in your ERP system.

- Deep ERP integration: All of this only works if your AP platform syncs data in real time with your ERP and accounting system, creating a single source of truth for invoices, payments, and reporting.

The Business Case for AP Automation

The case for automating is clear. Companies that automate see stronger controls, faster processing, and higher productivity without adding more staff. Below are some examples of the ROI that real Tipalti clients have achieved by modernizing their accounts payable processes:

JLAB

- Integrated Tipalti with NetSuite to unify AP workflows.

- Boosted productivity by 68% and managed 35% more invoices without adding staff.

- Reduced month-end close time by 27%.

GumGum

- Automated global AP and mass payments across nine entities.

- Maintained compliance across currencies and jurisdictions.

- Quadrupled USD transaction volume in three years with no new headcount.

Lantern Community Services

- Integrated Tipalti with Sage for automating coding and reconciliation.

- Reduced their finance team’s workload by 60%.

- Completed financial reconciliation 80% faster.

Ready to Upgrade Your AP Process? Tipalti Can Help

Despite staffing levels, manual workflows, and overall complexity can still impede future scale and global growth. Modern AP automation solutions aren’t a luxury anymore. They’re the foundation for scalable, strategic finance operations.

With Tipalti, you can:

- Eliminate manual work and errors

- Strengthen control and compliance

- Gain real-time visibility into payments

- Scale global operations confidently

- Empower your team to focus on growth

Tipalti combines AI-driven automation with deep finance expertise to simplify how teams manage payables, global payouts, and compliance—wherever they do business. More than 5,000 companies trust Tipalti to pay millions of suppliers across 200+ countries and territories quickly, securely, and in full compliance.